This report is written by Tiger Research and analyzes how Pendle transforms volatile funding rates into stable, predictable returns for institutional investors through Boros, thereby changing the DeFi derivatives space.

Key Takeaways

- Core Problem Addressed: Institutions need stable returns, but funding rates are highly volatile - Boros converts volatility into fixed returns.

- Market Opportunity: First-mover advantage in the DeFi derivatives space, becoming essential infrastructure for Delta-neutral strategies like Ethena.

- Expansion Vision: Extending from crypto asset funding rates to traditional finance (bonds, stocks), leading the on-chain derivatives market.

1. Untapped Areas Behind DeFi Success

Although the crypto market has spawned many narratives, decentralized finance (DeFi) and derivatives trading have shown the strongest product-market fit.

The initial growth of DeFi came from lending protocols like Aave and Compound, decentralized exchanges like Uniswap, and yield farming mechanisms. These recreated core financial primitives in a permissionless environment, opening access to services previously limited to institutions.

As these markets mature, DeFi is beginning to expand into the derivatives space, following a trajectory similar to traditional finance. In traditional markets, the scale and liquidity of derivatives far exceed spot trading. A similar shift is occurring in the crypto space, where permissionless derivatives are becoming the next growth driver.

2. Pendle: Financial Engineering in DeFi

Source: Pendle

Source: Pendle

Pendle recognized this opportunity early and launched in 2021, positioning itself as a leading project introducing structured derivatives to DeFi.

