Bitcoin Dominance Chart and History: Is Altcoin Season Index Weaken?

Will Bitcoin Take Back Market Control?

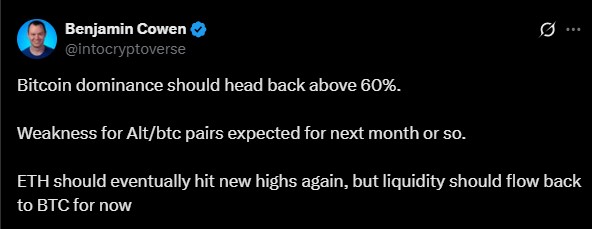

Is the crypto market entering another Bitcoin season? According to crypto analyst Benjamin Cowen, Bitcoin dominance could soon climb back above 60%. This means that a larger portion of money in the crypto market may start flowing into the golden asset rather than staying spread across smaller alt-coins.

Source: X

This comes at a time when the Altcoin Season Index has dropped from 78 to 69, showing weakening momentum for alts after weeks of strong performance.

Wondering About What “Bitcoin-Dominance Is”?

In short, investors appear to be transferring their funds from riskier altcoins and trusting more in Bitcoin. When they do so, it typically indicates that traders regard Bitcoin as a secure and better option than other cryptocurrencies, particularly in times of uncertainty in the market.

Historical Trends: How The Power Has Shifted

At the start of crypto history, Bitcoin commanded over 80% dominance, even above 90% when Ethereum launched in 2015.

-

2017 ICO Boom: The coin's leadership dropped to 38% as money flowed into ETH & ICOs

-

2018 Bear Market: After the crash, it recovered to around 70% by mid-2019 as altcoins collapsed.

-

2020–2021 Bull Run: BTC hit $63K, but DeFi/NFTs cut dominance below 50%.

-

2022 Bear Market: Terra & FTX crashes pushed dominance back to near 45%.

-

2024–2025: Spot ETFs, Trump’s win, U.S. Bitcoin Reserve lifted dominance to ~55%.

Today, ₿ coin sits at 56.18% dominance, with Ethereum at 12.63% and stablecoins at 6.97%, according to CoinMarketCap data.

Source: CoinMarketCap

Altcoin Season Index Signals Weakness

Cowen noted that Alt/BTC pairs are expected to weaken over the next month. While many altcoins recently outperformed BTC, the latest data shows capital rotation back into ₿ coin.

The Altcoin Season Index currently reads 70/100, down from 77 last week and far below its December 2024 high of 87. This metric, which compares altcoin returns to ₿ coin, shows altcoins may be losing steam.

This decline, coupled with a massive $8B altcoin open interest wipeout (compared to $1.5B in BTC), shows altcoins are facing greater pressure.

Ethereum Still Holds Long-Term Strength

Despite near-term weakness, Cowen remains optimistic about Ethereum. He expects ETH to eventually hit new highs again.ETH dominance currently stands near 13%, slightly recovering from recent lows.

Other altcoins like Aster (ASTER), MemeCore (M), Story Protocol (IP), and Pudgy Penguins (PENGU) were recent strong performers . But analysts caution that most altcoin seasons last only 2–3 weeks, raising the risk of a shift back to the Bitcoin-season.

Uptober: Could October Spark a BTC Rally?

Historically, September has been Bitcoin’s weakest month (“Redtember”), while October is known as “Uptober.” This year, ₿-coin already climbed from $108K to $117K earlier this month before correcting.

With ETF inflows, institutional adoption, macro liquidity from potential Fed rate reductions, most expect Bitcoin-to bounce back solidly in Q4. If so, BTC dominance might keep going up, pushing another genuine altcoin season further into the future.

Why This Trend Matters for Investors

-

Short Term: ₿- coin may dominate the market, with altcoins falling out of favor in BTC pairs.

-

Mid Term: If BTC continues to dominate, altcoins may struggle to gain traction.

-

Long Term: Ethereum and other large projects remain set for expansion once the liquidity cycle turns around again.

Market history reveals Bitcoin-tends to regain leadership before the next widespread rally. As Cowen foretells the strength of the golden asset, investors will be interested in rebalancing strategies and waiting for indications of a gradual altcoin rebound.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。