Either the next living Binance or the next dead FTX.

Written by: Zuoye

A ghost, a ghost of super liquidity, wanders on the chain. To conduct a holy siege against this ghost, all forces of CEX, both offshore and onshore, Perp DEX and FTX fragments, the radicals of Solana and the newcomers of L2, have united.

The US dollar is the anchor of liquidity, Hyperliquid is equivalent to crypto liquidity, and trading is increasingly concentrated on mainstream coins like BTC/ETH. People intentionally or unintentionally forget that Hyperliquid has grown by seizing the time window, inadvertently growing into a towering giant.

Everyone is talking about the possibility of Hyperliquid flipping Binance, as if Aster's offensive is just the beginning of a long attack. However, the 20x leverage limit of 2021 did not end the competitive landscape between FTX and Binance, and today's Aster 1001x will not hinder Hyperliquid's pace.

Mystery is the source of charm. The Hyperliquid ecosystem is too complex; this article only concerns how Hyperliquid survived the siege from CEX and turned the tables. The lineage of HyperEVM and its DeFi ecosystem, as well as the flywheel of $HYPE, the closed loop of $USDH, and capital operation stories like ETF and DAT will be discussed in subsequent sections.

The Price of Time

Do not hate your enemies; it will cloud your judgment.

The history of finance is as long as the history of arbitrage.

From the revelation of FTX's secrets by Coindesk on November 2, 2022, to FTX's bankruptcy filing on November 11, 2022, the strategies involved attacking the security of $FTT as FTX's reserve and the misappropriation of FTX user assets by the market maker Alameda. Subsequently, CZ first expressed interest in acquiring FTX but then refused, disrupting SBF's fundraising rescue rhythm.

When SBF was fundraising in the Middle East, he clearly expressed his hatred for CZ. Emotion is the enemy of business, and ultimately, SBF did not save FTX.

In hindsight, whether it is the prediction market, AI investment, or the Solana chain itself, as well as the gradual liquidation of FTX assets, even the collaboration of perpetual contract exchanges and market makers, one would find that SBF's thinking was correct; unfortunately, the person was unstable.

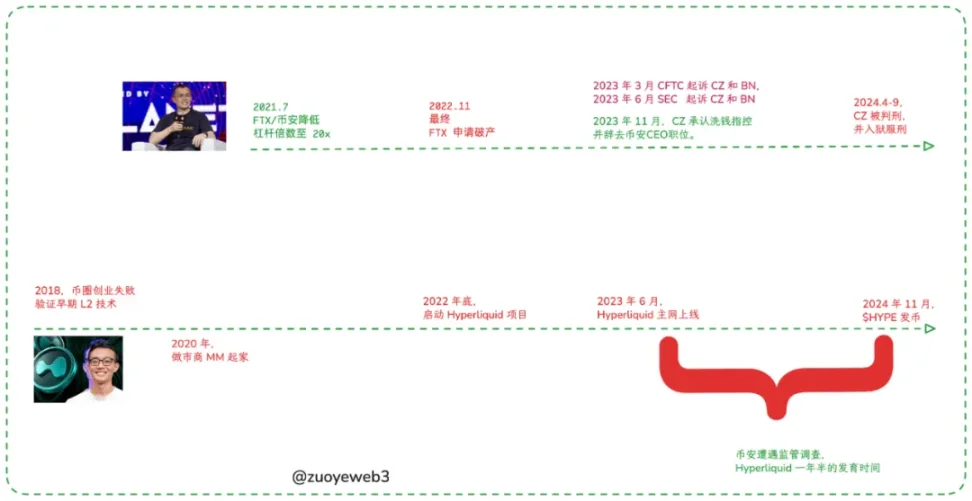

Caption: The early development history of Hyperliquid, image source: @zuoyeweb3

After the collapse of FTX, CZ began negotiating with the US judicial system regarding the ticket compensation issue. The price for getting on the bus and then compensating was $4.2 billion, but unfortunately, the high cost did not restore Binance's stable position; the seeds of Hyperliquid had already been sown.

