Original Author: Ignas

Original Translation: Luffy, Foresight News

_

I strongly agree with Ray Dalio's "World Order Change" model, as it forces you to step out of a short-term perspective and look at the bigger picture. The same should apply to viewing cryptocurrencies; we should not be obsessed with daily dramas like "the daily fluctuations of a certain cryptocurrency," but rather focus on the long-term trend changes.

The current cryptocurrency industry is not only characterized by rapid narrative shifts, but the underlying order of the entire industry has also changed. The cryptocurrency market in 2025 will no longer resemble that of 2017 or 2021. Here is my interpretation of the "new order."

Large-Scale Capital Rotation

The launch of Bitcoin spot ETFs is the first major turning point.

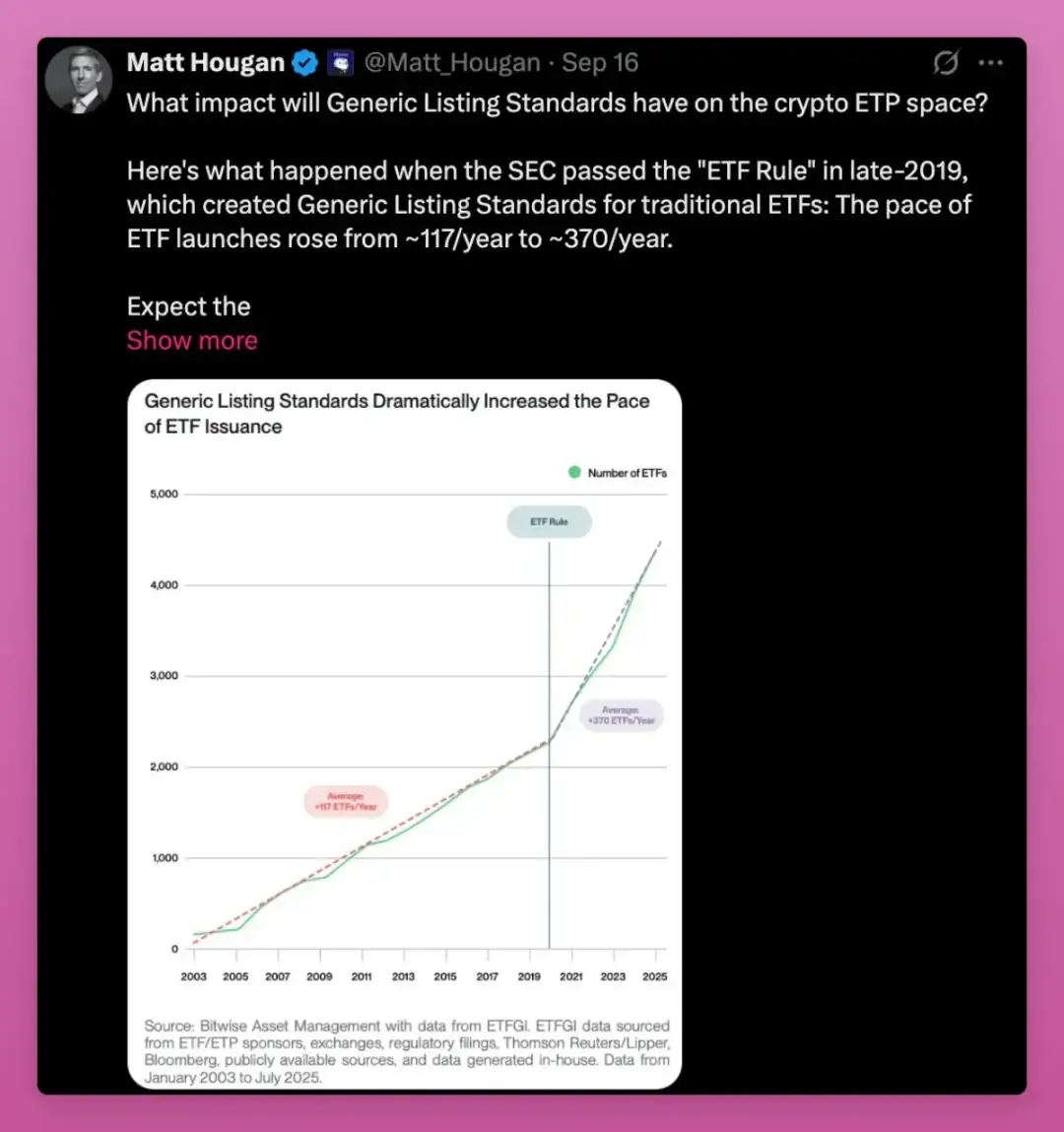

