The massive scale of funds and user base has made TRON a "gold mine" in the crypto space, continuously attracting a large influx of capital and developers into its ecosystem, seeking wealth opportunities.

As the core battleground for global stablecoins, the TRON network handles a vast amount of capital flow daily: the on-chain circulation of USDT reaches as high as $82.7 billion, with the daily trading volume of stablecoins consistently stable at around $30 billion, and the on-chain user base has already surpassed 330 million.

Such a large scale of funds and user base has made TRON a "gold mine" in the crypto field, continuously attracting a large influx of capital and developers into its ecosystem, seeking wealth opportunities. Developers are eager to freely deploy cross-chain DApp applications between TRON and multi-chain ecosystems to leverage more capital flow and reach a broader user base; users hope to realize that crypto assets can freely traverse the multi-chain world, capturing Alpha opportunities in the TRON ecosystem in a timely manner.

As of September 18, the total value locked (TVL) of crypto assets on the TRON chain has reached approximately $28.4 billion. Among them, the cross-chain protocol JustCrypto under the one-stop DeFi solution JUST stands out, with locked high-quality crypto assets like BTC and ETH exceeding $4.5 billion, ranking in the top three for TVL in the TRON ecosystem applications, with the top two being the TRX staking application TRX Staking and the lending center JustLend DAO.

To lower the threshold for users' cross-chain interactions, TRON has been accelerating its cross-chain layout: in July this year, the meme coin TRUMP successfully deployed cross-chain to the TRON network; on August 26, the multi-chain cross-chain protocol deBridge was fully integrated into the TRON ecosystem; on September 8, the native stablecoin USDD of the TRON ecosystem was officially deployed to the Ethereum network and launched a high-yield reward activity of 12%; on September 16, TRON announced it would fully integrate NEAR's multi-chain trading protocol NEAR Intents, among others.

On-chain Capital "Gold Mine": What Alpha Opportunities Exist in the TRON Ecosystem?

The TRON ecosystem not only holds a leading advantage in asset scale and user volume but also, with the continuous emergence of wealth opportunities, has become a "highland of wealth" in the crypto field. Whether it is the endless stream of popular meme projects, the comprehensive DeFi infrastructure, or the multi-dimensional layout of the stablecoin ecosystem, TRON provides users with abundant Alpha opportunities.

In terms of on-chain financial infrastructure, TRON has built a complete DeFi application matrix from "asset trading" to "yield enhancement," fully adapting to different users' investment and trading needs.

At the asset exchange and trading level, the one-stop trading center Sun.io not only integrates DEX functionality SunSwap, supporting crypto asset exchanges and liquidity mining, but also features SunCurve (a low-slippage trading tool for stablecoins) and PSM (a stablecoin exchange tool), where PSM supports 1:1 zero-fee exchanges between USDD and USDT, significantly reducing trading costs.

In terms of asset yield enhancement, the lending center JustLend DAO offers multiple yield paths:

First, deposit coins for interest: Users can directly deposit TRX, SUN, BTT, ETH, BTC, and various stablecoins (USDT, USDD, USD1) to earn fixed returns;

Second, collateralized lending: Supports using TRX or stablecoins as collateral to flexibly borrow other digital assets, enhancing capital utilization efficiency;

Third, TRX on-chain staking returns and capturing excess returns: By using the staking product sTRX, users can stake TRX to obtain liquid staking certificates sTRX, further participating in DEX market making, lending, or minting stablecoins to achieve compounded returns. Additionally, users can use sTRX as collateral to mint USDD and leverage the "sTRX+USDD" mining combination to elevate overall returns to over 15%, capturing excess returns. In July this year, the listed company TRON has staked 365 million TRX through JustLend DAO.

In terms of the stablecoin ecosystem, TRON has built a diversified product matrix of "USDT (mainstream stablecoin) + USDD (native decentralized stablecoin) + USD1 (compliant stablecoin)," and relies on a complete DeFi infrastructure to create a full-scenario ecosystem covering "trading - value-added - cross-border investment" for stablecoins, supporting the use of stablecoins for various DeFi activities such as trading, storage, and collateralized lending, with clear value-added paths that meet users' different needs for security and decentralization. For example, the DEX center Sun.io provides low-slippage exchanges and crypto asset purchasing services for stablecoins, while JustLend DAO supports stablecoin deposits for interest or as collateral for lending.

In terms of stablecoin yield enhancement, the TRON ecosystem also features the RWA product stUSDT, providing stablecoin holders with access and channels to invest in traditional financial markets, achieving cross-domain asset appreciation. As of September 17, stUSDT's annualized yield reached 5.11%. Additionally, USDD is set to launch a new interest-earning product sUSDD, a decentralized savings tool aimed at helping USDD holders earn stable interest, further expanding the yield possibilities of stablecoins.

In the meme sector, the TRON ecosystem frequently produces blockbuster assets, demonstrating a strong wealth creation effect. The meme issuance platform SunPump is known as a "blockbuster incubator," continuously launching new projects and high-potential assets. Previously, mainstream meme projects such as SUNDOG and PePe have successfully entered Binance's Alpha zone, gaining recognition from top global trading platforms, providing small and medium investors with an important window for early involvement in quality meme assets.

The wealth narrative of the TRON ecosystem continues. Recently, TRON founder Justin Sun has repeatedly hinted on the X platform that "major moves are brewing and will be announced soon." Many community users speculate that TRON is likely to usher in a new round of product iteration and ecosystem expansion, which is worth the market's continued attention.

