Crypto Market Growth Driven by Institutional Adoption and SOL Momentum

The crypto market has experienced a 0.6% uptick in the past 24 hours, largely driven by the growing momentum of institutional adoption and the expanding role of stablecoins within Europe’s financial infrastructure.

Crypto Market Sees Modest Growth Amid Institutional Push

The partnership of Deutsche Bors and Circle, which intends to boost the liquidity in the Eurozone crypto market by integrating stablecoins, is among the main events facilitating this increase. The partnership is likely to support the cryptocurrency ecosystem of the region.

The other significant aspect affecting the market mood is the growing enthusiasm about Solana (SOL). The introduction of the Jupiter Exchange-Traded Product (ETP) and bullish price outlooks in the fourth quarter, with possible upward growth of up to 30% has drawn the attention of businesspeople. This is the momentum that is giving SOL a good outlook on its price movement.

Meanwhile, Bitcoin (BTC) has been largely immune to market volatility, and it is currently trading at around the $112k level. The price recovery of Bitcoin has been boosted by hopes of possible inflows of exchange-traded funds (ETFs).

The recovery of Bitcoin above the $114k level shows that it is well supported technically, as it is still enjoying the rising institutional interest.

Ether (ETH), however, is still struggling with recovery. Despite its current price, which is still above 4100, bulls have had difficulties re-entering ETH into a robust upward movement.

The crypto market is experiencing significant changes as the main regulatory determinations and government-sponsored programs are influencing the market.

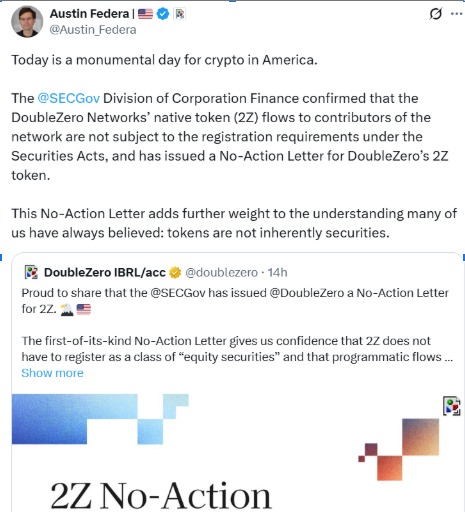

SEC Excludes DePIN Tokens from Securities Laws

This week, the US Securities and Exchange Commission (SEC) issued a rare no-action letter, meaning that it would not issue securities law against tokens related to Decentralized Physical Infrastructure Networks (DePIN).

Source: tweet

This decision was after the SEC examined a token issue of the DePIN project DoubleZero.According to Michael Seaman, chief counsel at the SEC's Division of Corporation Finance, the token and the services associated with it, does not fall under existing securities laws.

SEC Commissioner Hester Peirce emphasized that DePIN projects are fundamentally different from capital raising activities, which are the tasks for which the SEC is primarily charged.

Co-founder of DoubleZero, Austin Federa, said he was optimistic about the decision, which he called a huge milestone for the project and the larger U.S. crypto currency industry. The ruling will let DePIN providers get on with their infrastructure projects without having to worry about complicated securities regulations.

Kazakhstan Partners with Binance for State-Backed Crypto Fund

Kazakhstan has launched a state-backed crypto currency reserve fund, in partnership with Binance. The Alem Crypto Fund is the first BNB (Binance utility token) holding fund in the country, playing a role in the national development of the digital asset market.

Although the exact sum that BNB has purchased has not been disclosed, the fund intends to acquire strategic holdings in digital assets and create strategic reserves on behalf of Kazakhstan.

The relationship between the country and Binance dates back to 2022, when the crypto currency exchange signed a memorandum of understanding to support the development of the crypto regulatory framework of Kazakhstan. It is an extension of the introduction of Kazakhstan-based tenge-based stablecoin KZTE with Mastercard and other local partners.

These actions help emphasize the growing significance of regulatory transparency and government -supported projects in the international crypto industry, and pre-emerging economies like Kazakhstan and projects like DePIN can have future prospects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。