Bitcoin's performance lags, "Altcoin Season" reappears, and the macro environment may continue to evolve.

Author: Grayscale

Translated by: Deep Tide TechFlow

In the third quarter of 2025, the price returns of the six major sectors in the crypto market showed positive growth, but the changes in fundamentals varied. The Crypto Sectors is a proprietary framework developed in collaboration with index provider FTSE/Russell to organize the digital asset market and measure returns.

Bitcoin's performance is inferior to other crypto market sectors, and its return pattern can be seen as an "Altcoin Season," but it differs from previous "Altcoin Seasons."

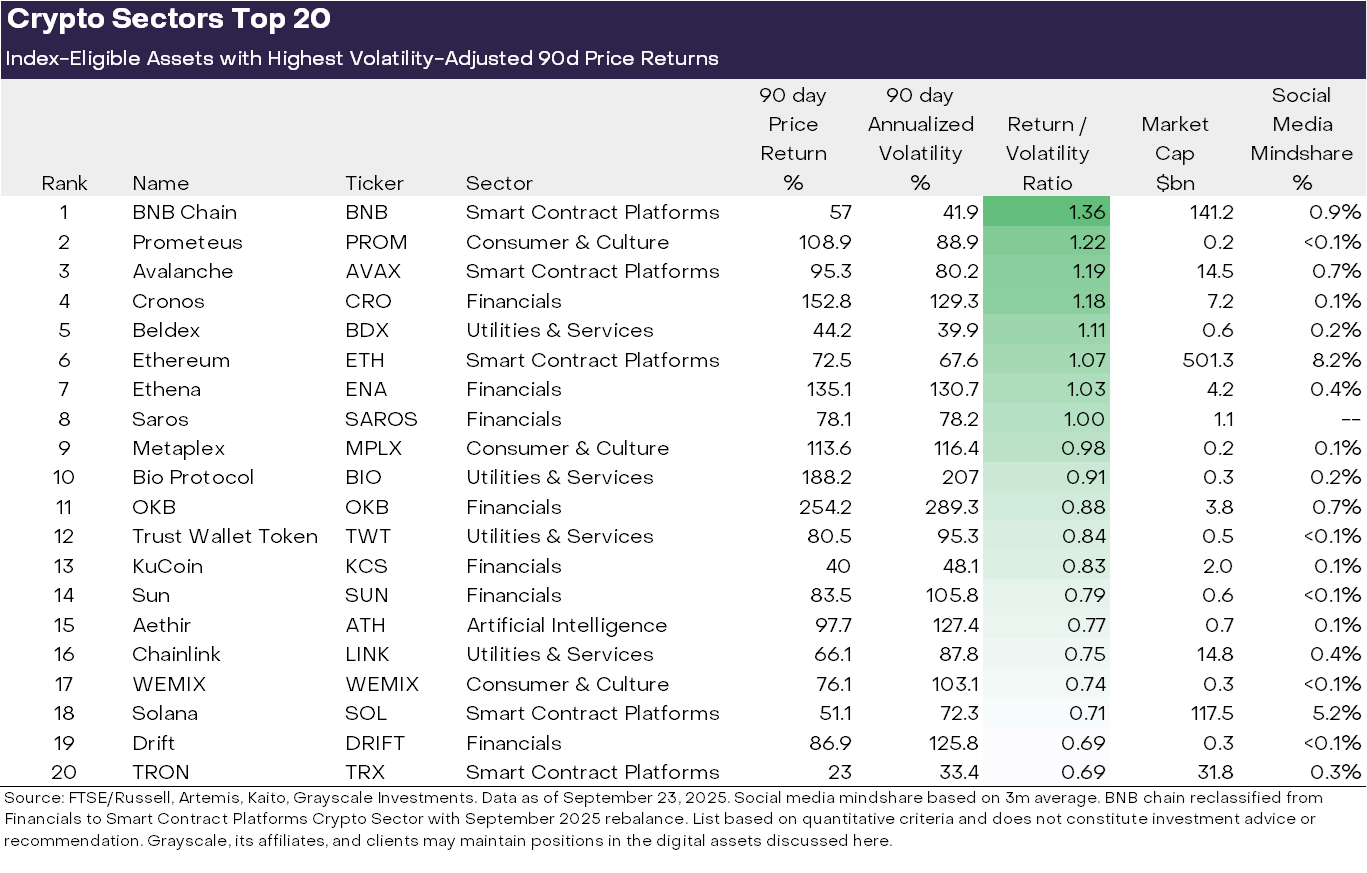

Based on volatility-adjusted price returns, the top 20 tokens in the third quarter highlighted the importance of stablecoin legislation and adoption, the rise in centralized exchange trading volume, and the trend of Digital Asset Treasuries (DATs).

Each crypto asset is related to blockchain technology and shares a fundamental market structure, but the similarities end there. The categories of crypto assets encompass a wide range of software technologies applied in areas such as consumer finance, artificial intelligence (AI), media, and entertainment. To keep the data organized, Grayscale Research uses a proprietary classification and index series developed in collaboration with FTSE/Russell, namely the “Crypto Sectors”. The "Crypto Sectors" framework covers six different sub-markets (Chart 1). They collectively include 261 tokens with a total market capitalization of $3.5 trillion. [1]

Chart 1: The Crypto Sectors framework helps organize the digital asset market

Measuring Blockchain Fundamentals

Although blockchains are not enterprises, their economic activity and financial health can be measured in similar ways. Three important metrics of on-chain activity are users, transaction volume, and transaction fees. Since blockchains are anonymous, analysts often use "active addresses" (blockchain addresses that have transacted at least once) as an imperfect indicator of user count.

