Author: Zhou, ChainCatcher

Polymarket has almost become synonymous with prediction markets. Public information shows that since the beginning of this year, Polymarket's monthly trading volume has repeatedly exceeded $1 billion, creating a significant gap with the second-ranked Kalshi. The project has not only received tens of millions of dollars in investment from Trump’s son but is also preparing to return to the U.S. market while advancing a new round of financing, with market estimates valuing it at up to $10 billion.

Against this backdrop, a number of third-party ecosystems have emerged around Polymarket, including data/dashboards, social experiences, front-end/end-user interfaces, insurance, and AI agents. On September 12, RootData included some representative projects in the "Polymarket Ecosystem Projects" compilation, and this article will introduce them one by one.

Polysights | One-stop Analysis Dashboard

Polysights is a one-stop analysis dashboard centered around Polymarket. Users can quickly filter topics and expiration dates, while the page provides key readings such as price/trading volume history, market depth and spreads, and capital flow. The built-in AI summary and arbitrage/trading indicators help identify mispricing opportunities within or across markets. The platform supports custom selections and instant alerts (including Telegram push notifications) and provides trader/market leaderboards. It compresses "topic selection, analysis, and alerts" into one screen, reducing page switching and manual comparisons, making entry judgments faster and cost estimates more intuitive.

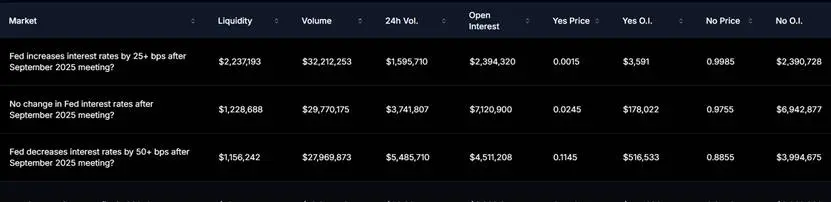

Polymarket Analytics | Official Statistics Platform

Polymarket Analytics is the official statistics platform launched by Polymarket. Users can pull up trading volume, open interest, price/trading history curves, and address profit/loss and position changes by searching for markets or addresses, and can export CSV for review. The platform does not pursue flashy visual attempts but excels in complete fields and stable metrics, making it suitable for media writing, investment research comparisons, and monthly/quarterly report production, used for data verification and chart generation.

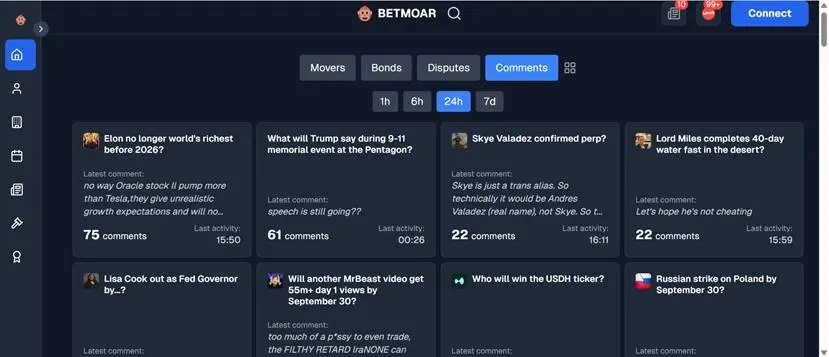

Betmoar | Third-party Discovery/Monitoring Front-end

Betmoar is a third-party discovery and monitoring front-end that aggregates Polymarket's markets into a dashboard. Its homepage divides the market into four views: Movers (ranking by price changes and trading volume over 1h/6h/24h/7d), Bonds (focusing on deposit/staking dynamics and risk capital changes), Disputes (a collection of markets in arbitration or determination stages), and Comments (summarizing the latest comments and activity levels across markets). Users can filter with one click or sort by trading volume to quickly determine the hottest/latest events, with orders still redirecting to the official Polymarket page for completion.

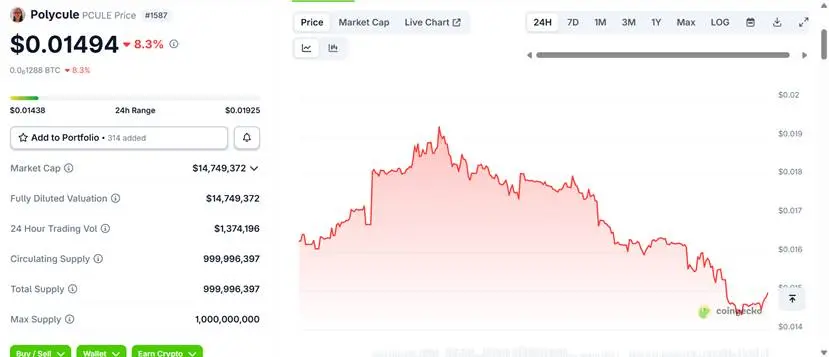

polycule | Polymarket's Telegram Trading Bot

polycule is a Telegram trading bot that connects with Polymarket, allowing users to search markets, view key market points, and directly place YES/NO orders in the chat window, making it more suitable for mobile light-entry usage scenarios. Friendly to new users, polycule includes a bridge from Solana to Polygon (using deBridge) and can automatically convert a small amount of SOL to POL for Gas, reducing the currency exchange and preparation costs for first-time participants.

