The winds of live streaming are rising, and fans are buying tokens.

Author: Alea Research

Translated by: Deep Tide TechFlow

The rise of live streaming has transformed content from a form of entertainment into a high-leverage market. The input-output ratio of traditional work for one hour is higher than fixed income, while live streaming multiplies the output of one hour by the number of viewers. An hour of live streaming can generate thousands of hours of watch time, which is a valuable asset that advertisers, platforms, and creators can monetize. However, the income distribution among creators remains extremely uneven.

On Twitch and YouTube, income primarily comes from subscriptions and advertisements, with tiered revenue sharing meaning that average streamers can only earn 50% of subscription revenue, while top creators can earn over 10 times that. New entrants like Kick have disrupted this model, allowing streamers to retain 95% of subscription revenue, sparking competition between "Kick vs Twitch" and leading to multi-million dollar signing contracts.

In this context, the Pump.fun platform has emerged, known for issuing memecoins. In mid-2025, it quietly added live streaming features and adopted a dynamic fee model that links streamer income to the performance of their own tokens.

In this issue, we will explore how the creator capital market on Pump.fun operates, why it is so important in the competition with Kick and Twitch, and why live streaming should be tokenized.

Stay updated on market dynamics ⬇️

Current Situation: Kick vs. Twitch

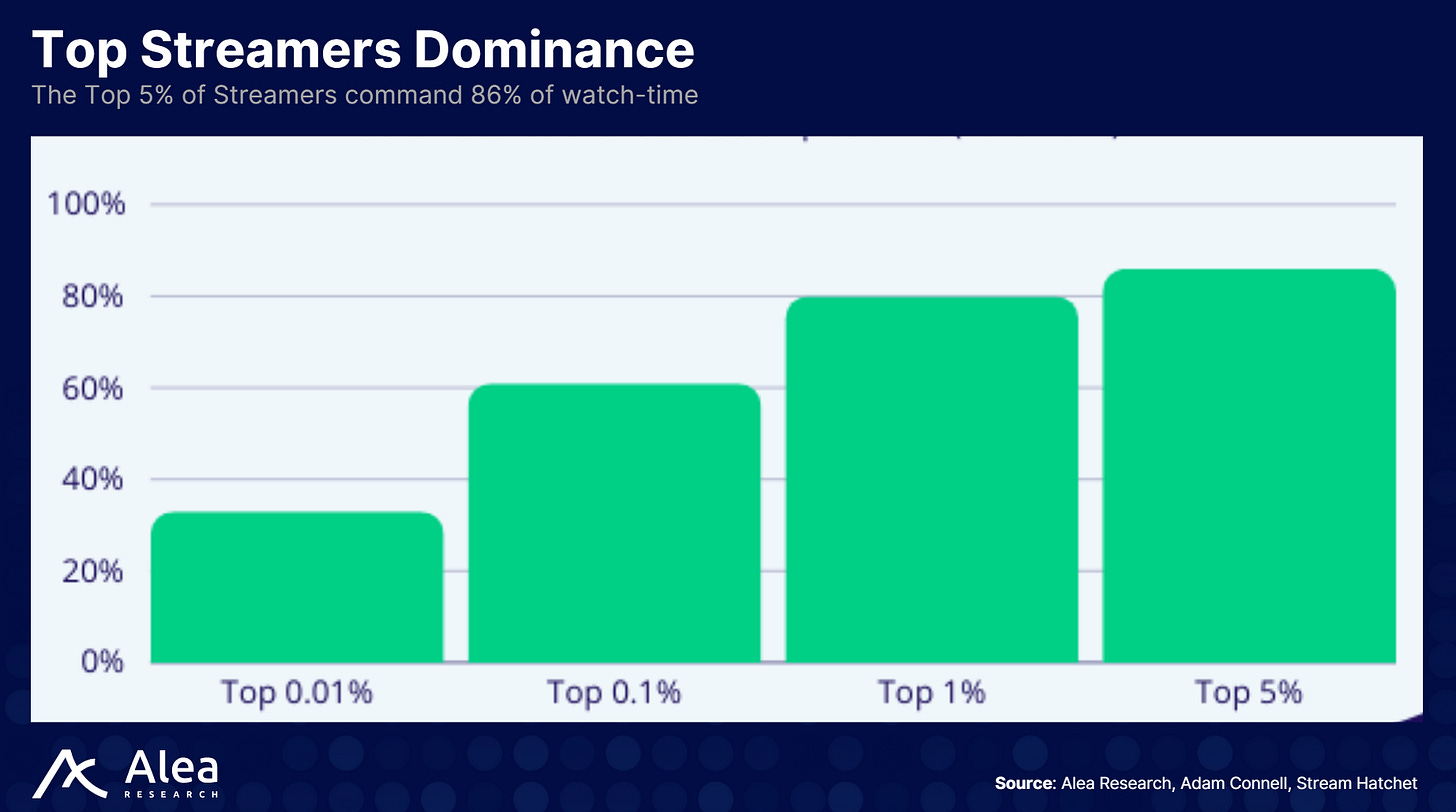

Twitch is the pioneer of the live streaming industry, with an average monthly watch time of 1.5 billion hours. For most streamers, the standard revenue share for subscriptions is split 50/50 with Twitch, while ad revenue (through the Ads Incentive Program, AIP) is 55/45. Top streamers with the Partner Plus program can earn a more favorable 70/30 subscription split. This creates a Pareto effect, where top creators account for 80% of watch time and revenue, while smaller creators compete for the remaining 20%.

