撰文:Juan Galt

编译:AididiaoJP,Foresight News

随着《GENIUS 法案》巩固了由美国国债支持的稳定币地位,比特币的去中心化网络使其成为更适合全球采用的区块链,并且在一个多极化世界中应对美国债券需求下降的趋势。

随着世界从美国主导的单极秩序转向由金砖国家引领的多极化格局,美元因债券需求下降和债务成本上升而面临前所未有的压力。2025 年 7 月通过的《GENIUS 法案》,标志着美国采取了一项大胆战略来应对此局面,即通过立法认可由美国国债支持的稳定币,从而释放海外对美国债券的巨量需求。

承载这些稳定币的区块链将塑造未来几十年的全球经济。比特币凭借其无与伦比的去中心化特性、闪电网络的隐私性以及稳健的安全性,成为推动这场数字美元革命的优越选择,确保在法定货币不可避免地衰落时实现较低的转换成本。本文探讨了美元为何必须且将会通过区块链实现数字化,以及为何比特币必须成为其运行轨道,美国经济才能从全球帝国的高位实现软着陆。

单极世界的终结

世界正在从单极世界秩序(即美国曾是唯一超级大国,能够左右市场、主导全球冲突)过渡到多极世界,在这种秩序下,东方的国家联盟可以在不受美国外交政策影响的情况下自行组织。这个东方联盟被称为金砖国家,由巴西、俄罗斯、中国和印度等主要国家组成。金砖国家崛起的必然结果是地缘政治的重组,这对美元体系的霸权构成了挑战。

有许多看似孤立的数据点表明了这种世界秩序的重组,例如美国与沙特阿拉伯的军事同盟。美国不再捍卫石油美元协议,该协议曾规定沙特石油仅以美元出售,以换取美国对该地区的军事防御。石油美元策略是美元需求的主要来源,自 70 年代以来一直被认为是美国经济实力的关键,但在最近几年实际上已经终结,至少自乌克兰战争开始以来,沙特阿拉伯开始接受美元以外的货币进行石油相关贸易。

美国债券市场的疲软

世界秩序地缘政治变革中的另一个关键数据点是美国债券市场的疲软,市场对美国政府长期信用度的怀疑与日俱增。有些人担忧该国内部的政治不稳定,而另一些人则怀疑当前政府结构能否适应快速变化的高科技世界以及金砖国家的崛起。

据称马斯克就是持怀疑态度者之一。马斯克最近花了数月时间与特朗普政府一起,试图通过政府效率部来重组联邦政府和该国的财务状况,但在五月份突然退出政坛。

马斯克最近在一次峰会上露面时震惊了互联网,他说道:「我自五月份以来就没去过华盛顿。政府基本上是无可救药的。我赞赏大卫·萨克斯的崇高努力……但归根结底,如果你看看我们的国债……如果人工智能和机器人不能解决我们的国债问题,我们就完蛋了。」

如果连马斯克都无法让美国政府摆脱金融厄运,那谁能做到呢?

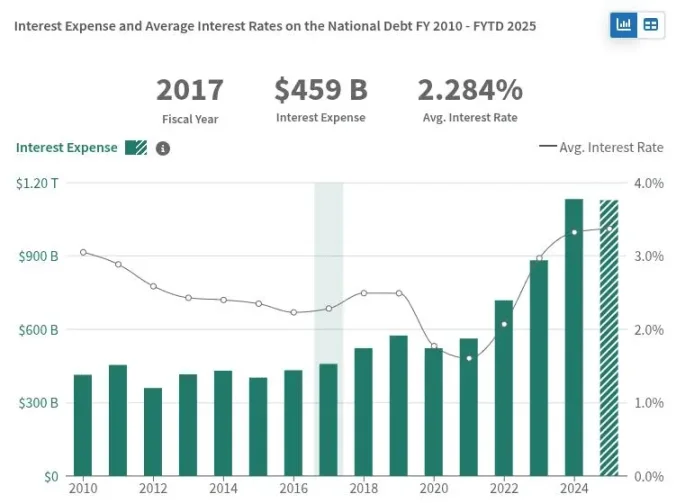

这类疑虑反映在对美国长期债券的低需求上,这表现为需要提高利率来吸引投资者。如今美国 30 年期国债收益率处于 4.75%,为 17 年来的高点。据路透社报道,像美国 30 年期国债这样的长期债券拍卖需求也呈下降趋势,2025 年的需求「令人失望」。

