Author: Thejaswini, Source: Token Dispatch

Exchange-Traded Funds (ETFs) were born out of crisis.

On Black Monday in 1987, the Dow Jones Industrial Average plummeted more than 20% in a single day. Regulators and market participants realized they needed better tools. Mutual funds could only be traded at the end of the trading day, leaving investors powerless during market panic.

ETFs emerged as a solution. An ETF is a basket of securities that trades like a stock, providing instant liquidity when market conditions worsen.

ETFs simplify index investing, offering broad market exposure with low fees and tax efficiency. They are designed to be passively managed and transparent—simply tracking an index without attempting to outperform it. The first successful ETF, launched in 1993, was the SPDR S&P 500 ETF (SPY), which became the largest fund in the world by strictly adhering to its commitment to track the S&P 500 index.

At first, the idea was indeed appealing. You wanted to buy "stocks" but didn't want to research individual companies or pay a fund manager to do it for you.

In September 2025, Wall Street crossed a new threshold: packaging meme coins into regulated investment products and charging a 1.5% annual fee for it.

Are We Witnessing a Fundamental Shift in ETFs?

ETFs have evolved from simple tools for simplifying investment to complex instruments capable of integrating any strategy you can think of. There are countless ways to combine, hedge, time, or build investments, but the actual number of companies available for investment is limited.

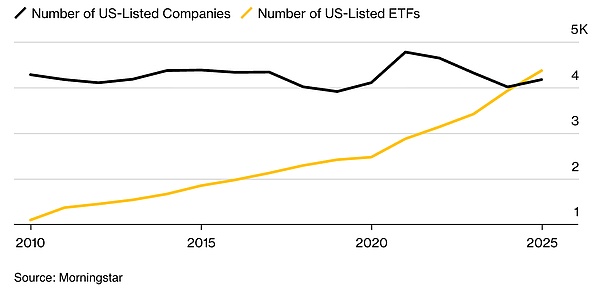

There are now over 4,300 exchange-traded funds, while the number of publicly traded companies is about 4,200. ETFs account for approximately 25% of all investment vehicles, up from 9% a decade ago. For the first time in market history, the number of funds has exceeded the actual number of stocks.

In my view, this creates a fundamental problem—too much choice, leaving investors overwhelmed rather than empowered. Today, we have funds covering every imaginable theme, trend, or political viewpoint. The line between serious long-term investing and entertainment has become completely blurred. It is almost impossible to distinguish between products designed to accumulate wealth and those aimed at capitalizing on social media trends.

Stop. This anxiety completely misses the point. The Dogecoin ETF does not distort the mission of cryptocurrency.

For fifteen years, cryptocurrencies have been viewed as worthless digital currencies. The traditional finance world has labeled us as degenerate speculators playing with worthless tokens. They said we would never create anything real, never achieve institutional adoption, and never warrant serious regulatory attention.

Now, they are trying to extract value from the assets we created as a joke.

The cryptocurrency industry has created a new category of value that traditional finance cannot ignore, cannot eliminate, and ultimately cannot resist monetizing. Dogecoin obtained an ETF before half of the Fortune 500 companies established comprehensive crypto strategies, serving as the most brutal testament to the dominance of cryptocurrency culture.

Well, now that we have celebrated victory, let’s take a look at what we are actually celebrating.

Why Would Anyone Pay a 1.5% Fee for Something That’s Free?

The economic logic of meme coin ETFs makes no sense for investors, but it is perfectly rational for Wall Street.

You can buy Dogecoin directly on Coinbase, completing the transaction in five minutes with zero ongoing fees. The REX-Osprey Dogecoin ETF charges an annual fee of 1.5% for the same exposure—$150 per year for a $10,000 investment. The Bitcoin ETF charges 0.25%. So why would anyone pay six times the fee for a meme coin compared to digital gold?

The answer reveals the true target users of these products. Bitcoin ETFs serve institutional investors and savvy wealth managers who need regulatory compliance and understand cryptocurrency. They compete on fees because their clients have alternative options and know how to use them.