The US defines challengers as those with a GDP reaching about 60% of its own; neither the Soviet Union nor Japan met this standard. Binance's warning line for challengers is 10%. As long as it is below this safety line, whether it is the on-chain dYdX or the centralized FTX, they are negotiable targets, and Binance's main site and BNB ecosystem's ApolloX can provide defense.

Hyperliquid has almost developed in sync with Binance, launching in June 2023 and issuing tokens in November 2024. Who remembers that CZ happened to publicly discuss Bio Protocol and educate Giggle at this time? Hyperliquid is merely another Perp project directed towards token issuance.

Caption: Hyperliquid OI market share, image source: @0xhypeflows

Unfortunately, Hyperliquid's growth flywheel did not stall after the epic 31% airdrop of $HYPE; instead, trading volume truly began to rise.

Counterintuitively, GMX also experienced a surge in trading volume, where trading volume was exchanged for tokens, and after the tokens were issued, both the token price and trading volume returned to zero. It can be predicted that whether it is Aster, Avantis, Lighter, Backpack, edgeX, StandX, Drift, or BULK, they will follow this path. This does not mean they are not good projects, nor does it mean that tokens cannot participate.

We are merely emphasizing that Hyperliquid's ability to survive after issuing tokens is itself an abnormal behavior, which is why we examine whether it can traverse cycles and become a main axis in the crypto industry.

The remaining similar projects will lose their attractiveness after issuing tokens. Sushiswap can absorb Uniswap's trading volume, GMX can absorb dYdX's trading volume, and Blur can absorb OpenSea's trading volume.

Binance's offshore arbitrage against Coinbase's onshore benefits, and SBF's use of FTX to arbitrage against Binance's regulatory benefits, Hyperliquid arbitrages the benefits of CEX.

The time window is merely a passive blank space; actively keeping up with the situation is what has led to the present.

The centralization of BTC/ETH trading and the meme craze mirror each other. It is precisely because large funds and ETFs dominate the price trends of mainstream coins that the on-chain market initiated by PumpFun has emerged. Desperate retail investors face sanctions like having their internet cut off through GameStop; memes do not restrict this point.

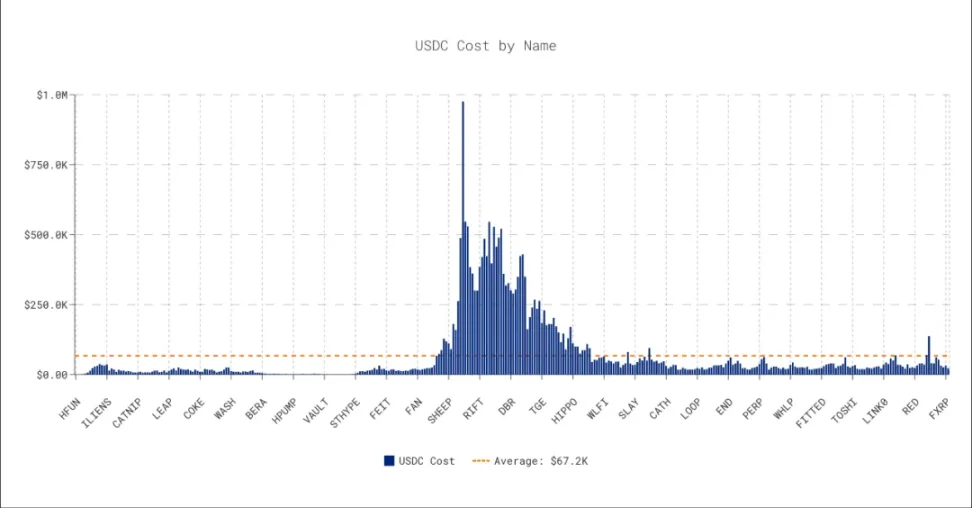

In mid-2024, Hyperliquid will launch a Dutch auction model for token issuance, innovating beyond the opaque token issuance model of CEX. More importantly, Hyperliquid will gradually enter a dual approach of spot and contract trading.