How to Cross-Chain Assets to the TRON Ecosystem with One Click?

With the growth of the ecosystem and the increase in Alpha opportunities, "cross-chain assets to the TRON ecosystem" has become a core demand for user value enhancement. Although withdrawing assets to the TRON network through CEX exchanges remains one option, the current explosion of on-chain applications and concentration of wealth opportunities have led funds to prefer on-chain circulation. According to data from Bridge WTF on September 17, the daily on-chain cross-chain transfer scale of crypto assets reaches as high as $640 million, and asset cross-chain interaction has become the mainstream method.

Currently, the facilities supporting cross-chain to the TRON network are mainly divided into two categories: native cross-chain infrastructure and third-party cross-chain tools.

Native Cross-Chain Infrastructure BTTC: As the ecosystem's built-in cross-chain infrastructure, BTTC has dual capabilities of asset cross-chain and application deployment: it supports users to quickly cross-chain other public chain assets to the TRON network, achieving seamless capital flow; it also allows developers to deploy their applications cross-chain to the TRON ecosystem with one click, lowering the multi-chain development threshold.

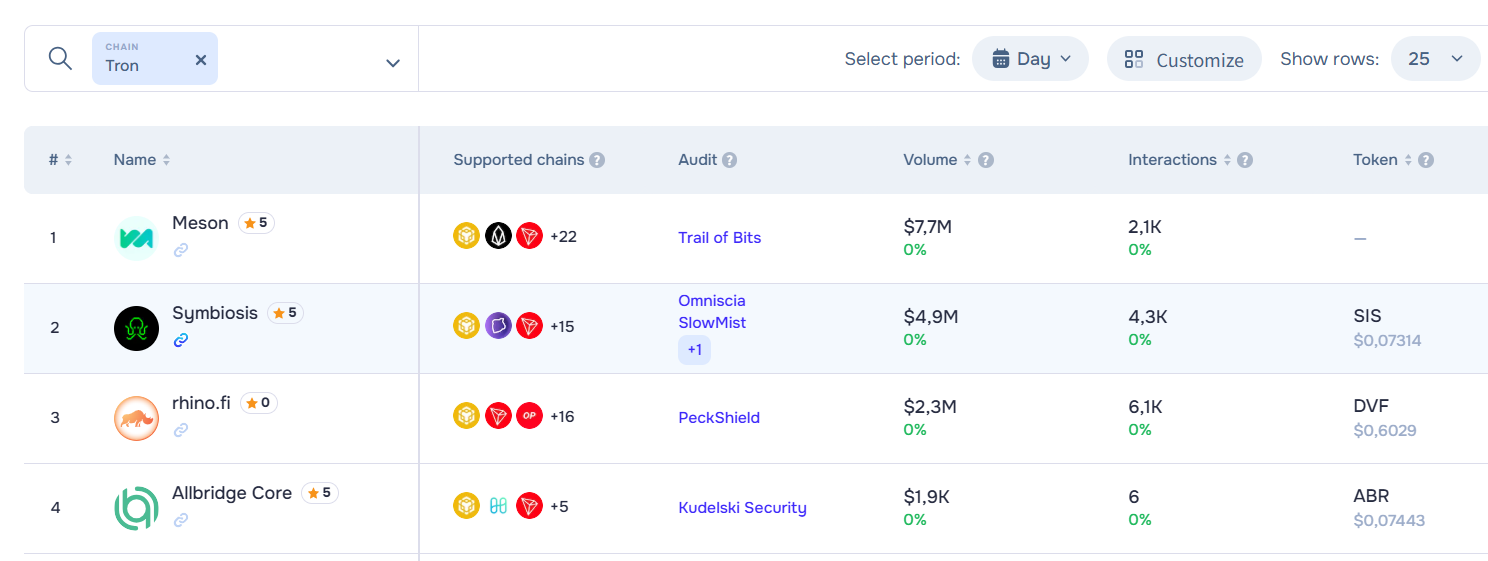

Third-Party Cross-Chain Bridge Tools: Covering more public chain networks, providing users with more choices. According to data from the cross-chain aggregation platform ChainSpot, there are currently 17 third-party cross-chain facilities supporting the TRON network, enabling asset interoperability with multiple public chains such as Bitcoin, Ethereum, Solana, BNB Chain, and Layer2. The four most commonly used tools include: Meson, Symbiosis, rhino.fi, and Allbridge Core.

In addition, TRON has recently continued to expand cross-chain cooperation, further enriching cross-chain channels: on August 26, the multi-chain cross-chain protocol deBridge was fully integrated into the TRON ecosystem, assisting TRON in achieving instant connectivity with 25 mainstream blockchains such as Ethereum and Solana, building a larger liquidity network; on September 16, TRON reached a strategic cooperation with the NEAR chain, fully integrating the multi-chain trading protocol NEAR Intents, bringing cross-chain operations into a new stage driven by "intents." Users only need to initiate a simple cross-chain request, and the system will automatically match the optimal path, truly achieving a new experience of "one-click direct access" for cross-chain operations.

