The approval or disapproval of Litecoin and SOL, which are the first to be ruled on, may determine subsequent market expectations.

Written by: 1912212.eth, Foresight News

In October 2025, the U.S. Securities and Exchange Commission (SEC) is set to make final rulings on at least 16 spot cryptocurrency exchange-traded funds (ETFs), with applications involving various tokens beyond Bitcoin and Ethereum, such as SOL, XRP, LTC, DOGE, ADA, and HBAR. According to the latest developments, the SEC has withdrawn several delay notifications and accelerated the approval process through new general listing rules, shortening the review period to less than 75 days.

As reported by crypto journalist Eleanor Terrett, the SEC has requested the issuers of LTC, XRP, SOL, ADA, and DOGE ETFs to withdraw their 19b-4 filings, as these documents are no longer necessary following the approval of the general listing standards.

Since the approval of Bitcoin and Ethereum spot ETFs, there has been significant capital inflow, contributing to price increases. So, will multiple ETFs be approved this time, and will there be a price increase effect?

The final deadline for multiple token ETF rulings is in October

According to information compiled by Twitter user Jseyff, the final deadlines for several altcoin spot ETFs are spread throughout October. The first to be approved is the Canary LTC ETF, with a deadline of October 2.

Next is Grayscale's Solana and LTC trust conversion, dated October 10, followed by WisdomTree's XRP fund, dated October 24.

According to a list of upcoming approvals created by Bloomberg ETF analyst James Seyffart, decisions may be made at any time before the final deadlines.

These applications come from institutions such as Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton. Notably, BlackRock and Fidelity are not participating in this round, but this does not diminish the potential impact—if approved, they could pave the way for larger-scale products in the future.

Since the BTC and ETH spot ETFs, no other cryptocurrencies have received SEC approval, and the SEC has continued its past practice of delaying decisions. However, the upcoming ultimate rulings must provide the market with a definitive Yes or No.

The market is eagerly awaiting.

The approval or disapproval of Litecoin and SOL may determine subsequent market expectations.

Probability of Approval

At the end of July this year, the SEC's new listing standards primarily focused on the eligibility requirements and operational mechanisms for crypto ETPs. First, the creation and redemption of physical assets have been officially allowed, meaning authorized participants can exchange ETP shares for actual crypto assets instead of cash.

The SEC also announced listing standards for spot ETFs, with the new standards expected to take effect in October 2025, aimed at simplifying the ETF listing process. The general listing standard requires that crypto assets must be listed on major exchanges like Coinbase for at least six months. This regulation aims to ensure that assets have sufficient liquidity and market depth to avoid manipulation.

Litecoin, known as a long-established altcoin, has its maturity and non-security attributes making it one of the first candidates for approval. Litecoin founder Charlie Lee stated in a recent interview that he expects a spot LTC ETF to be launched soon. This view is based on the SEC's approval of the general listing standards for cryptocurrency ETFs, with LTC being one of the ten assets that meet the criteria.

In the interview, Charlie Lee discussed LTC's prospects under the evolving regulatory framework. He mentioned that the SEC recently approved the general listing standards for crypto ETFs, which is a key driving factor, and emphasized that Litecoin meets the conditions for rapid approval.

As of now, bets on Polymarket have raised the probability of Litecoin's spot ETF approval this year to 93%.

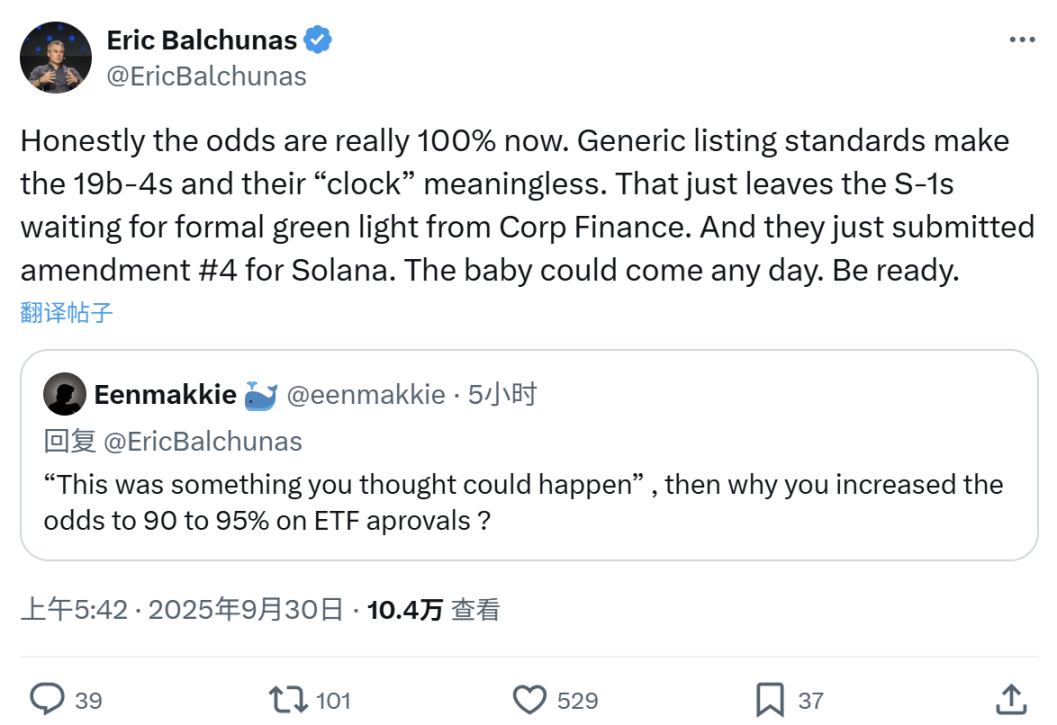

Regarding the situation of SOL's spot ETF, Bloomberg ETF analyst Eric Balchunas stated, "To be honest, the success rate for SOL's spot ETF approval is now close to 100%. The general listing standards have rendered the 19b-4 filings and their timelines meaningless; now only the S-1 form-related matters remain. The child could be born at any time, so be prepared."

It is worth mentioning that ADA is the last cryptocurrency awaiting a ruling at the end of October, with bets on Polymarket raising the probability of its ETF approval to 93%.

The SEC's decision at the beginning of October will clearly become a barometer.

Previously, the SEC approved the Hashdex Crypto Index ETF, and recently, the Hashdex Nasdaq Crypto Index U.S. ETF (NCIQ) added support for XRP, SOL, and XLM, allowing this product to provide U.S. investors with exposure to five crypto assets: BTC, ETH, XRP, SOL, and XLM through a single investment tool.

Earlier, the SEC approved Bitwise's conversion of the 10 Crypto Index Fund into an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

Will approval benefit coin prices?

Bitfinex analysts previously predicted that the approval of crypto ETFs could trigger a new season or rebound for altcoins, as these approvals would provide traditional investors with more exposure to crypto investments.

However, this view is not universally accepted by analysts.

Bloomberg ETF analyst James Seyffart stated that the current market is characterized by altcoin rallies driven by digital asset financial companies (DATCO) rather than traditional token price increases. Seyffart pointed out that institutional investors are more inclined to choose multi-cryptocurrency portfolio products rather than single altcoin ETFs. He emphasized that institutional funds prefer to gain exposure to cryptocurrencies through regulated products rather than directly holding tokens, and this structural shift could permanently change the upward pattern of altcoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。