A blueprint for a "madman" or an accurate map to the future?

1 trillion dollars.

You read that right; this is not the total economic output of some small country, but rather the "super gift package" that Tesla is preparing for its boss, Musk.

Recently, Tesla's board announced a proposal that left everyone stunned: they designed an unprecedented compensation plan for Musk, which could reward him with up to 1 trillion dollars over the next decade if he can lead the team to accomplish a series of "almost impossible" tasks. This is undoubtedly the largest executive incentive plan in the history of American companies.

According to the proxy statement filed by Tesla last Friday, the additional shares Musk could receive would increase his ownership stake in Tesla to 25%. Musk has previously expressed a desire to achieve this ownership level. Shareholders are scheduled to vote on these proposals on November 6.

Of course, this money doesn't come for free. There is no such thing as a free lunch, especially not for such a large sum. Tesla has set a series of absurdly high targets for Musk, including expanding Tesla's autonomous taxi, FSD, and robotics businesses, as well as increasing its market value from the current approximately 1 trillion dollars to at least 8.5 trillion dollars.

So, the question arises: how will this 1 trillion dollars be securely placed into Musk's pocket from what seems like an impossible dream? Let's do the math together and see how Musk can turn this dream into reality.

Car manufacturing is not the end, but a ticket to the future

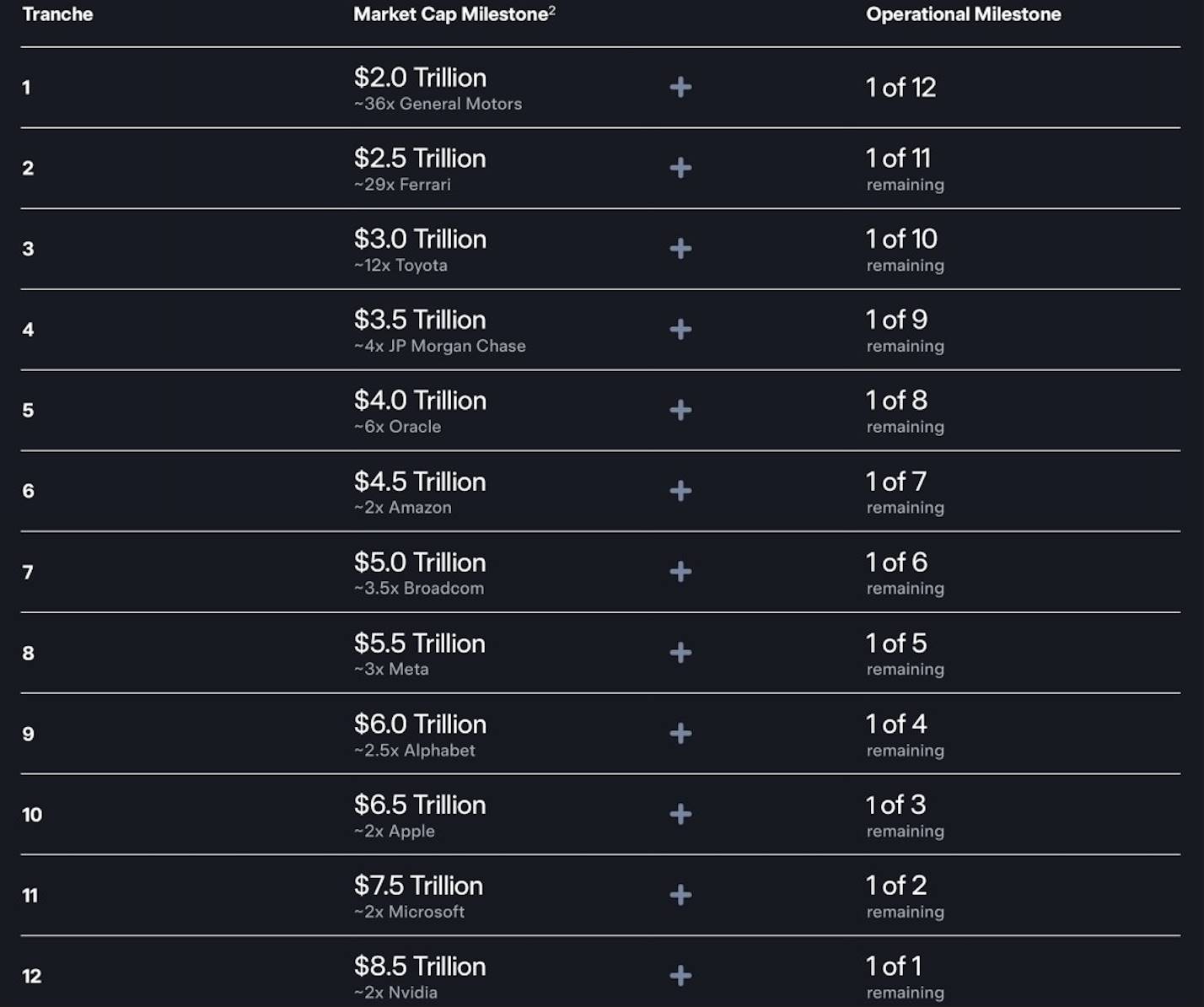

