Original Author| SoSoValue Research Original Editor| Wu Says Blockchain

On September 17, the U.S. SEC officially approved the "General Listing Standards for Commodity Trust Shares" (Release No. 34–103995). This is not a simple technical document, but a real "institutional gateway" — meaning that the listing of crypto spot ETFs in the future will shift from case-by-case approval to a standardized and expedited general standard process.

Against the backdrop of the Federal Reserve just initiating a new round of interest rate cuts and rising expectations of dollar depreciation, this institutional breakthrough brings a dual resonance of "liquidity + institutionalization" to crypto assets, making it one of the most iconic regulatory events in the crypto market this year.

In this article, we will answer the following questions:

- What exactly has changed with the new regulations, and what impacts will it bring?

- Which cryptocurrencies are likely to benefit first, and which coins' spot ETFs are expected to be approved first?

- What should investors pay attention to? In the context of the new regulations and the reshaping of capital migration logic, how can ordinary investors seize opportunities and manage risks?

1. What has changed with the general standards? From "whether to allow" to "how to regulate"

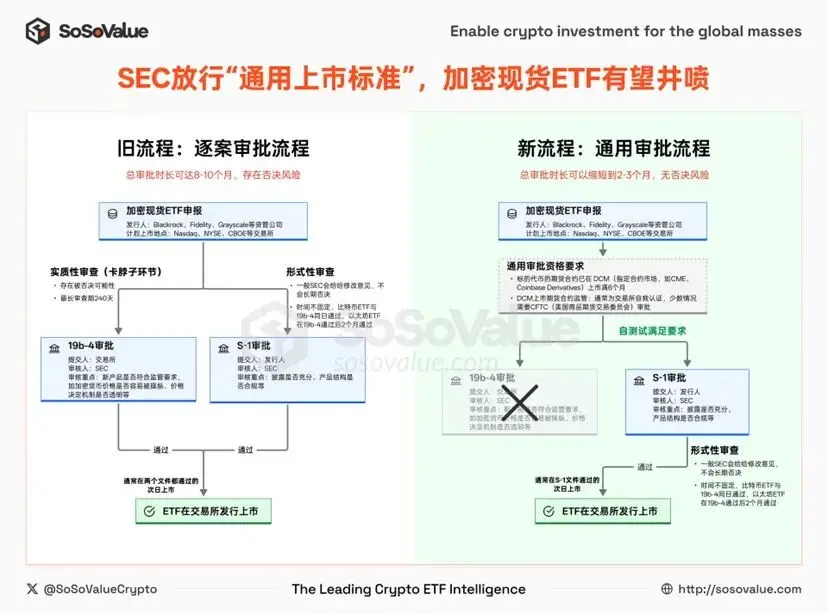

Before the release of this new regulation, crypto spot ETFs had to go through a case-by-case approval process, crossing two approval thresholds:

19b-4 rule change approval — The exchange applies to the SEC to modify exchange rules, which is a substantive approval and may be rejected by the SEC.

S-1 prospectus approval — The ETF issuer submits for SEC approval, disclosing details such as fund structure, manager, fee rates, etc., which is more of a formal review.

This dual approval model not only has a lengthy process but is often slowed down by political games and compliance disputes. For example, the Bitcoin spot ETF saw a surge in applications in 2021, but in 2021-2022, it was rejected by the SEC at the 19b-4 stage. From May to July 2023, a new batch of applications was submitted, and it wasn't until January 10, 2024, that the 19b-4 and S-1 documents were approved on the same day, experiencing nearly 8 months of back-and-forth.

The "General Listing Standards" approved by the SEC on September 17, 2025, brings fundamental changes. This standard clarifies that eligible commodity ETFs do not need to submit 19b-4 applications on a case-by-case basis, but only need to go through the S-1 approval process, significantly reducing approval time and costs.

ETFs that meet the standards must satisfy one of the following three paths:

The underlying commodity has been traded on ISG (Intermarket Surveillance Group) member markets, such as the NYSE, NASDAQ, CME, London Stock Exchange, etc.

The futures contracts of the underlying commodity have been continuously traded on a DCM (Designated Contract Market) for at least six months, and a Comprehensive Surveillance Sharing Agreement (CSSA) has been established between exchanges. DCMs are compliant exchanges authorized by the CFTC (U.S. Commodity Futures Trading Commission), such as CME, CBOT, Coinbase Derivatives Exchange, etc.