Just this month, the U.S. Securities and Exchange Commission (SEC) approved the "General Listing Standards for Exchange-Traded Products (ETPs)," which means that the approval speed for subsequent products will accelerate, and more cryptocurrency asset ETPs are set to enter the market. Grayscale has already submitted applications based on this new regulation.

Bitcoin ETFs have set the record for the most successful ETF issuance in history; although Ethereum ETFs started slowly, their assets under management have already surpassed several billion dollars even during market downturns.

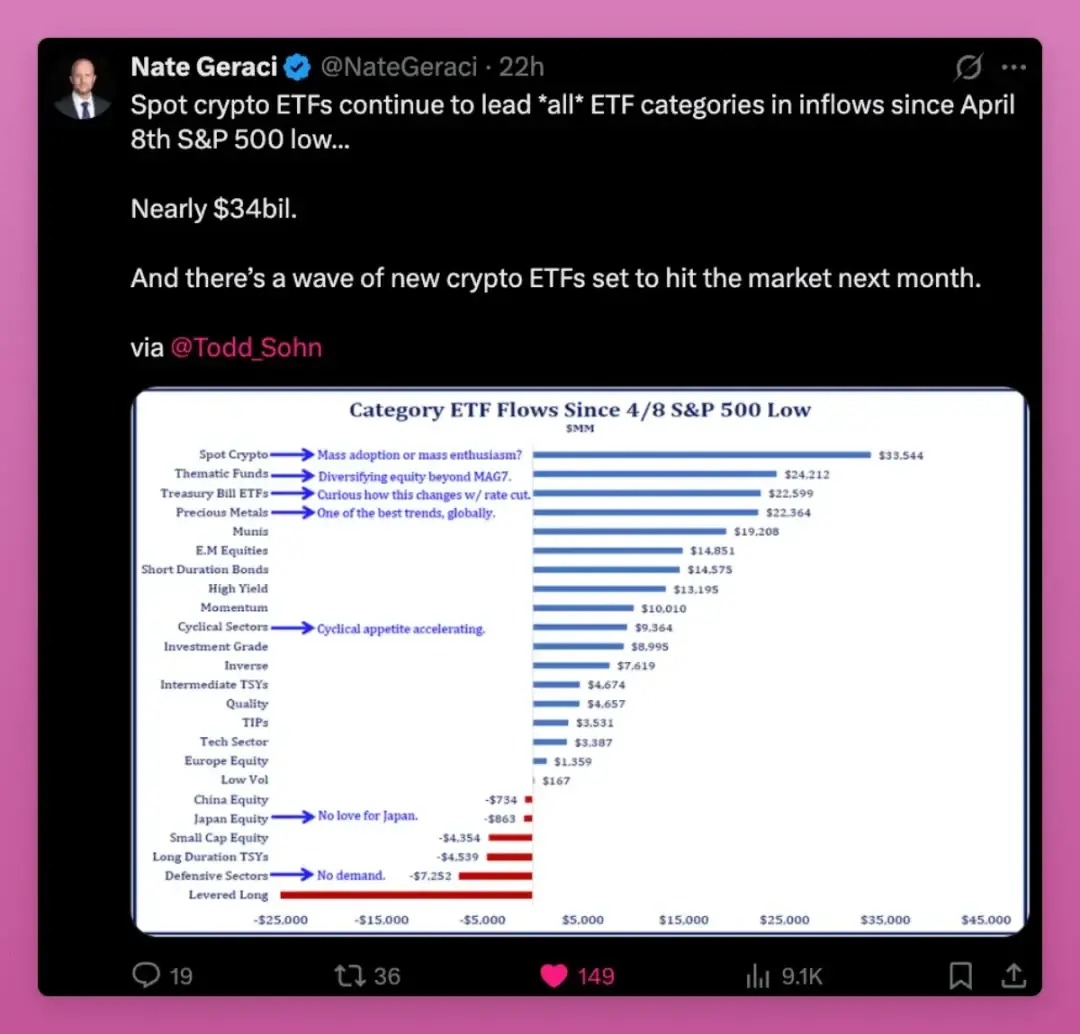

Since April 8, the inflow of funds into cryptocurrency spot ETFs has reached $34 billion, ranking first among all ETF categories, surpassing thematic ETFs, treasury ETFs, and even precious metal ETFs.

