Author: Felix, PANews

"From $0.1 to $1000, we have come a long way, but this is just the beginning." Binance founder CZ wrote on social media. Following CZ's quiet change of his X account bio from "ex-@binance" back to "@binance," the community erupted, with some shouting "CZ is back," while others were excited about BNB's impressive performance.

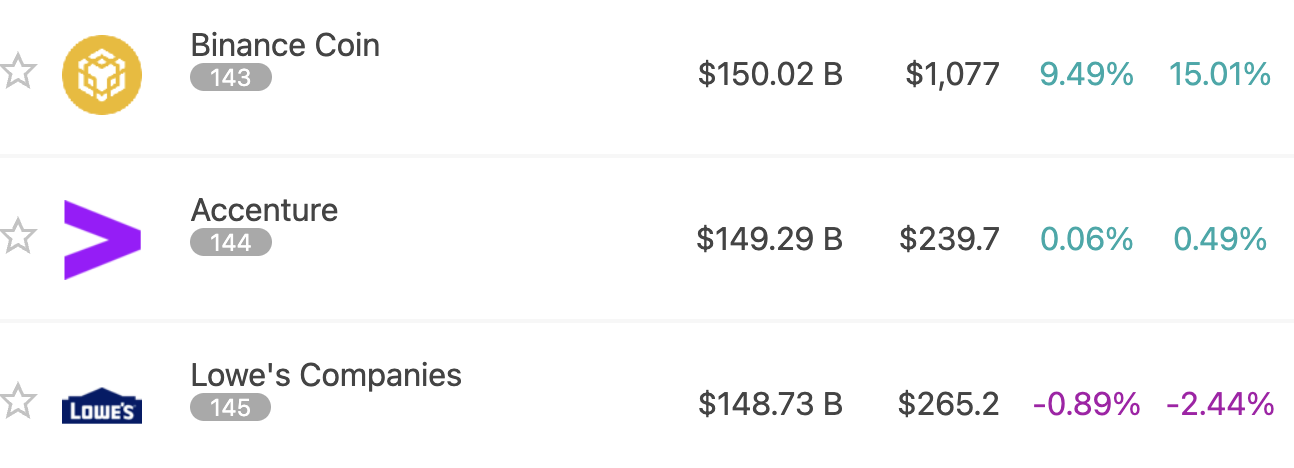

Last Thursday (September 18), BNB strongly broke through $1000, setting a new historical high; over the weekend, it continued to rise, reaching a peak of $1076.3, with its market cap briefly surpassing $150 billion, overtaking traditional industry giants like Accenture and BYD, and climbing to 143rd place in the global asset rankings. Behind this surge is not only a burst of market sentiment but also a value reshaping driven by alleviated regulatory pressure, the entry of traditional institutions, ecosystem expansion, and its own deflationary mechanism.

Source: 8marketcap

BNB's ability to "leap ahead" in this cycle is not due to a single factor but rather the result of multiple favorable factors resonating together.

Significant Improvement in Regulatory Environment, Could CZ "Return" to Binance?

After President Trump took office, his administration adopted a more crypto-friendly policy, shifting the overall regulatory atmosphere to a positive one, providing a more favorable external environment for the development of Binance and many cryptocurrencies like BNB. Globally, Binance has now obtained regulatory licenses in 21 countries or regions and is actively cooperating with regulatory agencies worldwide.

In this macro "tailwind," the U.S. has further relaxed regulatory requirements on Binance, alleviating long-standing uncertainties in the market. According to Bloomberg, insiders revealed that Binance is negotiating with the U.S. Department of Justice regarding a potential agreement that could end the compliance monitoring period that began in 2023 ahead of schedule. This development has greatly enhanced market confidence in Binance's future growth.

Shortly after this news broke, Binance founder CZ updated his social media bio to re-associate with the official Binance account, changing his X account bio from "ex-@binance" to "@binance." This move sparked speculation in the market about his possible return to Binance in a new capacity. Although there has been no official statement, this action has been interpreted by the market as a positive signal, boosting investor sentiment and becoming one of the catalysts for BNB's rise.

In response, CZ tweeted this morning, "The new U.S. government supporting cryptocurrencies may be the biggest driving force behind BNB breaking $1000. Its stance not only affects the U.S. but also most countries in the world. Now, most countries have adopted a supportive stance towards cryptocurrencies. This is a huge boost for the industry."