对美国长期债券需求的减弱对美国经济产生重大影响。美国财政部必须提供更高的利率来吸引投资者,这反过来又增加了美国政府必须支付的国债利息。如今,美国的利息支付接近每年一万亿美元,超过了整个国家的军事预算。

如果美国未能为其未来的债务找到足够的买家,它可能难以支付眼前的账单,转而不得不依赖美联储来购买这些债务,这会扩张其资产负债表和货币供应量。其影响虽然复杂,但很可能导致美元通胀,进一步损害美国经济。

制裁如何重创了债券市场

进一步削弱美国债券市场的是,2022 年美国操纵其控制的债券市场来对付俄罗斯,以回应其入侵乌克兰的行为。在俄罗斯入侵时,美国冻结了俄罗斯持有的海外国库储备,这部分储备本打算用于偿还其对西方投资者的国债。据报道,为了迫使俄罗斯违约,美国还开始阻止俄罗斯偿还其对外国债券持有人的所有债务企图。

一位美国财政部女发言人当时证实,不再允许某些支付。

「今天是俄罗斯进行另一笔债务支付的截止日期,」该发言人说。

「从今天开始,美国财政部将不允许从俄罗斯政府在美国金融机构的账户进行任何美元债务支付。俄罗斯必须选择是耗尽剩余的美元储备或新的收入来源,还是违约。」

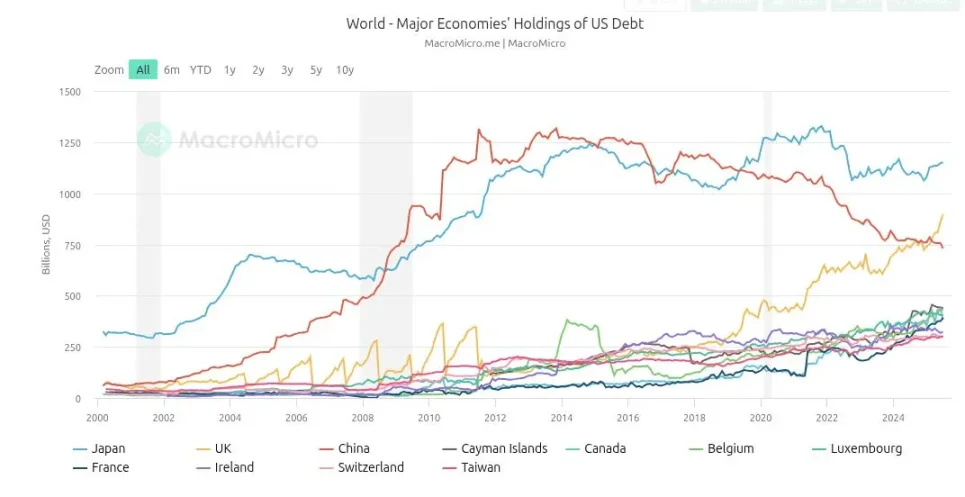

美国通过运用其外交政策制裁机制,有效地将债券市场武器化来对付俄罗斯。但制裁是一把双刃剑:自那时起,外国对美国债券的需求减弱,因为那些与美国外交政策不一致的国家寻求分散风险。中国引领了这股远离美国债券的趋势,其持有量在 2013 年达到超过 1.25 万亿美元的峰值,并自乌克兰战争开始以来加速下降,目前接近 7500 亿美元。

