Author: Prathik Desai

Translation: Saoirse, Foresight News

Seven years ago, Apple achieved a financial feat whose impact even surpassed that of the company's most outstanding products. In April 2017, Apple opened the $5 billion "Apple Park" campus in Cupertino, California; a year later, in May 2018, the company announced a $100 billion stock buyback plan—an amount 20 times its investment in the 360-acre headquarters known as the "spaceship." This sent a core message from Apple to the world: besides the iPhone, it has another "product" that is equally important (if not more so) than the iPhone.

This was the largest stock buyback plan in the world at the time and part of a decade-long buyback spree by Apple—during which the company spent over $725 billion repurchasing its own shares. Six years later, in May 2024, the iPhone manufacturer broke records again by announcing an $110 billion buyback plan. This operation proved that Apple not only knows how to create scarcity in hardware devices but is also adept at managing operations on the stock level.

Today, the cryptocurrency industry is adopting similar strategies, with a faster pace and larger scale.

The two main "revenue engines" of the industry—perpetual futures exchange Hyperliquid and meme coin issuance platform Pump.fun—are using almost every cent of their fee income to buy back their own tokens.

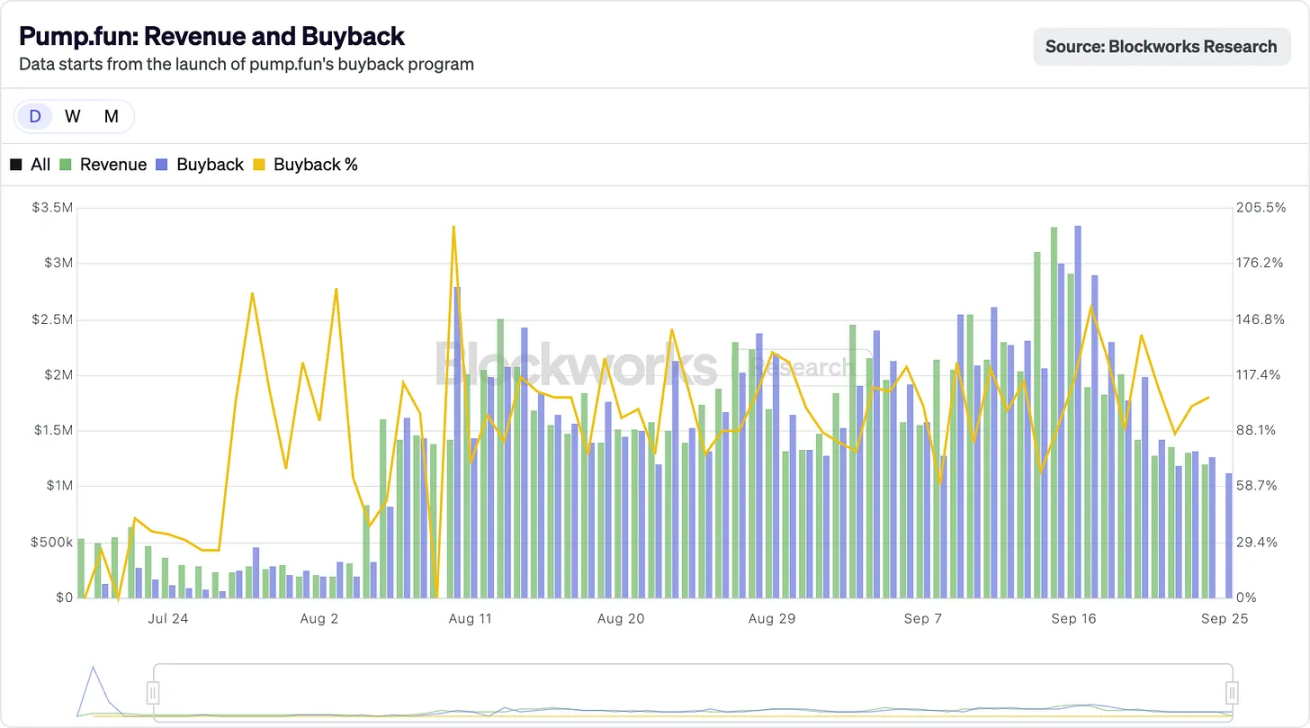

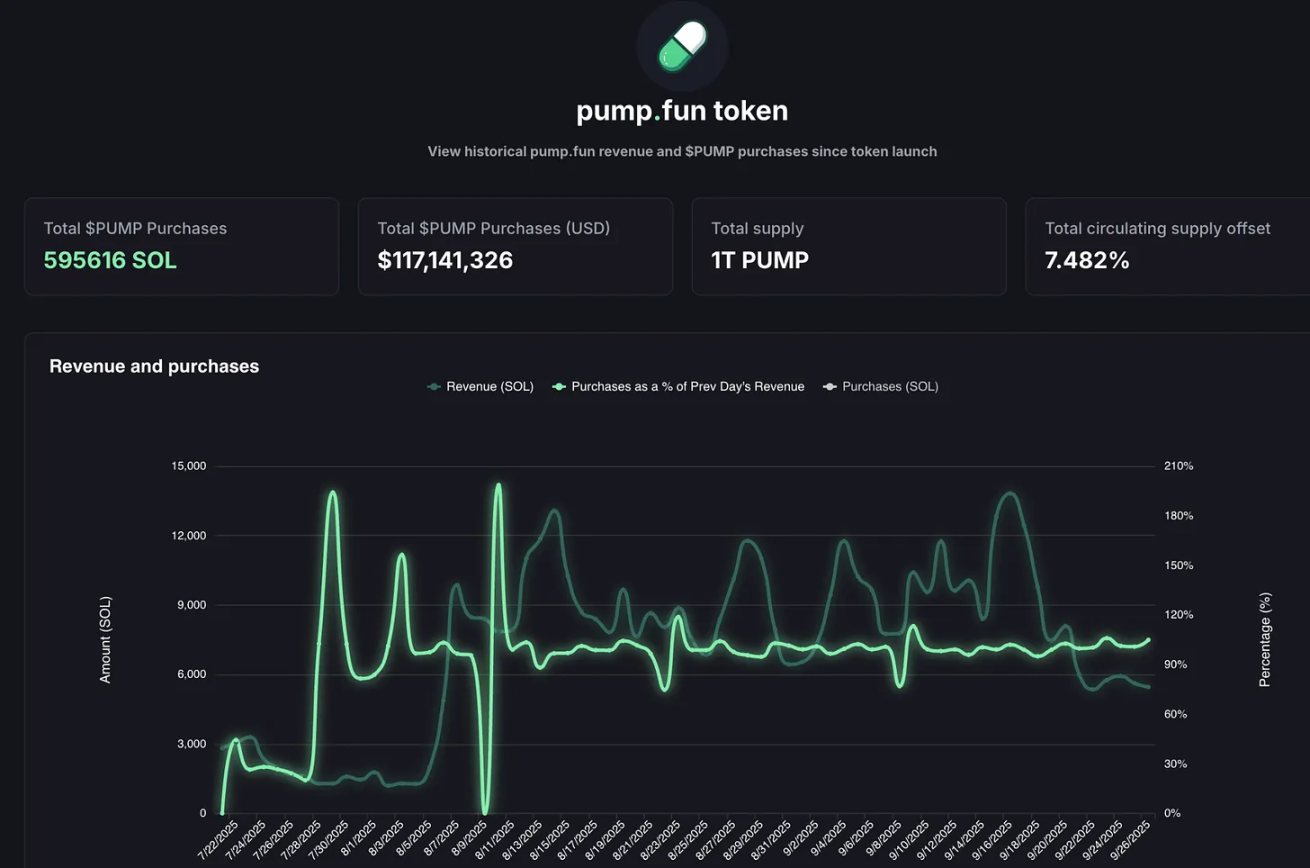

Hyperliquid set a record of $106 million in fee income in August 2025, with over 90% used to repurchase HYPE tokens on the open market. Meanwhile, Pump.fun's daily revenue briefly exceeded that of Hyperliquid—in September 2025, the platform's single-day revenue reached $3.38 million. Where does this income ultimately go? The answer is 100% used to buy back PUMP tokens. In fact, this buyback model has been ongoing for more than two months.