The target audience for meme coin ETFs is retail investors who see Dogecoin trending on TikTok but do not know how to buy it directly. They pay for simplicity and legitimacy, not market exposure. These investors do not shop around—they just want to click "buy" on the Robinhood app and gain the meme exposure they keep hearing about.

The issuers know this is absurd. They know customers can buy Dogecoin cheaper elsewhere. They bet that most people won’t figure this out or won’t want to deal with crypto exchanges and wallets. The 1.5% fee is essentially a tax on financial ignorance, packaged as institutional legitimacy.

What Makes an Asset Worthy of Inclusion in an ETF?

Traditional ETF definition: a regulated investment fund that holds a diversified basket of securities, trading on an exchange like a stock, providing investors with broad market exposure while maintaining professional regulation, custody standards, and transparent reporting.

Classic models track indices like the S&P 500, holding hundreds of companies across multiple sectors. Even single-sector ETFs, such as technology or healthcare funds, hold dozens of stocks within their focus area. Diversification reduces risk while providing exposure to market trends.

Now let’s look at what Dogecoin actually is: a cryptocurrency created in 2013 by copying Litecoin’s code and adding a meme dog logo, purely as a satire. It has no development team, no business plan, no revenue model, and no technological innovation. Its supply increases by 5 billion coins each year, designed to be inflationary, mocking Bitcoin’s scarcity.

This token has no economic utility. You cannot build applications on it, nor can you earn yield through staking. Its only function is to exist as a network meme, occasionally hyped due to celebrity tweets.

What Regulatory Loophole Made This Possible?

The path to market reveals how financial innovation actually works: evading the spirit of the law while technically complying with the letter of the law through regulatory arbitrage.

The REX-Osprey Dogecoin ETF (DOJE) was launched under the Investment Company Act of 1940, rather than the Securities Act of 1933, which regulates commodity ETFs like Bitcoin funds. This choice is crucial. The 1940 Act stipulates that unless the U.S. Securities and Exchange Commission (SEC) objects, it will be automatically approved after 75 days, creating a regulatory shortcut. The problem is what? The 1940 Act was designed to support diversified mutual funds that spread risk across multiple assets, not to facilitate single-asset speculation on abandoned memes.

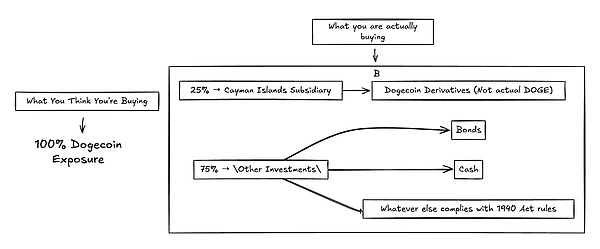

To meet diversification requirements, DOJE cannot directly hold Dogecoin. Instead, it gains exposure through derivatives via a Cayman Islands subsidiary, with a position limit of 25% of assets. This leads to an absurd situation: the Dogecoin ETF can have at most 25% exposure to Dogecoin.

This fundamentally alters what investors are actually buying. When an ETF directly holds an asset, it can accurately track the asset's price. Using offshore subsidiaries and derivatives introduces tracking errors, counterparty risks, and complexities, distorting performance. The fund's returns become disconnected from the actual market movements of Dogecoin.

This regulatory workaround creates transparency issues. Retail investors buying the Dogecoin ETF expect direct exposure to the meme they see on social media. But what they actually receive is a complex derivative product, with three-quarters of the investment unrelated to Dogecoin price movements. Their returns are diluted by the remaining 75% of other assets in the fund.

Worse, this structure undermines the original protective intent of the 1940 Securities Act. Congress established diversification rules to reduce risk by spreading investments across multiple assets. Wall Street has found a way to exploit the same rules to package high-risk speculation into regulated tools, with regulatory oversight weaker than anticipated. The regulatory framework not only fails to protect investors from risk but also obscures new risks under the guise of institutional legitimacy.

