From Elections to Everything Being Pledged, Prediction Markets Are Set to Explode.

Author: Dylan Bane

Translation: Deep Tide TechFlow

The application of prediction markets has transcended the realm of elections, demonstrating market fit (PMF).

Betting volumes are surging, with investors flocking in, and new methods such as information perpetual contracts and Telegram bots are entering the market.

So, which methods can truly work and maximize the growth of trading volume?

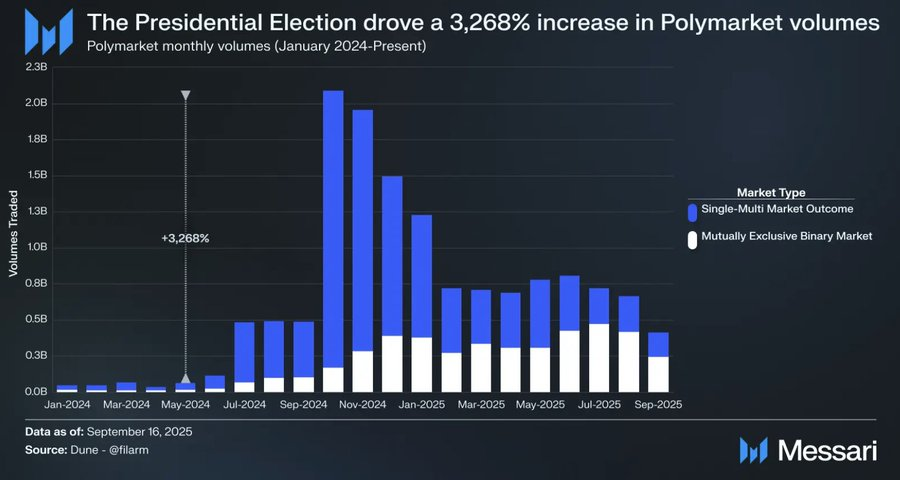

The 2024 elections have caused Polymarket's trading volume to skyrocket from $62 million in May to $2.1 billion in October, a growth of 3268%.

Mainstream media outlets like CNN and Bloomberg have cited Polymarket's odds live, presenting them alongside traditional polling data.

In fact, prediction markets ultimately outperformed polls in predicting election outcomes.

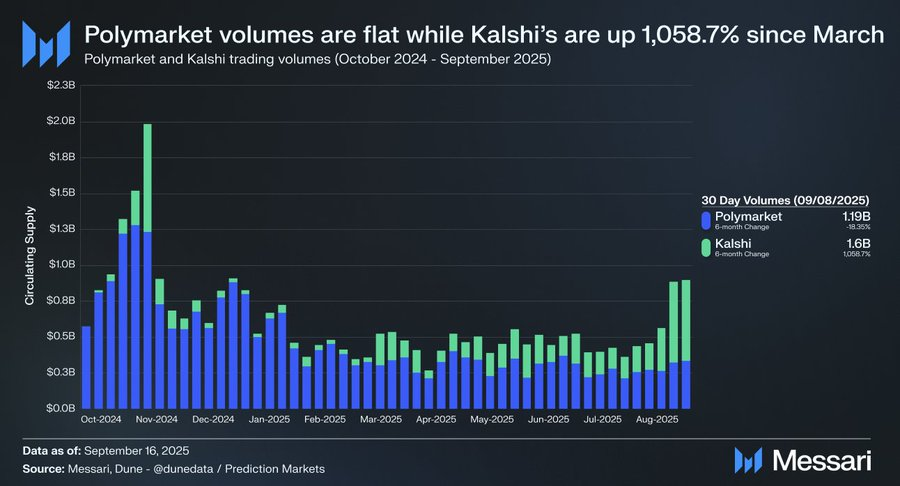

After the elections, while trading volume in prediction markets saw a decline, it remained stable at over $1 billion per month.

Combined with Kalshi's recent surge in trading volume, investors believe that prediction markets have validated demand and are poised for further growth.