Overview of the Six Major Cross-Chain Tools Supporting the TRON Network

1: Native Cross-Chain Protocol: BTTC (BitTorrent Chain) Aims to Become the Control Center for Multi-Chain Operations

BTTC (BitTorrent Chain) is a cross-chain solution jointly launched by the TRON Foundation and BitTorrent in 2021. As an EVM-compatible Layer2 scaling network using PoS consensus, BTTC is positioned as the "Layer2 cross-chain scaling protocol of the TRON ecosystem," aiming to solve the scalability and interoperability issues of blockchain networks. It currently supports asset interoperability between three major public chains: Ethereum, BNB Chain, and TRON.

In June this year, BTTC upgraded to version 2.0, enhancing network security and token value by reducing the total supply of BTT and setting the staking yield at 6%.

Among them, BitTorrent is the world's largest decentralized P2P file-sharing network, with over 100 million active users. It was acquired by TRON founder Justin Sun for approximately $120 million in July 2018 and has now developed into a complete ecosystem covering data transmission protocols (BitTorrent), decentralized storage (BTFS), cross-chain protocols (BTTC), and native tokens (BTT).

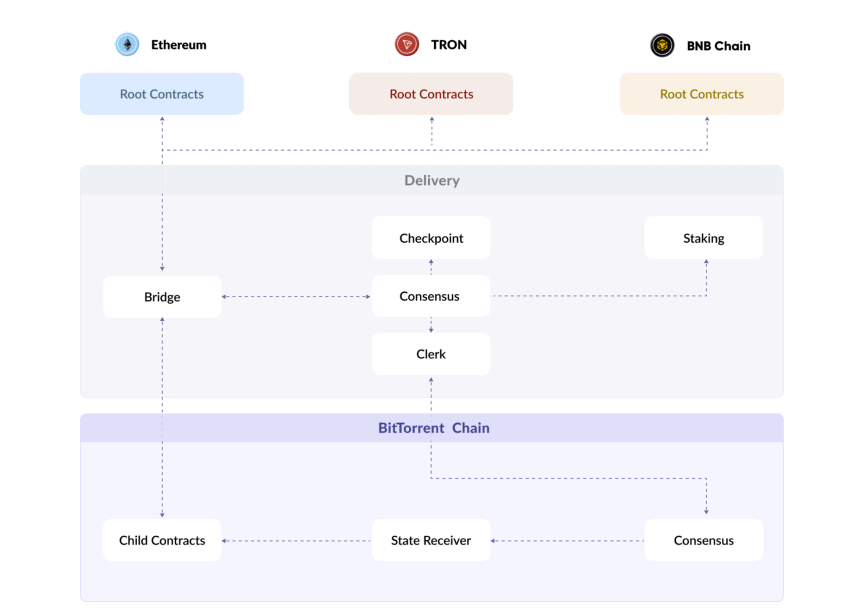

In terms of cross-chain implementation, BTTC adopts a "connect rather than custody" cross-chain model, modularly designing the entire cross-chain process (from initiating requests on the source chain to execution on the target chain) into general logic and standards, achieving bidirectional interoperability of assets and data between multiple chains. Its architecture is divided into three layers:

Root Contracts Layer: A cluster of smart contracts deployed on TRON, Ethereum, and BNB Chain, responsible for managing cross-chain assets/data, providing user interaction entry points, and serving as the initiator and receiver of user cross-chain requests;

Delivery Layer: A relay hub for consensus and data, responsible for the relay function of state transmission between the source chain and target chain. As a relay hub, it monitors source chain events (asset locking, staking, etc.) and generates "checkpoint" snapshots, which are synchronized to the target chain after multi-signature consensus by over 2/3 of the nodes;

BitTorrent Chain (Execution Layer): The DApp application running platform, handling cross-chain messages, verification, and simultaneously receiving snapshots from the Delivery layer, executing asset releases, contract triggers, and other operations.

For example, taking "cross-chaining ETH from Ethereum to TRON" as an example, the specific cross-chain process can be broken down into: the user locks ETH in the BTTC smart contract on the Ethereum chain, triggering a cross-chain event → the Delivery layer verifies the legitimacy of the event, generates a snapshot, and reaches node consensus → the BTTC execution layer mints the corresponding BTTC version of ETH and distributes it to the user's TRON address.

The goal of BTTC is not only asset cross-chain but also aims to achieve interoperability of underlying information and data across multiple chains. As stated in the latest white paper released in May this year, "Building a better cross-chain bridge is the starting point for reshaping; BTTC's ultimate goal is to become the control layer of a multi-chain operating system."