There is already an ETF listed on a U.S. national securities exchange, and at least 40% of its assets are allocated to the underlying commodity.

Since most crypto assets are considered "commodities," this rule is almost tailor-made for crypto spot ETFs. Among these, the second path is the most feasible: as long as a certain crypto asset has futures contracts running for six months on exchanges like CME or Coinbase Derivatives, it can skip the 19b-4 approval stage, and its spot ETF is expected to be launched quickly.

Figure 1: Approval process for new and old crypto spot ETFs (Data Source: SoSoValue)

Compared to the old model, the changes brought by the new regulations mainly manifest in two aspects:

1) Simplified approval path: 19b-4 is no longer a "roadblock."

In the old model, crypto spot ETFs needed to complete both the 19b-4 rule change and the S-1 prospectus dual approval, both of which were essential. Past Bitcoin and Ethereum ETFs were like this: the review time for 19b-4 lasted up to 240 days, becoming a key factor slowing down the process. In the new regulations, as long as the product meets the unified standards, the exchange can directly proceed to the S-1 approval stage, eliminating the repeated negotiations of 19b-4, significantly shortening the listing cycle.

2) Shift in the focus of review authority: CFTC and DCM play a more critical role.

The qualification review of futures contracts is gradually shifting from the SEC to DCMs (Designated Contract Markets) and the CFTC (U.S. Commodity Futures Trading Commission). According to the current system, DCMs have two main ways to launch new contracts:

- Self-Certification: DCMs only need to submit a self-declaration to the CFTC one business day before the contract goes live, and if there is no opposition, the contract automatically takes effect. This usually requires the spot market to have price transparency, sufficient liquidity, and controllable market manipulation risks.

- Voluntary Approval: If there is a dispute regarding the contract, the DCM can proactively apply for CFTC approval to obtain stronger legal protection.

This means that as long as the spot market for a certain type of crypto asset is healthy enough, DCMs have considerable autonomy to promote its futures listing. Meanwhile, the SEC's review of the S-1 mainly focuses on whether the information disclosure is sufficient and whether the product structure is compliant, which is more of a "formal review."

Overall, the SEC is transitioning from a case-by-case approver to a rule maker. The regulatory attitude is also shifting from "whether to allow" to "how to regulate." Under this framework, the launch of crypto spot ETFs will be more efficient and standardized.

2. Which cryptocurrencies are most likely to benefit? Existing futures contracts & 10 mainstream coins that have submitted ETF applications will be the first to see ETF launches.

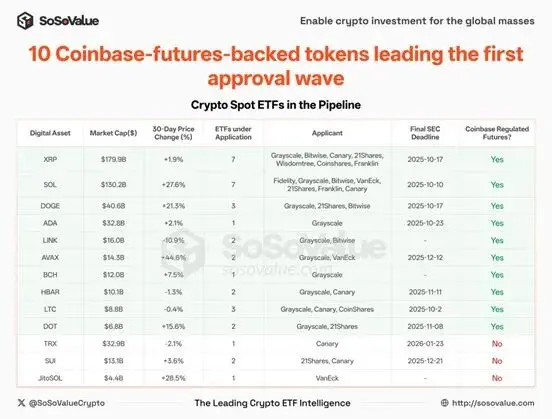

Among the existing DCMs (Designated Contract Markets), Coinbase's Coinbase Derivatives Exchange has the most comprehensive line of crypto futures products, currently covering 14 cryptocurrencies. (See Figure 2).

Figure 2: List of futures already listed on Coinbase (Data Source: SoSoValue)

According to SoSoValue data, there are currently 35 crypto spot ETFs queued for approval, covering 13 coins. Except for SUI, TRX, and JitoSOL, the other 10 coins have already had futures listed on Coinbase Derivatives for over 6 months, thus fully meeting the new general requirements.

Figure 3: Existing futures contracts & 10 mainstream coins that have submitted ETF applications will be the first to see ETF launches (Data Source: SoSoValue)

This means:

- About 30 spot ETFs covering 10 coins including LTC, SOL, XRP, DOGE, ADA, DOT, HBAR, AVAX, LINK, BCH are expected to be quickly approved in the coming weeks or months;

- The market is brewing the next wave of ETF "explosion." For example, while coins like XLM and SHIB already have futures, no one has submitted spot ETF applications yet, making them likely targets for the next batch of managers.

