Author: Chloe, ChainCatcher

On the 26th of last month, Tron implemented the largest fee reduction in its history. Sun Yuchen stated, "This proposal is a real benefit for users, reducing fees by 60%. No other network has such determination." He also mentioned that this would impact the short-term profitability of the Tron network, as network fees have been directly reduced by 60%. However, long-term profitability will be enhanced because more users and more transactions will occur on Tron.

According to the latest gasfeesnow data, even after the fee halving, the cost of USDT transfers on Tron still ranges from $2.02 to $4.22, far exceeding other major blockchain networks.

The fee comparison clearly shows that even with TronCastle optimization at $1.09 to $2.21, it is still 15 times higher than Arbitrum ($0.10), 302 times higher than Solana ($0.0036), and even 3,633 times higher than Polygon ($0.0003), while Aptos has the lowest at $0.0001.

Why were fees so high before the reduction?

Tron does not use the ETH gas model; it employs a unique bandwidth + energy model. This means that bandwidth allows users to have a free quota every day, supporting simple transfers. Energy is used for contract execution resources, and transferring USDT (TRC-20) requires energy.

Assuming a USDT transfer consumes about 130,000 units of energy, if the user's wallet has no resources, the system can only burn TRX directly, leading to high transaction costs.

In contrast, Ethereum's Layer 2 solutions like Arbitrum and Optimism use a simpler gas model, providing a more user-friendly experience. Solana achieves a processing capacity of 2,600 transactions per second through its unique Proof of History (PoH) and parallel execution architecture, while maintaining ultra-low fees.

After reducing fees, Tron plans to successfully combat "price decline" with "incremental" growth.

