作者:Kunal Doshi

编译:深潮TechFlow

近来,关于 CCM(深潮注:creator capital market,创作者资本市场,与内容创作者经济相关)的讨论很多,所以我计算了一些关于创作者收入的数据@pumpdotfun 对比 @Twitch。Pump 不仅仅是在与 Twitch 竞争,它还在抢占 Twitch 的市场份额。

创作者收入

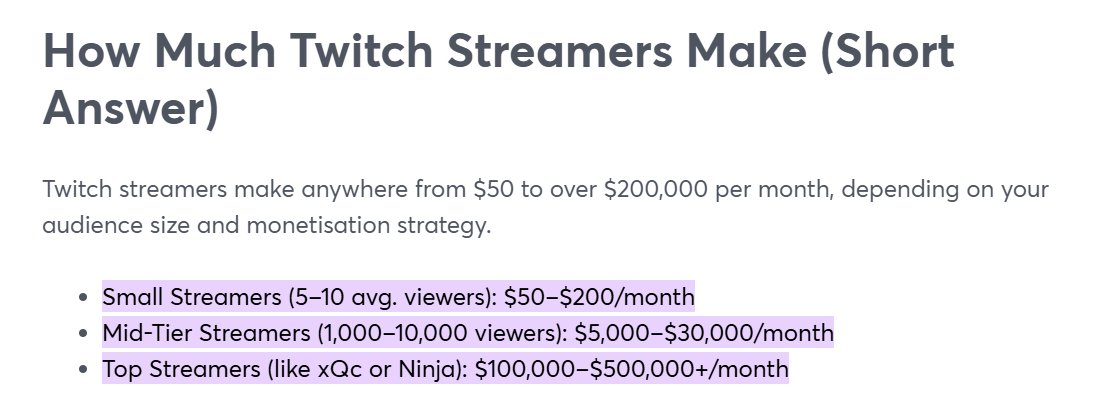

Twitch 上的创作者通过订阅和广告赚钱。订阅费每月 4.99 美元、9.99 美元或 24.99 美元,创作者和 Twitch 各占 50%。广告平均每千次展示费用为 3.50 美元,创作者获得广告收入的 50% 至 70%。实际上,这意味着小型主播每月只能赚几百美元,中型主播可以赚 5,000 至 3 万美元,而顶级主播每月可以赚到 10 万美元以上。

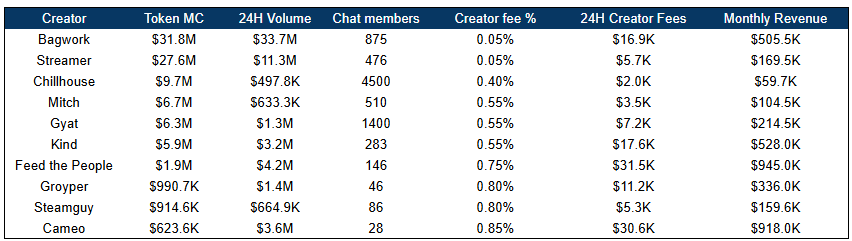

Pump 彻底颠覆了这一模式。创作者不再通过订阅和广告赚取佣金,而是通过其代币赚取交易费。在早期阶段(市值 8.8 万美元至 30 万美元),每笔交易的费率约为 0.95%,当市值超过 2000 万美元时,费率逐渐降至 0.05%。

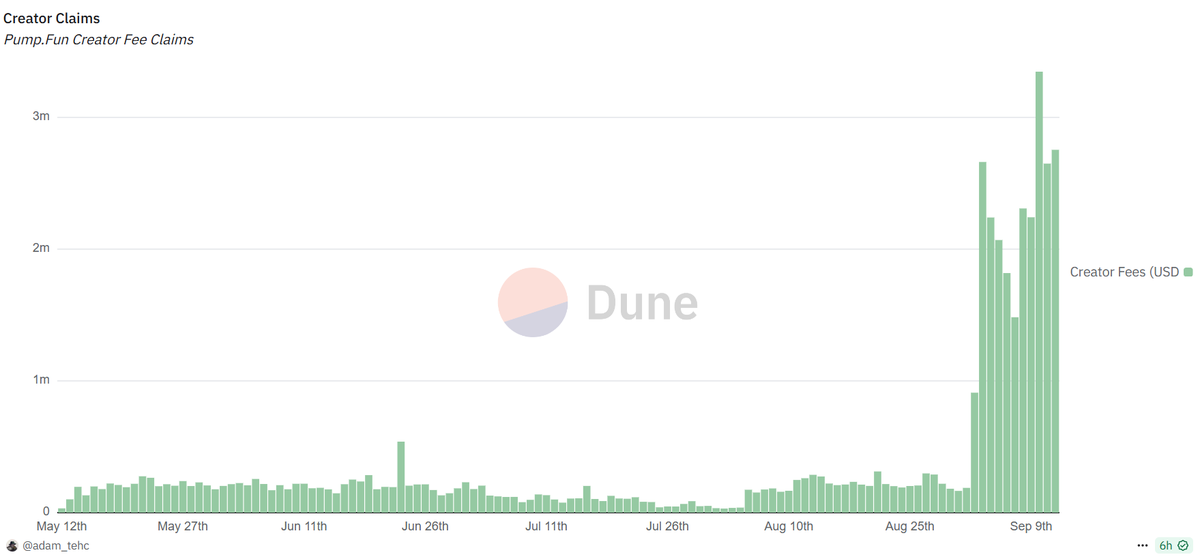

仅在昨天,就有 9,000 个钱包领取了 280 万美元的创作者费用。这意味着平均每位创作者每天可获得约 300 美元的报酬,如果持续下去,每月可获得约 9,000 美元的报酬。