虽然这一事件展示了制裁的毁灭性效力,但也深深伤害了对债券市场的信心。不仅在拜登政府制裁下俄罗斯被阻止偿还债务,同时也损害了作为附带损害的投资者,而且冻结其外国国库储备向世界表明,如果你作为一个主权国家违背美国的外交政策,所有赌注都将失效,这包括债券市场。

特朗普政府已不再将制裁作为主要策略,因为它们损害美国金融部门,并转向了基于关税的外交政策方法。这些关税迄今为止效果不一。虽然特朗普政府吹嘘创纪录的税收和私营部门在国内的基础设施投资,但东方国家通过金砖国家联盟加速了它们的合作。

稳定币策略手册

虽然中国在过去十年中减持了美国债券,但一个新的买家已经出现,迅速进入权力顶层。Tether,一家诞生于比特币早期的金融科技公司,如今拥有价值 1710 亿美元的美国债券,接近中国持有量的四分之一,并且超过了大多数其他国家。

Tether 是最流行的稳定币 USDT 的发行者,其流通市值达 1710 亿美元。该公司报告 2025 年第一季度利润 10 亿美元,其商业模式简单而卓越:购买短期美国债券,按 1:1 支持发行 USDT 代币,并将美国政府的票息利息收入囊中。年初拥有 100 名员工的 Tether,据说是世界上人均利润最高的公司之一。

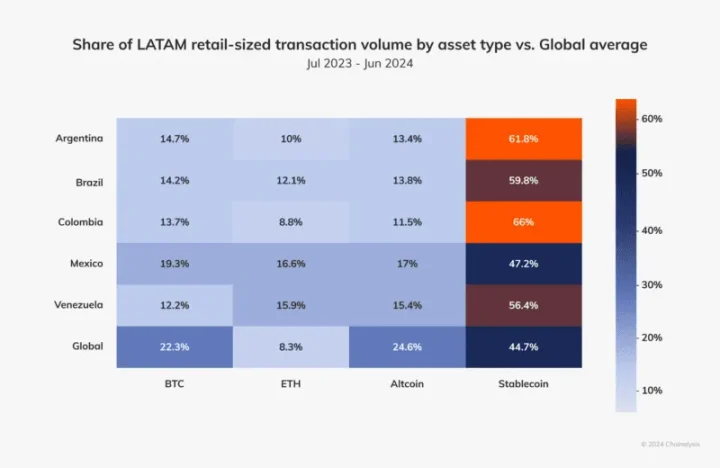

Circle,USDC 的发行者,也是市场上第二受欢迎的稳定币,同样持有近 500 亿美元的短期国库券。稳定币在世界各地被使用,特别是在拉丁美洲和发展中国家,作为当地法定货币的替代品,因为这些法币遭受着远比美元严重的通货膨胀,并且常常受到资本管制的阻碍。