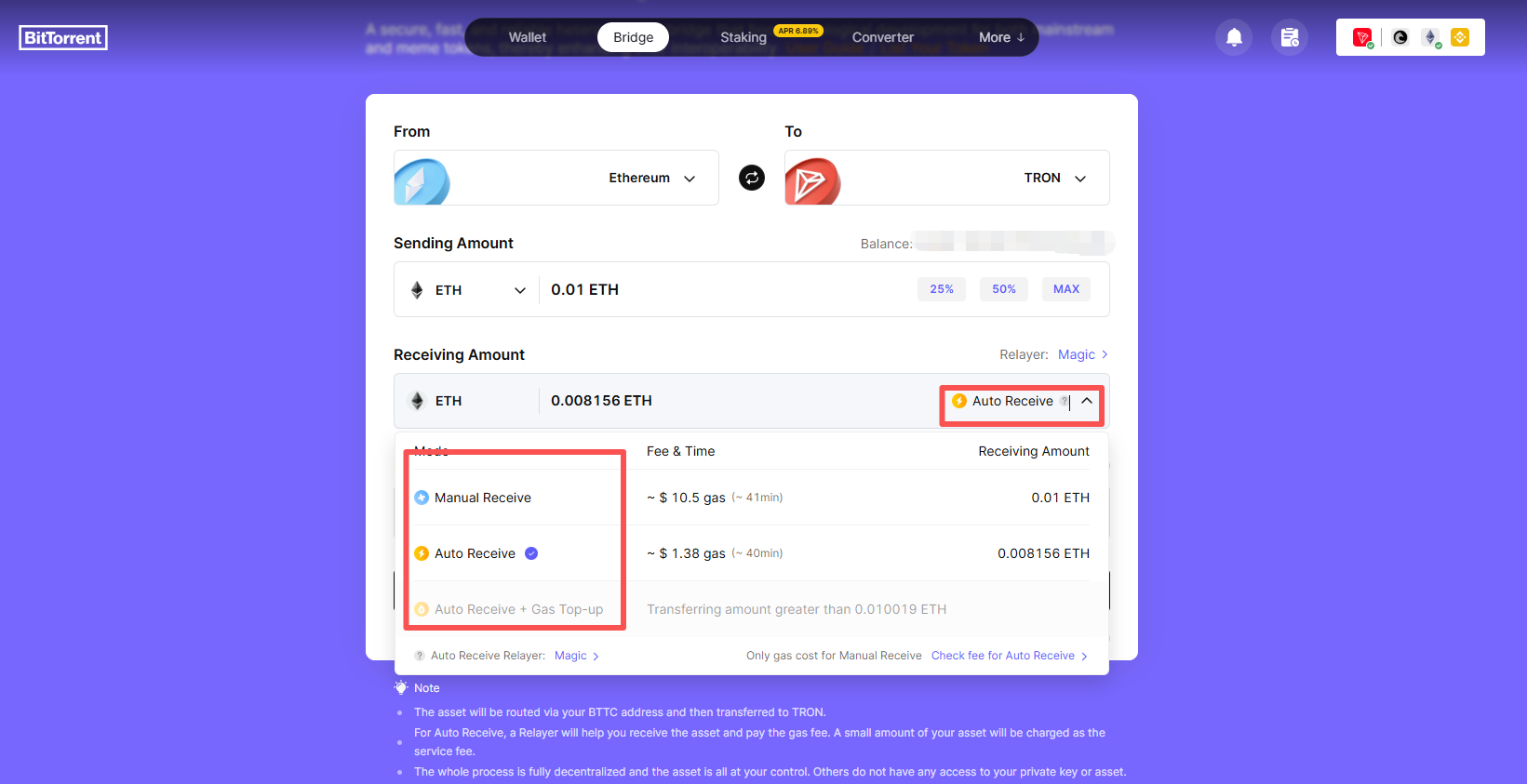

In terms of cross-chain products, BTTC has launched BitTorrent Bridge, focusing on asset cross-chain flow between EVM chains. It currently supports the interoperability of assets such as TRX, BTT, USDD, JST, SUN, WIN, NFT, ETH between TRON, Ethereum, and BNB Chain, and will expand to more chains and assets in the future.

To enhance user experience, BTTC offers an Auto Receive mode, where the Relayer pays the Gas fees for the target chain, allowing users to quickly receive cross-chain assets and avoid asset retention due to lack of Gas tokens. It is important to note that in this mode, the Gas fees will be directly deducted from the cross-chain asset, and the amount of cross-chain assets received will be reduced by the deducted Gas fee amount.

