HyperVault $3.6M Drain Sparks Rugpull or Hack Speculation: Full Story

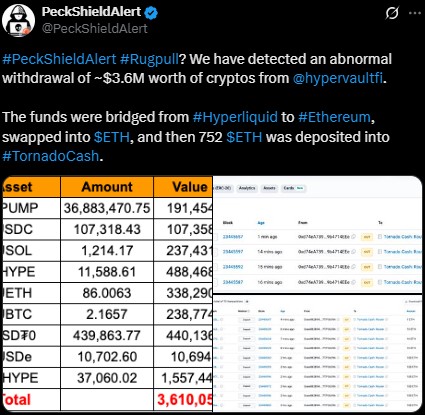

The crypto space is famously high risk and high reward, but whatever has been happening at HyperVault recently has many wondering: Is crypto safe? A staggering $3.6 million of cryptocurrency has left HyperVault, with alarm bells ringing in the community. PeckShieldAlert has exposed the unusual activity and informed the same over X (formerly Twitter).

Source: X

Source: X

The funds were bridged over to Ethereum, sold for $ETH, and transferred over to TornadoCash. Worst of all, HyperVault's official X handle has been suspended, which is added to the suspicion. So, is another rugpull scam or a bad hack case in play here?

Gigantic Crypto Outflow – What Went Wrong with HyperVault?

Following the wake of PeckShield alert, the community was left amazed as $3.6 million was drained from the platform. Initially, money was transferred from Hyperliquid to Ethereum , transformed into Ethereum ($ETH), and withdrawn to TornadoCash. All those involved were left puzzled after X account was abruptly terminated. Without any sign, the community was left waiting to understand what the true cause of the outflow was.

Community Warnings – An Increasing Red Flag?

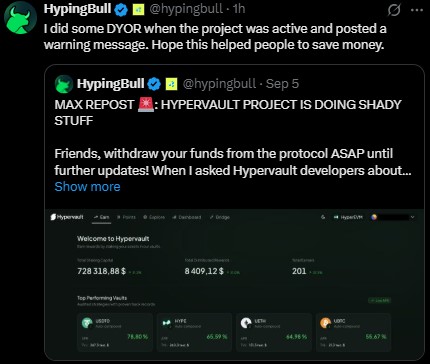

It is not the first time HyperVault raised eyebrows. At the end of last month, HypingBull , a renowned influencer, made a warning, calling for users to withdraw their funds. He elaborated in his warning that the project had reported that audits were ongoing, but when he contacted the auditors, they assured him they had no affiliation with the platform. Regardless of these red flags, most users remained invested until this massive exodus.

Source: X

Source: X

"A fishy situation is unfolding and the team must get to the bottom of it ASAP," wrote HypingBull in his thread.

Crypto Safety Issues – Is There More to HyperVault?

With cryptocurrency hacks and scams making the headlines on a daily basis, fears regarding the security of crypto investments are increasing. Some of the largest exchanges such as Binance, Bybit, WazirX, and Coinbase have suffered significant hacks, making investors even more cautious about the risks. With the NGP Protocol hack that has left it with more than $2 million depleted from its treasury to Kame Aggregator and UXLINK problems, digital assets are rapidly becoming a high-risk investment.

The Effect on HyperVault – A Dramatic Fall in Activity

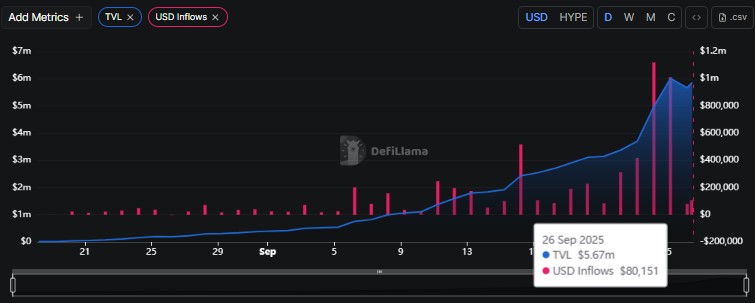

In reaction to the news, the platform experienced a dramatic fall in inflows as well as TVL. DefiLlama reports the platform having recorded inflows totaling $1.01 million on September 25 which plummeted sharply to only $80,151 on September 26. Even the TVL went down from $6.01 million to $5.67 million during the same time.

Source: DefiLlama

Source: DefiLlama

Such reversals indicate a general loss of confidence and trust among the users.

Conclusion

With no clear explanation yet from HyperVault, investors are left in the dark. Whether this is a hack, a scam, or something else remains to be seen. One thing, however, is certain: the community loudly demands more transparency. But with the future, users should watch out, especially after this incident.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。