However, by the end of 2024, aside from $GOD reaching $100,000, the remaining auction prices are hovering at low levels, and the tokens launched throughout 2024 are mostly "non-mainstream" meme coins, which cannot be compared to the current BTC spot trading volume approaching Binance.

Caption: Hyperliquid Dutch auction data, image source: @asxnr_

More accurately, Hyperliquid's development started from Perp DEX, focusing on low latency, token incentives, and permissionless processes. However, it closely followed the meme wave to launch an auction mechanism, thereby truly entering the spot market and the "retail" mindset, further cultivating a complete trading ecosystem.

Tip: At the right moment, enter the current mainstream ecosystem, turn yourself into a synonym for it, use liquidity to drive traffic, empower $HYPE, and create a system.

$USDH is the same, and the initiation of HyperEVM is also the same. System Thinker is the essence of Hyperliquid's founder, Jeff. You will see this methodology reused at various stages of Hyperliquid's development.

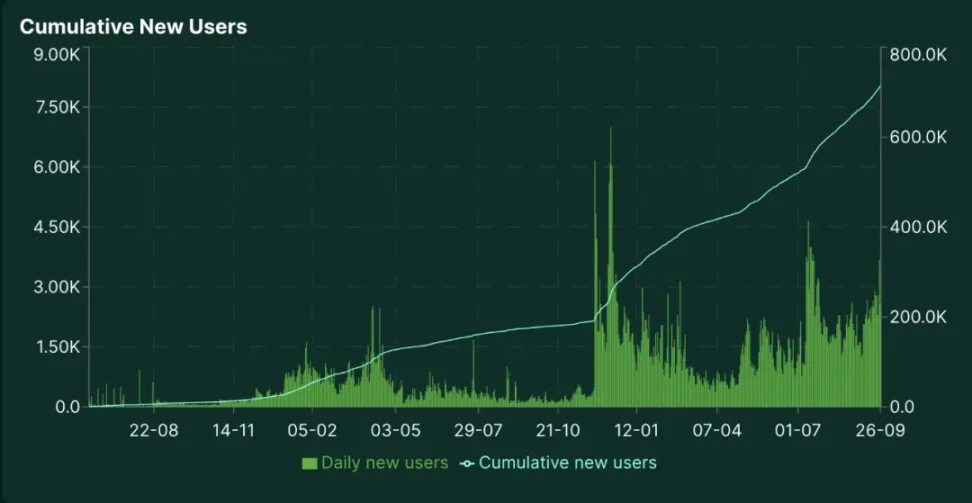

Caption: Hyperliquid user growth, image source: @Hyperliquidx

From an intuitive perspective on user growth, in the internal test of October 2023, the first 10,000 users were accumulated. However, in the S1 season from November 2023 to May 2024, Hyperliquid's user base grew to 120,000.

Among them, the spot mode created a second small peak during the Dutch auction in April/May, and at the end of 2024, when memes were at their hottest, $GOD was launched in a bidding frenzy, and $Solv also entered the Hyperliquid spot market, becoming the first mainstream ecosystem BTCFi project token.

Of course, I cannot quantify the causal relationship between the spot market and Hyperliquid's user and trading volume growth, but there is a high correlation between the two over time.

Hyperliquid does not simply rely on high leverage and No KYC to gain market position. It is essential to change the stereotype of Hyperliquid; from the beginning, Hyperliquid has been an all-purpose exchange, just entering through Perp products.

The Price of Liquidity

As of now, Hyperliquid's repurchase amount has reached $1.4 billion.

In November 2024, after the $HYPE airdrop is completed, the main spot trading will be concentrated within itself. However, at this point, a fork is needed because Hyperliquid is no longer just a spot and contract exchange; HyperEVM is in pre-research and will launch in early 2025.