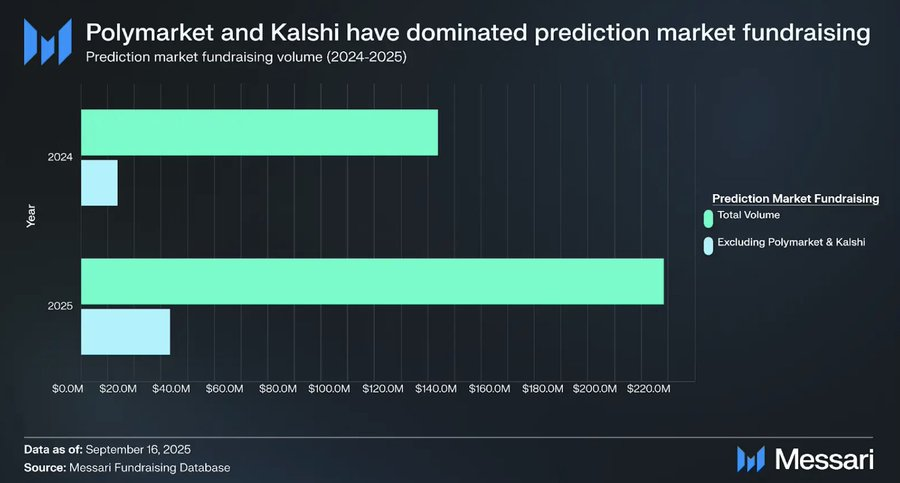

About 90% of the funds are concentrated on the Polymarket and Kalshi platforms, with valuations nearing ten digits (i.e., billions of dollars).

These industry leaders have established liquidity and are now focused on expanding trading volume and enhancing market resilience, as large exchanges like Hyperliquid and Coinbase are paying attention to this space.

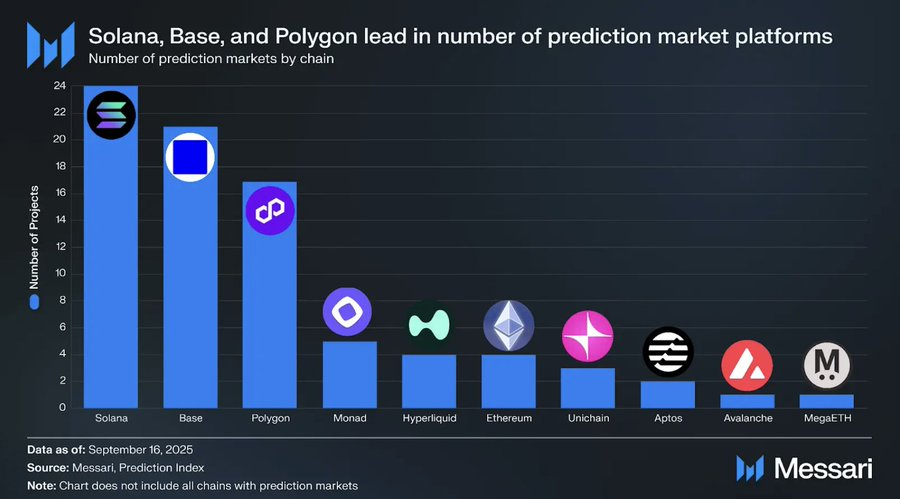

However, there are over 100 prediction market projects, and the number continues to grow, presenting a wealth of opportunities.

The question is, how should investors seek the best opportunities in this increasingly complex and noisy field?

We believe that the best way to address liquidity issues and increase trading volume is to attract retail speculators.

Prediction markets can appeal to this segment by focusing on accessibility, fun, user experience, and high potential financial returns.

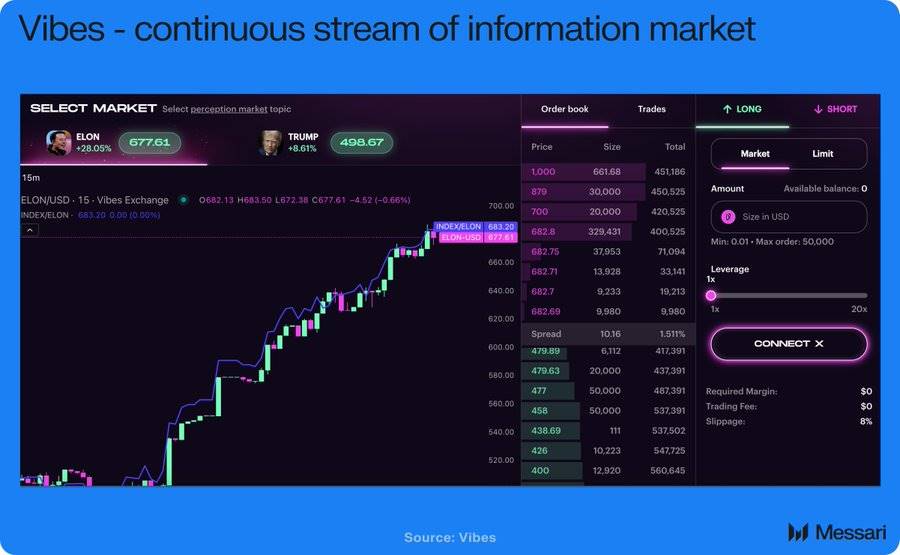

The Continuous Flow of Information Perpetual Contracts

Due to the constant fluctuations of perpetual contracts, they overcome the issues that hinder speculators in binary outcome markets due to slow settlement speeds.