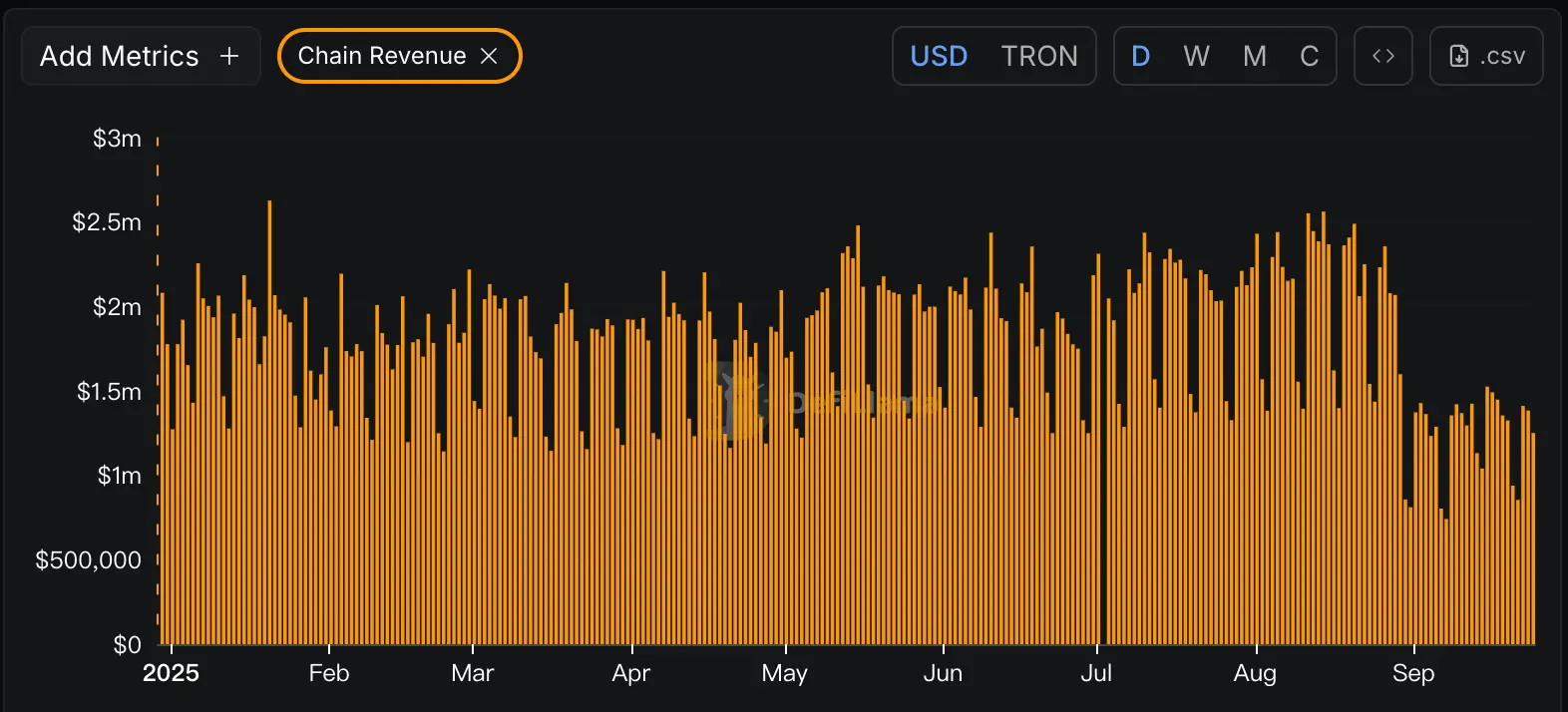

This 60% fee reduction by Tron is a significant adjustment for the market and a decision by the project team to actively promote explosive growth in user scale. According to CryptoQuant, on September 7, Tron's daily network fee income dropped to $5 million, the lowest level in a year. Before the reduction on August 28, daily income was still at $13.9 million.

On-chain data from DeFi Llama shows that Tron's average income in September indeed experienced a cliff-like drop of nearly 50% compared to the previous month.

However, even with reduced income, on-chain activity has actually increased. Daily transaction volume, active wallet numbers have surged, and the number of new smart contracts added daily also indicates a continuous influx of users and dApp developers.