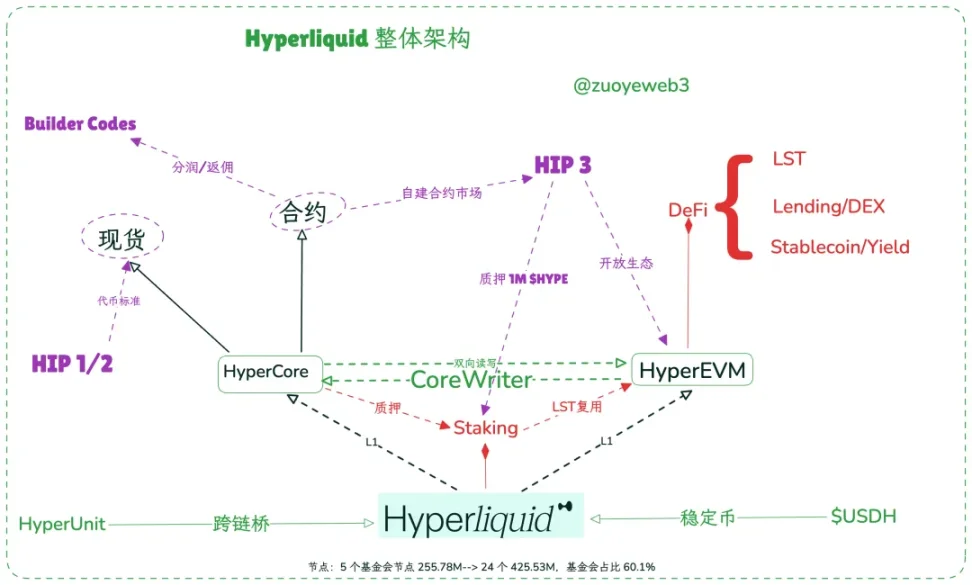

To categorize, Hyperliquid is somewhat like an Ethereum with a consensus layer + two execution layers. HyperBFT is its consensus layer, where nodes maintain the consensus of HyperBFT, while HyperCore is the contract and spot exchange L1, and HyperEVM is an open L1 with permissionless access.

Caption: Overall architecture of Hyperliquid, image source: @zuoyeweb3

Through the CoreWriter system, HyperEVM can call and allocate liquidity from HyperCore. For example, the LST protocol does not require intermediaries to wrap assets but can directly reuse the native staking standard.

In addition, the Unit Protocol can bridge external ecological assets to Hyperliquid, and Builder Codes allow any frontend to use HyperCore liquidity and participate in fee sharing. Rabby Wallet and Based App belong to this type of frontend access.

The above text introduces how Hyperliquid, relying on a passive time window, actively creates two super markets for spot and contract trading. However, how to avoid liquidity fragmentation before and after the launch of $HYPE has not been addressed, and a complete narrative is provided here.

First, let's piece together the appearance of Hyperliquid's growth flywheel. The following is the most rational path:

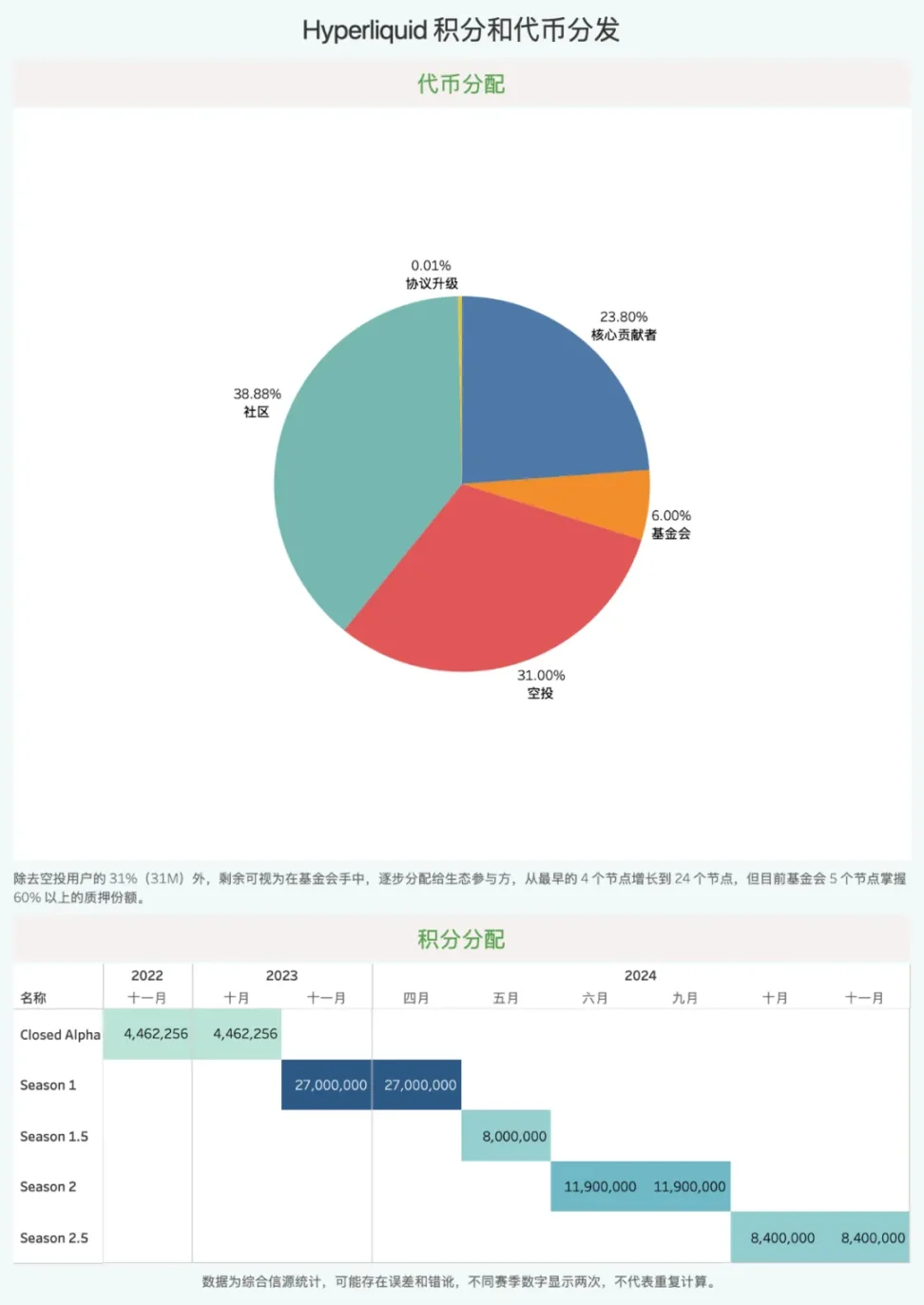

- S1 and the points system, token airdrop in November 2024, 31% (31M) of tokens distributed to S1 and Closed Alpha users, with the main criterion being the user's contract trading volume at that time;

- However, it is important to note that after the airdrop, continued actions, the hidden S1.5 and S2.5 have been ongoing, and this combination of public and semi-hidden activities gives the Hyperliquid team great flexibility;

- Hyperliquid claims to have 10 people, no VC, prioritizing community interests, with its fees roughly evenly distributed between HLP (liquidity treasury, responsible for liquidation) and the repurchase of $HYPE, which is also an important source of support for the token price.

So before the airdrop, it relies on points, and after the airdrop, it relies on repurchases.

Caption: Hyperliquid points system, image source: @zuoyeweb3

Hyperliquid is very similar to Solana's founder Anatoly, both placing great importance on the market price of tokens, viewing it as a crucial indicator for continuously stimulating ecosystem activity. This is not common; Vitalik cares more about technology and the values of "doing good." Public chains and large projects with VC involvement constantly face the game-theoretic pressure of sell-offs from various parties.