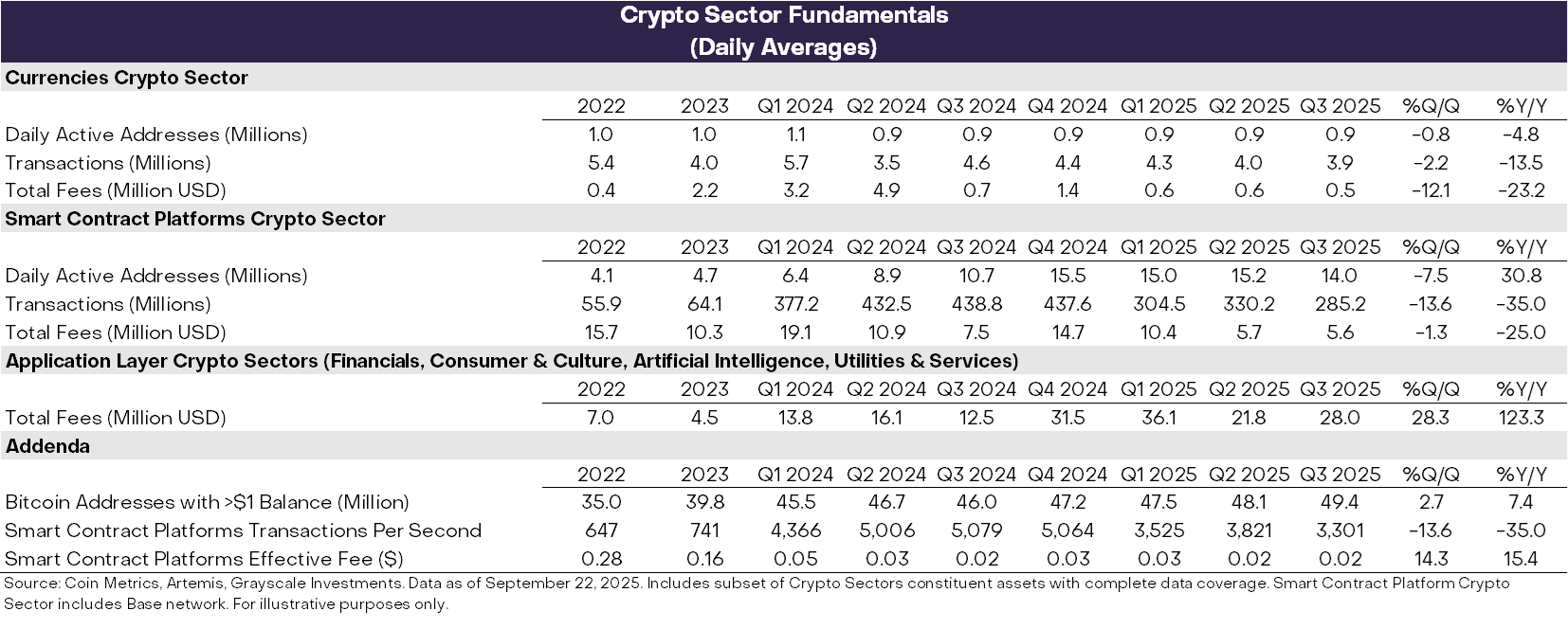

In the third quarter, the fundamental indicators of blockchain health showed mixed results (Chart 2). On the negative side, the number of users, transaction volume, and fees in the currency and smart contract platform crypto sectors all declined quarter-over-quarter. Overall, since the first quarter of 2025, speculative activity related to Memecoins has decreased, leading to a decline in transaction volume and activity.

Encouragingly, application fees based on blockchain grew by 28% quarter-over-quarter. This growth was primarily driven by fee revenues from a few leading applications: (i) Jupiter, a decentralized exchange based on Solana; (ii) Aave, a leading lending protocol in the cryptocurrency space; and (iii) Hyperliquid, a leading perpetual futures exchange. On an annualized basis, application layer fee revenues have now exceeded $10 billion. The blockchain serves as both a network for digital transactions and a platform for applications. Therefore, higher application fees can be seen as a sign of increasing adoption of blockchain technology applications.

Chart 2: In Q3 2025, the fundamental performance of various cryptocurrency industries varied