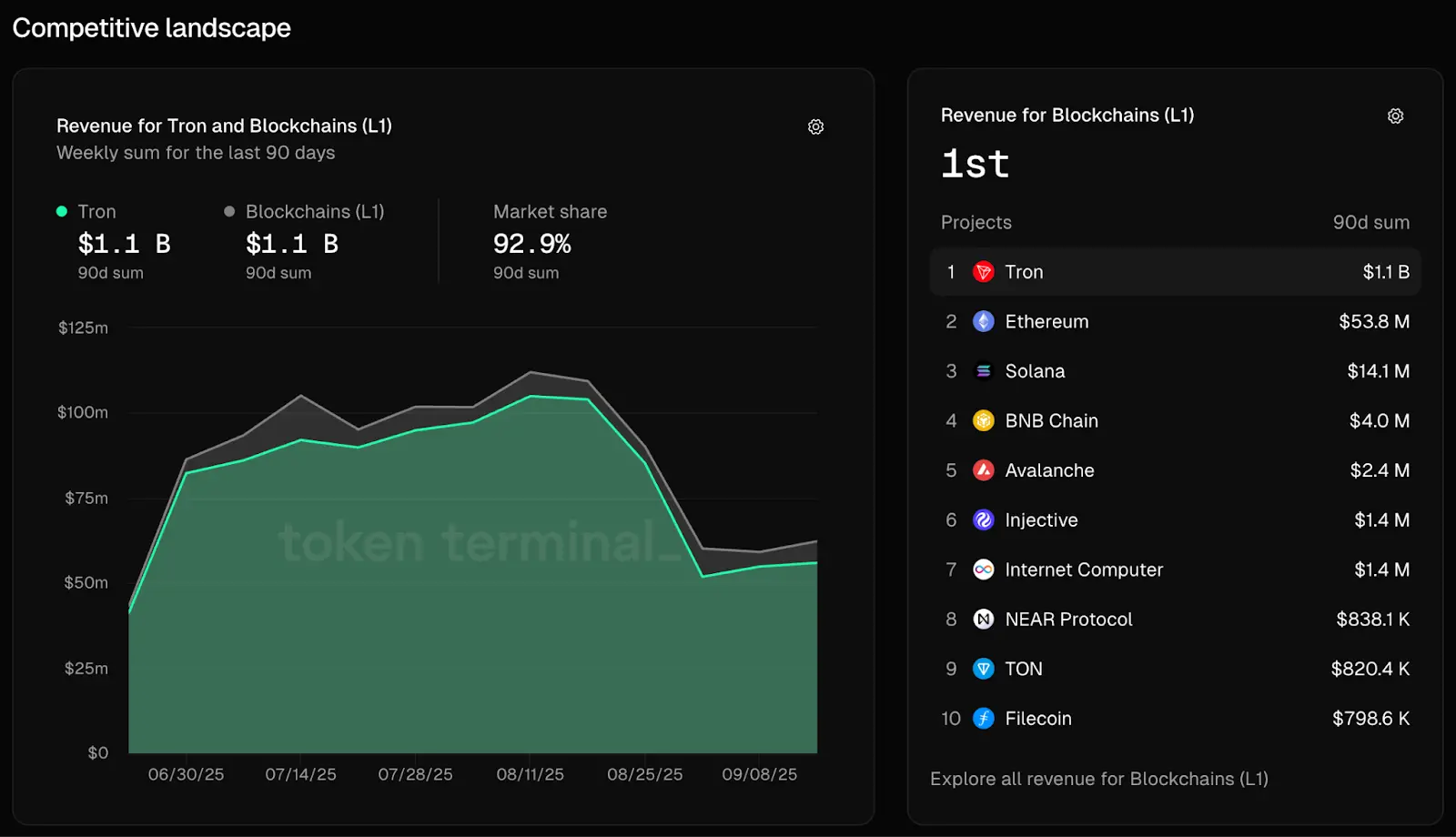

According to Token Terminal data, in the past seven days, Tron still accounted for 92.9% of total revenue from L1 public chains. Over the past 90 days, Tron's total fee income remains significantly higher than that of Ethereum, Solana, BNB Chain, and Avalanche during the same period.

**

**

Initially, Tron and Sun Yuchen expected that as long as users and transaction volumes continued to grow, revenue would eventually rebound and become more sustainable, equating to using "incremental" growth to combat "price decline."

Although Tron's revenue currently appears to maintain an advantage, with the passage of the GENIUS Act in July this year, the competitive landscape of the on-chain market is undergoing fundamental restructuring. Stablecoin issuers may reassess the cost-effectiveness of deploying assets on Tron in light of stricter registration, auditing, and reserve requirements, which could indirectly affect the trading volume of stablecoins and the ecological activity of the network, posing a significant barrier for Tron.

Wall Street giants are entering the market, and CBDCs are maturing

There are mixed opinions on the passage of the GENIUS Act, with both advantages and disadvantages for the crypto market. Supporters believe this milestone brings higher credibility to stablecoins, making financial institutions and consumers more willing to use them. Opponents argue that this act effectively allows the president and related institutions to profit, creating a conflict of interest with the crypto market.

Currently, Wall Street giants like BlackRock and JPMorgan are already building their blockchain empires. BlackRock's BUIDL tokenized money market fund has reached a scale of $2.2 billion, deployed across multiple networks including Ethereum, Avalanche, Aptos, and Polygon. JPMorgan's Kinexys platform focuses on institutional-level DeFi and programmable digital cash, providing on-chain lending and digital asset collateral services for corporate clients.

The advantages of these traditional financial institutions include: 1. Regulatory compliance: Deep cooperative relationships with financial regulatory agencies in various countries; 2. Financial strength: BlackRock manages over several trillion dollars in assets; 3. A large corporate client base: Established networks and trust relationships with institutional clients, as well as the technical integration capability to seamlessly incorporate blockchain into existing financial infrastructure.

Tron's compliance gap cannot be compared to the regulatory relationships of BlackRock and JPMorgan. Additionally, its adoption rate among Fortune 500 companies is extremely low, not to mention that the SEC lawsuit is still ongoing, affecting institutional trust.

Supplement: Last week, two Democratic lawmakers in the U.S. wrote to the SEC, asking for an explanation of why it paused the enforcement case against Sun Yuchen, suggesting that this decision might be related to Sun Yuchen's "substantial investments" in President Trump's related crypto projects. Meanwhile, the lawmakers questioned Tron's recent listing on Nasdaq, believing that this move could pose financial and national security risks, urging the SEC to ensure that the company meets strict listing standards.

Furthermore, 98% of the world's GDP has been covered by central bank digital currency (CBDC) projects, with 19 G20 countries developing or piloting CBDCs. Major economic CBDC projects like China's digital yuan (e-CNY), the EU's digital euro, and India's digital rupee will directly compete with Tron in the fields of cross-border payments and large-value settlements.

McKinsey research indicates that 2025 will be a turning point for the development of stablecoins, with the stablecoin market expected to grow from the current $150 billion to $3 trillion by 2030. However, this significant increment will mainly be divided among compliant institutional-level stablecoins and CBDCs.

The market believes that Tron must complete its transformation within this critical time window, or it will face the fate of being marginalized. The crypto market is clearly transitioning from experimental technology to core infrastructure, and during this transition, only a few platforms will survive.

Click to learn about ChainCatcher's job openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。