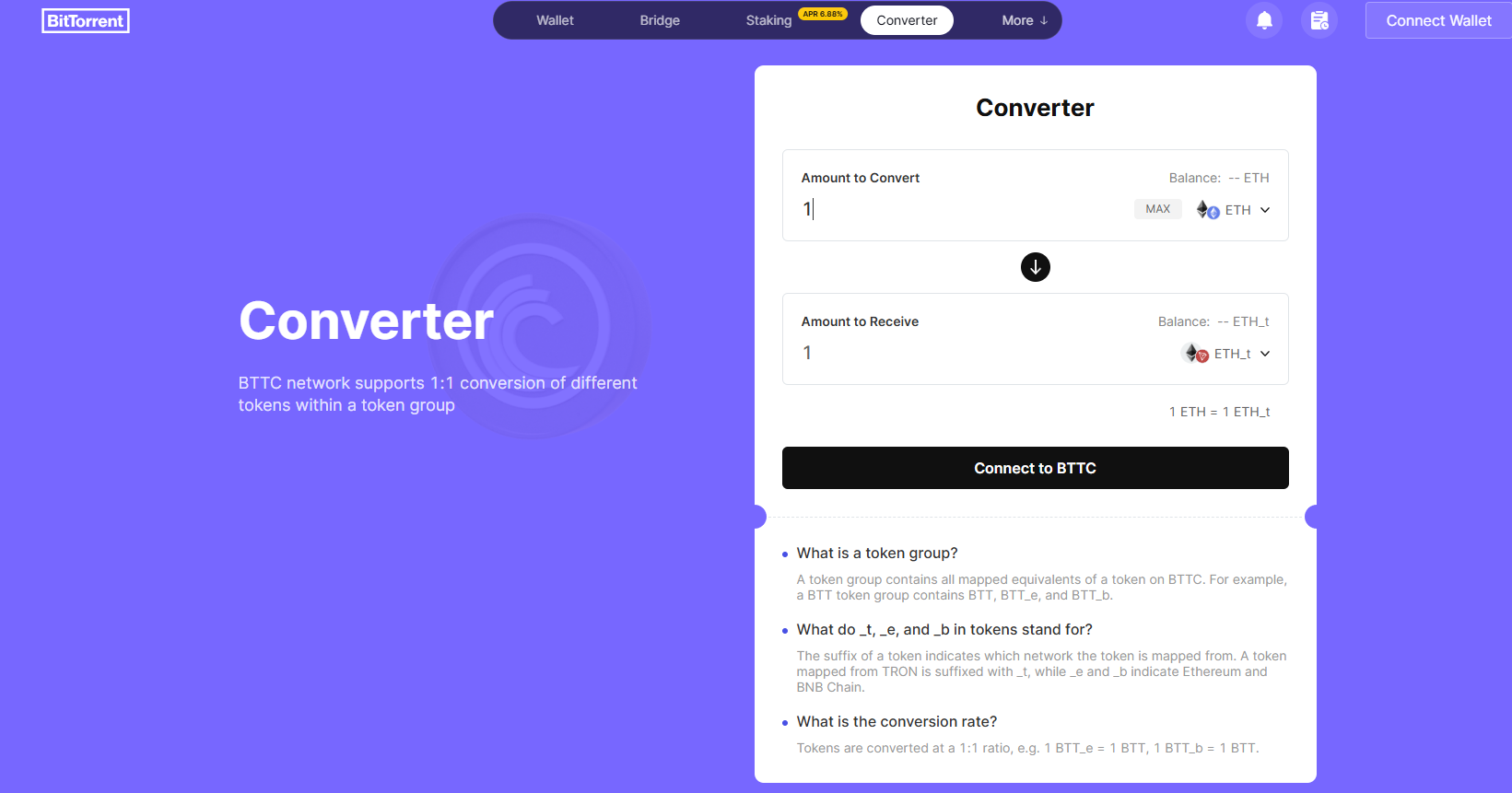

Additionally, BTTC has launched a 1:1 token converter, supporting fee-free swaps of similar assets on BNB Chain, Ethereum, and TRON networks, for example, 1ETHe (Ethereum) can be exchanged 1:1 for 1ETHb (BNB Chain).

As the official Layer2 cross-chain scaling protocol of TRON, BTTC inherits the security of its mainnet, and using BitTorrent Bridge for cross-chain transfers incurs no fees; users only need to pay Gas fees, making it the preferred product for TRON users to cross-chain. Furthermore, BTTC is EVM-compatible and supports the Solidity programming language, enabling one-click cross-chain migration and deployment of existing DApps on EVM networks.