Buyers of crypto ETFs include pension funds, investment advisors, and banks. Today, cryptocurrencies are being discussed alongside gold and the Nasdaq index in asset allocation.

The current assets under management for Bitcoin ETFs have reached $150 billion, accounting for over 6% of Bitcoin's total supply.

Ethereum ETFs account for 5.59% of Ethereum's total supply.

And all of this has happened in just over a year.

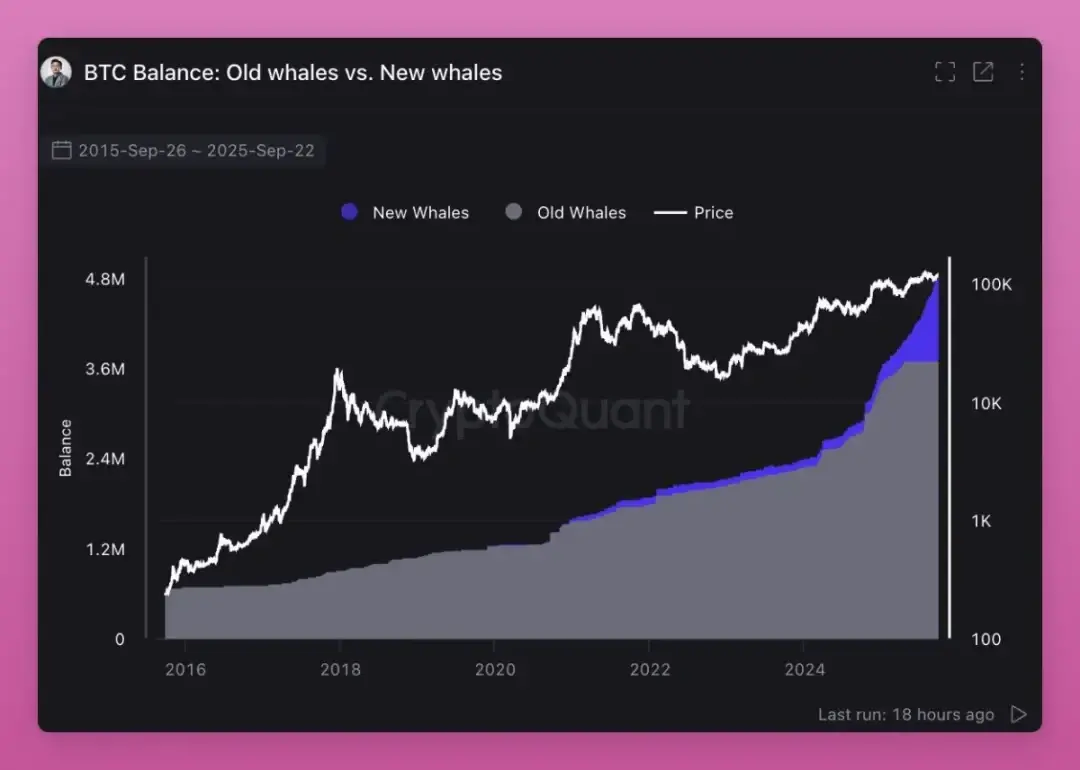

ETFs have become the main buyers of Bitcoin and Ethereum, shifting the holder structure of crypto assets from retail-dominated to institution-dominated. From my past analysis, it is evident that whales are continuously accumulating, while retail investors are selling.

More critically, old whales are selling their assets to new whales.

The holder structure is undergoing a rotation: investors who believe in the four-year cycle are selling, expecting historical scripts to repeat, but the current market is undergoing entirely different changes.

Retail investors who bought at low prices are selling their assets to ETFs and institutional investors. This "retail to institutional" transfer not only raises the cost basis of crypto assets but also solidifies the price floor for future cycles; new institutional holders will not sell off for small profits.

https://x.com/DefiIgnas/status/1970051841711894981

This is the large-scale capital rotation in cryptocurrencies: crypto assets are shifting from speculative retail hands to long-term institutional hands.