Tracking Price Performance

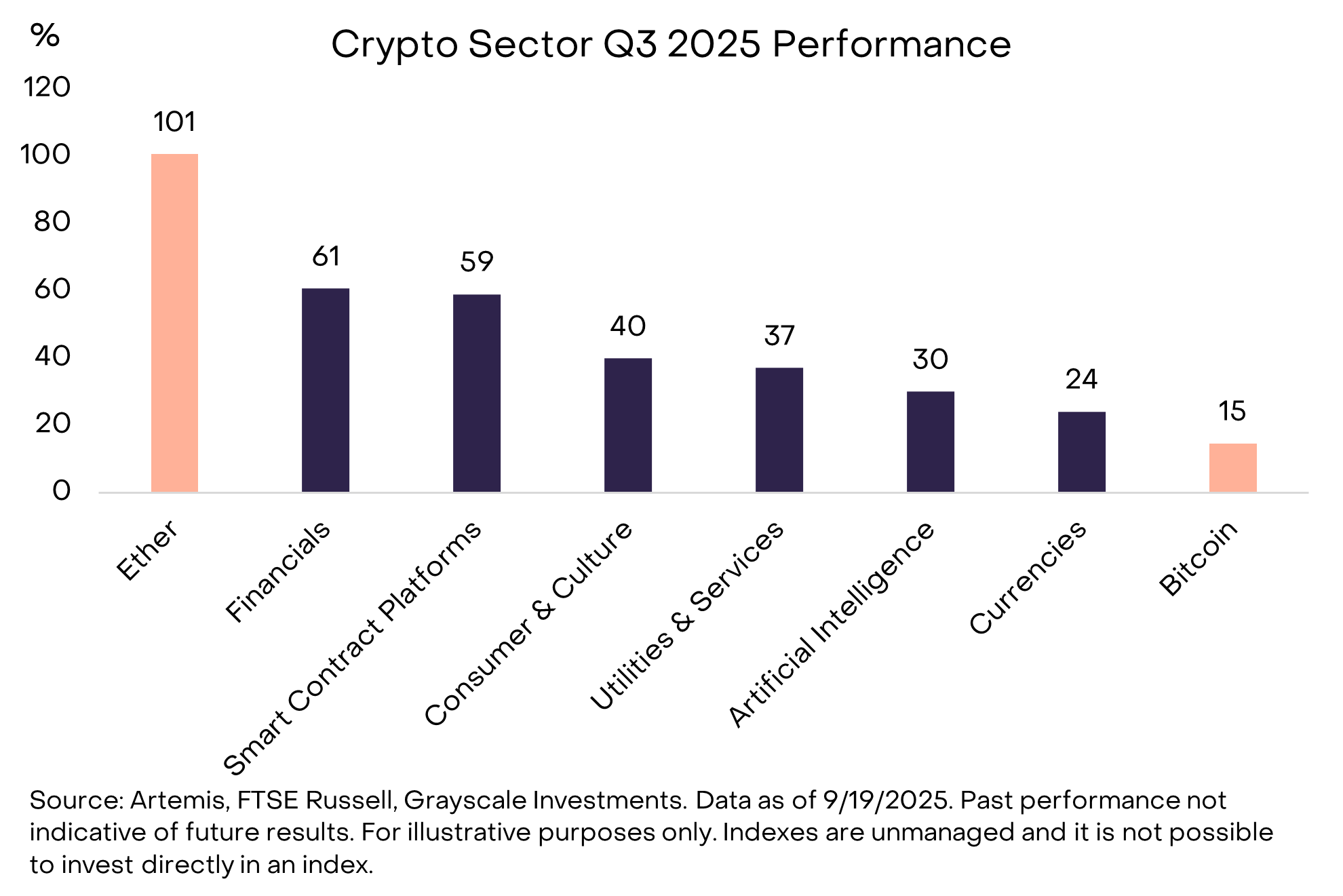

In the second quarter of 2025, all six crypto sectors had positive returns on crypto assets (Chart 3). Bitcoin's performance lagged behind other sub-markets, and this return pattern can be viewed as an "Altcoin Season" for cryptocurrencies—though it differs from other periods of Bitcoin's declining dominance. [2] Driven by the rise in centralized exchange (CEX) trading volume, the financial crypto sector led the way, while the smart contract platform crypto sector may benefit from stablecoin legislation and adoption (smart contract platforms are networks where users make peer-to-peer payments using stablecoins). Although all crypto sectors achieved positive returns, the AI crypto sector lagged behind other sub-markets, reflecting a period of poor returns for AI stocks. The currency crypto sector also performed poorly, reflecting the relatively modest increase in Bitcoin prices.

Chart 3: Bitcoin's performance lags behind other cryptocurrency markets

The diversity of crypto asset categories means frequent changes in dominant themes and market leadership. Chart 3 shows the top 20 index-qualified tokens based on volatility-adjusted price returns in the third quarter of 2025. [3] This list includes several large-cap tokens with market capitalizations exceeding $10 billion, including ETH, BNB, SOL, LINK, and AVAX, as well as some tokens with market capitalizations below $500 million. The financial crypto sector (seven assets) and the smart contract platform crypto sector (five assets) accounted for the highest proportion in the top 20 list this quarter.

Chart 4: Based on risk-adjusted returns, the best-performing assets in the cryptocurrency sector

We believe there are three major themes that have recently stood out in market performance:

(1) Digital Asset Treasuries (DAT): Last quarter, the number of DATs surged: publicly traded companies holding cryptocurrencies on their balance sheets as investment tools for equity investors. Several of the top 20 tokens may benefit from the creation of new DATs, including ETH, SOL, BNB, ENA, and CRO.

