Points black box, everyone locked up, YT trapped; the number of airdrops is expected to be 1/4, with only 0.4% of tokens claimed.

Written by: Alex Liu, Foresight News

DeFi actuaries are one step ahead, but is DWF Labs "one step higher"?

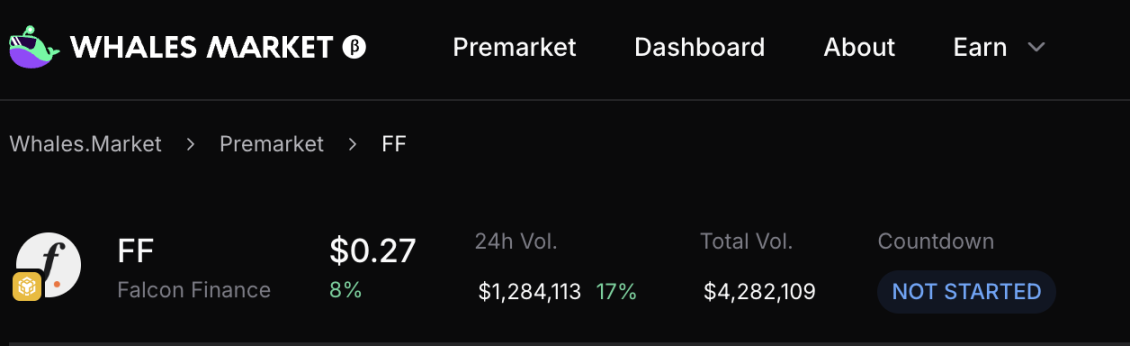

Price trend of FF after launching on Binance Alpha

On the evening of September 29, Falcon Finance's token FF officially launched, landing on major exchanges such as Binance, OKX, Upbit, Bitget, and Bybit. As a project incubated by market maker DWF, the price trend of FF after launch showed a "high open and low close" pattern. Why is this?

High Opening

Based on FF's opening price of $0.6 on Binance Alpha, its FDV (Fully Diluted Valuation) is $6 billion. From the project's fundamentals, Falcon Finance's synthetic dollar stablecoin USDf has a supply of $1.9 billion, while the leading project in the sector, Ethena, has a stablecoin supply exceeding $16 billion, with the FDV of the ENA token at $8.4 billion.

In comparison, FF is relatively overvalued. For reference, the pre-market pricing for FF was around $0.27.

Why did FF open at such a high price?

Where does the selling pressure come from?

The high opening and low closing price of the token indicate selling pressure. With such a high opening price, Falcon Finance claims that 7% of the token supply is allocated for point airdrops. Is it the eager sellers of the airdrop tokens that caused the price to drop?

In fact, before the airdrop claims opened, Falcon Finance did not allow token quantity inquiries. When the claims finally opened about an hour late, participants found that the number of tokens they could claim was less than 1/4 of the expected amount based on the 7% airdrop ratio. The official explanation for this was absent.

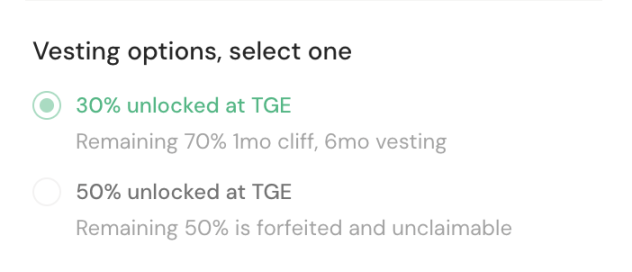

Additionally, all participants are required to lock their tokens. If they choose to claim 50% of the tokens, the other 50% will be forfeited. If they choose to claim 30% of the tokens, the remaining 70% must be locked for 1 month and then released linearly over 6 months. Furthermore, participants with points below 5 million (approximately $100 in tokens) are not eligible to claim.

All these factors mean that participants in the Falcon points activity could only sell airdrops amounting to about 1/10 of what was expected. According to on-chain data, the actual number of airdrop tokens claimed is less than 40 million, about 0.4% of the token supply.