The introduction of general listing standards will open the next phase of this rotation.

In 2019, similar general rules in the U.S. stock market tripled the issuance of ETFs. The cryptocurrency sector is expected to replicate this trend: a large number of ETFs targeting assets like SOL, HYPE, XRP, DOGE, etc., will emerge, providing ample exit liquidity for retail investors.

The biggest question remains: can institutional buying power offset retail selling?

If the macro environment remains stable, I believe that those investors currently selling due to their belief in the four-year cycle will ultimately have to buy back their assets at higher prices.

The End of the Era of Universal Price Increases

In past cryptocurrency bull markets, assets often "rise together." Bitcoin would rise first, followed by Ethereum, and finally, other assets would experience a broad increase. Small-cap coins could surge because liquidity would flow down the risk curve.

But this time is entirely different; not all tokens will rise in sync.

The current crypto market has millions of tokens, with new tokens launching daily on platforms like pump.fun, as "creators" continuously shift market attention from old tokens to their newly issued meme coins. The supply of tokens has surged, but retail attention has not increased correspondingly.

Since the cost of issuing new tokens is almost zero, liquidity is dispersed across a vast array of assets.

In the past, tokens with "low circulation and high fully diluted valuation (FDV)" were highly sought after, but now retail investors have learned their lesson and prefer tokens that "can create value or at least have strong cultural influence."

Ansem's viewpoint is quite reasonable: pure speculative fervor has peaked. The new mainstream today is revenue-supported; only those with revenue-generating capabilities can achieve sustainable development. Applications that have product-market fit (PMF) and can generate transaction fees will thrive, while others will struggle.

https://x.com/blknoiz 06/status/1970107553079079341

Two things stand out: users are paying high fees for speculation, and the efficiency of blockchain relative to traditional finance. The former has peaked, while the latter still has room for growth.

Murad added a point that Ansem might have overlooked: tokens that can still surge today are often "newly launched, uniquely modeled, and not yet understood," but they need to be supported by a community with strong beliefs. I personally enjoy such novelties (like my iPhone Air).

https://x.com/MustStopMurad/status/1970588655069622440

Cultural significance is key to a token's survival or demise. A clear mission, even if initially seeming unrealistic, can sustain community vitality until user adoption creates a snowball effect. Pudgy Penguins, Punk NFTs, and some meme coins fall into this category.

However, not all novelties can survive. Cases like Runes and ERC-404 have made me realize how quickly novelty can fade. Many narratives may vanish before reaching critical scale.

By synthesizing these points, we can understand the logic of the new order. Revenue filters out unreliable projects, while culture carries misunderstood elements.

Both are equally important, but their pathways of influence differ. Ultimately, the big winners will be a few tokens that possess both revenue-generating capabilities and cultural influence.

The Stablecoin Order Grants Credibility to Cryptocurrencies

In the early days, traders held USDT or USDC solely to purchase Bitcoin and altcoins. At that time, inflows of stablecoins typically indicated bullish sentiment, as funds would ultimately convert into spot buying, with 80% to 100% of stablecoin inflows used to purchase crypto assets.

Today, this logic has changed.

The use of stablecoins has expanded to scenarios like "lending, payments, earning interest, asset management, and airdrop arbitrage," with some funds no longer flowing into Bitcoin or Ethereum spot markets, but still injecting vitality into the entire crypto system: increased transaction volumes on layer 1 (L1) and layer 2 (L2) networks, enhanced liquidity on decentralized exchanges (DEX), revenue growth in lending markets like Fluid and Aave, and deepening of the entire ecosystem's currency market.

Payment-oriented layer 1 (L1) blockchains are the latest trend:

- Tempo, jointly launched by Stripe and Paradigm, is designed for high-throughput stablecoin payments, supporting Ethereum Virtual Machine (EVM) tools and featuring native stablecoin automated market makers (AMMs);

- Plasma is a Tether-supported L1 designed specifically for USDT, equipped with new banking features and payment cards aimed at emerging markets.

These blockchains are pushing stablecoins away from trading attributes and integrating them into the real economy, bringing us back to the narrative of blockchain being used for payments.

