BSE Denial Highlights India’s Reluctance Towards Crypto Treasuries

Is India ready to open its arms to Bitcoin treasury companies —or is it still fighting digital assets? That's a question being asked once again after the Bombay Stock Exchange (BSE) rejection of Jetking Infotrain's IPO listing for reasons regarding its crypto treasuries. Sapna Singh , a Bitcoin enthusiasts, shared the news over X (formerly Twitter).

Source: X

Source: X

The IT training company had gone on to invest big in digital assets, one of a new world phenomenon where publicly listed companies diversify balance sheets with Bitcoin and other tokens. The BSE denial is, however, an expression of how India's regulatory vacuum is shrouding the future of such ventures.

Timeline: From Approval to Rejection

Jetking Infotrain raised ₹6.1 crore by issuing 3,96,156 equity shares at ₹154 each on preferential basis. The funds, the disclosure said, were partially utilized to invest in virtual digital currency, part of its crypto treasuries plans.

May 9, 2025 – In-principle approval from BSE.

May 23, 2025 – Preferential issue approved by Jetking board.

June 10, 2025 – Listing application submitted with BSE.

September 24, 2025 – BSE returned the application.

In its statement, BSE wrote :

"The rationale for the issue is investment in virtual digital assets is of speculative nature. Policy on this front is being considered and applications of this type cannot be considered until a clear stance emerges."

This abrupt reversal left Jetking in limbo—funds already invested on the basis of previous sanction, but now listing is being delayed.

Stock Price and Market Reaction

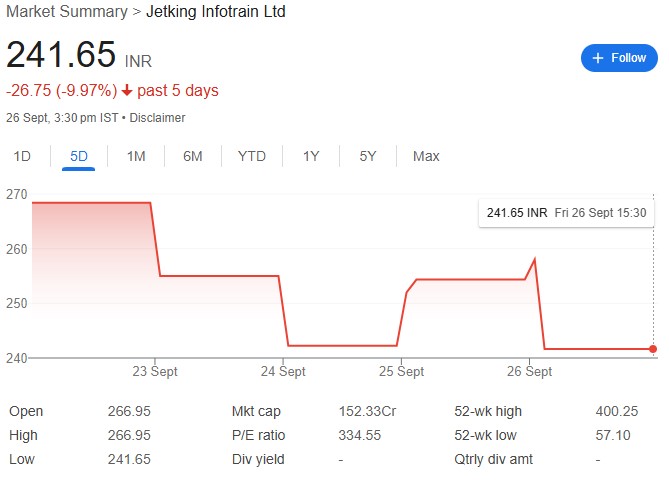

The denial shook investor confidence. Jetking Infotrain stocks fell around 10% in the last five trading days, from ₹268.40 to ₹241.65. The stock opened at ₹268.40 on 23rd September and reached a high of the same value. Over the past five days, the price has steadily declined, closing at ₹241.65 on 26th September, marking a loss of ₹26.75 (-9.97%) . The stock hit its 5-day low at ₹241.65.

Source: Google Finance

Source: Google Finance

The company stated that it could consider appealing the Securities Appellate Tribunal (SAT) as it weighs other legal remedies.

Questions Regarding India's Crypto Policy Beyond the Present Crisis

The case also asks a larger question: Does India wish to see companies use Bitcoin or crypto treasuries? Across the world, from Tesla to MicroStrategy , companies have utilized treasury diversification in Bitcoin as a long-term play. Indian hesitation is an exception.

While, in one breath, regulators call for cybersecurity audits of exchanges and bask in India's #1 retail adoption ranking. And, in another, the across-the-board refusal to list Jetking reflects hesitation to grant corporate digital asset exposure.

Recent high-profile events—from Raj Kundra Bitcoin scam to WazirX and CoinDCX hacks—kept regulators on their toes. With full India cryptocurrency regulation, listed companies are being kept under control from venturing into digital assets.

Conclusion

The cancellation of the Jetking Infotrain IPO by BSE is not just putting a delay on one company's plan. It indicates India's reluctance towards digital asset treasuries. Such schemes would have to be put on the back burner by public companies until there are clear crypto regulations. India might be at the forefront of crypto adoption by retail investors, but corporate acceptance is not quite set to take the leap in India yet.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。