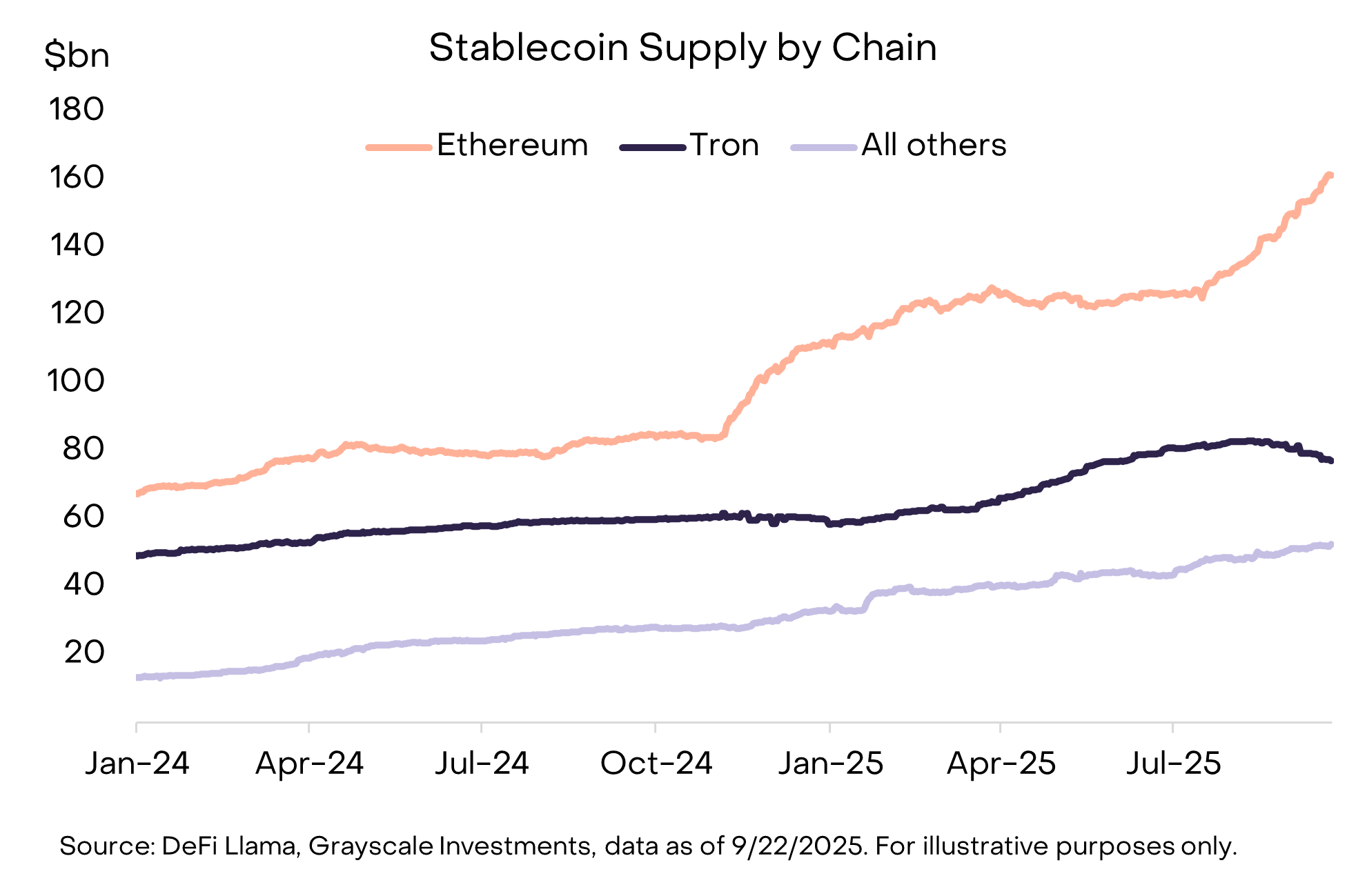

(2) Adoption of Stablecoins: Another significant theme from the last quarter was the legislation and adoption of stablecoins. On July 18, President Trump signed the GENIUS Act, which provides a comprehensive regulatory framework for stablecoins in the U.S. (refer to our report “The Future of Stablecoins and Payments”). Following the passage of this act, the adoption of stablecoins accelerated, with circulating supply growing by 16% to over $290 billion (Chart 4). [4] The main beneficiaries are smart contract platforms that host stablecoins, including ETH, TRX, and AVAX—among which AVAX saw a significant increase in stablecoin trading volume. The stablecoin issuer Ethena (ENA) also achieved strong price returns, despite its USDe stablecoin not meeting the requirements of the GENIUS Act (USDe is widely used in decentralized finance, and Ethena has launched a new stablecoin that complies with the GENIUS Act). [5]

