On one hand, it brings higher returns to users, and on the other hand, it brings higher TVL to the project.

Written by: Eric, Foresight News

Binance Wallet has announced the latest information on the Booster event. Users who reach 61 points in Alpha can participate in this Booster event, with a total reward of 15 million on-chain liquidity distribution protocol Turtle tokens (TURTLE). The tokens received from the Booster event will be subject to a lock-up period set by the project party, and the event will open today at 18:00.

Before Binance Wallet announced the event, Turtle officially announced its token economic mechanism: the total supply of TURTLE tokens is 1 billion, which will be issued on Ethereum, Linea, and BNB Chain. Among them, 31.5% will be allocated to the ecosystem, 13.9% will be used for airdrops, 2% will be allocated to core contributors, 1.6% will be allocated to advisors, 5% will be used for communication and marketing, 20% will be allocated to the team, and 26% will be allocated to investors.

What is Turtle?

Turtle is a feature-rich one-stop DeFi manager. Although it is not well-known in the Chinese community, its influence in the English community is significant. As of the time of writing, Turtle has provided a total liquidity of over 1.1 billion dollars to its partners.

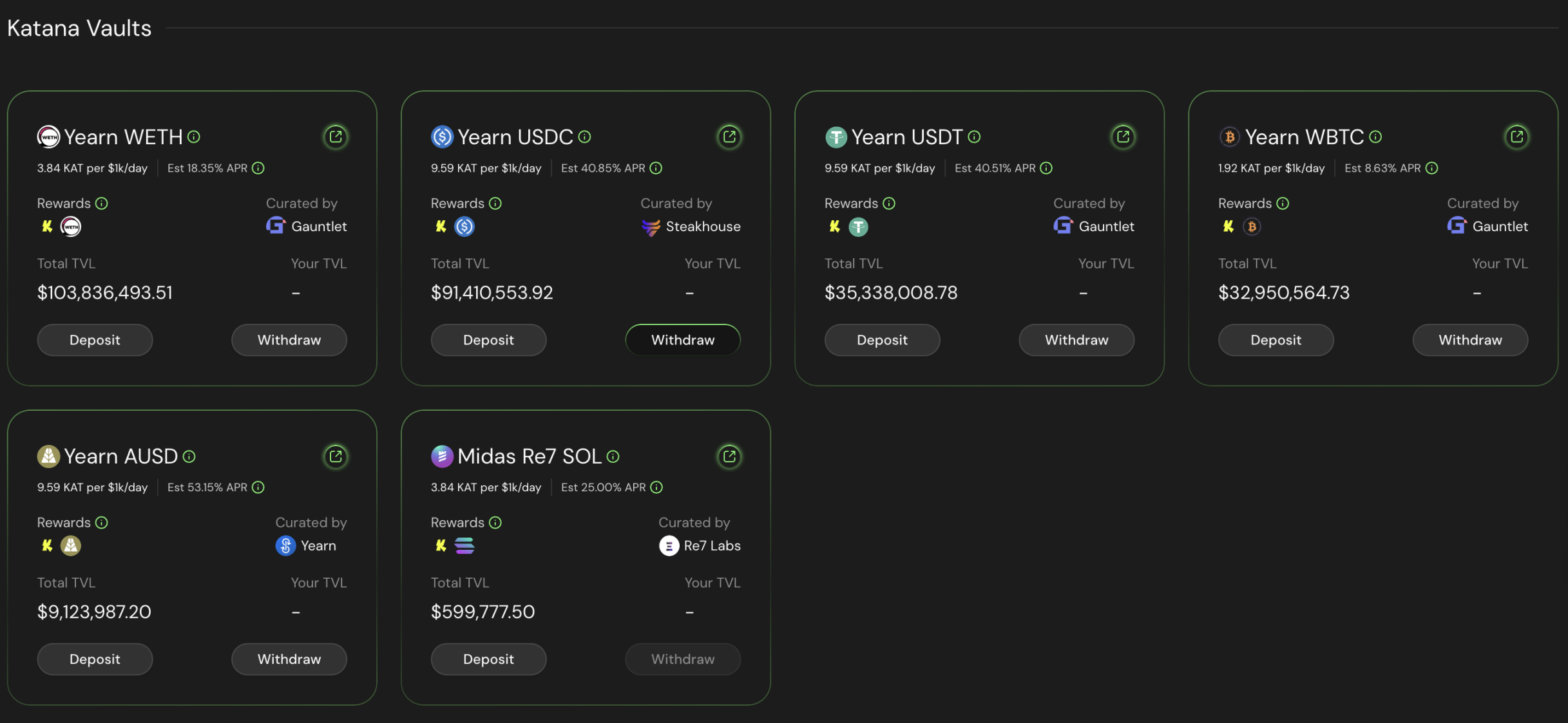

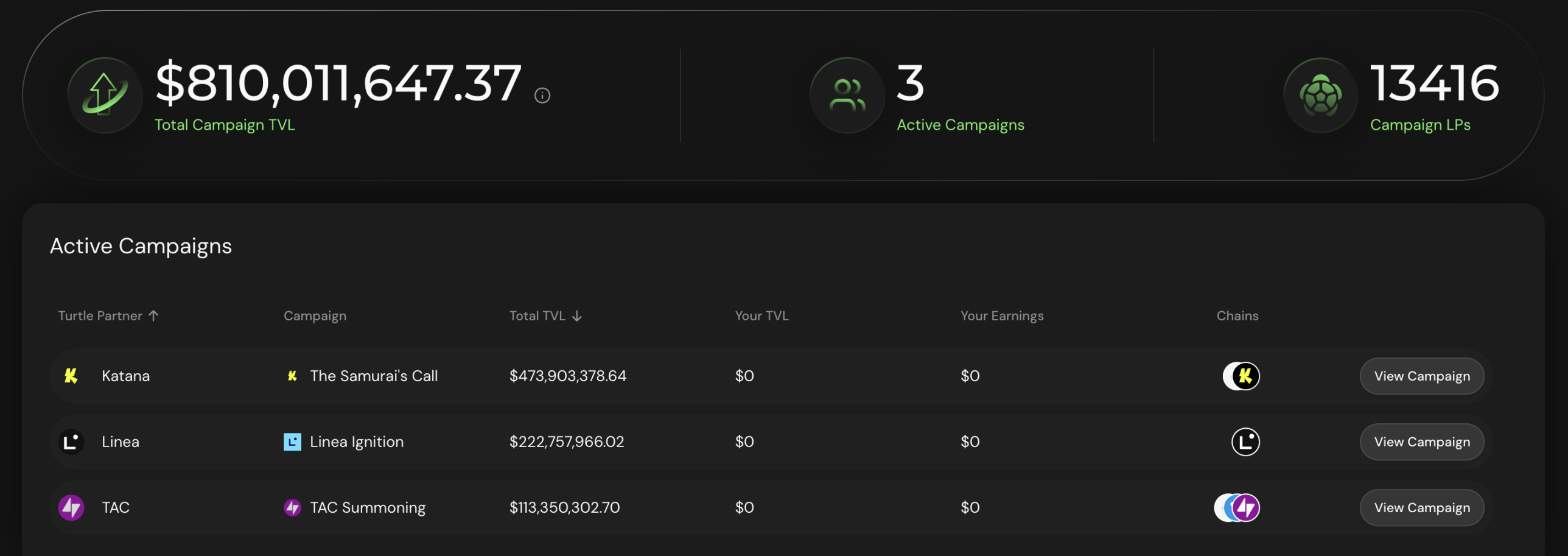

Overall, Turtle offers two main products. The first product is called Turtle Campaigns, which aims to bring more TVL to a public chain or project’s ecosystem by summarizing and displaying the paths to achieve the highest possible returns on certain income-generating assets (such as stablecoins or ETH) available within that ecosystem. Users do not need to collect information and calculate returns themselves; they just need to choose their preferred path.

Currently, the projects (ecosystems) supported by Turtle Campaigns include the DeFi-focused public chain Katana incubated by Polygon Labs and GSR, the Ethereum L2 Linea launched by Consensys, and the EVM blockchain TAC from the TON ecosystem, with a total guided liquidity exceeding 800 million dollars.