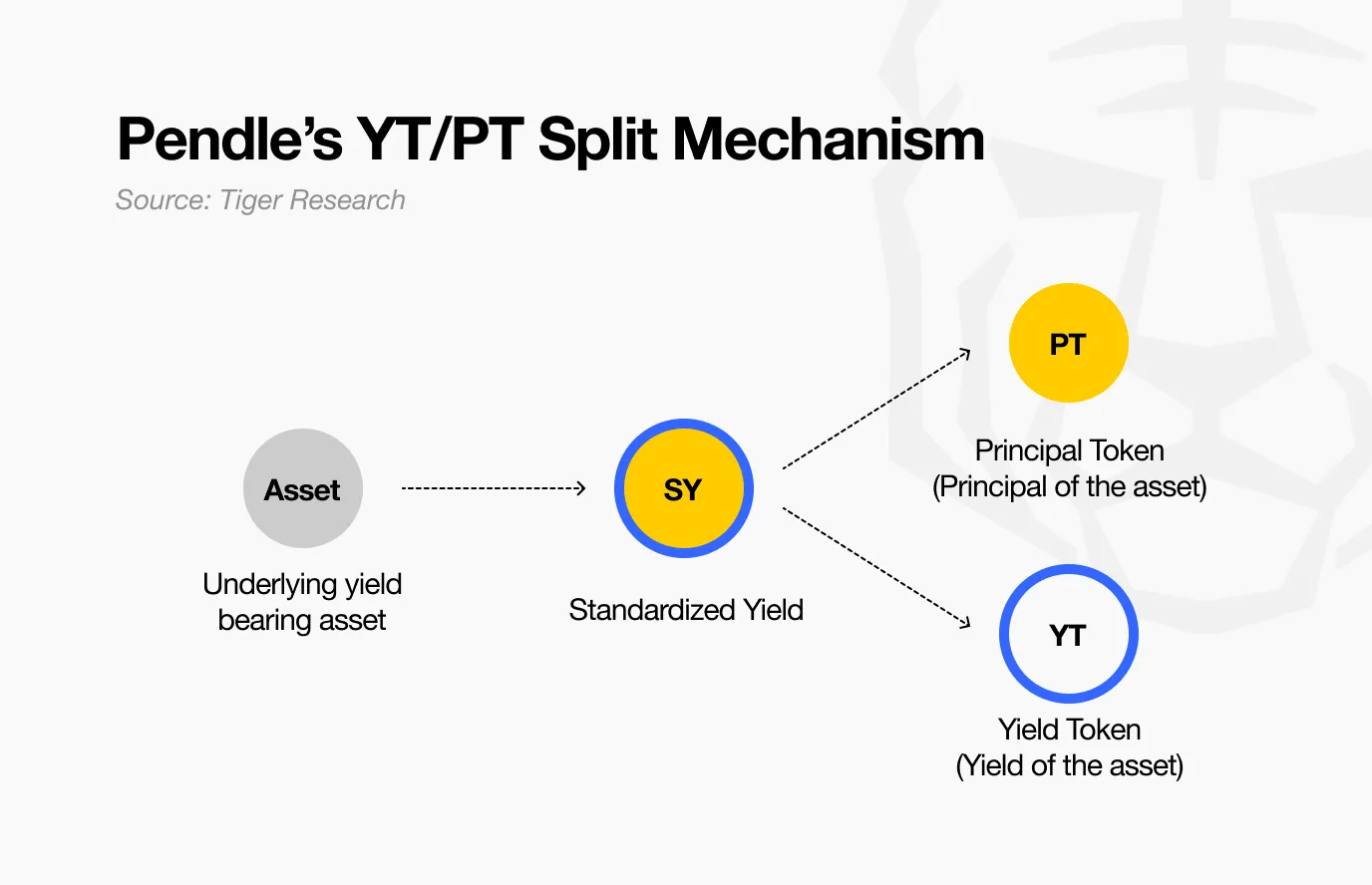

Its entry point is the separation of the principal and yield of yield-bearing tokens. The timing was very effective: yield staking is becoming mainstream, and by 2023, the narratives around staking and future airdrops have become increasingly prominent, attracting more attention to Pendle. Today, many new projects integrate Pendle as a foundational layer for yield-related strategies.

Its core mechanism appears simple but effectively creates two distinct asset classes: a discounted claim on future value (PT) and pure exposure to interest rate volatility (YT).

The impact is significant. With Pendle, yield-bearing assets like stETH or rETH are no longer limited to being staking substitutes; they can now serve as building blocks for more complex strategies.

Investors looking to capitalize on rising yields can purchase YT, gaining leveraged risk exposure that may exceed six times based on market conditions. Conversely, investors seeking fixed returns can buy PT, often locking in double-digit discounts relative to future value.

More importantly, Pendle's design enhances capital efficiency across DeFi. Strategies that once required complex hedging or derivatives expertise are now simplified through its yield-splitting mechanism. Investors can now access, trade, and customize yield risk exposure on-chain.

In doing so, Pendle not only introduces a new yield concept but also lays the groundwork for financial engineering in DeFi, providing institutional-grade tools to users in a permissionless manner.

