The market dominance of Bitcoin may shrink, but it could always remain an "anchor" in many people's portfolios.

Author: Stephen Katte

Compiled by: Deep Tide TechFlow

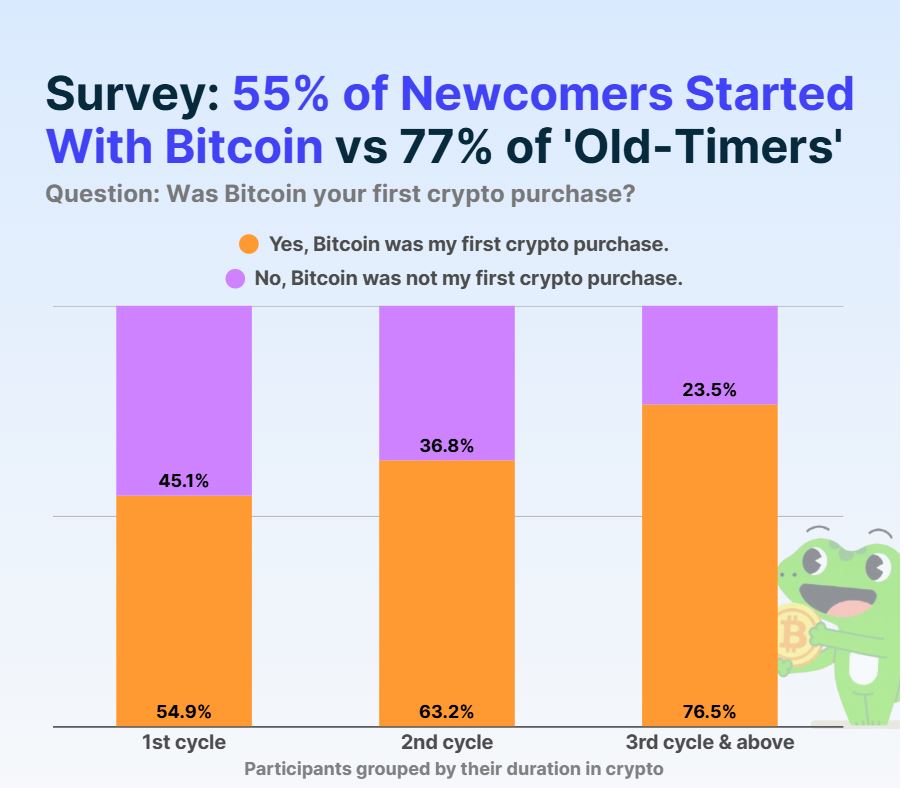

A CoinGecko survey released on Monday shows that 10% of respondents have never purchased Bitcoin, and only 55% of newcomers have included Bitcoin in their portfolios.

The latest survey from data aggregation platform CoinGecko found that only 55% of new cryptocurrency users chose Bitcoin in their portfolios, which analysts see as a sign of market maturity.

The survey conducted by CoinGecko among 2,549 cryptocurrency participants revealed that 10% of respondents have never purchased Bitcoin.

CoinGecko research analyst Yuqian Lim stated, "In other words, as other narratives and altcoin communities rise and gain attention, the likelihood of Bitcoin serving as an entry mechanism is gradually decreasing."

Among new cryptocurrency holders surveyed by CoinGecko, only 55% initially held Bitcoin.

Source: CoinGecko

The Rise of Altcoins: Signs of a Healthy Market

Jonathon Miller, General Manager of cryptocurrency exchange Kraken, told Cointelegraph that investors are starting to enter through other areas, such as DeFi or memecoins.

He said, "This proves the growth and maturity of the crypto ecosystem: Bitcoin is no longer the only major asset, and the process of acquiring cryptocurrency is becoming smoother, allowing newcomers to more easily engage with emerging narratives."

However, he also believes that given the increasing geopolitical uncertainty, ongoing currency devaluation, and Bitcoin's reputation as "the most robust form of currency," users who initially avoided Bitcoin may refocus on it.

"As time goes on, many participants who entered the crypto market due to speculative trends will gradually recognize the importance of Bitcoin and adjust their portfolios accordingly."

The Appeal of Altcoins

Hank Huang, CEO of quantitative trading firm Kronos Research, told Cointelegraph that investors who bypass Bitcoin when first entering the market are often attracted by the low unit cost of altcoins and a stronger sense of community.

CoinGecko's survey found that 37% of respondents entered the crypto space through altcoins rather than Bitcoin.

Source: CoinGecko

Hank Huang stated, "As cryptocurrency becomes more mainstream, more investors will bypass Bitcoin and focus on lower market cap altcoins and vibrant communities. This reflects that the market is maturing, with diversification driving participation."

"The market heat is shifting towards Sol, ETH, and memecoins, turning Bitcoin from the default entry point into one of many options in the crypto space."

He further speculated that in the long term, the future of cryptocurrency will not solely rely on Bitcoin, as it faces competition from new frameworks, and its adoption is increasingly driven by a "diverse ecosystem where innovation, culture, and community are equally important as value."

Users May Worry About Missing Opportunities

Tom Bruni, Head of Market at investment social media platform Stocktwits, told Cointelegraph that a lack of understanding and frequent price surges of Bitcoin may also be influencing factors.

He said, "While native cryptocurrency users believe the industry is still in its early stages, onlookers may feel that if they haven't bought Bitcoin when its price was lower, they have already missed the opportunity, as its price has exceeded $100,000."

"In the recent bull market, certain altcoins have significantly outperformed Bitcoin, leading investors to seek 'cheaper' cryptocurrencies for investment, which has driven people into the higher-risk altcoin and memecoin markets."

In 2025, Bitcoin set multiple all-time highs, with the most recent on August 14 when it first broke $124,000.

Meanwhile, Bruni stated that as altcoins, stablecoins, and other related blockchain technologies develop, Bitcoin's market dominance may shrink, but it could always remain an "anchor" in many people's portfolios.

He concluded, "Ultimately, performance dictates allocation decisions. Therefore, as long as Bitcoin's returns can keep pace with the rest of the ecosystem, it is unlikely that more people will completely avoid it."

"Currently, Bitcoin is performing well, but if the market declines, it may become a catalyst for people to turn back to Bitcoin, as it is a more stable and institutionalized cryptocurrency option."

Zero Bitcoin Holders Will Not Last Long

Qin En Looi, Managing Partner at venture capital firm Onigiri Capital, told Cointelegraph that early adopters already own Bitcoin, and most later users will only enter the market when Bitcoin is embedded in the traditional financial system and accessible through banks, wealth management institutions, or retirement products.

He said, "As these infrastructures mature, we may see the number of zero Bitcoin holders decrease, but this process may be slower than many expect, as it requires systematically building trust."

Ultimately, En Looi believes that Bitcoin's role is evolving but will never disappear, as it serves as a benchmark for the entire crypto market, just as gold continues to be a reference point in traditional finance.

"What we are seeing is not a decline in correlation, but an expansion of correlation, with stablecoins, tokenized assets, and application layer projects now becoming the focus of attention."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。