Chart 5: This quarter's stablecoin supply growth, led by Ethereum

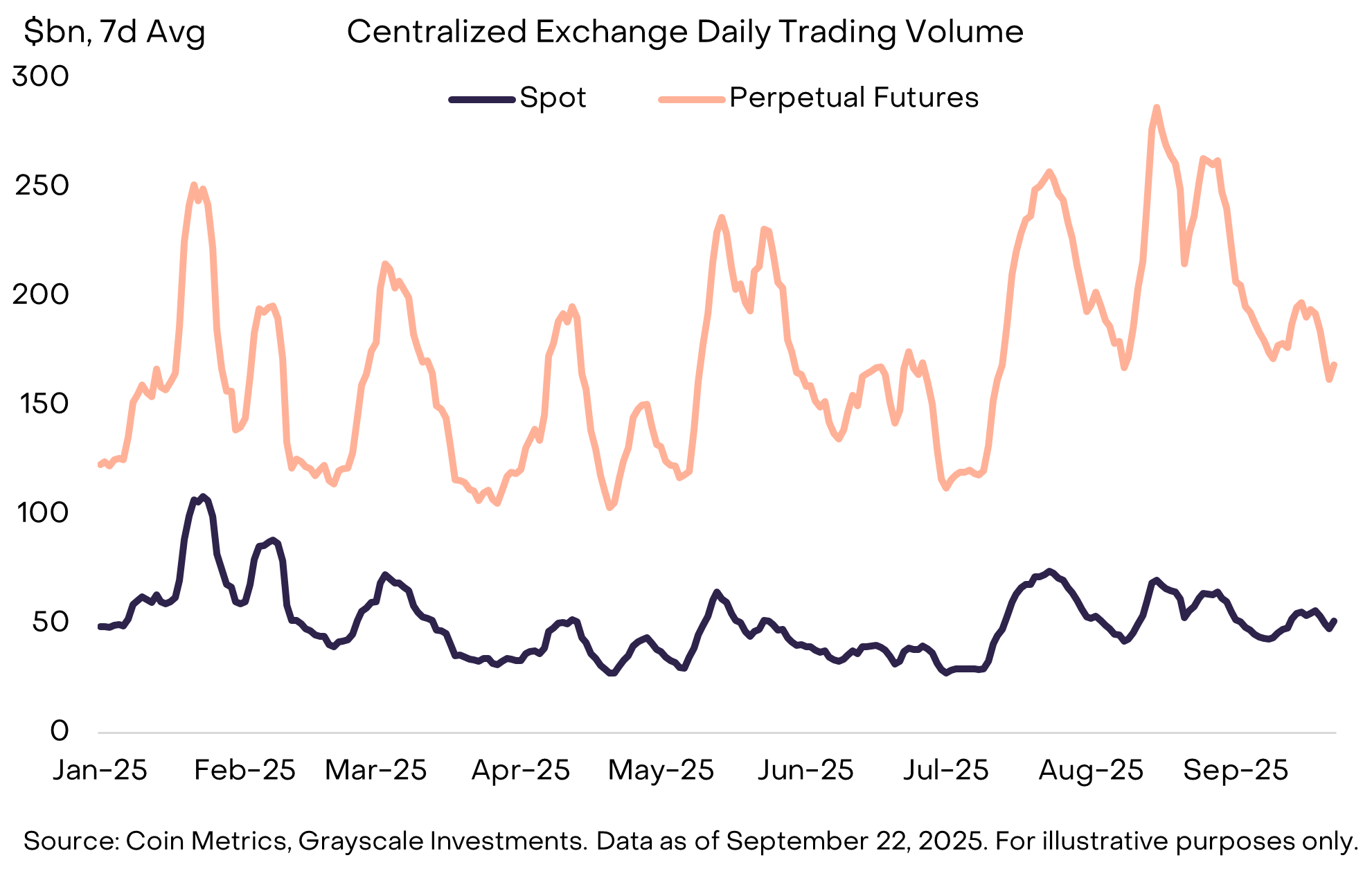

(3) Rise in Exchange Trading Volume: Exchanges are another major theme, with centralized exchange trading volume reaching a new high in August since January (Chart 5). [6] The increase in trading volume seems to have benefited several assets associated with centralized exchanges, including BNB, CRO, OKB, and KCS, all of which ranked in the top 20 (in some cases, these assets are also linked to smart contract platforms). [7]