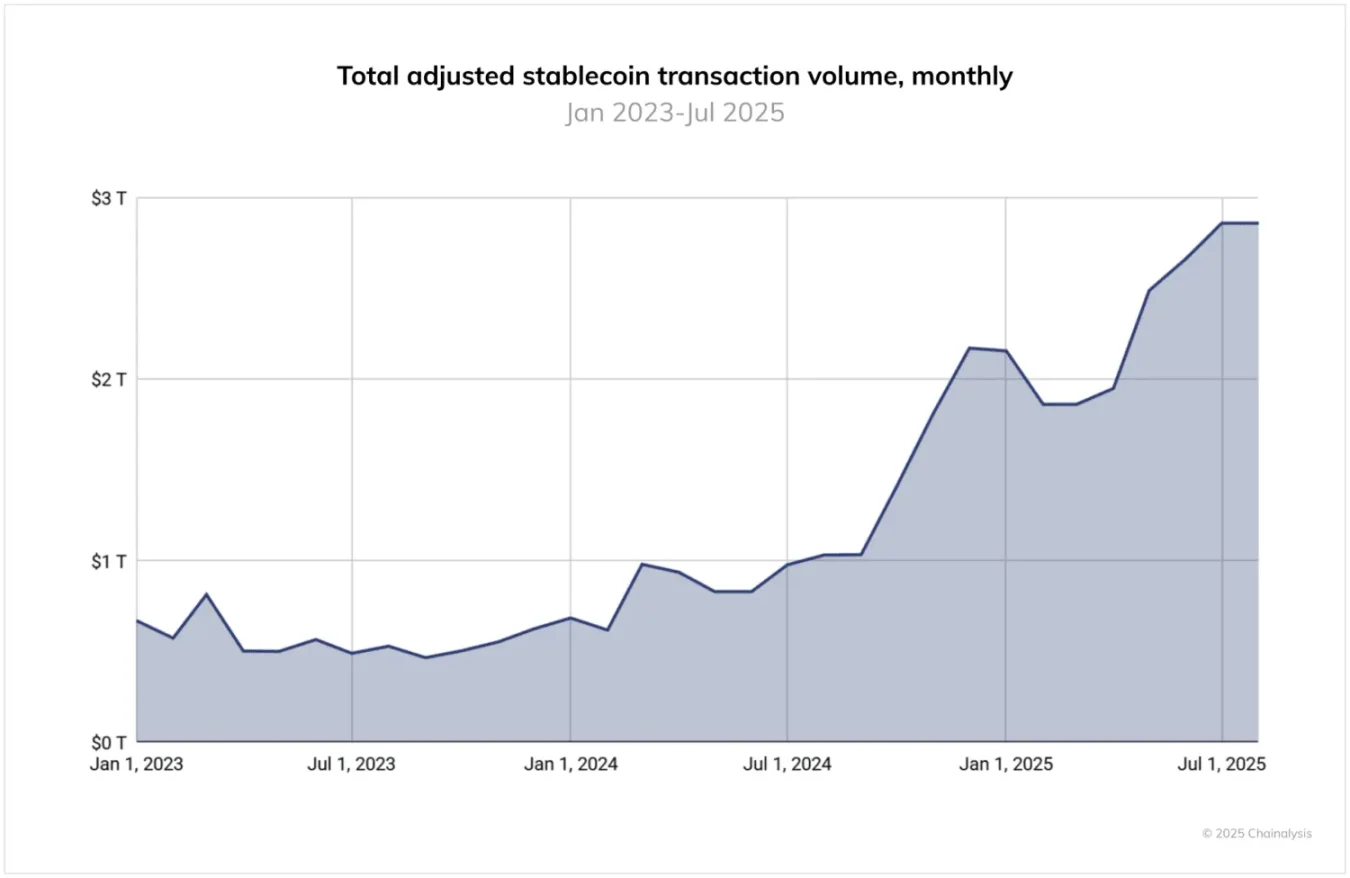

如今稳定币处理的交易量已不再是利基的、极客的金融玩具,它达到了数万亿美元。一份 2025 年 Chainalysis 报告指出:「在 2024 年 6 月至 2025 年 6 月期间,USDT 每月处理超过 1 万亿美元,在 2025 年 1 月达到峰值 1.14 万亿美元。与此同时,USDC 的月处理量在 1.24 万亿至 3.29 万亿美元之间。这些交易量凸显了 Tether 和 USDC 在加密市场基础设施中持续的核心地位,特别是在跨境支付和机构活动方面。」

例如,根据 Chainalysis 一份 2024 年聚焦拉丁美洲的报告,在 2023 年至 2024 年间接收的总加密价值中,拉丁美洲占 9.1%,年使用增长率在 40% 至 100% 之间,其中超过 50% 是稳定币,这展示了发展中世界对替代货币的强劲需求。

美国需要其债券的新需求,而这种需求以对美元需求的形式存在,因为世界上大多数人被困在在远逊于美国的法定货币中。如果世界转向一个迫使美元与所有其他法定货币在同等条件下竞争的地缘政治结构,美元可能仍然会是其中最好的。尽管美国有其缺陷,但它仍然是一个超级大国,拥有惊人的财富、人力资本和经济潜力,特别是与许多小国及其可疑的比索相比时。