3. Boros: Empowering Delta-Neutral Yields

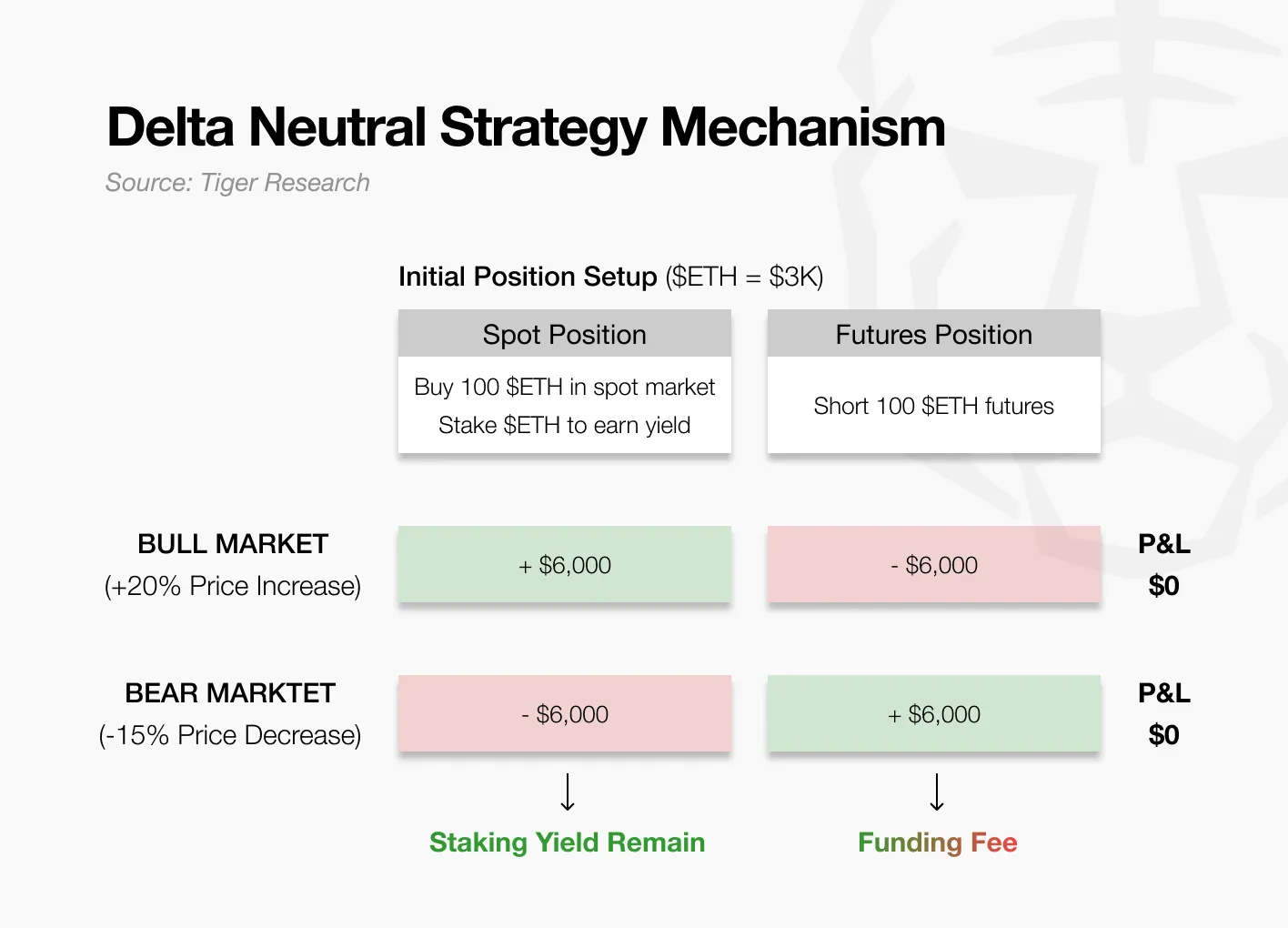

As the crypto market expands, institutions are deploying larger capital bases and adopting more complex trading strategies to generate returns. Their primary focus is on stable returns, often achieved through Delta-neutral positions to minimize price risk.

Ethena exemplifies this, holding spot ETH while shorting an equivalent amount in the futures market. The gains on one side offset the losses on the other, keeping the portfolio value stable regardless of price direction (see diagram).