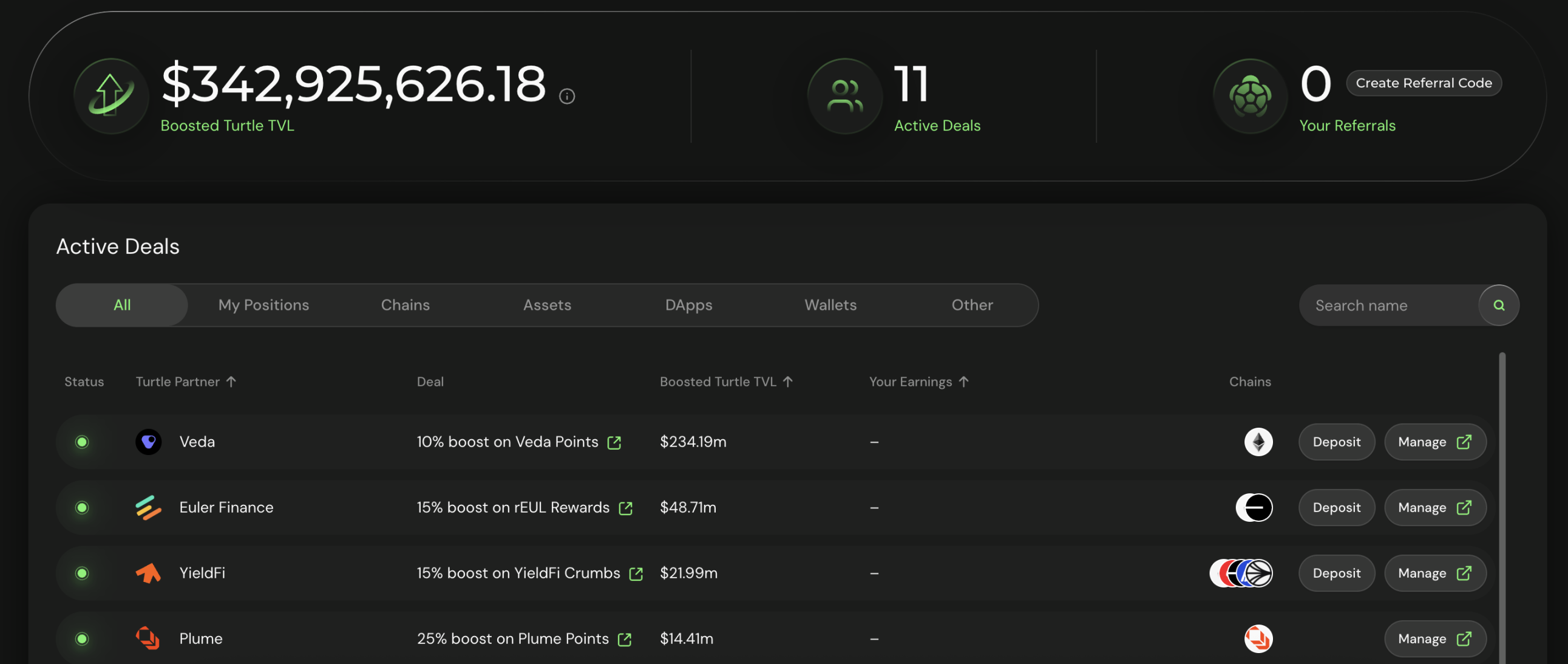

The second product is called Boosted Deals, where projects collaborating with Turtle offer additional rewards to users providing liquidity through Boosted Deals to attract more liquidity. At the same time, Turtle will distribute a certain amount of TURTLE token rewards based on the actual contributions of the users providing liquidity. This product has currently guided over 340 million dollars in liquidity.

Turtle completed a financing round led by THEIA in May this year, raising over 6 million dollars, with participation from Consensys and Ethereum co-founder Joseph Lubin. Turtle's founder, Essi Lagevardi, was previously the Chief Financial Officer of the contract auditing company Omniscia (whose clients include Euler Finance, Etherfi, Morpho, Fetch.ai, Maverick, etc.). Before Omniscia, Essi served as the DeFi lead at the blockchain cloud infrastructure company W3BCloud.

Co-founder and Chief Technology Officer Nick Thoma worked as a software engineer at ParaFi Capital before founding Thoma Technologies, which launched the visual product Ovrlook for managing investment portfolios. The company is also a distributed validator cluster operator for Lido and EtherFi.