You can think of it as a "hell-level" challenge game tailored for Musk. The entire plan is to be completed within ten years and is divided into 12 major levels. He can only unlock a portion of the stock rewards after passing each level.

To open each "treasure chest," two keys must turn simultaneously; one cannot be missing.

The first key: Company market value

This key is straightforward: it’s about making Tesla bigger. The starting target is 2 trillion dollars (almost double the current value), then increasing by 500 billion for each level, ultimately aiming for a staggering 8.5 trillion dollars. What does this mean? It’s equivalent to adding another "Amazon + Google" on top of the current Tesla.

The second key: Hardcore performance

Simply inflating the stock price won't work; there must be solid business backing it up. This second key consists of the "milestones" that Tesla's four core businesses must achieve, each challenging the limits:

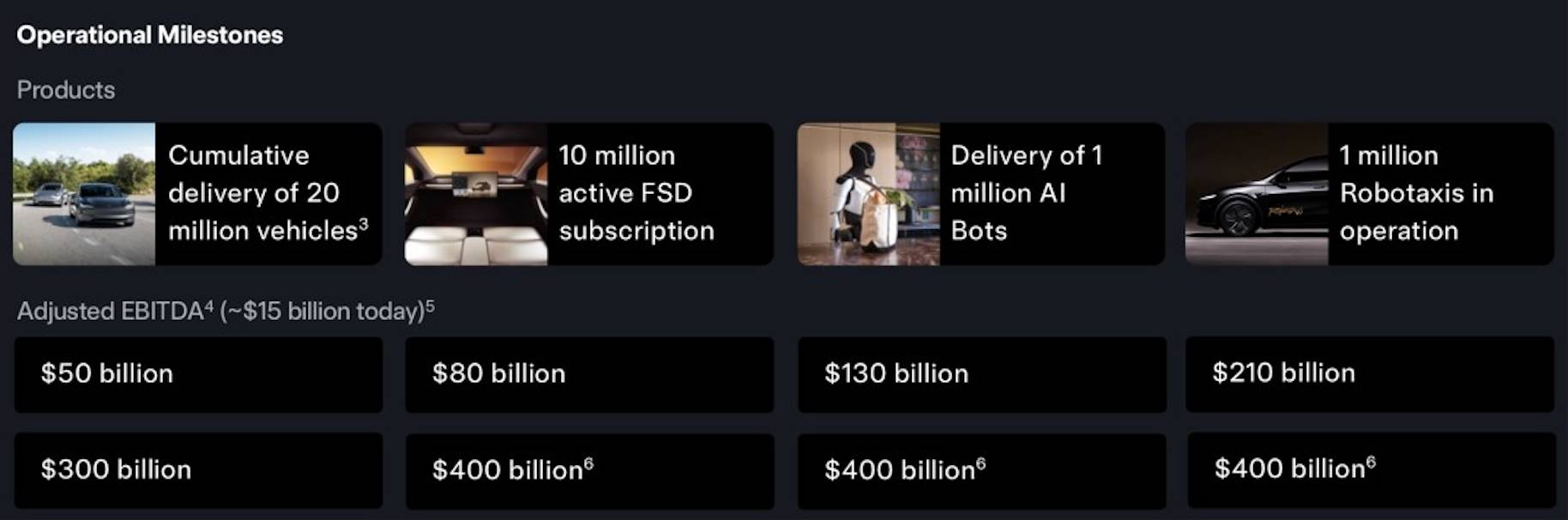

Sell another 12 million cars: By 2025, Tesla will have delivered about 8 million cars over nearly twenty years. This plan requires selling another 12 million cars in the next decade.

Develop 10 million FSD paying users: This means the FSD (Full Self-Driving) software must become extremely user-friendly and safe, making the vast majority of car owners feel "it's worth the money" and willingly subscribe.

Deploy 1 million Robotaxis: This is essentially a massive project from 0 to 1. Transforming autonomous taxis from sporadic testing to a fleet of a million commercial vehicles involves overcoming significant technological, regulatory, and safety challenges.