拉丁美洲已表现出对美元的深切渴望,但存在供应问题,因为当地国家抵制传统的银行美元通道。在美国以外的许多国家,获得美元计价的账户并不容易。当地银行通常受到严格监管,并听命于当地政府,而当地政府也有维护其比索的利益。毕竟美国不是唯一一个懂得印钞和维护其货币价值的政府。

稳定币解决了这两个问题;它们创造了对美国债券的需求,并且能够将美元计量的价值传递给世界任何地方的每个人。

稳定币利用其底层区块链的抗审查特性,这是当地银行无法提供的功能。因此通过推广稳定币,美国可以触及尚未到达的国外市场,扩大其需求和用户基础,同时还将美元通胀输出到对美国政治没有直接影响的国家,这是美元历史上的一个悠久传统。从战略角度来看,这对美国来说听起来很理想,并且是美元几十年来运作方式的简单延伸,只是建立在新的金融技术之上。

美国政府明白这个机会。根据 Chainalysis 的说法:「稳定币监管格局在过去 12 个月中发生了显著变化。虽然美国的《GENIUS 法案》尚未生效,但其通过已推动了强烈的机构兴趣。」

为什么稳定币应该超越比特币

确保比特币从发展中世界摆脱平庸法币的最佳方式,是确保美元使用比特币作为其运行轨道。每一个美元稳定币钱包也应该是一个比特币钱包。

比特币美元策略的批评者会说,这违背了比特币的自由主义根源,比特币本应取代美元,而不是增强它或将其带入 21 世纪。然而这种担忧在很大程度上是以美国为中心的。当你以美元获得报酬并且你的银行账户以美元计价时,谴责美元是容易的。当 2-8% 的美元通货膨胀率是你当地的货币时,批评它是容易的。在美国以外的太多国家,每年 2-8% 的通货膨胀率是一种恩赐。

世界上很大一部分人口遭受着远比美元糟糕的法定货币之苦,通货膨胀率从较低的两位数到较高的两位数,甚至三位数,这就是为什么稳定币已经在第三世界获得了大规模采用。发展中世界需要先离开这艘正在沉没的船。一旦他们登上一条稳定的船,他们可能会开始寻找升级到比特币游艇的方法。

不幸的是,尽管大多数稳定币最初始于比特币,但如今它们并不运行在比特币之上,这一技术现实给用户带来了巨大的摩擦和风险。如今大部分的稳定币交易量运行在 Tron 区块链上,这是一个由孙宇晨在少数服务器上运行的集中式网络,他很容易被那些不喜欢美元稳定币在其境内传播的外国政府盯上。

如今大多数稳定币赖以运行的区块链也完全是透明的。作为用户账号的公共地址是公开可追踪的,常常被当地交易所与用户的个人数据关联起来,并且容易被当地政府访问。这是外国可以用来回击美元计价稳定币传播的一个杠杆。

比特币没有这些基础设施风险。与以太坊、Tron、Solana 等不同,比特币是高度去中心化的,在全世界有数万节点,并且拥有一个健全的点对点网络,用于传输交易,这种方式可以轻松绕过任何瓶颈或阻碍。它的工作量证明层提供了其他权益证明区块链所没有的权力分离。例如,迈克尔·塞勒尽管他持有大量比特币,占总供应量的 3%,但他在网络的共识政治中没有直接投票权。对于 Vitalik 和以太坊的权益证明共识,或者孙宇晨和 Tron,情况就不同了。

此外建立在比特币之上的闪电网络解锁了即时交易结算,这受益于比特币底层区块链的安全性。同时还为用户提供了显著的隐私性,因为所有闪电网络交易在设计上都是链下的,并且不会在其公共区块链上留下足迹。这种支付方法的根本性差异,使用户在向他人汇款时能获得隐私。这将能够侵犯用户隐私的威胁行为者数量,从任何可以查看区块链的人,减少到少数企业家和科技公司,最坏情况如此。