In a bull market, longs pay funding rates to shorts, allowing Ethena to generate income. In a bear market, the situation reverses, and Ethena must pay funding fees.

The challenge is that funding flows are inherently unstable—sometimes generating income, other times requiring payment. This volatility undermines protocols like Ethena that rely on Delta-neutral strategies to support their stablecoin USDe.

Source: Pendle

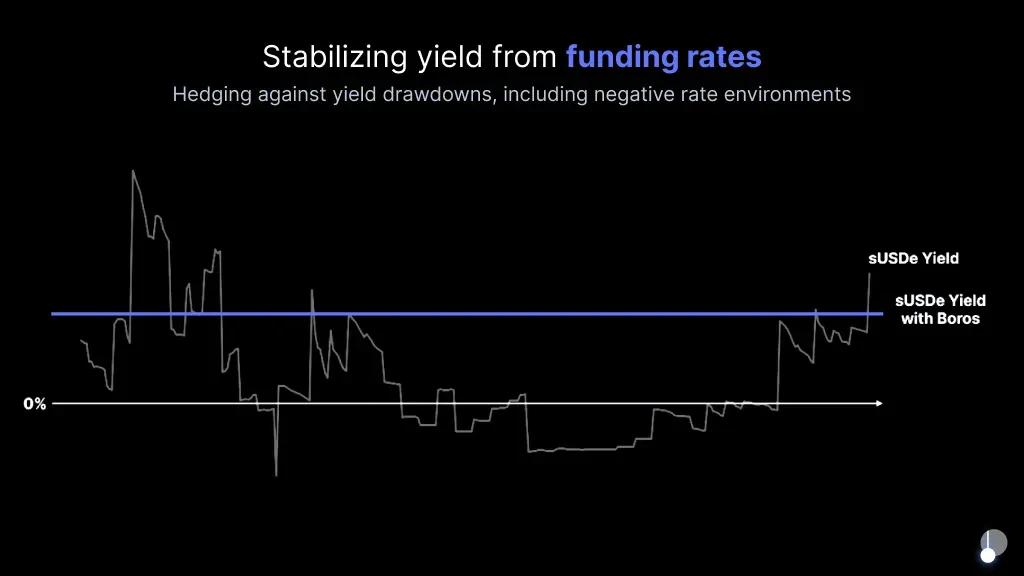

Boros addresses this gap by converting unstable funding flows into fixed, predictable returns. In doing so, it provides institutions with the stability needed to expand capital deployment in the crypto market.