The contract address with an initial balance of 500 million tokens has 461.9 million tokens remaining

The official initial circulation of the tokens is stated to be 23.4%. The public sale on Buidlpad and the Binance airdrop together account for less than 5% of the token supply, which raises questions about the source of the selling pressure.

Reflection on Transparency

Due to Falcon Finance's claim that 7% of the first season's airdrop was actually less than 2%, the transparency issue has caused users to lose trust in its second season airdrop. The leveraged points obtained through Pendle YT dropped from 15% to 12% in a short time (due to underlying yields, this indicates a significant decrease in expected valuation of the points), leaving users who had positioned themselves for Falcon Finance's second season trapped.

Whether retail or institutional investors, participants in stablecoin projects typically seek transparent rules and predictable returns. If Falcon Finance does not respond to this, it may lose a considerable number of users and face an even harder-to-repair trust gap.

Comparison with ENA

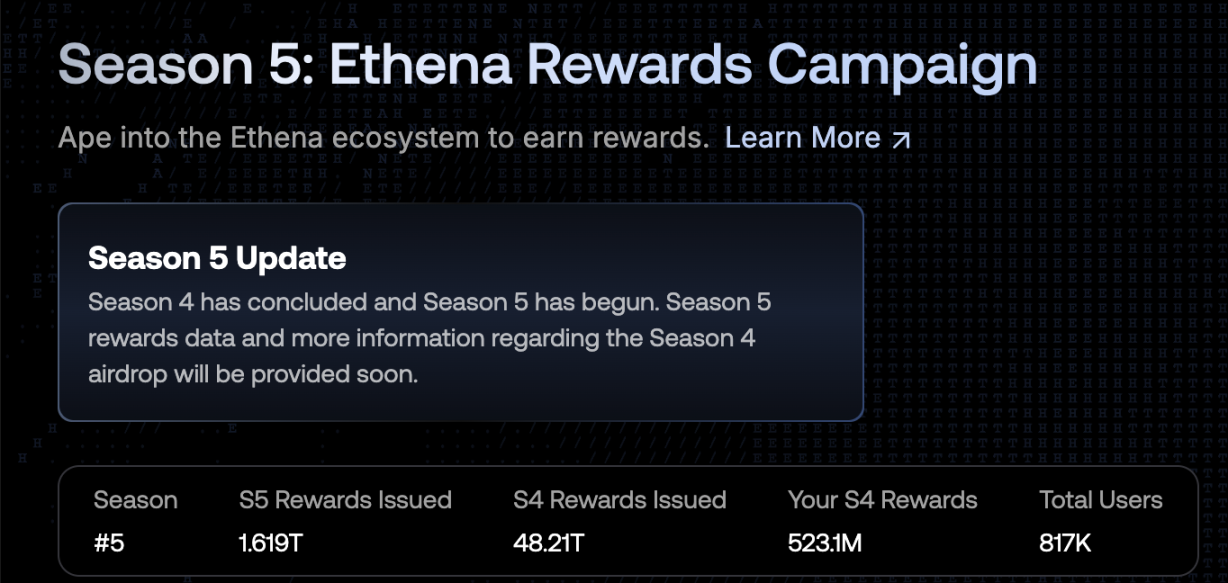

As a control group, Ethena's points activity is much more transparent.

Ethena airdropped 5% of the total token supply in the first season, and is set to airdrop 3.5% in the fourth season, while Falcon's first season was less than 2%. Ethena requires the top 2000 participants to lock half of their tokens, while retail investors have all tokens unlocked. In contrast, Falcon mandates everyone to lock their tokens.

Ethena publishes the daily increase in points and the total points. Due to the transparency of rules and data, the airdrop returns for each season can be calculated before the tokens are issued. Falcon's points black box, while attracting many DeFi players to calculate, ultimately left the project party not following the rules.

From the perspective of ease and fairness, for large investors in stablecoin wealth management, participation in Ethena is still recommended.

Disclaimer: The author of this article participated in the FF token claims and is also involved in the Ethena ecosystem; some content is based on personal experiences.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。