@BlockworksResearch

This operation is gradually giving cryptocurrency tokens the attributes of "shareholder equity representation"—which is rare in the cryptocurrency field, as tokens are often sold off to investors at the first opportunity.

The logic behind this is that cryptocurrency projects are trying to replicate the long-standing successful path of Wall Street's "dividend aristocrats" (like Apple, Procter & Gamble, Coca-Cola): these companies spend huge amounts to return profits to shareholders through stable cash dividends or stock buybacks. For example, in 2024, Apple's stock buyback amounted to $104 billion, accounting for about 3%-4% of its market value at the time; while Hyperliquid achieved a "circulation offset ratio" of up to 9% through buybacks.

Even by traditional stock market standards, such numbers are astonishing; in the cryptocurrency field, they are unprecedented.

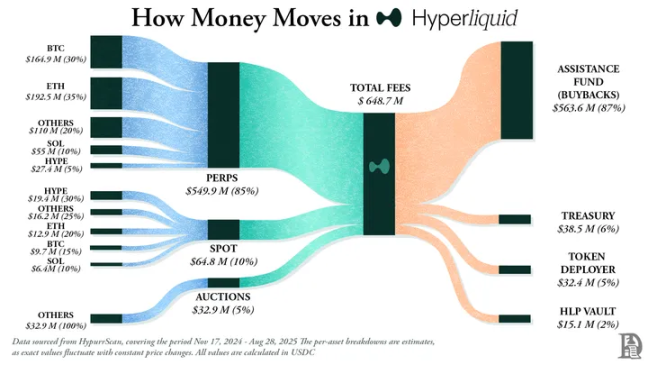

Hyperliquid's positioning is very clear: it has created a decentralized perpetual futures exchange that combines the smooth experience of centralized exchanges (like Binance) but operates entirely on-chain. The platform supports zero gas fees, high-leverage trading, and is centered around perpetual contracts. By mid-2025, its monthly trading volume had surpassed $400 billion, capturing about 70% of the DeFi perpetual contract market.

What truly sets Hyperliquid apart is its use of funds.