It is worth noting that the support behind BNB's recent rise is not only a repair of market sentiment but also a series of solid fundamental factors that provide more lasting confidence for its price performance.

Expanding Financial Landscape, Backed by Traditional Institutions

On September 10, Binance announced a strategic partnership with Franklin Templeton, aiming to jointly develop digital asset-related products to promote the deep integration of traditional finance and blockchain technology.

According to the statement, the core of this collaboration is to combine Franklin Templeton's expertise in compliant security tokenization with Binance's global trading network and user base.

As the world's largest cryptocurrency exchange serving over 280 million users, Binance has unparalleled trading infrastructure and a global investor network. Franklin Templeton, managing over $16 trillion in assets, has been actively positioning itself in the blockchain space in recent years, diversifying its approach by tokenizing traditional financial products, providing regulated digital asset investment tools (such as ETFs), and exploring blockchain applications in financial infrastructure.

The collaboration between Binance and Franklin Templeton is seen as not just a product complement but also an acceleration of the integration of new finance and old finance, with one side providing speed and market reach, while the other brings compliance and institutional endorsement. Both parties are committed to enhancing the efficiency, transparency, and accessibility of capital markets, as well as competitive returns and settlement efficiency, to meet the evolving needs of investors.

It is noteworthy that Binance's recent series of actions also signals expansion; it recently announced a new partnership with South African payment service provider Zapper, starting September 9, over 31,000 merchants in South Africa will begin accepting Binance payments, expanding Binance's global merchant network to over 63,000. Whether partnering with Wall Street institutions or establishing payment solutions in the African market, Binance is embedding its business more into broader mainstream financial and consumer scenarios.

DAT Leads BNB Accumulation Trend, Supporting Strong Companies

Since the beginning of this year, the strategy of cryptocurrency treasury represented by publicly listed companies has become an important driving force behind the rise of cryptocurrencies. Under the influence of this strategy, tokens like BTC, ETH, and SOL have gradually been included in the balance sheets of many companies, including BNB. Several publicly listed companies, investment institutions, and even sovereign nations have incorporated BNB into their strategic reserves, forming another force driving BNB's rise.

At the level of sovereign economies, the newly established special administrative region of Gelephu Mindfulness City (GMC) in Bhutan has included BNB in its strategic reserves. In January of this year, this economic zone announced that it would include BTC, ETH, and BNB in its official strategic reserve asset list. The rationale is that BNB has a high market value, good liquidity, and its underlying BNB Chain is a mature and secure network that has been tested over time. Although this is an action of an economic zone and not the main action of the entire Kingdom of Bhutan, it has greatly boosted market confidence in BNB. Additionally, there are reports that Binance founder CZ has proposed to the Kyrgyz government to consider BNB in its planned national-level cryptocurrency reserves, but there has been no public progress on this matter.

In contrast, publicly listed companies are the main force in purchasing BNB. Currently, several U.S. publicly listed companies have announced that they will use BNB as a strategic reserve asset, with some even making it a core business direction. For example:

BNB Network Company (BNC, formerly CEA Industries): Currently the "number one fan" of BNB, supported by YZi Labs, it has completed a $500 million private placement, aiming to become the world's largest publicly listed company with BNB reserves. The company has thus directly renamed itself to BNB Network Company, with the stock code changed to "BNC." As of September 10, BNC holds a total of 418,888 BNB.

Web3 infrastructure company Nano Labs (NA): This company plans to invest $1 billion in purchasing BNB over three years, aiming to hold 5%-10% of the total circulating supply of BNB. According to the company's financial report for the first half of the year, it holds a total of 128,000 BNB.

Biopharmaceutical company Windtree Therapeutics (WINT): This company announced that it has signed a common stock purchase agreement of up to $500 million to establish an equity line of credit ("ELOC") and strengthen its BNB cryptocurrency funding strategy. The company also signed an additional stock purchase agreement worth $20 million with Build and Build Corp. 99% of the funds raised by ELOC and Build and Build Corp will be used to acquire BNB.

Biopharmaceutical company Liminatus Pharma (LIMN): This company plans to establish a wholly-owned subsidiary named "American BNB Strategy," aiming to raise $500 million through this entity for long-term strategic investment in BNB.