4. Boros Mechanism: Stabilizing Funding Rates

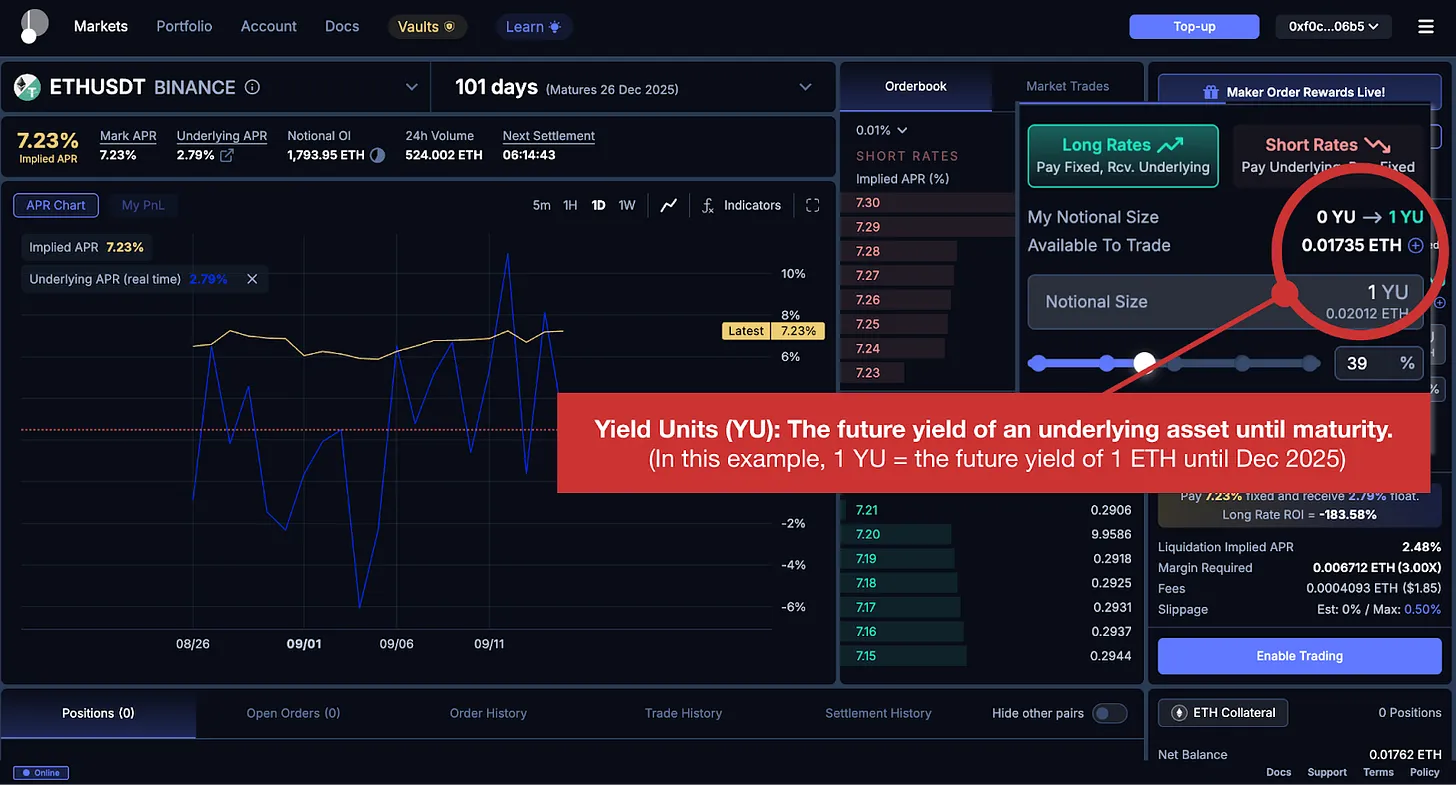

Boros introduces Yield Units (YU), a derivative that separates funding rate volatility from the underlying asset price. YU allows for two things: directional betting on funding rates and converting unstable funding flows into predictable income streams. The following sections explain its mechanism.