2: Third-Party Cross-Chain Tools Supporting the TRON Ecosystem

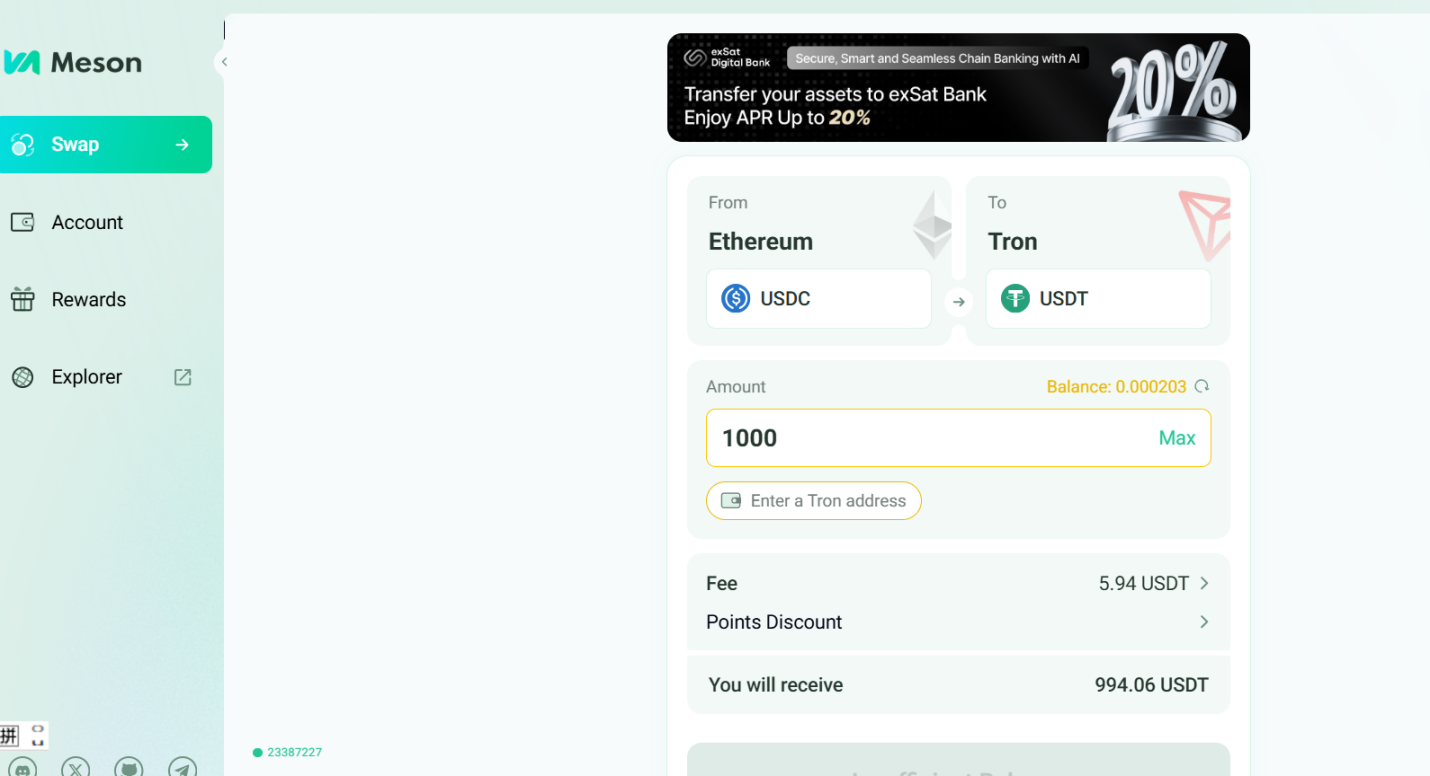

1. Meson: Focused on Stablecoin Cross-Chain Trading

Meson is a multi-chain stablecoin cross-chain trading protocol that primarily focuses on supporting native stablecoin cross-chain exchanges between EVM, non-EVM, and Layer2 networks, such as USDT, USDC, USD1, DAI, etc.

Through the Meson platform, users can currently quickly cross-chain exchange stablecoins like USDC, USD1, and USDT from various chains such as Ethereum, Arbitrum (Layer2), and Solana to TRC20-USDT on the TRON network.

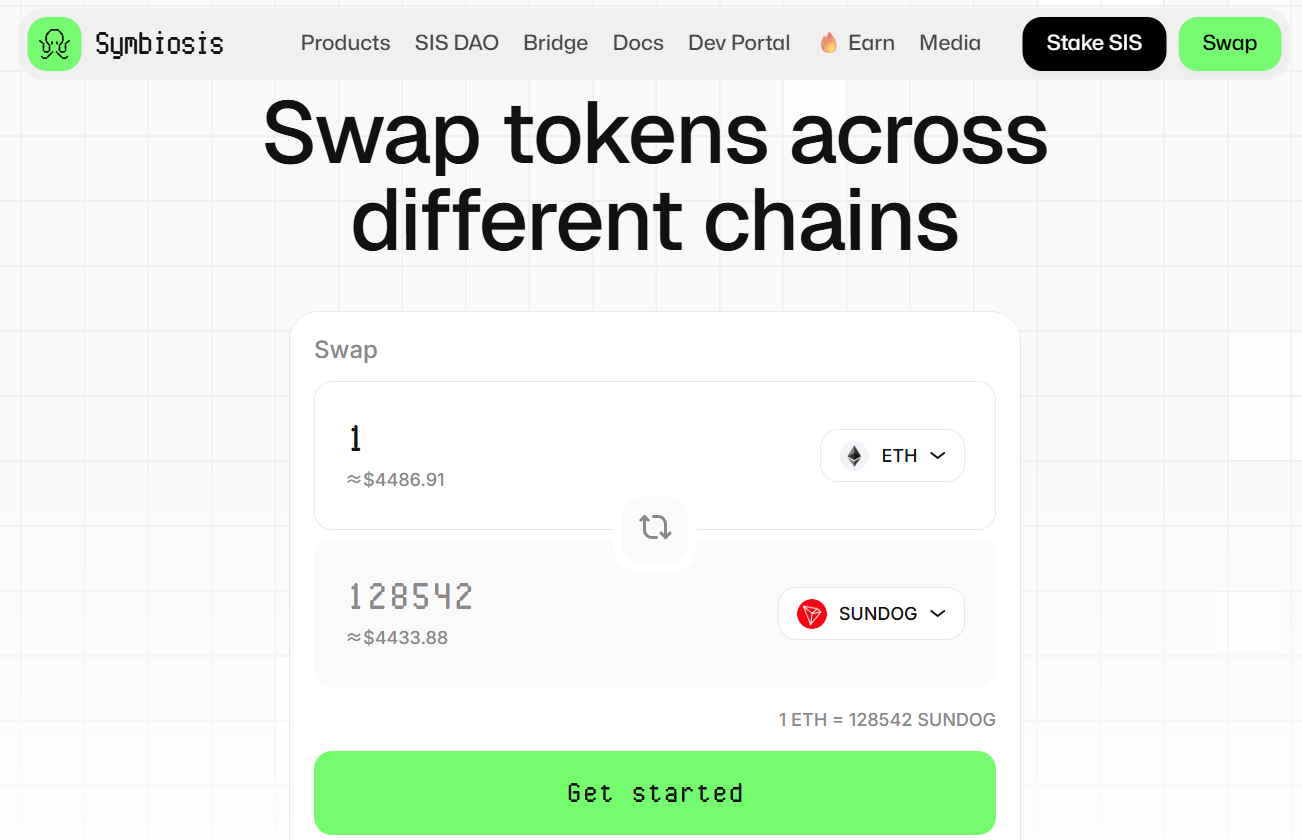

2. Symbiosis: Cross-Chain Trading DEX

Symbiosis is a decentralized cross-chain exchange DEX protocol based on AMM, which not only supports cross-chain transfers of homogeneous assets but also allows for cross-chain exchanges of any token pair. Users simply select source chain assets and target chain assets on the Symbiosis interface, and the protocol will automatically complete the steps of exchanging source chain assets for an intermediate stablecoin, cross-chain transfer, and then exchanging for target assets. For example, users can directly exchange ETH on Ethereum for USDT, TRX, or SUNDOG on the TRON chain.