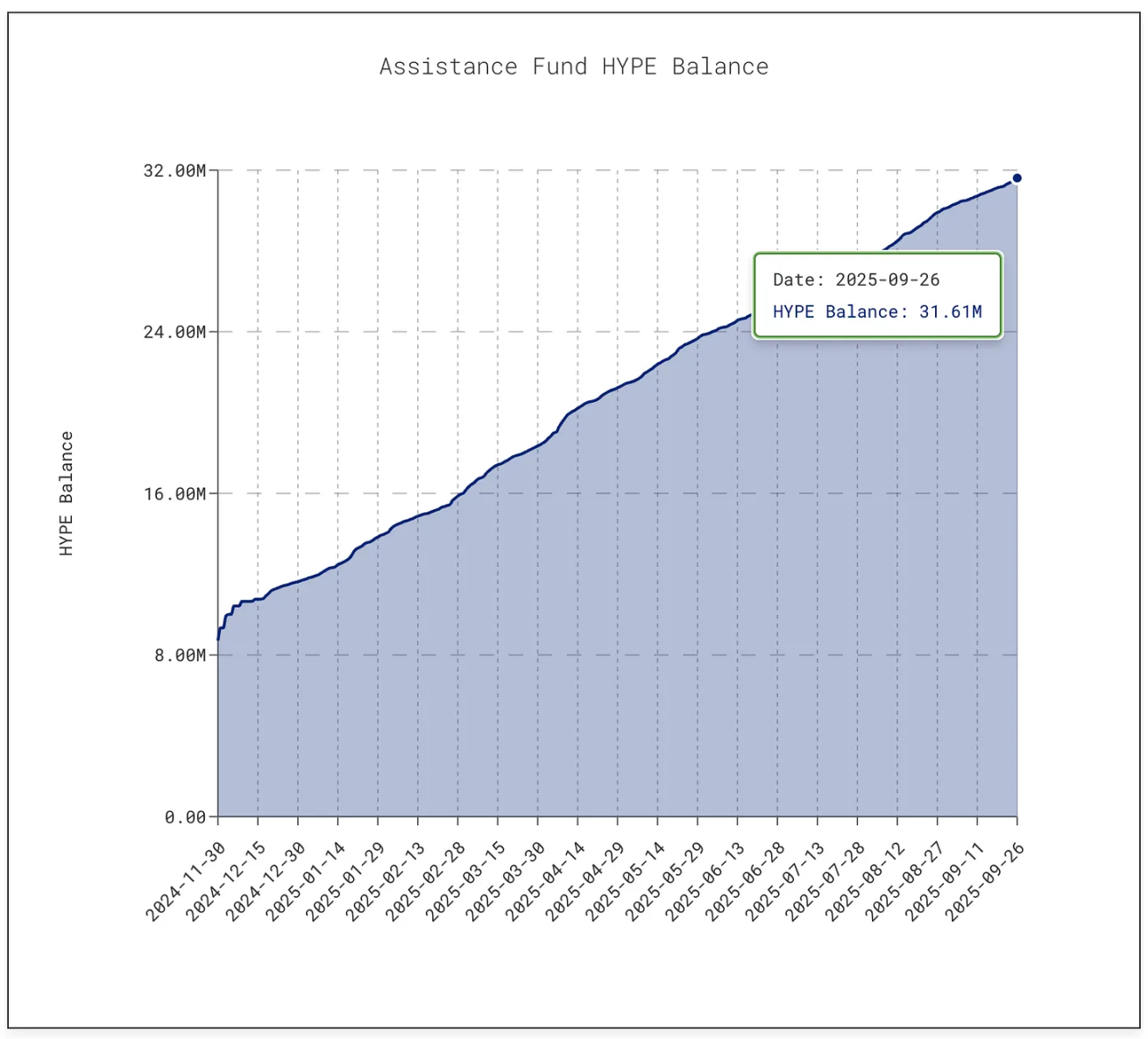

The platform allocates over 90% of its daily fee income to a "support fund," which is directly used to purchase HYPE tokens on the open market.

@decentralised.co

As of the writing of this article, the fund has accumulated over 31.61 million HYPE tokens, valued at approximately $1.4 billion—an increase of tenfold from 3 million tokens in January 2025.

@asxn.xyz

This buyback frenzy has reduced the circulating supply of HYPE by about 9%, pushing the token price to a peak of $60 in mid-September 2025.

At the same time, Pump.fun has reduced the circulating supply of PUMP tokens by about 7.5% through buybacks.

@pump.fun

This platform has transformed the "meme coin craze" into a sustainable business model with extremely low fees: anyone can issue tokens on the platform and build "bonding curves," allowing market enthusiasm to ferment freely. What initially started as a "joke tool" has now become a "production factory" for speculative assets.

However, there are also hidden dangers.

Pump.fun's income is clearly cyclical—because its revenue is directly tied to the popularity of meme coin issuance. In July 2025, the platform's revenue fell to $17.11 million, the lowest level since April 2024, and the scale of buybacks shrank accordingly; by August, monthly revenue rebounded to over $41.05 million.

However, "sustainability" remains an unresolved issue. When "meme season" cools down (which has happened in the past and will inevitably happen in the future), token buybacks will also contract. More critically, the platform is facing a lawsuit amounting to $5.5 billion, with plaintiffs accusing its business of being "similar to illegal gambling."