4.1. Yield Units (YU): Structure and Purpose

Suppose an investor seeks a fixed annual return of 8% over three months, regardless of whether the Bitcoin funding rate fluctuates positively or negatively. Conversely, another investor may prefer direct exposure to funding rate volatility, willing to pay a fixed yield in exchange.

YU connects these two parties by separating and trading only the volatility of funding rates (independent of underlying asset price movements).

Source: Boros, Tiger Research

For example, the product “1 YU-ETHUSDT-Binance” represents the funding rate return of a nominal position of one ETH in Binance's perpetual futures contract before the expiration date. Purchasing this product allows investors to profit or lose based on changes in the funding rate associated with that position, without holding ETH itself. In this way, YU transforms the funding rate of a specific exchange-asset pair into an independent, tradable tool.

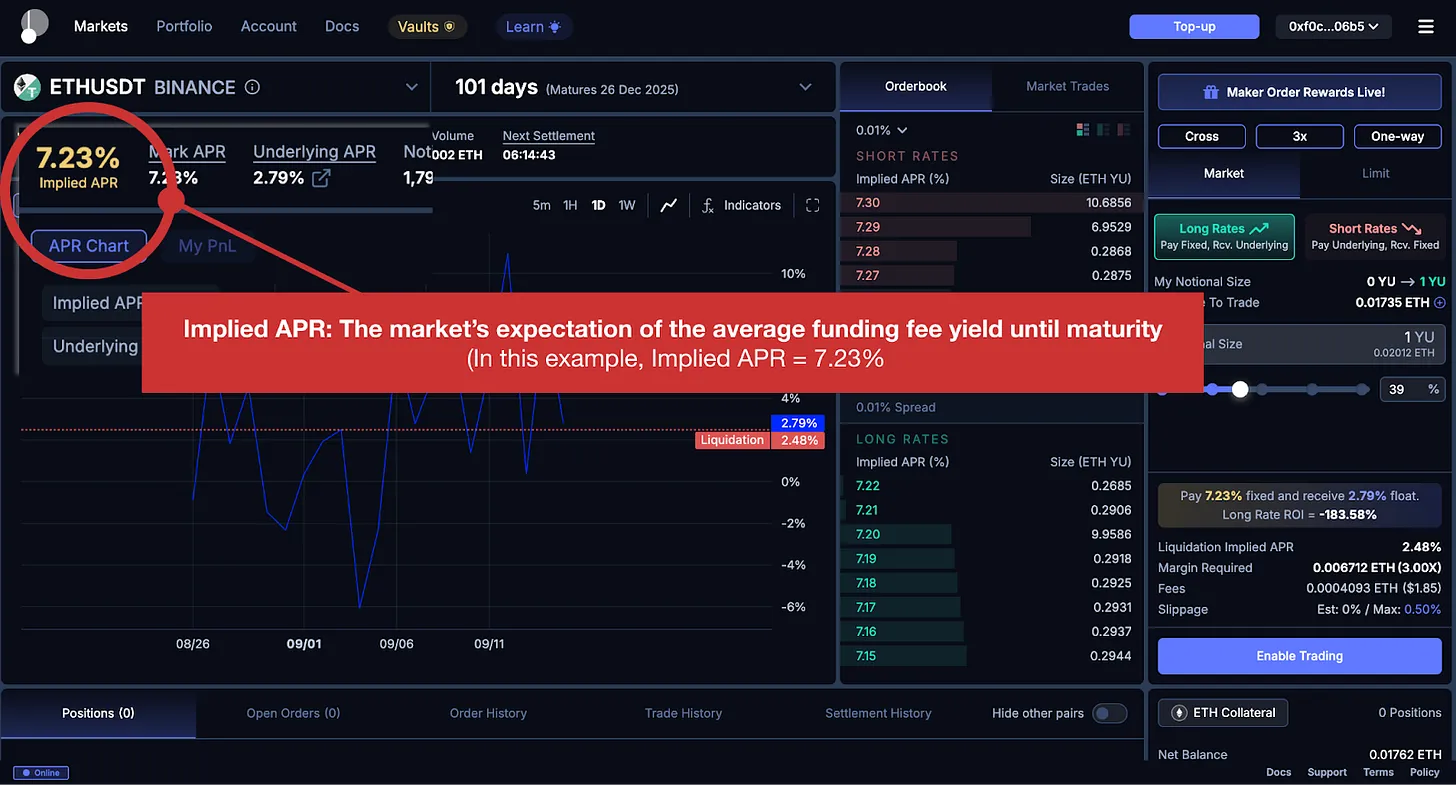

4.2. Implied Annual Percentage Rate (Implied APR): Market Expectations as Price Signals

Source: Boros, Tiger Research

Source: Boros, Tiger Research

A core concept of YU trading is the Implied Annual Percentage Rate (Implied APR). This represents the market's expectation of the average funding rate return until expiration, reflected in the current price of YU.

Just as the $80,000 Bitcoin price reflects the market's valuation of that asset, a YU-BTCUSDT Implied APR of 8% indicates that participants expect the Bitcoin funding rate to average 8% annually over the relevant period.

In short, the function of the Implied APR is similar to the market price in the futures market: it reflects the current consensus view of the market.

4.3. Long/Short Positions: Trading Implied vs. Actual Yield

YU positions are similar to futures trading, with longs and shorts having different motivations.

- Bitcoin Futures Long: Marked Price $50,000 → Target Price $60,000 = $10,000 Profit

- YU Long: Implied APR 8% → Actual APR 10% = 2% Profit (Long pays Implied APR and receives Actual APR)

A YU long position reflects the belief: “The actual funding rate will be higher than the current market expectation of 8%, say 10%.” In this case, the long pays the implied APR (8%) and receives the actual APR (10%). This is akin to saying, “Bitcoin futures are currently $50,000, but I expect it to rise to $60,000,” and going long.

- Bitcoin Futures Short: Marked Price $50,000 → Target Price $40,000 = $10,000 Profit

- YU Short: Implied APR 20% → Actual APR 15% = 5% Profit (Short receives Implied APR and pays Actual APR)

A YU short position reflects the belief: “The actual funding rate will be lower than the current market expectation of 20%, say 15%.” Here, the short receives the implied APR (20%) and pays the actual APR (15%). This is similar to saying, “Bitcoin futures are currently $50,000, but I expect it to drop to $40,000,” and going short.

In summary, Bitcoin futures represent a bet on “current price vs. future price,” while YU represents a bet on “current market expectation (Implied APR) vs. actual funding outcomes (Actual APR).” Since funding rates reset every eight hours, returns depend on whether each actual realized rate is above or below the prevailing market expectation.