What impact might this have (to be honest, I'm still not sure):

- Tempo: Stripe has a vast distribution network that helps promote cryptocurrency adoption, but it may bypass the spot demand for Bitcoin or Ethereum. Tempo could ultimately become the PayPal of the crypto space, with significant capital flow but limited value transmission to public chains like Ethereum. It remains unclear whether Tempo will issue a token (I believe it will) and how much fee revenue will flow back into cryptocurrencies;

- Plasma: Tether has already established dominance in the stablecoin issuance space. Through the integration of "public chain + issuer + application," Plasma may capture a large amount of payment demand from emerging markets into a closed ecosystem, competing with the open internet advocated by Ethereum and Solana. This has sparked a default public chain competition for USDT, with participants including Solana, Tron, and Ethereum L2. Among them, Tron faces the highest risk of loss, while Ethereum is not primarily positioned for payments. However, if projects like Aave choose to deploy on Plasma, it could pose a significant risk to Ethereum;

- Base: The "savior" of Ethereum L2. Coinbase and Base are promoting stablecoin payments and USDC earning products through the Base application, continuously generating fee revenue for Ethereum and DeFi protocols. Although the ecosystem remains fragmented, the competitive landscape will drive further liquidity dispersion.

Regulation is also aligning with this trend. The "GENIUS Act" is pushing countries worldwide to follow suit with stablecoin regulation; the U.S. Commodity Futures Trading Commission (CFTC) recently allowed stablecoins to be used as tokenized collateral for derivatives, adding capital market demand beyond payment needs.

https://x.com/iampaulgrewal/status/1970581821177111034

Overall, stablecoins and stablecoin-prioritized new public chains are granting credibility to cryptocurrencies.

Cryptocurrencies are no longer just speculative casinos; they now possess geopolitical significance. Although speculation remains the primary use case, stablecoins have become the second-largest application scenario in the crypto industry.

The future winners will be those that can capture the capital flow of stablecoins and convert it into sticky users and cash flow for public chains and applications. The biggest unknown at present is whether new L1s like Tempo and Plasma can become leaders in value locking within the ecosystem, or whether Ethereum, Solana, L2, and Tron can successfully counterattack.

The next major trading opportunity will arise with the launch of the Plasma mainnet (September 25).

Digital Asset Trust (DAT): A New Leverage and IPO Alternative for Non-ETF Tokens

Digital Asset Trust (DAT) concerns me.

In every bull market, we find new ways to leverage and push token prices higher. This method allows price increases to far exceed spot purchases, but the deleveraging process is always brutal. During the FTX collapse, forced selling triggered by centralized finance (CeFi) leverage destroyed the entire market.

In this cycle, leverage risk may come from DAT: if DAT issues stocks at a premium, borrows funds, and invests in tokens, it will amplify upward gains; but once market sentiment turns, the same structure will exacerbate downward movements.

Forced redemptions or halted stock buybacks could trigger massive selling pressure. Therefore, while DAT broadens access to crypto assets and brings in institutional capital, it also adds a new layer of systemic risk to the market.

Recently, there have been cases where market net asset value (mNAV) > 1. Simply put, DAT distributes Ethereum to shareholders, who are likely to sell these Ethereum. Even with a quasi-airdrop operation, the trading price of BTCS (a DAT token) is only 0.74 times its market net asset value, which is not optimistic.