Currently, the core support for Hyperliquid and Pump.fun is their willingness to "return profits to the community."

Apple has returned nearly 90% of its profits to shareholders through buybacks and dividends in some years, but these decisions are often stage-based "bulk announcements"; whereas Hyperliquid and Pump.fun continuously return almost 100% of their income to token holders every day—this model is sustainable.

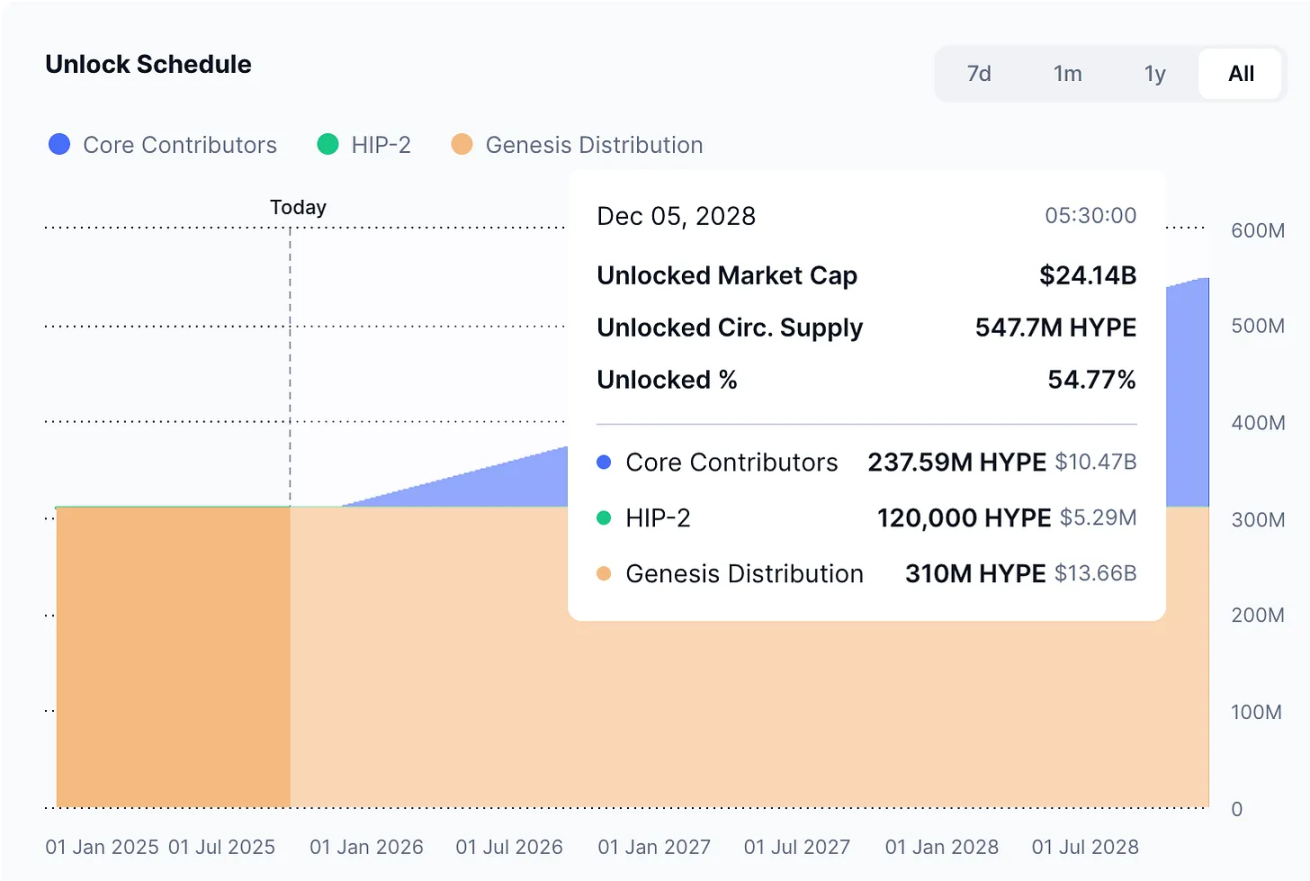

Of course, there are still essential differences between the two: cash dividends are "realized income," which, although taxable, are stable; while buybacks are at most a "price support tool"—once income declines or the amount of unlocked tokens far exceeds the buyback amount, the effect of buybacks will be nullified. Hyperliquid is facing an impending "unlock shock," while Pump.fun must deal with the risk of "meme coin popularity transfer." Compared to Johnson & Johnson's record of "63 years of continuously increasing dividends" or Apple's long-term stable buyback strategy, the operations of these two crypto platforms resemble "walking a tightrope."

But perhaps, this is already a challenge in the crypto industry.

Cryptocurrency is still in a maturation phase and has not yet formed a stable business model, but it has already shown astonishing "development speed." The buyback strategy just happens to have elements that drive industry acceleration: flexibility, tax efficiency, and deflationary properties—these characteristics align closely with the "speculation-driven" crypto market. So far, this strategy has transformed two completely different projects into top "revenue machines" in the industry.

Whether this model can be sustained in the long term remains to be seen. But it is evident that it has allowed crypto tokens to shed the label of "casino chips" for the first time, coming closer to "company stocks that can generate returns for holders"—the speed of returns may even put pressure on Apple.

I believe there is a deeper insight behind this: Apple realized long before the emergence of cryptocurrency that it was selling not just iPhones, but its own stock. Since 2012, Apple has spent nearly $1 trillion on buybacks (more than the GDP of most countries), reducing its stock circulation by over 40%.

Today, Apple's market value still maintains above $3.8 trillion, partly because it views its stock as a "product that needs marketing, polishing, and maintaining scarcity." Apple does not need to raise funds through issuing new shares—its balance sheet is cash-rich, so the stock itself has become a "product," and shareholders have become "customers."