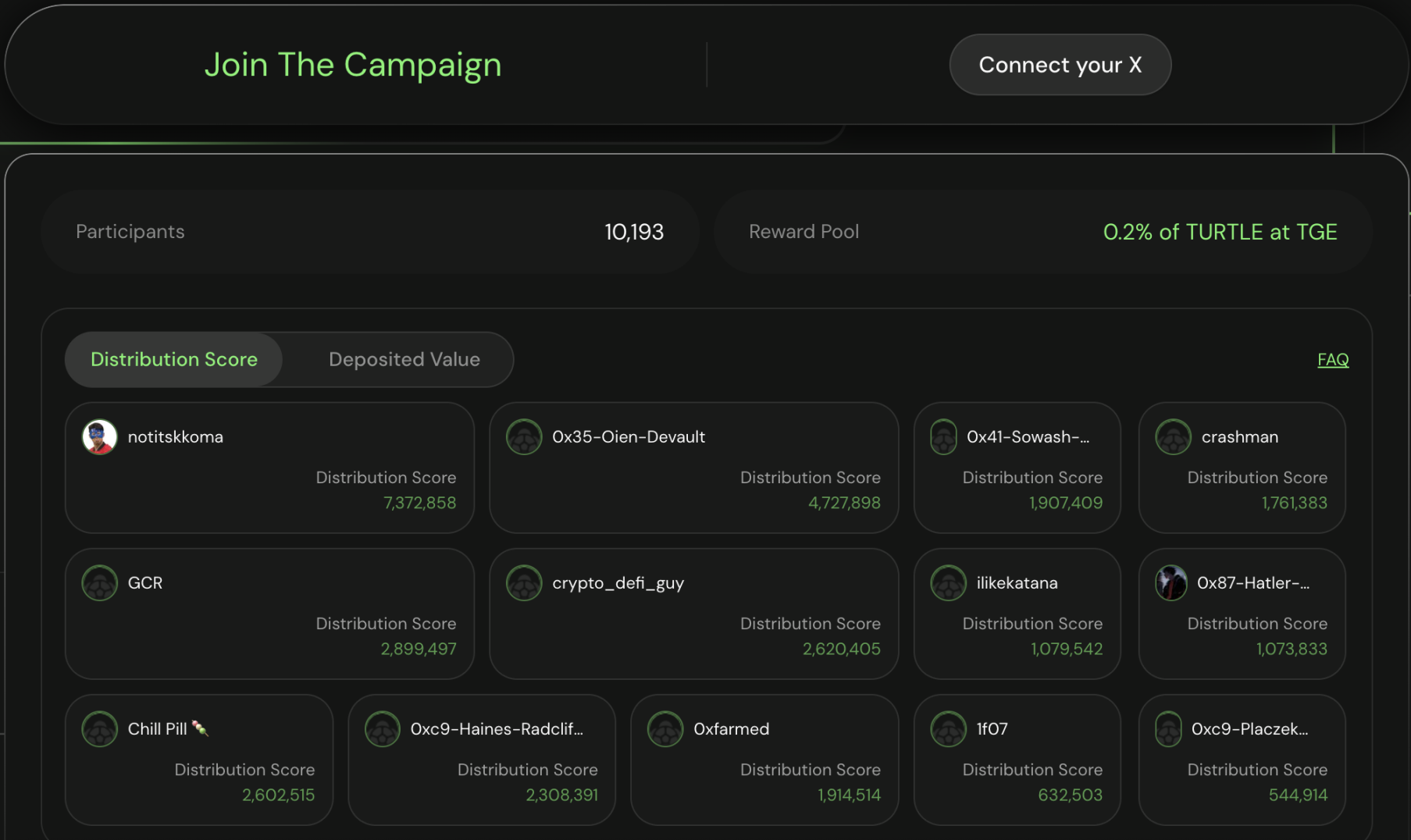

Turtle previously launched a leaderboard event, where users could earn points by depositing assets into the product and recommending others to deposit assets, ultimately receiving token rewards based on their points. For users who are already keen on participating in DeFi mining, they can save on complex operational gas costs and research time costs through the Turtle protocol while earning additional returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。