For example, the active subscriber count and income of Twitch's top streamer Kai Cenat nearly exceed the combined total of streamers ranked 2nd to 10th.

Kick launched in 2022, supported by the gambling platform Stake.com. It challenges Twitch by promising streamers to retain 95% of subscription revenue and allowing content that Twitch restricts (such as gambling). Kick has also signed lucrative contracts with top Twitch streamers to attract them to migrate. For instance, it was reported that Kick offered Twitch star xQc a two-year non-exclusive contract worth $100 million, while also signing Amouranth for approximately $30 to $40 million.

Between these announcements, Kick added over a million users. These moves indicate that live streaming platforms are willing to spend big on attention, but revenue still primarily comes from subscriptions, ads, and donations.

Attention Economy and the Pareto Effect

A common misconception is that with more streamers joining, live streaming is a zero-sum game where rewards and watch time get diluted. In reality, attention follows a Pareto distribution, where a few viral creators capture most of the audience share, while the majority struggle. When top creators like Kai Cenat or iShowSpeed start streaming, they expand the overall viewer pool, attracting millions of fans who may have never used the new platform to register and watch.

This phenomenon explains why Kick is willing to pay hefty signing fees: introducing attention capital can grow the entire ecosystem rather than just poaching existing streamers' audiences.

On the Pump.fun platform, traditional Twitch streamers have already begun to migrate (for example, League of Legends streamer BunnyFuFuu).

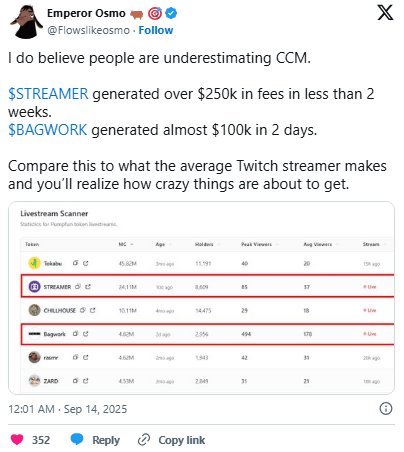

Pump.fun attempts to achieve this dynamic by allowing fans to import their spending power through tokens. Core fans have already budgeted for monthly donations, and purchasing a streamer’s tokens simply converts that spending into a tradable asset. Token holders are incentivized to promote the streamer (driving up the price), and if the creator goes viral, early supporters can share in the profits. In this sense, streamer tokens convert donations into a form of equity, aligning fan incentives with creator success and potentially alleviating the "dilution effect" when new streamers join.

Entering the Creator Capital Market

The live streaming transformation on Pump.fun introduces a completely different economic model: streamer tokens. Viewers no longer support streamers solely through tips or subscriptions; instead, they purchase tokens linked to specific streamers. The value of these tokens fluctuates with supply and demand, creating an investment-like mechanism that allows fans to speculate based on the creator's popularity.