https://x.com/DefiIgnas/status/1958867508456194204

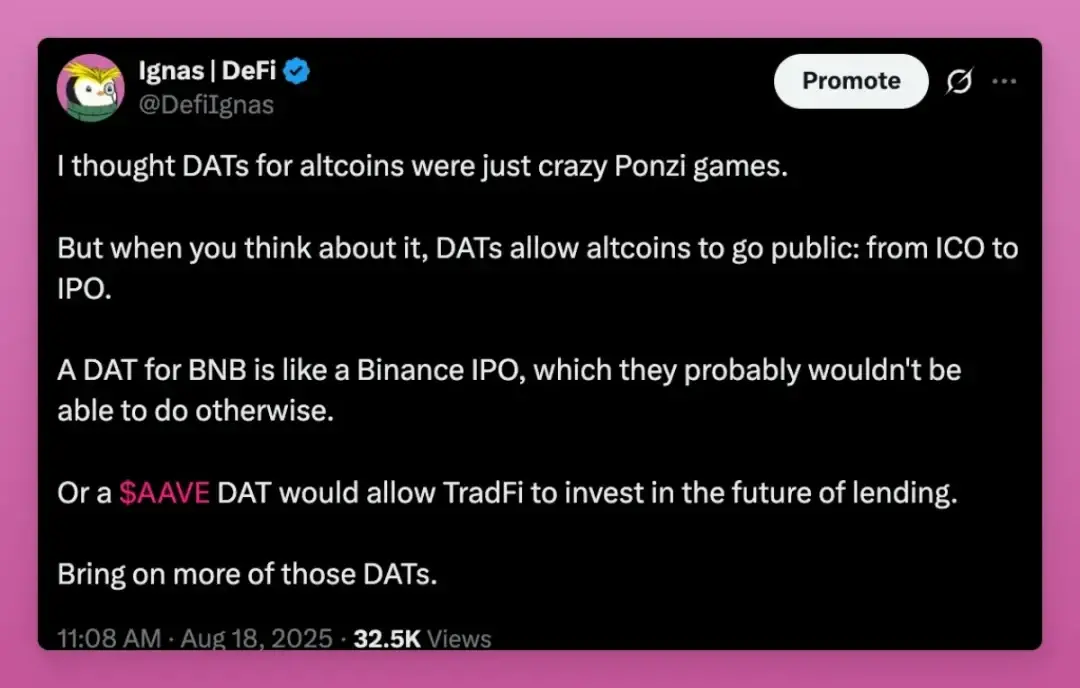

On the other hand, DAT also builds a new bridge between token economics and the stock market.

As G, the founder of Ethena, said: "One of my concerns is that we have exhausted 'crypto-native capital' and cannot push altcoins to the peak of the previous cycle. Comparing the total market cap of altcoins in Q4 2021 and Q4 2024, the two are not far apart (both slightly below $1.2 trillion); if we exclude inflation factors, the peaks of the two cycles are almost identical. This may be the maximum amount of capital that global retail investors can invest in 'conceptual assets.'"

This is the significance of DAT.

Retail capital may have reached its limit, but tokens with real businesses, real revenue, and real users can now tap into a much larger stock market. Compared to the global stock market, the entire altcoin market is just a fraction, and DAT opens a door for new capital to flow into the crypto space.

Moreover, since a few altcoin teams have the expertise to issue DAT, DAT can refocus market attention from millions of tokens back to a few key assets.

G's other point is that asset net value premium arbitrage is not important… this is actually a bullish signal.

https://x.com/gdog 97_/status/1948671788747300932

Except for Michael Saylor (founder of MicroStrategy), most DATs struggle to maintain long-term net value premiums. The true value of DAT lies not in the premium game, but in the access channel; even if it can only maintain a 1:1 net value and stable capital inflow, it is better than being completely unable to access the stock market.

ENA and even SOL's DAT have sparked controversy, being accused of being "tools for venture capital cashing out."

The risks of ENA are particularly prominent, with a large amount of venture capital holdings behind it. However, considering that the scale of private equity venture capital far exceeds the liquidity of the secondary market, this capital mismatch issue makes DAT a bullish signal: venture capital can exit through DAT and reallocate funds to other crypto assets.

This is crucial; in this cycle, venture capital has suffered heavy losses due to the inability to exit their portfolios. If they can achieve exits and gain new liquidity through DAT, they can reinvest in innovative projects in the crypto industry, driving the industry forward.

Overall, DAT is beneficial for the crypto industry as a whole, especially for tokens that cannot go public through ETFs. It allows projects like Aave, Fluid, and Hype, which have real users and revenue, to shift their asset exposure to the stock market.

Admittedly, many DATs will ultimately fail and pose spillover risks to the market, but they also provide an IPO-like exit path for initial coin offerings (ICOs).

