Who do you think is the third stablecoin?

USDT and USDC occupy the top two spots without much doubt, but today’s third is not DAI, FDUSD, or TUSD, but a newcomer that has been launched for less than two years—USDe.

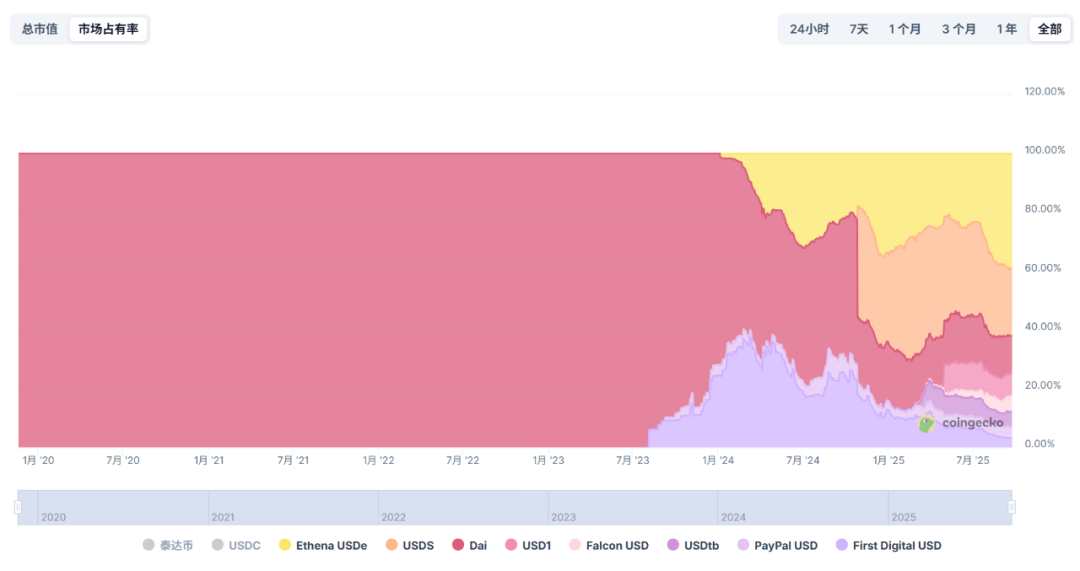

According to CoinGecko data, as of September 23, the circulating supply of USDe has surpassed $14 billion, ranking third in the stablecoin market, only behind USDT and USDC. More notably, if we exclude the volumes of USDT and USDC, USDe has almost captured 40% of the market share of all other stablecoins, creating strong pressure on the survival space of established stablecoins.

What exactly has allowed this rising star to emerge so rapidly? What are the underlying profit logic and risk concerns? Meanwhile, as USDe rises swiftly, what new variables are emerging in the stablecoin arena?

Source: CoinGecko

01. From 0 to $14 billion: The Non-linear Rise of USDe

The stablecoin sector has always been a lucrative super cake.

In horizontal comparison, the "money printing machine" attribute of the leading player Tether is comparable to that of top CEXs. According to Tether's Q2 2025 attestation report, Tether's total holdings of U.S. Treasury bonds exceeded $127 billion (an increase of about $8 billion from the first quarter), with a net profit of approximately $4.9 billion in the second quarter, and a total net profit of $5.7 billion in the first half of this year.

It’s worth noting that Tether has only about 100 employees, and its profit margin and operational efficiency are astonishingly high, almost at least an order of magnitude lower than those of crypto trading platforms and traditional Web2 financial giants!

However, not all players are sitting comfortably at this profitable table. In fact, it can be said that, apart from USDT, the performance of established stablecoins in recent years has not been perfect:

- USDC once lost its peg during the banking crisis in 2023 due to reserve risks, significantly retracting in volume and suffering lasting damage;

- DAI has gradually moved towards "super USDC" after MakerDAO's transformation, and its volume has also hit a bottleneck;

- Newcomers like TUSD and FDUSD have seen short-term growth but struggle to shake up the landscape.

Source: Ethena Official Website

It is against the backdrop of slowing growth and solidified models of traditional stablecoin giants that USDe has emerged, charting a distinctly different "non-linear" growth curve.

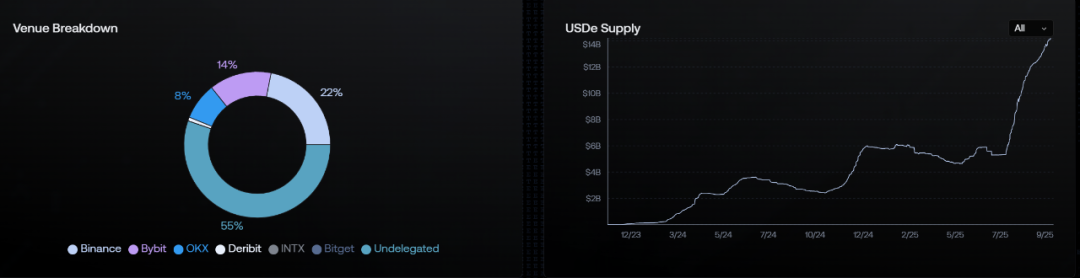

Since its official launch in November 2023, USDe's total circulating market value has rapidly grown from 0 to the $14 billion level in less than two years, experiencing only two pullbacks during this period and quickly recovering growth. Notably, since July of this year, it has surged nearly twofold from about $5 billion in just two months and has been deeply integrated by several leading CEXs.

In the long run, USDe's growth curve can be described as almost unparalleled.