Huaxing Capital: This company signed a strategic memorandum of cooperation with YZi Labs, planning to invest approximately $100 million for the special allocation of BNB assets and to promote the listing of BNB on licensed virtual asset exchanges in Hong Kong, becoming the first Hong Kong-listed company to include BNB in its digital asset allocation.

Additionally, some investment institutions have launched funds or investment tools focused on BNB:

B Strategy: A digital asset investment company, plans to raise $1 billion to establish a BNB reserve company listed in the U.S. This plan has received strategic support from YZi Labs, which will not only hold BNB but also invest in and support the development of the BNB ecosystem.

Hash Global BNB Yield Fund: Hash Global launched a compliant BNB yield fund, which plans to expand its management scale to $3 billion within three years.

Regarding the BNB treasury company (DAT), CZ stated in a video conversation that he has contacted about 50 potential teams but cannot support all BNB DAT companies, only a few strong companies will receive support.

Apart from BNB DAT, the BNB ETF also provides potential support for BNB's rise to some extent. Currently, two institutions have submitted applications for a BNB ETF to the U.S. SEC, namely VanEck and a joint application from REX Shares and Osprey Funds. These applications aim to provide investors with a channel to invest in BNB through traditional securities exchanges and may include staking yield features.

If approved, the BNB ETF will offer traditional investors a regulated and familiar investment channel, likely bringing new capital inflows to BNB and enhancing its market recognition and liquidity.

Technical Upgrades and Deflationary Mechanism

The value support for BNB comes not only from the increased holdings by external institutions and companies but also from the technological advancements and economic model optimizations within its own ecosystem.

As the native token of BNB Chain, BNB's ability to reach new highs is closely tied to the excellent performance of BNB Chain. On June 30, BNB Chain completed the Maxwell hard fork upgrade, significantly enhancing network performance by increasing block speed and validator collaboration capabilities. After the upgrade, the block time on BNB Chain was reduced to 0.75 seconds, and the final transaction confirmation time was accelerated to 1.875 seconds, greatly improving user experience. The gas fees on BNB Chain were also reduced by ten times, making it one of the lowest-cost blockchains.

Additionally, unlike the common sandwich attacks and front-running seen on EVM chains like Ethereum, as well as large-scale arbitrage and spam attacks faced by blockchains like Solana, BNB Chain has excelled in resisting MEV (Miner Extractable Value) attacks. Developers, nodes, block builders, wallets, DEXs, and other participants on BNB Chain have invested significant effort to mitigate MEV attacks.

In terms of products, WLF issued the first native stablecoin USD1 on BNB Chain, further enhancing the liquidity of on-chain stablecoins; several RWA issuers have deployed on BNB Chain, enriching the assets on BNB Chain and increasing its visibility in traditional sectors.

BNB's deflationary mechanism continues to support its price increase. Binance's ongoing token burn program has gradually reduced the circulating supply of BNB, benefiting long-term holders. On July 10, the BNB Foundation completed its 32nd quarterly burn, destroying a total of 1,595,599.78 BNB. After this burn, the total supply of BNB remains at 139,289,513.94. The dual support of deflation and network upgrades provides a solid foundation for BNB's price.

With so many favorable factors, OSL HK also opened BNB trading services to professional investors on September 3, becoming the first exchange in Hong Kong to support BNB.

Conclusion

In summary, the recent price increase of BNB is not coincidental. The combination of factors such as alleviated regulatory pressure, deepened cooperation with traditional institutions, increased institutional investment, and its own deflationary mechanism has provided multiple supports for its value. The breakthrough of BNB's price above $1000 is more like a market affirmation of BNB's fundamentals and ecological potential, perhaps far from reaching its true limits.

However, the cryptocurrency market is volatile, and investors should remain cautious in the short term. In the long run, BNB's performance is closely tied to Binance's operational status, and there remains uncertainty regarding future regulatory directions. Additionally, both BNB Chain and CEX operations face fierce competition from other public chains and exchanges (CEX and DEX) in the future.

As CZ recently stated, "This is just the beginning." Therefore, although BNB is currently the "star" of the cryptocurrency market, PANews advises users to view the market rationally, avoid chasing highs and falling into FOMO, and focus on long-term value and ecological development.

Related reading: BNB Amid Institutional Accumulation: What Opportunities Are Left for Retail Investors?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。