The Revolution of Real Asset Tokenization (RWA): On-Chain Financial Life Becomes Possible

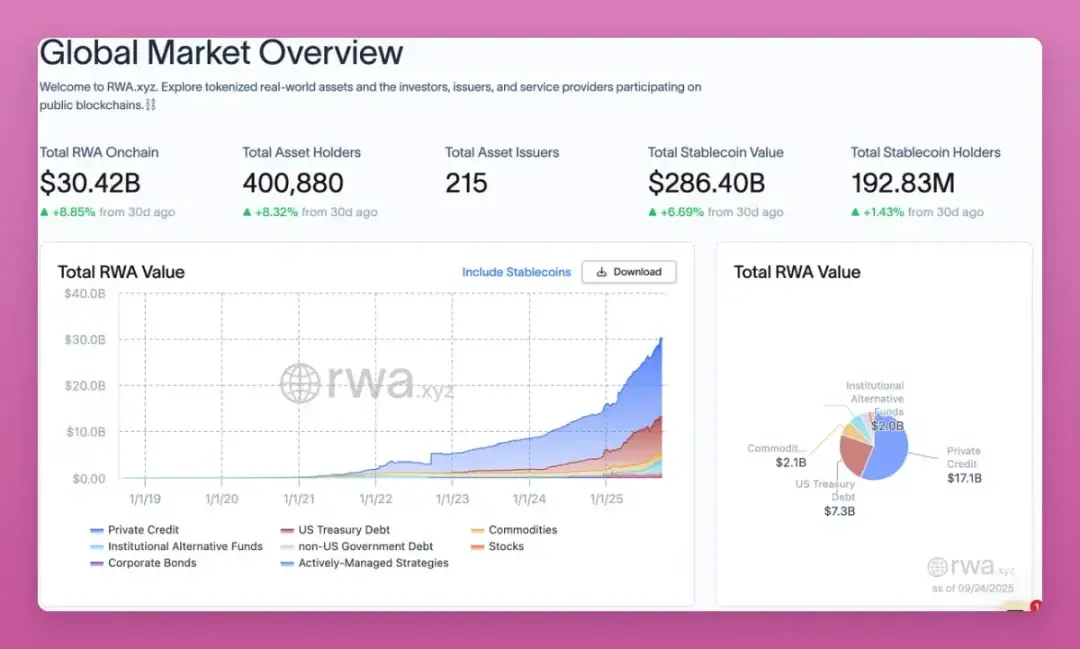

The RWA market has just surpassed $30 billion, growing nearly 9% in just one month, and the growth curve continues to rise.

Now, government bonds, credit, commodities, and private equity have all been tokenized, and the escape velocity is rapidly increasing.

RWA has brought the global economy onto the blockchain, leading to some significant transformations:

- In the past, investors had to convert crypto assets into fiat currency to purchase stocks or bonds; now, they can operate entirely on-chain, holding Bitcoin or stablecoins, directly converting them into on-chain government bonds or stocks, and controlling their assets (self-custody);

- Decentralized finance (DeFi) has broken free from the Ponzi loop, bringing new revenue sources to DeFi and L1/L2 infrastructure;