Compared to Bitcoin ETFs, most Bitcoin ETFs, such as ProShares BITO or Grayscale's spot Bitcoin ETF attempts, typically use the 1933 Securities Act or other frameworks designed for commodity funds, allowing for more direct or futures-based Bitcoin exposure without the strict 25% asset limit.

Bitcoin ETFs usually hold futures contracts directly or seek to hold Bitcoin directly (when approved), thus more closely tracking the underlying price of Bitcoin.

The Dogecoin ETF represents the perfect storm of regulatory arbitrage. The investments of this ETF fundamentally do not align with the target it is supposed to track, holding a useless asset while exploiting laws from the 1940s designed to prevent such speculative behavior. This is the most irreverent manifestation of financial engineering—using regulatory loopholes to create speculative products under the guise of investor protection.

Why the Obsession with Yield?

Wall Street has abandoned a focus on fundamentals, fully chasing yield regardless of asset quality.

State Street data shows that the stock allocation in institutional portfolios has reached its highest level since 2008. Investors are pouring money into options income ETFs that promise monthly dividends, high-yield junk bonds, and crypto-related yield products that offer double-digit returns through derivatives.

Capital flows prioritize chasing returns, with questions about the underlying issues coming later. When interest rates soared, investors actively shifted to high-yield corporate bonds, abandoning safer investment-grade bonds. Thematic ETFs focused on artificial intelligence, cryptocurrencies, and meme assets are being launched at record speeds, catering to speculative demand rather than long-term value.

Risk appetite indicators continue to flash green lights. Despite macro market uncertainties, the volatility index (VIX) remains low. After the turmoil in early 2025, defensive sectors briefly attracted capital inflows, but funds quickly flowed back into high-risk, high-return sectors like industrials, technology, and energy.

Wall Street has essentially decided that in a world of unlimited liquidity and constant innovation, yield trumps all. If something can deliver premium returns, investors will always find reasons to buy, regardless of its fundamentals or sustainability.

Are We Creating a Bubble?

What happens when the number of investment products exceeds the actual investment targets?

We have crossed the "Rubicon," with the number of ETFs exceeding stocks. This is a fundamental change in market structure. We are essentially creating a synthetic market on top of the real market, adding layers that increase fees, complexity, and potential points of failure.

Matt Levine points out:

“As ETFs become increasingly popular, technology is also lowering their implementation costs, and more previously customized, manual trades will become standardized ETFs. The potential number of trades far exceeds the number of stocks… In the long run, the potential market space for ETFs is limited by (infinite) trading volume rather than (diminishing) stock numbers.”

The phenomenon of meme coin ETFs is accelerating this trend. Rex-Osprey has already submitted applications for Trump Coin ETF, Bonk ETF, and traditional ETFs for XRP and Solana. Currently, there are 92 crypto ETF applications awaiting approval from the SEC. Each successful launch creates demand for the next product, regardless of its underlying utility.

This brings to mind the CDO square problem of 2008, when Wall Street created derivatives of derivatives until financial products became completely disconnected from underlying realities. We are now doing the same thing, replacing mortgages with attention and cultural phenomena.

The market appears more liquid than it actually is, as multiple products trade around the same underlying asset. But in a crisis, all these products often move together, and "liquidity" evaporates simultaneously.

What Do Meme Coin ETFs Mean?

The deeper story is about finance evolving into a comprehensive attention-capturing mechanism that can monetize any phenomenon that generates price fluctuations.

The launch of ETFs creates its own momentum through network effects. Driven by expectations of institutional investor inflows, the price of Dogecoin rose 15% in the month leading up to the DOJE launch. Higher prices attract more attention, which in turn spawns more memes, enhancing cultural relevance and providing justification for the birth of more financial products. Success breeds imitation.

Traditional finance monetizes productive assets like factories, technology, and cash flow. Modern finance monetizes any factor that can drive prices: narratives, memes, social momentum. ETF packaging transforms cultural speculation into institutional products, extracting fees from the very communities that initially created these phenomena.