Currently, the Symbiosis platform supports dozens of TRON network assets for cross-chain exchange, including TRX, BTT, SUN, JST, SUNDOG, etc.

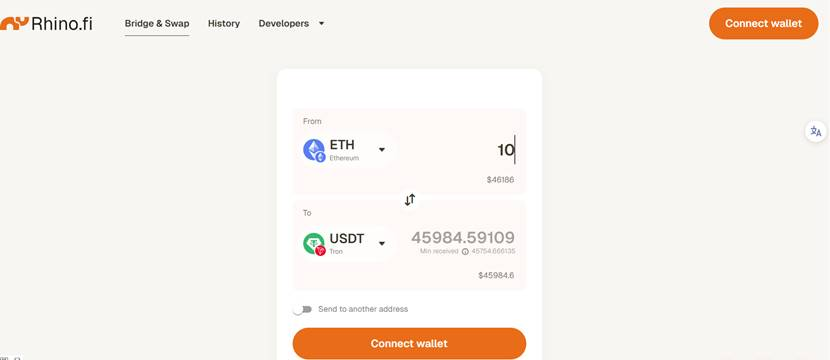

3. Rhino.fi: Cross-Chain DeFi Facility Focused on Stablecoin Liquidity

Rhino.fi is a cross-chain DeFi infrastructure aimed at solving the problem of liquidity fragmentation in multi-chain ecosystems. In the latest product roadmap released in June this year, Rhino.fi clearly stated its intention to build a stablecoin liquidity layer, addressing liquidity fragmentation and cross-chain interoperability pain points by unifying global stablecoin liquidity. It also launched a developer toolkit Bridge+, providing a complete stablecoin interoperability solution to help developers efficiently handle stablecoin payments, multi-chain integration, and other needs.

To address user asset cross-chain needs, Rhino.fi has created the Bridge&Swap feature—combining cross-chain and trading attributes, equivalent to a "cross-chain DEX," allowing direct exchange of asset b on chain A for target asset d on chain C. For example, it can convert ETH on the Ethereum chain to USDT on the TRON chain with one click, significantly simplifying the cross-chain and trading process.

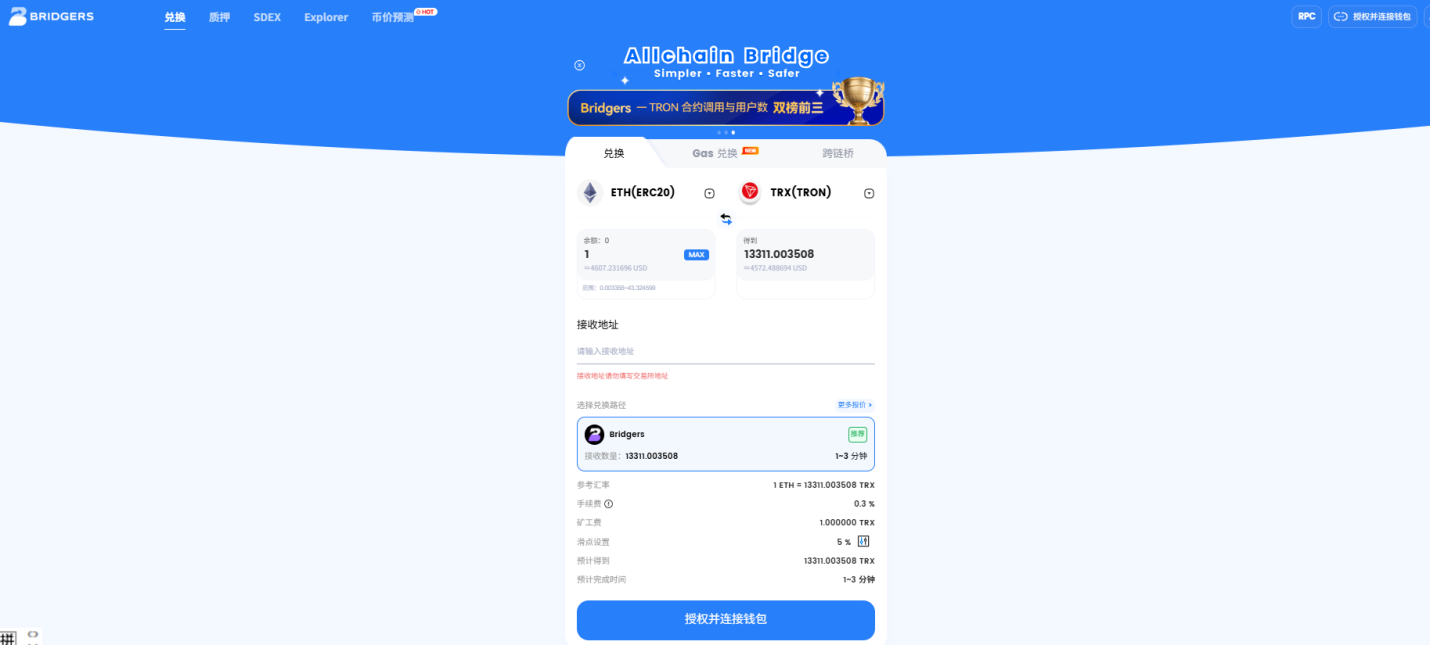

4. Bridgers: Cross-Chain Liquidity Aggregator

Bridgers (also known as AllChain Bridge) is a cross-chain liquidity aggregator that aggregates liquidity from external DEXs and bridges, calculates the optimal execution path for assets across DEXs and bridges, and then executes transactions using smart contracts, such as directly cross-chain exchanging ETH on Ethereum for TRX on the TRON chain.

