"The fundamental reason I am a Pump maxi is that I deeply understand the darkness of human nature and the inevitability of the world heading towards chaos."

Author: Crypto Weituo

In July, I stood as the top scholar in the Chinese Pump community amidst widespread FUD, being criticized for two months and blocked by thousands.

Pre-sale +27 +45 rolling positions to buy the dip, taking losses on long positions repeatedly, enduring significant losses with the mindset of "spot trading is not afraid." $Pump is the most painful coin in my two years of holding large positions. Now, I finally hear phrases like "the great scholar has his own interpretations" and "the light boat has passed through ten thousand mountains," so I won't say things like "I said it long ago."

In my view, the questions raised by the wizard regarding the Pump live-streaming game, as well as the majority of discussions about Pump's model and moat in the Chinese community, are essentially about understanding Pump's audience.

TL;DR

Pump is right because he understood earlier than anyone that this generation of young people is the "PVP generation";

Pump is a mass media phenomenon based on the values of the PVP generation, equivalent to Truth Social and Bluesky;

The game of live-streaming coins is no different from other coins, understood from the perspective of the track and ecosystem;

Pump must engage in live-streaming coins because it needs to capture Taker traffic from trading platforms;

The fundamental reason I am a Pump maxi is that I deeply understand the darkness of human nature and the inevitability of the world heading towards chaos;

Understanding the PVP Generation

For any market, the decisive factor is the audience.

Pump's greatest moat is his audience, which I referred to as the "PVP generation" in the open-source discussion 23, a generation born after 2005.

Why?

The traditional moats we talk about—liquidity, technology, regulatory barriers, etc.—are based on the economic assumption of "rational individuals"—that individuals in economic activities are self-interested and can rationally weigh pros and cons to maximize their economic benefits at the lowest cost. BTC mining games, DeFi, token economic models, etc., all operate on this premise.

Of course, in practice, not everyone can be a saint. The transmission of rationality is institutional; as long as the holders of discourse power among economic participants are "rational," these models generally hold.

The problem lies here: the PVP generation is the first generation to grow up under the discourse power of social media.

The characteristics of this generation are:

Unlike our generation, they did not experience struggles for basic needs in childhood; they have no worries about food and clothing.

The influence of social media and other "irrational amplifiers" on them far exceeds that of rational education.

The vast majority of this generation in most countries have never experienced the global economic growth that their parents did; instead, they face a sharp reduction in job opportunities due to technological replacement and industrial transfer.

As a result, their cognitive style is "irrational," based on labels rather than rational analysis.

Moreover, the proportion of the smartest individuals engaging in zero-sum industries has significantly increased, including finance, real estate, entertainment, and other service industries. The essence of these industries is to extract money from others' pockets and put it into their own, dividing the cake rather than baking it.

If you don't believe it, you can see that in the past decade, the most profitable companies in China have all shifted to finance, and many highly educated individuals are now live-streaming or becoming internet celebrities. In the U.S., most young people lean left, focusing not on the right's "make America great again" (baking the cake) but on "social justice warrior" (dividing the cake).

Zero-sum, in the eyes of the previous generation, is about harvesting leeks; for this generation, it is the new normal. Therefore, it is meaningless to judge them with the universal morals and values of the past.

They are indifferent to survival issues, and their understanding of achievement is "how many followers I have" and "how I go viral," rather than how to build a "business" like their parents did. They even disdain their parents' values.

Behaviorally, this generation may lack professionalism but is highly action-oriented, knowing how to purposefully "attract attention," detesting being judged even slightly, and having a very low tolerance for delayed gratification.

The Core Moat of Pump

Pump's success mainly stems from understanding the demands of the PVP generation:

No moral judgment

Super timely feedback stimulation

Low barriers to entry

The latter two are addressed through product features, which many say "have no moat."

Thus, the core of Pump's brilliance lies in shaping a value system that does not adhere to traditional moral judgments; as long as you win and attract attention, you are impressive. Pump will never hypocritically tell you "community first," "long-term value," "the team has a vision," etc.

Even if you rug like $Quant or $HANDS, the official and community accounts will only treat you as a new meme to be edited into videos. There is no concept of rights protection in the entire Pump ecosystem.

Various news coins, political coins (even so-called "dead coins") may be harmonized on other platforms or even Twitter itself, making it impossible to monetize. But on Pump Fun, everything is possible.

Whether it's the devs or the trenches of the PVP generation, they hate being rug-pulled but hate being preached to even more, being told that what they participate in "is a scam, is beastly, is harvesting leeks." For the incels of the PVP generation, the trenches are trenches, but being denied in terms of values is a visceral aversion.

Like it or not, values are the foundation of mass media.

Just as right-wing figures like old Deng detest being silenced on Twitter during Jack Dorsey's era, leading to the creation of Truth Social; left-wing figures like old Deng detest the post-Musk X, which they see as "Farcist Rhetorics," and thus move to Bluesky. People choose their echo chambers based on their value inclinations. The PVP generation feels that everyone else is old Deng, so they choose PumpFun.

If you ask me why I understand this so well, it might be because "birth understands birth."