Meanwhile, decentralized perpetual contracts continue to maintain strong momentum (for background information, see “DEX Appeal: The Rise of Decentralized Exchanges”). The leading perpetual contract exchange Hyperliquid has seen rapid growth, ranking among the top three in fee revenue this quarter. [8] Smaller competitor DRIFT has entered the top 20 in the cryptocurrency industry after a significant increase in trading volume. [9] Another decentralized perpetual contract protocol, ASTER, launched in mid-September and saw its market capitalization grow from $145 million to $3.4 billion in just one week. [10]

Chart 6: CEX perpetual contract trading volume reached an annual high in August

In the fourth quarter, the returns of the cryptocurrency sector may be driven by a series of different themes. First, following bipartisan support for related legislation in the House of Representatives in July, the relevant committee in the U.S. Senate has begun drafting cryptocurrency market structure legislation. This represents comprehensive financial services legislation targeting the cryptocurrency industry and could serve as a catalyst for its deep integration with the traditional financial services industry. Second, the U.S. Securities and Exchange Commission (SEC) has approved generic listing standards for commodity-based exchange-traded products (ETPs). [11] This could lead to an increase in the number of crypto assets available to U.S. investors through ETP structures.

Finally, the macro environment may continue to evolve. Last week, the Federal Reserve approved a 25 basis point rate cut and hinted at the possibility of two more rate cuts later this year. All else being equal, crypto assets are expected to benefit from the Fed's rate cuts (as lower rates reduce the opportunity cost of holding non-interest-bearing currency and can support investors' risk appetite). Meanwhile, a weak U.S. labor market, rising stock market valuations, and geopolitical uncertainty may be seen as sources of downside risk in the fourth quarter.

Index Implications:

FTSE/Grayscale Crypto Sectors Total Market Index: This index measures the price return performance of digital assets listed on major global exchanges, providing a reference for overall trends in the crypto market.

FTSE Grayscale Smart Contract Platforms Crypto Sector Index: This index aims to assess the performance of crypto assets that support the development and deployment of smart contracts, which serve as the foundational platforms for self-executing contracts.

FTSE Grayscale Utilities and Services Crypto Sector Index: This index focuses on measuring the performance of crypto assets designed to provide practical applications and enterprise-level functionalities.

FTSE Grayscale Consumer and Culture Crypto Sector Index: This index evaluates the performance of crypto assets that support consumer-centric activities across various goods and services sectors.

FTSE Grayscale Currencies Crypto Sector Index: This index measures the performance of crypto assets that fulfill one of three core functions: store of value, medium of exchange, and unit of account.

FTSE Grayscale Financials Crypto Sector Index: This index specifically assesses the performance of crypto assets aimed at providing financial transactions and services.

[1] Source: Artemis, Grayscale Investments. Data as of September 23, 2025.

[2] Altcoins are crypto assets with a market capitalization lower than Bitcoin.

[3] To be included in the cryptocurrency sector, tokens must be listed on a minimum number of qualified exchanges and meet minimum market capitalization and liquidity thresholds.

[4] DeFiLlama, data as of September 22, 2025.

[6] The Block, data as of September 22, 2025.

[7] Certain exchange tokens also benefit from special factors. For example, OKX announced a token buyback and burn plan, with $26 billion worth of tokens being burned. Source: The Block.

[8] Artemis, data as of September 22, 2025.

[10] CoinMarketCap, data as of September 23, 2025. ASTER launched too late to be included in the cryptocurrency industry index.

[11] Source: U.S. Securities and Exchange Commission.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。