看看 Pump 首页上的 10 个创作者币,大多数都已经产生了可观的日收益。在 Twitch 上,要达到六位数的收益需要 1 万+ 的同时在线观看人数。而在 Pump,创作者通过规模更小的社区就能实现类似的收入水平。

市场估值

从估值角度来看 @Twitch 在 2024 年 10 月的价值为 450 亿美元,当年的收入为 18 亿美元,相当于 25 倍的估值倍率。 @pumpdotfun 根据其 8 月份的数据,其估值倍率接近 14 倍。

更重要的一点是激励机制。Pump 上的早期创作者可以拿到高达 80% 的费用,而且随着他们的发展,平台才会逐步提高抽成比例。这正是 Twitch 的不足之处,也是 Pump 看起来如此具有颠覆性的原因。

核心竞争力

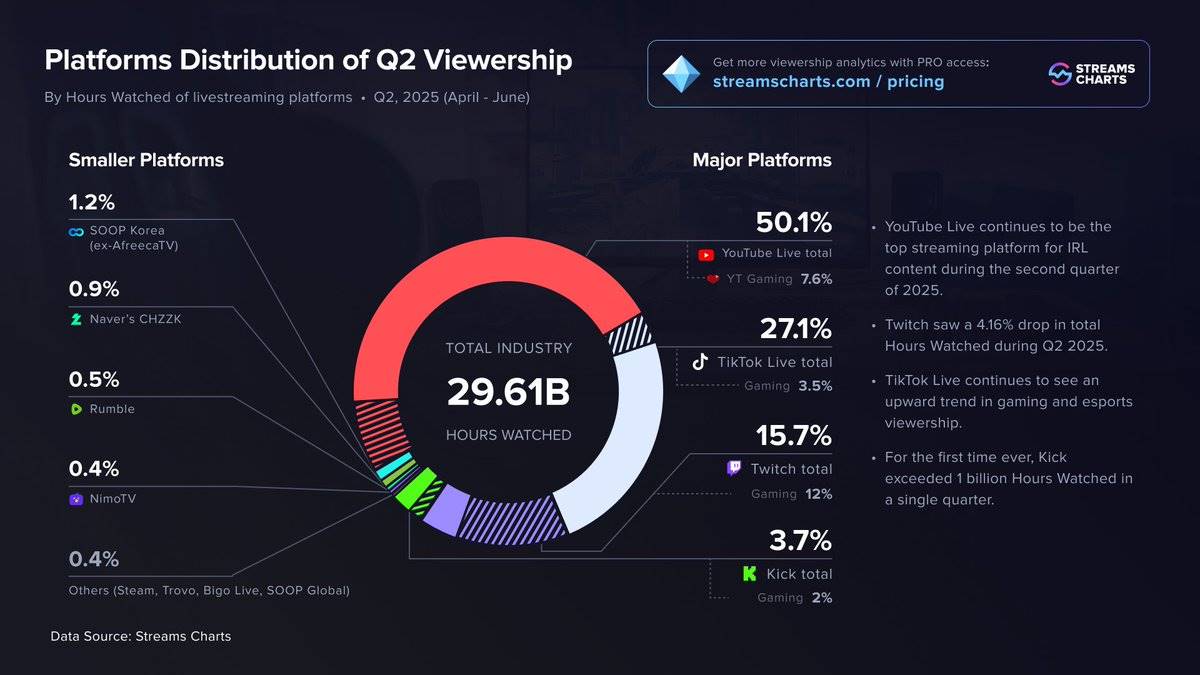

Pump 为小型创作者提供了过去只有 Twitch 顶尖 1%创作者才能享有的收入机会。如果 Twitch 的创作者群体中哪怕只有一部分迁移到 Pump,整个流媒体经济可能会被彻底重塑。而不仅仅是 Twitch,TikTok 和 YouTube 的创作者也可能成为迁移的一部分,这使得未来增长空间更为巨大。

可持续飞轮

最大的问题在于可持续性。Pump 的发展取决于创作者如何使用他们赚取的费用。如果他们将收入重新投资到自己的代币或更好的内容上,就能推动飞轮效应。

我们还需要看到更多直播观众,以吸引更顶流的主播。目前感觉更像是投机取巧,而非真正的内容消费,但这是一个充满希望的开端。向 Pump 致敬!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。