In reality, it is hard to believe that Hyperliquid has no external funding support at all. Initial market-making requires self-operation or third-party attraction of real retail and institutional investors. Just look at how Aster's trading volume instantly surpassed Hyperliquid to understand.

Currently, Hyperliquid has nodes and several market maker names, such as Infinite Field, Alphaticks, CMI, Flowdex, FalconX, etc., and Galaxy has also become one of its nodes, with Paradigm confirming its purchase of $HYPE in November 2024.

The most reasonable guess is that market makers participated in Hyperliquid trading early on, but unlike previous VC investment models that divide equity and tokens, they are gradually purchasing tokens from the foundation. This does not violate the persona of having no VCs, as market makers are indeed not VCs.

Warning: However, it is important to note that Hyperliquid's data is not completely transparent, especially before November 2024.

For market makers, Hyperliquid's strong repurchase mechanism can also ensure their long-term interests, and Hyperliquid can gain long-term liquidity support, thus breaking the dilemma of declining trading volume after token issuance, leading to falling token prices, and ultimately no one subscribing to the nodes.

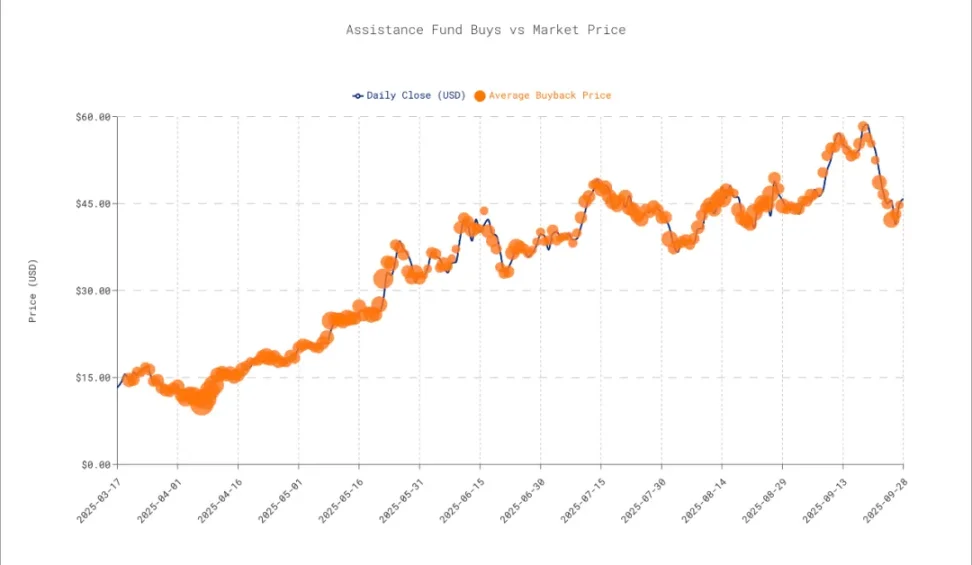

According to estimates from @Mint_Ventures, approximately $50 million flowed into the repurchase fund Assistance Fund before and after the airdrop, along with $40 million allocated to HLP, the latter of which can be considered market-making expenses, while the former is overall marketing expenses. As for VCs and market makers, they are hidden within and cannot be precisely distinguished.

In addition to market makers, HLP and the repurchase mechanism also contribute to supporting the price. However, the final usage rights of HLP also depend on the Hyperliquid team. In the $JELLYJELLY incident, the team ultimately decided to use the HLP treasury to cover $20 million in bad debts, but during the $XPL hedging incident, they chose to let users bear the losses.

However, there is good news: Arthur Hayes sold $5M, and DragonFly followed closely with a purchase of $3M.

