Tether News: $20B Raise May Push Valuation Toward $500 Billion

Is Tether about to become one of the most valuable private companies in the world?

That’s the big question driving Tether news this week.

Reports suggest SoftBank and Ark Investment Management are in primary discussions with Tether Holdings SA for joining its biggest fundraising round to date.

Source: X (formerly Twitter)

The issuer of stablecoins is said to be seeking a $20 billion raise that would take its valuation to almost $500 billion.

This headlines is generating debate throughout finance and crypto, with question marks surrounding whether stablecoins are entering a new period of mass adoption.

Tether News Highlights $20 Billion Raise

According to Bloomberg, insiders confirmed that this fundraising effort could value this stablecoin issuer among the world’s most valuable private firms.

A $500B valuation from $20 Billion, would place it in the same conversation as global tech giants, an almost unimaginable leap for a company that started with one stablecoin.

Both companies are industry giants in conventional finance, and their support reflects increasing confidence in it's dominance of the crypto economy.

Solid Numbers Supports the Headlines

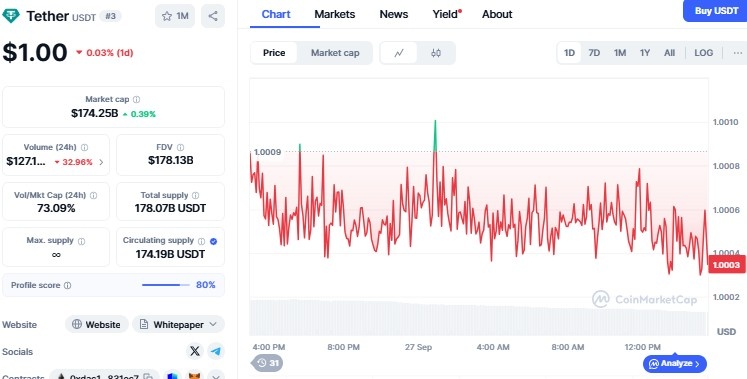

Underlying this wave of discussion are powerful financials. It has a market cap of $174B, a Q2 profit of $4.9B, and almost 99% margins. No other stablecoin is anywhere near.

Source: CoinMarketCap

But this isn't just about liquidity. The organisation is venturing into artificial intelligence, renewable energy, and other sectors.

The fundraising is designed to fuel that broader expansion, making the company less reliant on the crypto market alone.

$1 Billion USDT Mint

Joining the headlines, Tether printed additional $1 billion USDT on Ethereum recently . On-chain monitors such as Whale Alert reported the release, one of a whopping $5B disbursed across various blockchains in a single week.

This Tether news is an indication of increasing liquidity requirements throughout DeFi and large exchanges. By holding the tokens in reserve, the firm creates stability within the market and prepares to meet increasing demand.

Mixed Responses in the Market

The latest news about the organisation has drawn opposing reactions. Bulls see it as a clear sign of institutional liquidity and capital flowing into the system. Ethereum remains the settlement and DeFi activity center, thus the clear choice for mass issuance.

Critics persist in doubting it's transparency, however. Despite the fact that the company insists assets outpace liabilities, others think there needs to be more transparency given the rapid issuance.

Why This Matters?

Between the $20B fundraising talks and the billion-dollar USDT mint, this USDT news underscores the company’s growing influence.

If the $500B valuation is achieved, The organisation won’t just be the king of stablecoins it will be one of the most powerful private firms globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。