The Game of Pump Live Streaming Coins

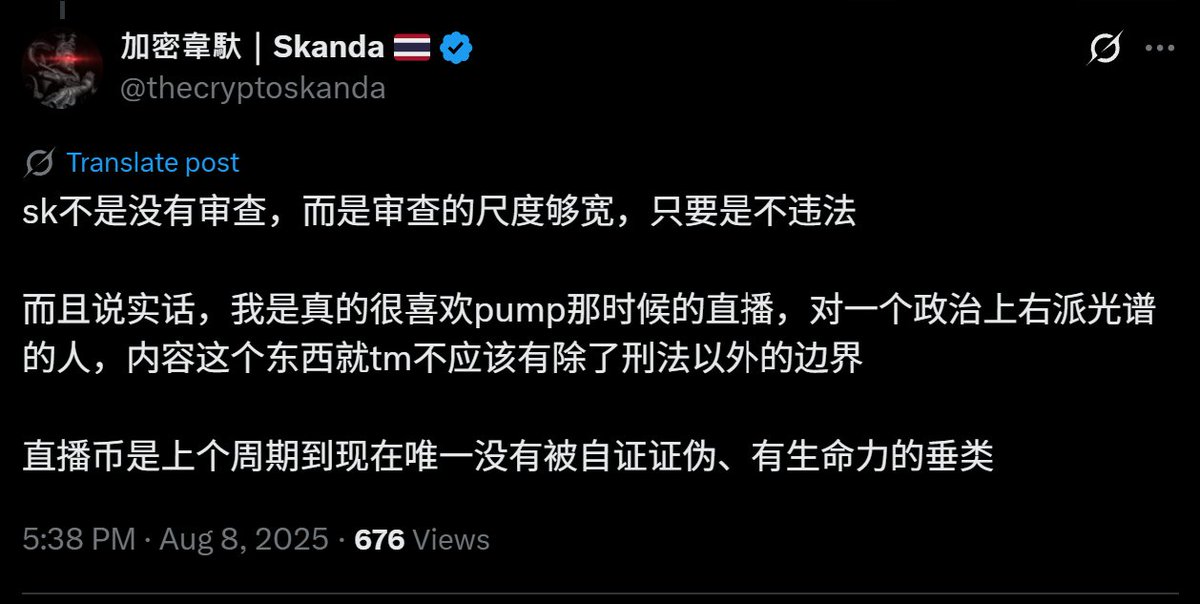

Last year, during a conversation with friends, I clearly saw the potential of live-streaming coins and believed that live-streaming coins were the only track that had not been falsified last year (Pump's interruption of live streaming was due to regulatory changes, not because it couldn't continue). This became the main reason I supported @Sidekick_Labs at that time.

Of course, the questions raised by the wizard were also very representative: web2 is about tipping, so streamers are motivated to keep streaming to earn money. In web3, the streamer buys in at the bottom, streams for a while, dumps, and then what? To earn transaction fees? If a lot of coins go to zero, does the game keep getting pushed forward? Is the market cap getting lower and lower?

First, the game theory he mentioned is correct, but it stands on a specific coin. If we consider the track, we need to think in reverse: if it’s not live streaming, would it be the same?

Whether it’s AI or Bonk’s CTO, or ICM promoted by Solana, or even not limited to on-chain launches, including exchange VC coins, devs have always had the advantage of not being held accountable; they can dump and walk away.

The only factors that can influence whether a team abandons a project are the initial costs and whether there is a continuous cash flow. The higher the initial costs and the continuous cash income, the less likely the project party is to abandon it. When I shared the PUMP ICO video on July 9, I said the same thing about Pump itself, and at that time, I was heavily criticized; many believed Alon was a beast, so Pump would definitely rug.

Looking back now, is that the case? Similarly, a streamer who rugs once is unlikely to stream again; it’s a one-time deal. If they can continuously earn creator fees like Bagwork, why would they want to kill a cash cow?

Second, the live-streaming industry in web2 is an industrialized system; streamers are just platforms (from the perspective of memecoins), while the real driving force is the buying of traffic, finding backers, and the unions and arms dealers that wash the flow of funds. Streamers don’t take home much money.

Live-streaming coins are the same; the success of the coin mainly relies on market makers (MM). Streamers are unlikely to be MMs, so Pump is responsible for attracting wannabes, while MMs take on the responsibilities of the unions.

There are two points here:

The most profitable part of a casino is not the gambling itself, but the flow of money, with a ratio of about 1:9;

For applications like ICM or AI, as an MM, you need to control a team; for live-streaming coins, you only need to control one person.

Why Must Pump Engage in Live Streaming Coins?

This is Pump's wisest decision.

The entire flow lifeline on the Solana chain does not lie in the platform but in the trading platform, specifically Axiom.

Solana can systematically smear Pump, inciting VC funds to support Bonk or other platforms, pushing Useless, but cash flow and attention are two different things. Users trading either Bonk or Pump's coins do so through Axiom; no matter what story you tell, it’s all the same CA.

However, live streaming is different; the content of live streaming directly translates to K-lines. Placing orders while watching a live stream provides an asymmetric information advantage compared to watching Axiom's K-lines. Live streaming is not a specific narrative; it is a traffic carrier in itself. The order volume will genuinely tilt towards Pump.

Therefore, the key data for the next phase is to see whether Pump's front-end order volume can capture market share from Axiom, rather than looking at the ratio between Pump and other platforms.

Why Did I Support Pump So Early?

For quite some time, I was almost the only Pump Maxi in the Chinese community, and if I had to say why:

I have led a dev team myself;

I have worked on a launchpad but failed, understanding why I had other launchpads in Solana that would fail, witnessing Pump's brilliance;

I got to know Pump's early investors early on, gaining firsthand insights and witnessing the Pump team's working methods and logic from the front row;

I spent a lot of time with young people;

I have been in the market for 10 years; perhaps I am not proficient in secondary markets, but I understand human nature and the darkness of human nature even more. My understanding of the world at its core is heading towards chaos, and chaos is a ladder;

As I said, the Pump team is sharks, reading Napoleon's conquerors on the toilet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。