Deliver 1 million humanoid robots: Producing and successfully launching a million units of the Optimus robot into the market over ten years is a monumental challenge at every step.

In addition to these four pillars, the plan is also tied to a series of continuously growing EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) targets, starting at 50 billion dollars and reaching an astonishing 400 billion dollars. This ensures that while Tesla pursues scale expansion, it must maintain strong profitability and healthy cash flow.

You might wonder, where to start with so many grand goals?

The automotive business is Tesla's "foundation," the starting point for all future stories. The hard metrics in Musk's compensation plan require total deliveries to reach 20 million in the next 10 years. This means they need to ramp up production from the current level of 2 million vehicles per year to selling 3 to 4 million vehicles annually.

Considering that there may be more affordable models in the future, let's assume each car sells for an average of 40,000 dollars. If we calculate based on an annual sales volume of 3.5 million vehicles, just from car sales, Tesla could generate 140 billion dollars in revenue each year.

In the eyes of many, car manufacturing is a "heavy asset" industry with low valuations. However, considering Tesla's brand, technology, and profitability, it could be valued at 5-7 times P/S.

The more critical point is that every car Tesla sells is not just a car but a "mobile terminal" leading to the future. Therefore, when Tesla achieves the milestone of 20 million deliveries, the automotive business alone could support a valuation of 1 to 1.5 trillion dollars.

7.5 trillion dollars in new valuation, how to achieve it?

If Tesla's cars are the "body" that keeps running, then the FSD software is the "soul" injected into it.

Another milestone in this plan requires 10 million FSD subscription users. Let's do a simple calculation: assuming the average subscription fee globally is 100 dollars per month. When 10 million users come on board, it means 1 billion dollars every month, or 12 billion dollars a year!

FSD subscriptions are essentially a SaaS business, with its core being high gross margins and strong customer stickiness. The market is willing to pay extremely high valuation multiples for high-quality SaaS revenue, typically in the range of 20-40 times P/S or even higher. Given FSD's uniqueness and its core position in the trillion-dollar mobility market, assigning it a super high valuation is reasonable.

Just this 12 billion dollars in annual revenue, if the market believes in its enormous growth potential (for example, licensing to other car manufacturers), could command a P/S of over 100, directly contributing 1.2 trillion dollars in market value. If we consider future price increases or service tiering, this part of the business could see annual revenue reach 20 billion dollars, supporting a valuation of 1.6 to 2 trillion dollars at an 80-100 times P/S.

Once the FSD brain is smart enough, Tesla's ace—Robotaxi (autonomous taxi)—will take the stage.

The target for this part is to deploy 1 million Robotaxis, which will become a massive, driverless profit-making fleet. Today, your private car is idle 95% of the time. In the Robotaxi network, every Tesla can become a money-making tool working for you 24/7.

Assuming a Robotaxi operates 5,000 hours a year, generating a net income of 25 dollars per hour for Tesla (after deducting electricity, maintenance, cleaning, etc.).

The annual income per vehicle is about 125,000 dollars, and for a fleet of a million vehicles, the annual income would be 125 billion dollars.

This is a brand new, technology-driven high-profit service network. Its business model is similar to Uber or Didi, but without driver costs, leaving a huge profit margin. The market will view it as a combination of technology and utilities, making a 20-25 times P/S valuation entirely possible. Therefore, just from the Robotaxi network, this business could support a valuation of 2.5 to 3 trillion dollars.

When the automotive, energy, AI software, and mobility networks are all in place, Tesla's sights will turn to a grander goal: the Optimus humanoid robot. The target for this part is to have 1 million Optimus robots enter factories, warehouses, and even homes.

This is not just about selling the robots themselves at a hardware price of 25,000 to 30,000 dollars. Its true power lies in its potential to disrupt the largest market—the labor market.

Model one: Selling hardware. 1 million units * 25,000 dollars/unit = 25 billion dollars in annual revenue. This is just the beginning.

Model two: Robots as a Service (RaaS). Hiring a worker for a factory position costs at least 50,000 dollars a year in various expenses. Now, a factory can rent an Optimus robot for only 30,000 dollars a year in "service fees," saving 20,000 dollars annually. Annual revenue = 1 million units × 30,000 dollars/unit = 30 billion dollars.

Optimus targets the global labor market worth trillions of dollars. Therefore, we cannot use traditional metrics to value it. The capital market will define a brand new track for it, allowing for a valuation of 50 to 100 times P/S based on future pricing.