5. Application of Boros in Delta-Neutral Strategies

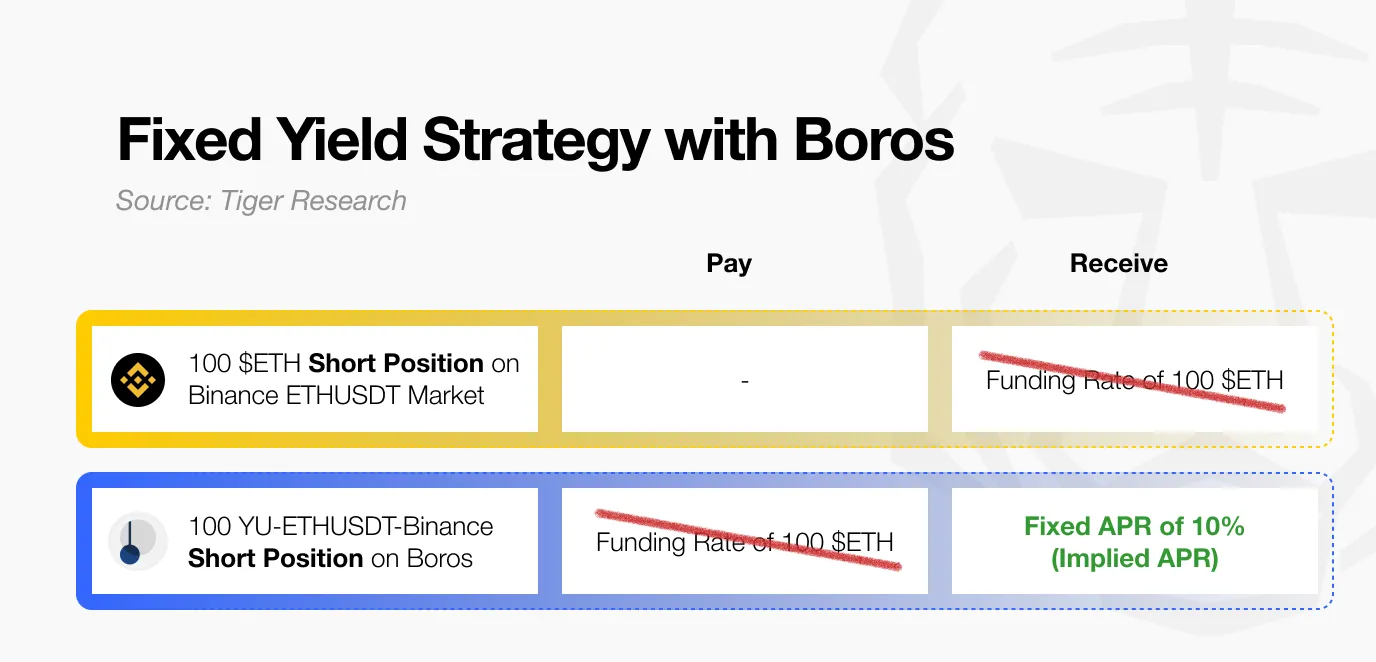

What practical use does YU have for institutions? To illustrate this, consider how Boros addresses the funding rate volatility challenges faced by Ethena.

Assuming Ethena operates a Delta-neutral strategy containing 100 ETH. It holds 100 ETH in the spot market while shorting 100 ETH in the futures market. The core issue of this setup is the volatility of funding rates: in a bull market, the short position receives funding fees, but in a bear market, it must continuously pay funding fees.

To stabilize this risk exposure, Ethena additionally establishes a short position of “100 YU-ETHUSDT-Binance” with an implied annual return of 10%. This means it receives a fixed 10% return equivalent to the nominal value of 100 ETH while paying the actual funding fees incurred.

As shown in the table, the variable funding income from futures is offset by the variable funding payments in Boros. In practice, even when receiving positive funding fees, an equivalent funding fee payment is made through the Boros contract, resulting in a net effect fixed at zero. What remains is the fixed 10% return provided by Boros. Combined with staking yields (4%), Ethena achieves a predictable total return of 14%.

However, this approach requires trade-offs. Institutions must allocate additional margin to maintain these positions, and severe price fluctuations may pose liquidation risks. Therefore, investors like Ethena need to apply YU within a sound risk management framework.

6. Pendle's Next Target: Traditional Finance

While the Ethena case demonstrates how YU can be applied to a single Delta-neutral strategy, the potential of Boros extends far beyond that.

The scope of Boros goes well beyond funding rates. Currently, it operates on Arbitrum and supports perpetual markets for BTC and ETH from Binance, as well as the ETH market from Hyperliquid. However, institutions do not limit Delta-neutral strategies to a single exchange. To manage risks and capture arbitrage opportunities, they diversify across assets and venues. Therefore, expansion is crucial.

Boros plans to increase support for assets like Solana and BNB and integrate exchanges including Bybit. This will broaden the channels for investors to access the funding rate market. However, Pendle's ambitions go even further.

These strategies are unlikely to be limited to institutions. As Boros matures and diversifies, we expect mature individual investors to also participate. Even for those who do not directly adopt such strategies, funding rates will undoubtedly become a widely monitored market sentiment and position indicator, shaping the trading environment for both institutional and retail participants.

The larger vision is to bridge traditional finance. Pendle has already outlined plans to incorporate benchmarks and tools such as LIBOR, mortgage rates, bonds, and stocks. Unlike the familiar path of “traditional finance absorbing crypto assets,” Pendle takes the opposite approach, applying crypto technology architecture to reconstruct traditional tools on-chain.

Overall, Pendle's expansion can be viewed optimistically. The growing participation of institutions and their demand for more advanced strategies may further enhance its role in the market. More importantly, Pendle is not merely following the transformation of traditional finance; it shows the potential to become a leader in shaping the future of global markets—this vision deserves recognition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。