This seemingly counterintuitive growth curve is also closely tied to its well-known high-yield flywheel—when the stablecoin competition enters the "stock game" phase, USDe's extremely high annualized yield, practical scenarios for trading margins, and the "Delta neutral" narrative have indeed helped it quickly open up the incremental market, making it the most controversial and attention-grabbing new star.

02. Deconstructing USDe: Where Do High Yields Come From?

The biggest impact of USDe on the stablecoin market is undoubtedly its high-yield attribute—users can earn all the profits generated by the protocol by staking USDe as sUSDe.

According to data from Ethena Labs' official website, as of the time of writing, the annualized yield of sUSDe remains as high as 7.83%, having previously maintained above 20%. So, what kind of stablecoin mechanism is USDe, and why does it have such a high annualized yield?

To understand USDe, it is essential to clarify its fundamental difference from the previously collapsed UST—UST was an uncollateralized algorithmic stablecoin, while USDe is a fully collateralized synthetic dollar that maintains value stability through a "Delta neutral" strategy. This is essentially a practical version of the "Satoshi Dollar" concept proposed by BitMEX founder Arthur Hayes in his March 2023 article "Dust on Crust."

Source: BitMEX

In simple terms, excluding the expected airdrop profits, the high yield of USDe mainly comes from two sources:

- LSD staking yields: The assets deposited by users, such as ETH or stETH, generate stable staking yields;

- Funding rate income from Delta hedging positions: This is the bulk of the yield, which is earned from short positions in perpetual futures opened on CEXs;

The former is relatively stable, fluctuating around 3% to 4%, while the latter entirely depends on market sentiment. Therefore, the annualized yield of USDe is, to some extent, directly tied to the overall funding rate (market sentiment). The key to understanding how this mechanism operates lies in the "Delta neutral strategy"—if an investment portfolio consists of related financial products and its value is not affected by small price changes in the underlying assets, such a portfolio is considered "Delta neutral."

In other words, USDe will establish equal amounts of long positions in spot ETH/BTC and short positions in futures ETH/BTC to form a "Delta neutral strategy": the Delta value of the spot position is 1, while the Delta value of the futures short position is -1. After hedging, the combined Delta value is 0, thus achieving "Delta neutrality."

Simply put, when the USDe stablecoin module receives user funds and buys ETH/BTC, it will simultaneously open equal amounts of short positions, thereby maintaining the value stability of each USDe through hedging, which also ensures that the collateral position is free from liquidation risk.

Source: Ethena Official Website

For example, assuming the BTC price is $120,000, if a user deposits 1 BTC, the USDe stablecoin module will simultaneously sell 1 BTC in futures, and after hedging, the total Delta value of the investment portfolio will be 0:

- If BTC drops to $100,000: The spot position loses $20,000, but the futures short position gains $20,000, keeping the total portfolio value at $120,000.

- If BTC rises to $140,000: The spot position gains $20,000, but the futures short position loses $20,000, and the total portfolio value remains $120,000.

Through this method, the total value of the collateral can be kept stable, while this short position can continuously earn funding rates. Historically, the crypto market has had positive funding rates most of the time (especially during bull markets), meaning that longs pay fees to shorts.

Thus, the combination of these two sources of income constitutes the highly attractive high APY of USDe.

03. Shadows Beneath the Halo: Potential Risks and Controversies of USDe

Despite the clever design of USDe's mechanism, its high yield is not without risks, and market concerns primarily focus on the following points.

First is the funding rate risk. Since USDe's yield model heavily relies on positive funding rates, if the market enters a bear phase, funding rates may remain negative for an extended period. At that time, the short positions would not only yield no profits but would also incur costs, severely eroding USDe's yield and potentially triggering de-pegging risks.

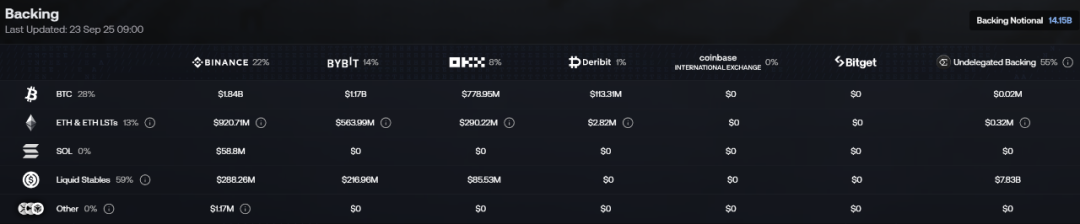

Next is the centralization and custody risk. Since USDe's collateral and hedging positions are stored in centralized custodial institutions and CEXs, although relatively dispersed, it still faces counterparty risks. If an exchange encounters issues (such as bankruptcy or theft), it would directly threaten the asset security of USDe.

Lastly, there are liquidity and execution risks. In extreme market fluctuations, Ethena needs to quickly adjust its large spot and futures positions, and during such times, market liquidity may dry up, leading to significant trading slippage and causing the "Delta neutral" strategy to fail.

Additionally, there is an invisible risk of LSD collateral de-pegging—if the liquid staking tokens like stETH used by Ethena become unpegged from ETH, the hedging effect would be significantly diminished, resulting in asset losses.

Overall, the rapid rise of USDe reflects the immense market expectation for a high-yield, high-capital-efficiency decentralized stablecoin "holy grail" against the backdrop of algorithmic stablecoins retreating and centralized stablecoins facing regulatory pressures. Moreover, it has indeed pioneered a new "synthetic dollar" paradigm.

However, for users, while embracing its high yields, it is crucial to be acutely aware of its unique risk model. This competition concerning the future core assets on-chain is worth our continued attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。