Even if we only calculate based on the 30 billion dollars in annual service fees, at an 80 times P/S, its valuation would reach 2.4 trillion dollars. If the market believes that Tesla will dominate this trillion-dollar emerging industry, it could be valued at 2.5 to 3.5 trillion dollars.

In addition to the valuation, this compensation plan also includes a very stringent target—an annualized EBITDA of up to 400 billion dollars, which is the ultimate condition for unlocking a key part of the compensation plan. Based on the above projections, how far are we from this "ultimate goal"?

Musk's 1 trillion dollar compensation plan is not free money. In addition to achieving sky-high company valuations, there is an extremely demanding ultimate condition: the company must earn 400 billion dollars in "core profit" each year.

Based on the most ambitious predictions, let's sum up the profits from Tesla's future major "money-making machines":

Automotive business (140 billion in revenue, 20% profit margin) = 28 billion dollars

FSD software (12 billion in revenue, 90% profit margin) = 10.8 billion dollars

Robotaxi network (125 billion in revenue, 70% profit margin) = 87.5 billion dollars

Optimus robot services (30 billion in revenue, 80% profit margin) = 24 billion dollars

Adding in the often-overlooked energy and other businesses, we optimistically assign it 30 billion dollars.

Now, let's summarize: 28 + 10.8 + 87.5 + 24 + 30 = 180.3 billion dollars. This number is still 220 billion dollars short of the ultimate goal of 400 billion dollars, not even halfway there!

So, how do we bridge this massive gap of 220 billion dollars?

First, there must be absolute economies of scale. The previously assumed 1 million Robotaxis and 1 million Optimus units are far from enough. This number needs to be expanded to 2 million or even 3 million. Just 2.5 million Robotaxis alone could directly contribute over 200 billion dollars in EBITDA, enough to fill most of the gap single-handedly.

In addition to quantity, there also needs to be a focus on "quality" profits, meaning increasing profit margins. The pricing or subscription rates for FSD may be higher than we expect, and the service fees for Optimus could rise as its capabilities improve; the manufacturing costs of cars could drop to unimaginable levels due to economies of scale.

Moreover, throughout the entire plan, the energy business acts like a "hidden boss." Imagine a future where there are tens of millions of Tesla electric vehicles globally, with countless homes and factories using Tesla's energy storage batteries. Connecting them through a network would create a "virtual power plant" spanning the globe. Selling electricity during peak times and storing it during low times—this "middleman" business alone represents a profit space in the hundreds of billions.

A "Golden Handcuff," a Trillion-Dollar Gamble

After discussing that grand and somewhat sci-fi blueprint, let's pull back the lens and examine the human relationships and business games behind it. This exorbitant compensation is far more than just money; it resembles an exciting card game laid out on the table.

Musk's intentions have long been no secret. He has publicly stated multiple times that he hopes to hold about 25% of the voting rights in Tesla; otherwise, he would prefer to venture out on his own with AI and robotics.

After Musk sold a large amount of stock to buy Twitter (now X), his ownership stake decreased significantly. This new compensation plan, if he can see it through to the end, would allow his shares to return to the range of 25%-29%.

Thus, this feels more like a setup for him to "legitimately" and firmly grasp the steering wheel of Tesla's future. He wants to ensure that his AI visions, which many see as risky or even somewhat crazy, are not derailed by shareholders focused solely on immediate profits or by "barbarians" that might emerge unexpectedly.

For Tesla's board, this is a pair of "golden handcuffs" for Musk.

Musk is a powerhouse, simultaneously managing SpaceX, which builds rockets, Neuralink, which works on brain-machine interfaces, and making waves in social media and political circles as the "Iron Man of Silicon Valley."

The board's biggest headache is likely: how to ensure this "big boss" focuses his main energy on Tesla?

The answer lies in this ten-year plan, deeply tied to the future blueprint he has drawn up. This is undoubtedly the most splendid "golden handcuff" tailored for him. Want to earn the rewards? Then he must fulfill these commitments over the next decade.

So, circling back to our initial question: how does Musk plan to take home this 1 trillion dollars?

The answer is: by personally transforming Tesla from a leading electric vehicle company into a super technology platform that integrates AI software, robotics, shared mobility, and energy.

Therefore, for the shareholders who will vote on November 6, the choice they face becomes exceptionally clear and critical. This vote is far more than just deciding whether to grant the boss a hefty bonus. It resembles a national referendum, allowing every investor to answer with real money:

What you are investing in is a better car company or a potential AI and robotics empire that could define the next era?

Regardless of the outcome, this compensation plan itself has already painted a sufficiently shocking picture of the future. It tells the world in the most straightforward way: in Musk's dictionary, limits are meant to be broken.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。