What happened in the Crypto market today? Know recent market highlight

Today’s crypto market sentiment has slipped into the fear zone with a score of 45 dropping from yesterday’s neutral 49. Just a week ago, the index was at 53, showing neutral sentiment and last month it was 60, reflecting greed.

Source: Alternativeme

This steady decline signals growing caution among investors, likely due to recent market volatility and uncertainty. Traders seem hesitant to take risks, and the shift from greed to fear suggests more cautious moves in the days ahead.

Top Crypto news highlights of Today!

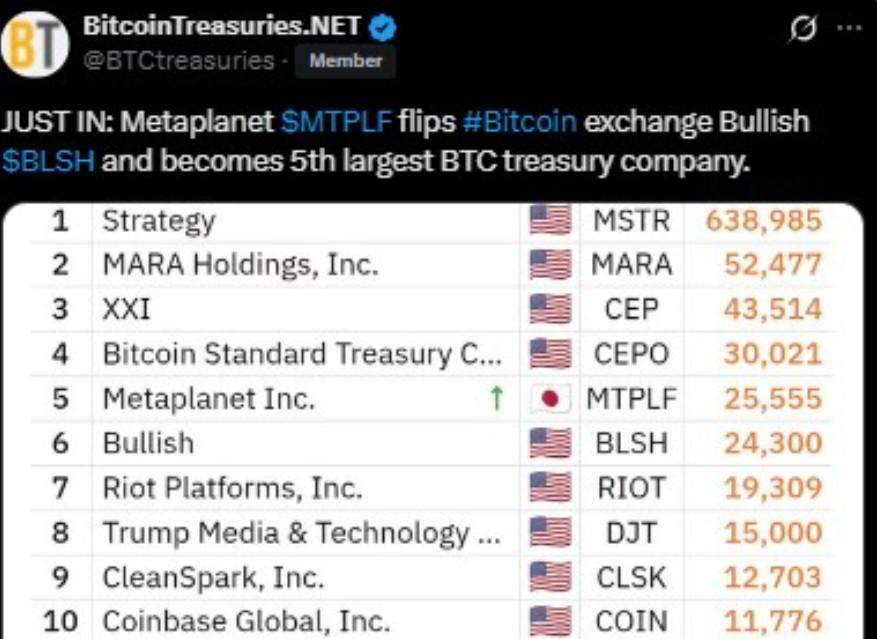

Metaplanet Hits 25,555 BTC, Challenges Top Holders

Metaplanet has made a bold move by buying 5,419 BTC worth $632 million at an average price of $116,724 per coin. This brings its total Bitcoin holdings to 25,555 BTC now valued near $3 billion, even with Bitcoin-dipping to $112,456.

Source: X

The company’s average cost is $106,065 giving it an unrealized profit of nearly $290 million. With this, Metaplanet has passed Bullish to become the fifth-largest corporate holder, signaling its rise as a serious challenger to giants like MicroStrategy.

UK Speeds Up Crypto Approvals as BlackRock Takes Lead

The UK’s Financial Conduct Authority (FCA) has sped up crypto application approvals , cutting review time from 17 months to just over five months. Since April, five companies, including BlackRock and Standard Chartered, have been approved.

The approval rate has climbed to 45%, up from less than 15% over the last five years. Still, the number of applications has dropped from 46 in 2022–23 to 26 in 2024–25. The FCA plans a full digital asset framework by 2026.

0G Token Hits $2B Valuation Amid Rug-Pull Concerns

The 0G token, worth more than $2 billion less than a year after its release, is making waves of hype and panic. Some are looking at it as a huge leap for decentralized AI, while others are worried about a rug-pull.

KuCoin listed 0G/USDT on September 22, and Binance also has it supported via a HODLer airdrop and complete spot trading shortly.

Early trading pushed prices from $2.49 to $3.20 (a 28.5% jump), with predictions of $3.50–$5 if demand rises. Still, doubts remain if the token can sustain its bold claims.

Peter Schiff Says Gold and Silver Could Outshine Bitcoin in 2025

Economist Peter Schiff predicts gold and silver may beat Bitcoin this year . Silver jumped to $43.87, up 37.5% year-to-date, while gold climbed 31%, now priced at $3,701.

Schiff pointed out silver’s strong rally, noting it still trades below its 2011 peak of $50. Meanwhile, Bitcoin dropped 2.5% to $112,985, raising doubts about its safe-haven status.

Source: X

With gold and silver gaining after the Fed’s rate cut, Schiff believes precious metals could continue to rise while Bitcoin faces more pressure.

Arthur Hayes Warns DAT Models Could Spark FTX-Like Collapse

BitMEX co-founder Arthur Hayes has warned that digital asset treasuries (DATs) could trigger an “FTX-like collapse” if prices fall.

He says only a few winners will dominate, like MicroStrategy in Bitcoin, while weaker players risk failure. Still, Hayes remains bullish on BTC expecting the Fed’s rate cuts and money printing to push investors toward hard assets like gold and Bitcoin.

Source: X

He also believes stablecoins will fuel DeFi growth, while Bitcoin will act as a strong hedge against fiat devaluation.

Conclusion

Market sentiment fell into the fear zone at 45, reflecting investor caution amid volatility. Metaplanet boosted BTC holdings to 25,555, the UK speeds crypto approvals led by BlackRock, 0G token surged to $2B, while Schiff favors gold and silver. Arthur Hayes warns of potential DAT-driven collapses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。