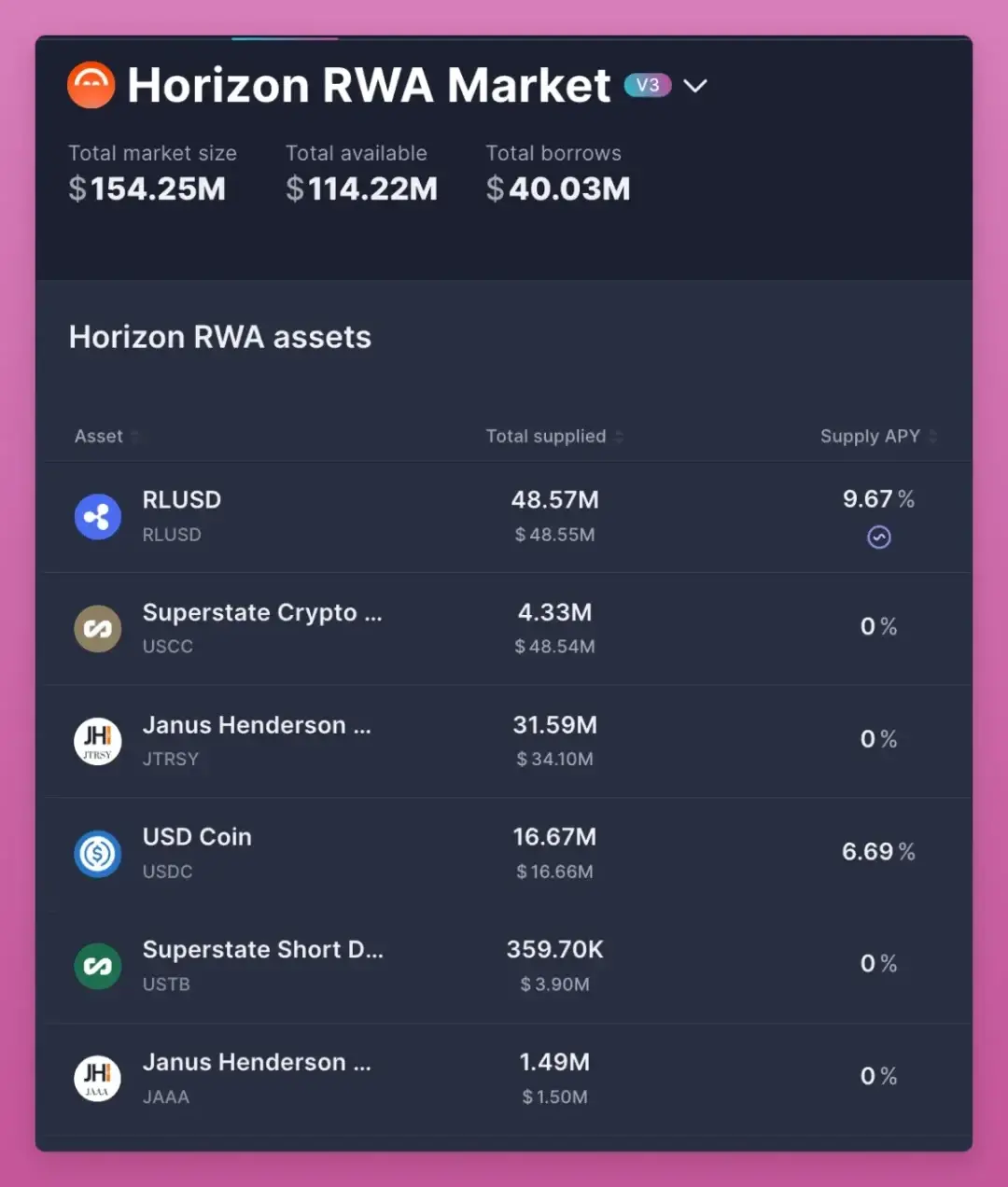

Aave's Horizon protocol allows users to deposit tokenized assets of the S&P 500 index and use them as collateral for loans. Although the current total value locked (TVL) is only $114 million, indicating that RWA is still in its early stages.

Traditional finance (TradFi) has almost completely excluded retail investors from such opportunities.

RWA ultimately makes DeFi a true capital market. It establishes benchmark interest rates based on government bonds and credit, expanding global coverage, allowing anyone to hold U.S. government bonds without going through U.S. banks.

BlackRock launched BUIDL, and Franklin Templeton launched BENJI. These are not marginal projects but bridges for trillions of dollars of capital to access crypto infrastructure.

Overall, RWA is the most important structural revolution in the current crypto industry. It connects DeFi with the real economy and builds the infrastructure for a fully on-chain financial life.

The End of the Four-Year Cycle?

For native crypto participants, the most important question is: has the four-year cycle ended? Many people around me have started selling, expecting the cycle to repeat. But I believe that with the arrival of the new order in cryptocurrencies, the four-year cycle will not repeat. This time, things are truly different.

I am betting on my own holdings for the following reasons:

- ETFs are transforming Bitcoin and Ethereum into assets that institutions can allocate;

- Stablecoins have become geopolitical tools and are expanding into payment and capital market domains;

- DAT opens a funding channel to the stock market for tokens that cannot issue ETFs, while allowing venture capital to exit and inject funds into new innovative projects;

- RWA brings the global economy onto the blockchain, establishing benchmark interest rates for DeFi.

The current crypto market is neither the casino of 2017 nor the frenzied bubble of 2021, but a new era of structure and adoption. Cryptocurrencies are merging with traditional finance while still retaining the core driving forces of culture, speculation, and belief.

The next round of winners will not come from players who buy in wholesale; many tokens may still experience four-year cycle-style crashes, and investors must be selective.

The true winners will be those projects that can adapt to macro and institutional changes while maintaining the cultural influence of retail investors.

This is the new order of cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。