Bridgers is one of the most frequently used cross-chain applications by users in the TRON ecosystem. According to the TRONSCAN browser, the number of contract calls for Bridger ranks in the top three within the TRON ecosystem.

5. deBridge: Cross-Chain Interoperability Infrastructure

deBridge is a universal cross-chain interoperability infrastructure and messaging protocol that supports the transmission of any messages, data, and assets between different blockchains. It not only provides services such as cross-chain liquidity networks but also offers a complete set of tools for developers to build various cross-chain applications (deApps).

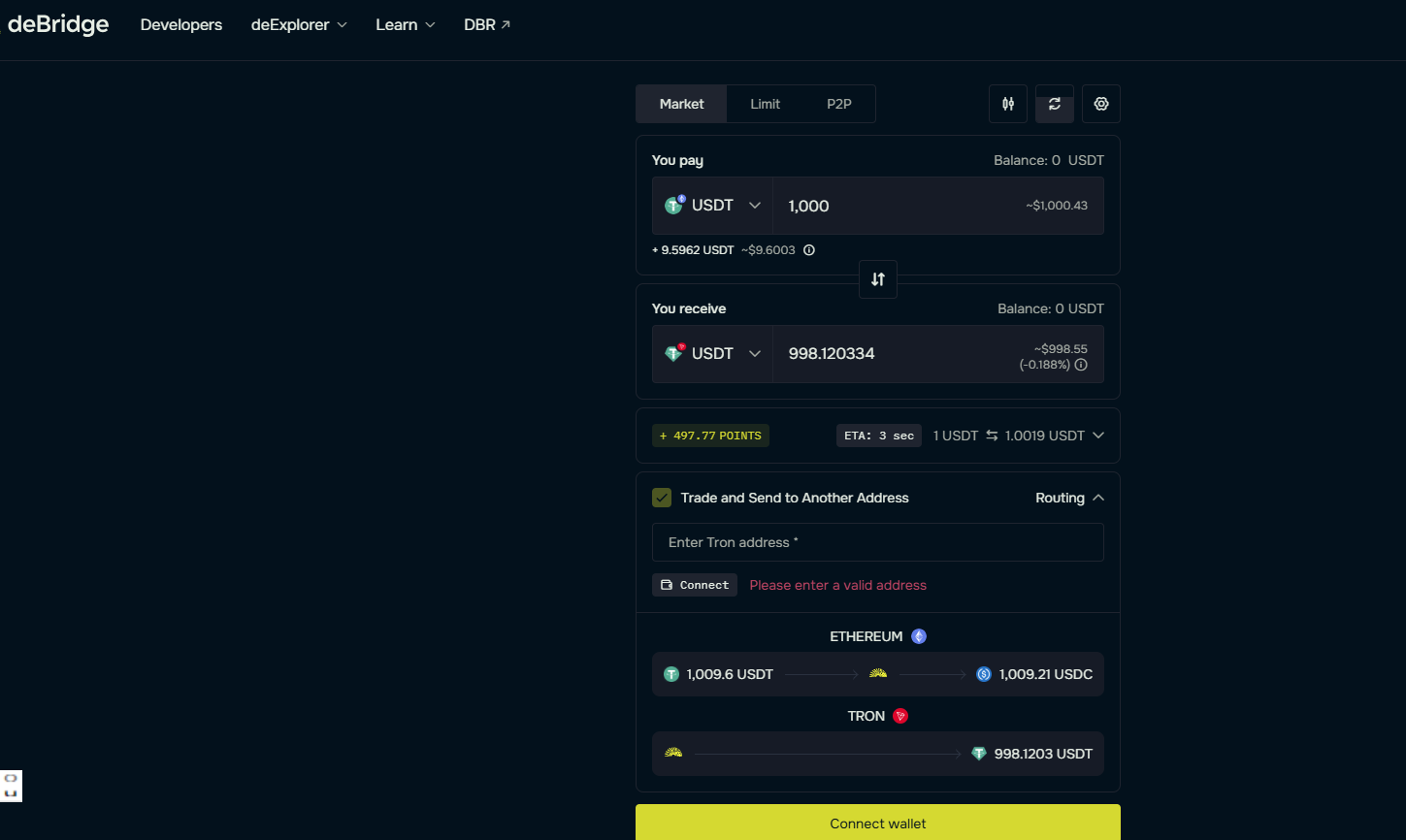

To meet asset cross-chain needs, deBridge has launched its core product, the cross-chain token bridge dePort, primarily used for cross-chain transfer and trading exchange of assets between different blockchains, supporting not only cross-chain transfer of homogeneous assets but also one-click cross-chain trading exchanges.

On August 26, deBridge announced its full integration into the TRON ecosystem, allowing users to cross-chain their supported assets from other public chains to the TRON ecosystem with one click. According to deBridge's official data on September 18, since its integration into the TRON ecosystem, the asset scale flowing from the Ethereum network to TRON has reached $4.28 million, demonstrating the attractiveness of the TRON ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。