用户也可以在本地运行自己的闪电节点,并选择如何连接到网络,很多人确实这样做,将隐私和安全掌握在自己手中。这些特性在当今大多数人用于稳定币的区块链中都看不到。

合规政策甚至制裁仍然可以应用于美元稳定币,其治理锚定在华盛顿,使用当今用于阻止稳定币犯罪使用的相同分析和基于智能合约的方法。从根本上说像美元是无法去中心化的,毕竟它的设计就是中心化的。然而如果大部分稳定币价值转而通过闪电网络进行转移,用户的隐私也能得到维护,保护发展中国家的用户免受有组织犯罪甚至其当地政府的侵害。

最终用户关心的是交易费用,转移资金的成本这就是为什么 Tron 至今主导着市场。然而随着 USDT 在闪电网络上上线,这种情况可能很快就会改变。在比特币美元世界秩序中,比特币网络将成为美元的交换媒介,而在可预见的未来,美元将仍然是记账单位。

比特币能承受这一切吗?

该策略的批评者也担心比特币美元策略可能对比特币本身产生影响。他们想知道将美元置于比特币之上,是否会扭曲其底层结构。像美国政府这样的超级大国可能想要操纵比特币的最明显方式,是迫使其符合制裁制度的要求,这理论上他们可以在工作量证明层做到。

然而如前所述,制裁制度可以说已经达到顶峰,让位于关税时代,后者试图控制商品流动而非资金流动。这种后特朗普、后乌克兰战争的美国外交政策战略转变,实际上减轻了比特币的压力。

随着西方公司,如贝莱德,甚至美国政府,继续将比特币作为长期投资策略,或者用特朗普总统的话说,作为「战略比特币储备」,它们也开始与比特币网络未来的成功和生存保持一致。攻击比特币的抗审查特性不仅会破坏他们对该资产的投资,还会削弱网络向发展中世界输送稳定币的能力。

在比特币美元世界秩序中,比特币必须做出的最明显妥协是放弃货币的记账单位维度。这对许多比特币爱好者来说是个坏消息,并且理应如此。记账单位是超比特币化的终极目标,其许多用户今天就生活在那个世界里,他们根据对其持有比特币聪数量的最终影响来计算经济决策。然而对于那些理解比特币是有史以来最健全货币的人来说,没有什么能真正夺走这一点。事实上比特币作为价值储存和交换媒介的信念将因这种比特币美元策略而得到加强。

可悲的是在试图使比特币成为像美元一样无处不在的记账单位 16 年之后,一些人认识到在中期,美元和稳定币很可能满足那个用例。比特币支付永远不会消失,由比特币爱好者领导的公司将继续崛起,并且应该继续接受比特币作为支付方式来建立其比特币储备,但在未来几十年里,稳定币和美元计量的价值很可能将主导加密贸易。

没有什么能阻止这列火车

随着世界继续适应东方崛起的力量和多极世界秩序的出现,美国可能不得不做出艰难而关键的决定,以避免持久的金融危机。理论上美国可以降低支出、转向并重组,以便在 21 世纪变得更高效、更具竞争力。特朗普政府当然正在尝试这样做,正如关税制度和其他相关努力所显示的那样,这些努力试图将制造业带回美国并培养本地人才。

虽然有几个奇迹或许可以解决美国的财政困境,例如科幻般的劳动和智能自动化,甚至比特币美元策略,但最终,即使将美元放在区块链上也不会改变其命运:成为历史爱好者的收藏品,一个适合博物馆的、被重新发现的古老帝国代币。

美元的中心化设计和对美国政治的依赖最终注定了其作为一种货币的命运,但如果我们现实一点,它的消亡可能在 10 年、50 年甚至 100 年内都不会看到。当那一刻真的到来时,如果历史重演,比特币应该作为运行轨道在那里,准备好收拾残局,实现超比特币化的预言。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。