The broader question is whether this is innovation or extraction. Is the financialization of memes creating new value, or merely extracting value from organic cultural movements by increasing institutional costs?

Internet culture has generated immense economic value—advertising revenue, merchandise sales, platform engagement, and the creator economy.

I think it’s time to “soft launch” my relationship with internet culture.

I have been pondering what drives these companies to valuations in the billions by 2025. Somehow, I found myself ordering matcha at Mitico coffee roasters in Bangalore, just to feel like I was part of it. Not because I particularly enjoy the taste of the ground green powder, but because matcha has become a ritual, symbolizing the luxury of productivity and tranquility, somehow making you feel more closely connected to the global health aesthetic.

Internet culture has now devolved into a spectacle: a series of participation fees disguised as lifestyle choices. And monetization opportunities are everywhere, from the blatantly absurd to the genuinely clever.

Look at the trending events of 2025. We witnessed Coldplay’s “Kiss Cam” incident, turning two people’s awkward moment into a corporate resignation scandal, with Gwyneth Paltrow inexplicably becoming a temporary spokesperson. The entire internet went wild over whether 100 men could defeat a gorilla (spoiler: experts say yes, but barely). The Labubu craze turned $30 blind box collectibles into symbols of identity, with people even scrambling to buy them in stores.

Then there’s the language barrier I can’t seem to cross. Gen Z slang is constantly evolving. Last week, someone said my outfit was “bussin’,” and I genuinely didn’t know whether to be angry or happy. Apparently, it’s a good thing? My nephew tried to explain that “rizz” describes something charming, but then he started talking about “skibidi” this and “Ohio” that, and I realized I was completely lost. I try to keep up, but to be honest, trying to use these words correctly makes me feel a bit “cheugy” (outdated). That “trying too hard millennial” vibe is not what I want.

Then Taylor Swift got engaged to Travis Kelce, and within minutes, the entire marketing universe shifted. From Walmart to Lego to Starbucks, brands dropped everything to insert themselves into this conversation.

The key is that this cultural momentum itself is an economic engine. Katy Perry took an 11-minute space flight, and the internet spent a week debating whether it was “extravagant waste”—this level of engagement can be converted into advertising revenue, brand exposure, and cultural capital, which can be monetized in dozens of different ways. When everyone starts calling their friends “pookie” because of a couple on TikTok, suddenly an ecosystem of pookie playlists, pookie ribbons, and pookie merchandise forms.

Internet culture creates immense economic value through the creator economy, merchandise sales, platform engagement, and movements that drive stock price fluctuations faster than quarterly earnings reports. If a tweet from Elon can add billions to Dogecoin’s market cap, and if Tesla’s valuation relies more on cultural momentum than fundamentals, then cultural phenomena are legitimate economic forces deserving of the same institutional packaging as other asset classes.

ETF packaging does not extract value from these communities—it formalizes existing forms of value, making them accessible to previously excluded groups. Retirees in Ohio can now access internet culture through their 401(k) plans without needing to learn about crypto wallets or navigate Discord servers.

Conversely, the same retirees could also lose a significant portion of their retirement savings due to an abandoned internet joke. A mere 1.5% annual fee would eat away $1,500 each year from a $100,000 investment, regardless of whether Dogecoin rises or falls. Due to regulatory requirements, the ETF can only have 25% exposure to Dogecoin, meaning this retiree may not have received the cultural exposure they thought they were buying. Financial accessibility without financial education can be dangerous. Making speculative assets easier to purchase does not reduce risk—it merely makes the risks less apparent to those who may not understand what they are buying.

Financializing memes could actually empower these communities rather than exploit them. When cultural movements gain institutional investment support, they gain stability and resources.

If internet culture can drive prices, then internet culture becomes an asset class. If social momentum creates volatility, then social momentum becomes tradable. ETF packaging is merely a mechanism for transforming cultural energy into institutional products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。