3. When the interest rate cut cycle meets the ETF explosion, what should investors pay attention to? ETF issuance progress, macro interest rate trends, cross-asset allocation, and capital flows

In the short term, the implementation of the general standards will significantly accelerate the pace of crypto ETF launches, lower issuance thresholds, and attract more institutional funds and compliant products into the market.

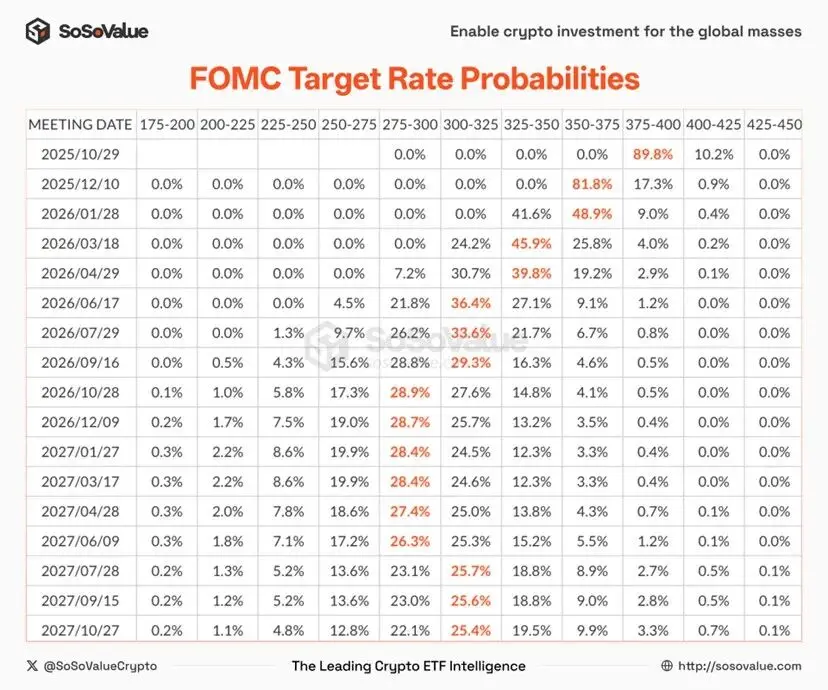

At the same time, the Federal Reserve lowered interest rates by 25 basis points as expected on Thursday, signaling two more cuts within the year, marking the beginning of the interest rate cut cycle, and expectations of dollar depreciation are starting to take shape, with global capital seeking new asset anchors.

The forces of macro liquidity and institutional innovation are colliding: on one side is the massive liquidity released by the dollar system, and on the other side is the potential product explosion of crypto asset ETFs. The intertwining of the two may reshape capital allocation logic, accelerate the deep integration of traditional capital markets and crypto assets, and could even become the starting point for a reconfiguration of the global asset landscape in the next decade.

In this context, investors need to focus on four aspects:

ETF issuance pace: For crypto spot ETFs that meet the general rules, the S-1 will often update the prospectus multiple times before final approval, supplementing details such as fees and initial issuance scale. These updates often indicate that the product is entering the "countdown" to listing.

Macro environment: The Federal Reserve's interest rate path, dot plot expectations, and the dollar index trend will determine the direction of risk preference switches, which are core clues for asset pricing.

Figure 4: Federal Reserve interest rate path expectations (Data Source: SoSoValue)

Cross-asset allocation: During a weak dollar cycle, gold, commodities, and crypto assets often complement each other. By diversifying exposure, investors can reduce risks while capturing multiple yield curves.

Capital flows: Compared to price fluctuations, the daily net inflow of ETFs can better reflect market sentiment and trends, often possessing stronger foresight, helping investors seize opportunities before market reversals.

Figure 5: Daily net inflow of Bitcoin spot ETF (Data Source: SoSoValue)

Figure 6: Daily net inflow of Ethereum spot ETF (Data Source: SoSoValue)

In summary, the new regulations combined with the interest rate cut cycle are opening a "dual gateway" of institutions and liquidity for crypto ETFs. For investors, this is both a new opportunity window and a deep reshaping of asset allocation logic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。