Institutions have not abandoned Hyperliquid; the only debate is how much $HYPE is actually worth.

The Price of Leverage

Extend the selling curve to slow down the selling speed.

Interest rates are the speed of money flow, and prices are the differences in valuation between both parties.

If we simply compare Hyperliquid's income and expenses, the income consists of spot listing fees (Dutch auction), spot trading fees, contract fees, liquidation fees, and profit sharing from Builder Codes, while expenses include repurchases and burns.

But it won't be that simple; otherwise, the price of $HYPE would become another representation of trading volume, which should be around 10% of $BNB, or $100. Unfortunately, it is currently only $40-50.

Caption: $HYPE repurchase price, image source: @asxnr_

Continuing from the previous text, the repurchase of $HYPE reflects the Ethereum Foundation's selling at the current high point, which neither affects the normal development of the ecosystem nor relies entirely on repurchases to inflate prices and create false prosperity. In contrast, when the EF acts, it's best to run.

Three factors disrupt the valuation system of $HYPE:

- High control: The main spot and contract trading volume of HYPE occurs in HyperCore, with the foundation controlling most of the $HYPE staking and circulation;

- Market sales rate: P/S must be effective in a fully traded market. Coinbase and Circle represent CEX and stablecoin prices in the US stock market, but $HYPE can be "manipulated" under high control;

- Institutional price: The main participants in ETH and DAT, as well as the intermingling of the staking system and HyperEVM ecosystem, are still in the growth phase and have not experienced the market consensus that $BNB has traversed.

However, P/S can give us an illusion; the false illusion appears objective through numbers. Let's simply calculate P/S to see how far HYPE is from $1,000:

- As of now, Hyperliquid's projected revenue for 2025 is $730 million. Assuming an annual revenue of $1 billion is reasonable, the market cap would be $15 billion, giving a P/S of around 15.

- Coinbase's P/S is 11.8, Binance's annual revenue is about $10 billion, and BNB's market cap is $136 billion, resulting in a P/S of about 13.6. Robinhood's current value is 30, which is clearly too high, as it was also 11.4 just before the Cannes conference in June.

A not-so-precise estimate suggests that the normal P/S for CEX/crypto brokers in the US stock market is around 11, meaning the token price includes 10 times leverage, which is the discounted price of the market's 10 times imagination space.

However, Hyperliquid's price is derived from various "operational" methods. The only issue is that Arthur Hayes believes the $HYPE repurchase cannot outpace the selling pressure. He predicts that on November 29, there will be 237.8 million $HYPE needing to be unlocked, creating massive selling pressure that could crush HYPE's future, although he maintains a long-term forecast of 126x.

In the face of the end of S2, the Hyperliquid team chose to empower NFTs rather than continue directly airdropping tokens. This can also be seen as a way to drive traffic to HyperEVM, rather than directly causing selling pressure on $HYPE.

$BNB represents Binance's unique position in the trading field. It is not enough for Hyperliquid to only reign in the Perp DEX field; it needs to defeat Binance to maintain $HYPE at a high level. Once the market fluctuates sharply or turns bearish, the current massive buying pressure could turn into selling pressure. UST is not Bitcoin, and $HYPE may not be $BNB.

Either the next living Binance or the next dead FTX.

Conclusion

Sow the seeds of a gentle breeze, leaving a storm for future generations.

Hyperliquid has not transcended the era but has seized a rare time window, providing the strongest synergy from the market combination. The early Midjourney was similar; Hyperliquid will truly push Perp into the retail market, making DeFi OGs a part of daily on-chain use, a testing ground for institutions, and a hunting ground for whales.

Let go and unleash the memes, seizing the opportunity to grow stronger.

After growing, Hyperliquid did not choose to enter a selling mode but instead tried to maintain the price of $HYPE in a moderate range. It must be noted that it took Binance 8 years to raise BNB to $1,000, while Hyperliquid has been around for 3 years, and $HYPE still has a long way to go to catch up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。