Such perpetual contracts can also track interesting and easily understandable topics that currently lack existing markets.

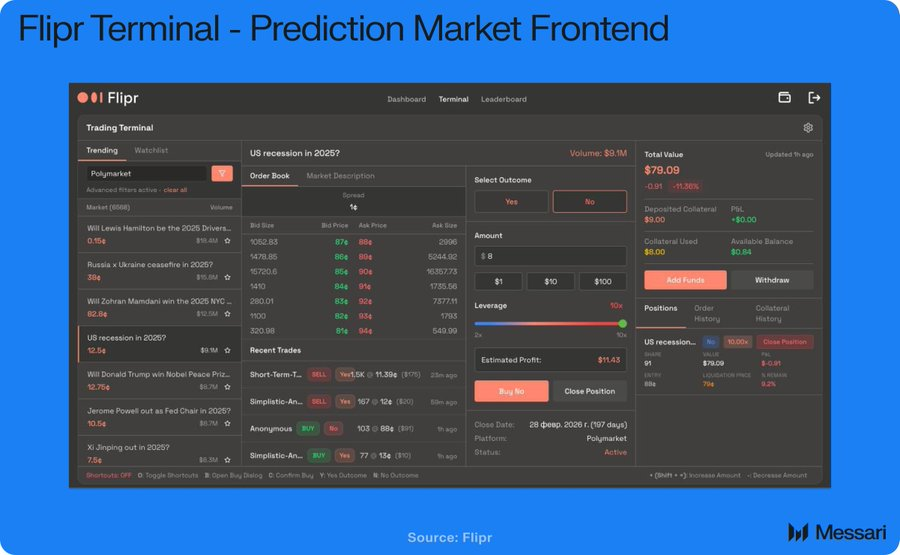

Frontend Platforms

Instead of building native liquidity, startups can source supply from existing industry leaders and provide users with a higher quality trading experience.

For example, Flipr offers a trading terminal, trading bots on the X platform, and utilizes existing liquidity to achieve up to 10x leverage.

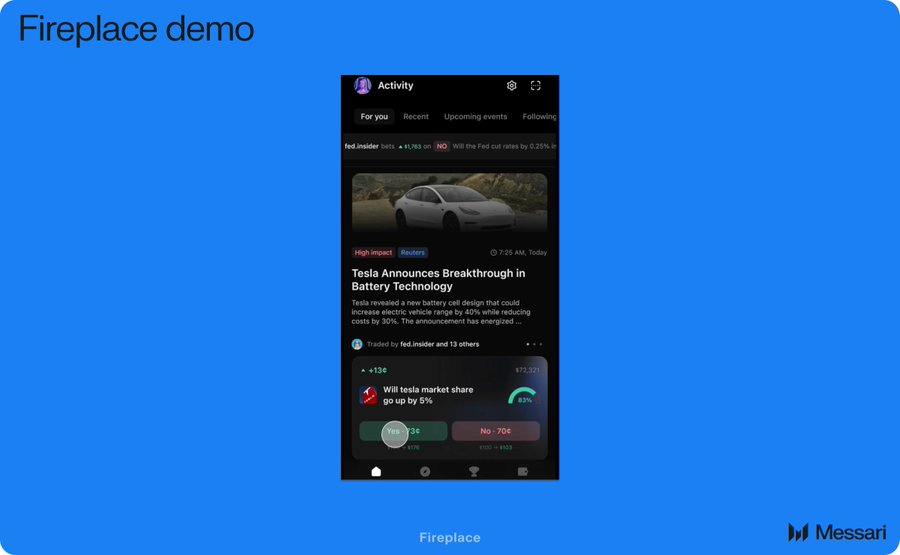

Social Applications

Gamified applications or social experiences can make predictions more engaging.

Just as sports betting is essentially a social experience, prediction markets can cultivate similar interactive experiences.

In the early stages of prediction market adoption, the design space is vast.

Basket trading, managed indices, celebrity copy trading, parlays, and more innovative forms are worth exploring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。