The AI platform Edgen, which integrates stocks and cryptocurrencies into a unified intelligent layer, announced a major upgrade today, fundamentally changing the way investors interact with the market. This release marks a key step for Edgen towards building a transparent and collaborative financial ecosystem—allowing investors, developers, and protocols to operate efficiently on the same intelligent foundation.

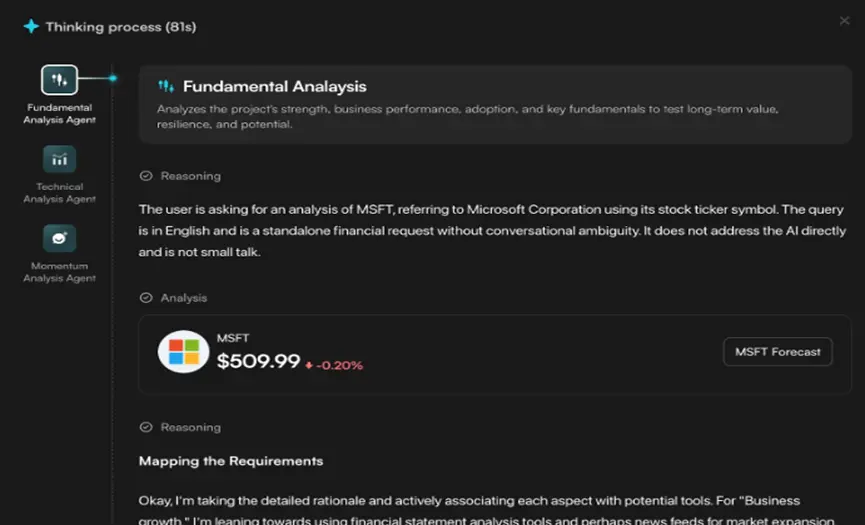

Currently, investors face the dual challenges of market fragmentation and data overload. Edgen transforms market noise into actionable insights through a multi-agent architecture, integrating industry narratives, market signals, and real-time events into a unified view. Unlike traditional single models, Edgen's underlying design adopts a distributed thinking model: its multi-agent system breaks down complex market issues into analyses from various professional perspectives, such as fundamentals, technicals, momentum, and sentiment, ultimately merging them into coherent decision support.

This architecture not only enhances decision-making efficiency but also ensures the transparency of the reasoning process. The analytical logic of each agent is fully visible, allowing users to trace the generation path of conclusions, moving away from the uncertainties of traditional black-box models.

When asked about the driving factors behind Microsoft's stock price, Edgen does not provide vague conclusions like "profit growth" or "AI dividends," but instead presents breakthrough patterns identified by technical analysts, the trade-offs of revenue and profit analyzed by fundamental analysts, product release volume captured by sentiment trackers, and the impact of bond yields from a macro perspective. Each analytical clue is traceable and verifiable.

(Image: Edgen Fundamental Analysis Agent Work Interface)

This constitutes an essential difference: traditional tools provide unchallengeable perfect answers, while Edgen delivers a disassemblable reasoning scaffold. Users can compare different perspectives, validate hypotheses, and observe the consensus and divergences of agents, ultimately gaining dynamic market insights that combine speed and depth, clarity and interpretability.

Multi-agent reasoning is not just a functional feature; it is the core mechanism by which Edgen transforms fragmented signals into structured cognition. It constructs a research flow where every conclusion is traceable and every narrative has context, allowing users to truly "hear the threads of market thinking."

The Edgen-selected news engine supporting this system can filter market noise, accurately capture key events, and automatically associate affected assets and themes. Meanwhile, the Edgen Store further expands the ecosystem: every new agent introduced through the store will integrate into the multi-agent framework, continuously enhancing the system's collective intelligence from fundamental analysis to alternative strategies.

"This upgrade demonstrates that AI systems can achieve speed, depth, and transparency simultaneously," said Edgen founder Sean Tao. "We are building an open, explainable, and actionable infrastructure for the next generation of market intelligence ecosystems."

Through the triple combination of narrative-driven analysis, reasoning-first AI, and ecological reporting, Edgen is gradually becoming the "market operating system." In this unified layer, insights, strategies, and stories intersect, providing smarter and more agile decision support for every participant in the financial ecosystem.

About Edgen

Edgen is an AI collaborator for investors, integrating stocks and cryptocurrencies into a unified intelligent layer. By coordinating hundreds of professional tools, agents, and data sources, it helps investors from diverse backgrounds tackle data overload and information asymmetry. The platform integrates AI assistants, real-time social sentiment analysis, and on-chain data tracking, supporting automated analysis, portfolio optimization, and market opportunity identification.

The Edgen team brings together former Wall Street quantitative traders and core Web3 protocol developers, backed by investments from institutions such as Framework Ventures and North Island Ventures, dedicated to building cognitive infrastructure for the next generation of open finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。