This logic is gradually permeating the cryptocurrency field.

The success of Hyperliquid and Pump.fun lies in the fact that they do not use the cash generated from their business for reinvestment or hoarding, but rather convert it into "purchasing power that boosts demand for their own tokens."

This also changes investors' perceptions of crypto assets.

While iPhone sales are certainly important, investors who are optimistic about Apple know that the stock has another "engine": scarcity. Now, for HYPE and PUMP tokens, traders are beginning to form a similar understanding—these assets, in their eyes, come with a clear commitment: every transaction or consumption based on these tokens has over a 95% chance of being converted into "market buybacks and destruction."

But Apple's case also reveals another side: the strength of buybacks always depends on the strength of the cash flow behind them. What happens if income declines? When iPhone and MacBook sales slow down, Apple's strong balance sheet allows it to fulfill buyback commitments through debt issuance; whereas Hyperliquid and Pump.fun do not have such a "buffer"—once trading volume shrinks, buybacks will also come to a halt. More importantly, Apple can turn to dividends, service businesses, or new products to respond to crises, while these crypto protocols currently have no "backup plans."

For cryptocurrencies, there is also the risk of "token dilution."

Apple does not have to worry about "200 million new shares flooding the market overnight," but Hyperliquid faces this issue: starting in November 2025, nearly $12 billion worth of HYPE tokens will be unlocked for insiders, a scale far exceeding daily buyback amounts.

@coinmarketcap

Apple can autonomously control the circulation of its stock, while crypto protocols are bound by token unlock schedules that were "written in black and white" years ago.

Even so, investors still see value in it and are eager to participate. Apple's strategy is evident, especially for those familiar with its decades-long development history—Apple has cultivated shareholder loyalty by transforming its stock into a "financial product." Now, Hyperliquid and Pump.fun are attempting to replicate this path in the crypto field, only with a faster pace, greater momentum, and higher risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。