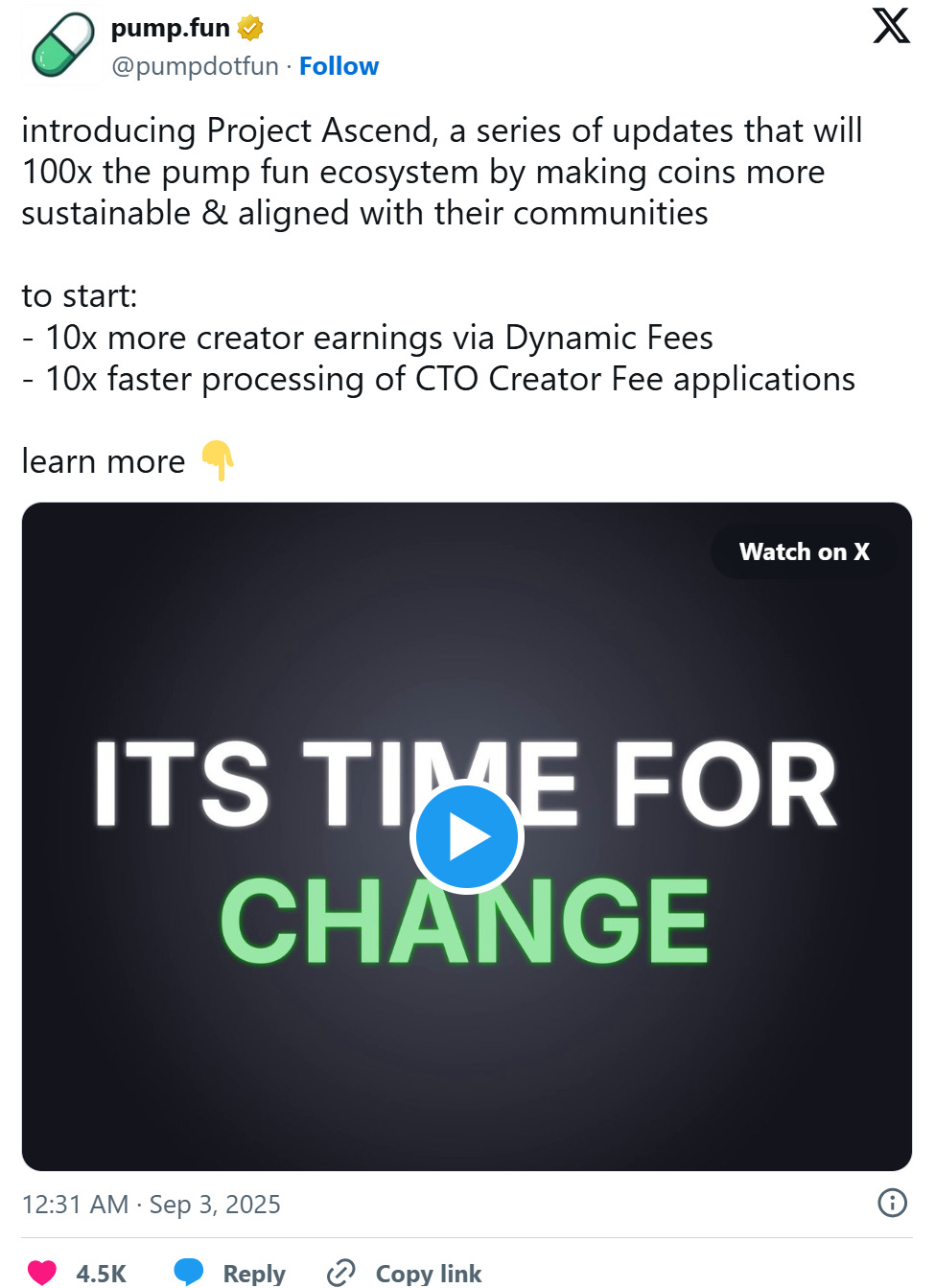

Streamers earn a fee on each token transaction (up to 0.95% for smaller market cap projects, in the Project Ascend initiative), and as the token's market value grows, this fee naturally decreases to 0.05%.

Pump.fun has also reopened live streaming features for some users and improved content moderation mechanisms to prohibit violence and animal abuse. However, its core innovation lies in this tokenized feedback loop, tightly linking fan interaction with creator income.

Pump.fun's Tokenized Live Streaming Model

Project Ascend has changed Pump.fun's fixed creator commission of 0.05% to a floating fee, charging 0.95% for tokens with a market cap below $300,000 and 0.05% for tokens with a market cap above $20 million. This mechanism allows small creators to earn nearly 1% from each transaction of their tokens. According to Blockworks, this update has helped Pump.fun regain market share, generating over $834 million in total revenue, with an annualized operating rate close to $492 million, while driving daily repurchase amounts exceeding $68 million.

After suspending live streaming features due to harmful behavior, Pump.fun has reintroduced live streaming services for 5% of users and established stricter guidelines: prohibiting violence, animal abuse, and hate speech. Although the platform anticipates some NSFW (not safe for work) content will still appear, it aims to allow some impactful entertainment content while maintaining a safety baseline. This is crucial for mainstream user acceptance and avoiding failures in their initial attempts.

Viewers can buy and sell streamer tokens without permission and are not subject to liquidity control by any single entity. The long or short functionality of streamer tokens enhances market depth and provides price signals that reflect community sentiment. Tokens linked to creator performance also incentivize streamers to maintain a consistent streaming schedule and strengthen community interaction.

Why Choose Pump.fun Over Twitch or Kick?

- Economic Incentives: On Twitch or Kick, fans' donations or subscriptions do not yield any financial returns; whereas on Pump.fun, donations become an asset. If a streamer’s popularity rises, their tokens may appreciate, providing speculative returns for early supporters.

Creator Income Grows with Success: Streamers' income is no longer limited by fixed subscription fees. They can earn fees through token trading volume and benefit from network effects as more traders join. Pump.fun's dynamic fee model means that small creators can earn up to 19 times more per transaction compared to the old uniform fee system.

Community Ownership: Streamers share economic incentives with their audience. This may encourage more collaborative content, such as joint missions or community decisions on future streaming directions.

Summary

Pump.fun bets on tokenizing streamer fan bases, unlocking a larger attention and donation market by allowing fans to share in the profits. Whether it can replicate Kick's early success depends on its ability to attract top talent, maintain a strong content moderation mechanism, and expand its dynamic fee model.

But if the experiment succeeds, it could create a new paradigm for the creator economy, merging live streaming, trading, and speculation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。