In May 2025, polycule issued the token PCULE, currently valued at approximately $14.75 million. In June, the team announced a $560,000 investment from AllianceDAO; the same month, X and Polymarket announced an official partnership, enhancing the exposure and distribution of prediction markets on mainstream social platforms, which indirectly benefits tool-based products surrounding Polymarket.

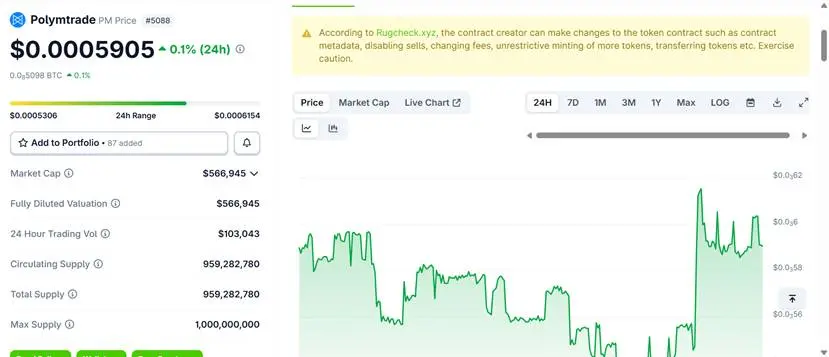

Polymtrade | Trading Terminal

Unlike polycule, Polymtrade is a heavy trading terminal aimed at Polymarket. It adopts a multi-panel layout, displaying market data, order book/depth, orders, and positions on the same screen, supporting keyboard shortcuts and batch ordering. Additionally, its order window shows estimated slippage and fees, and the combined view can be sorted by topic or expiration order, facilitating hedging and grid management. The value of this project lies in compressing the "view market—place order—adjust position" process into a few steps, making the Polymarket experience closer to that of intraday trading exchanges. Its token PM was launched in July, currently valued at approximately $560,000.

fireplace | Social Trading Information Stream

fireplace focuses on the social experience of the Polymarket prediction market, presenting the latest trading dynamics of users' followed accounts in a news feed format, allowing comments, replies, and copying on any trade.

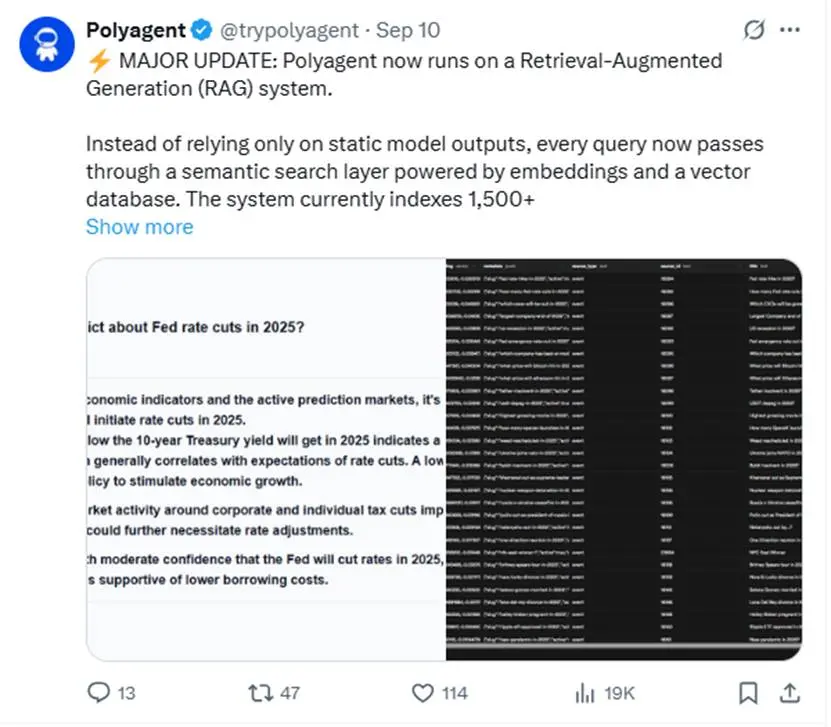

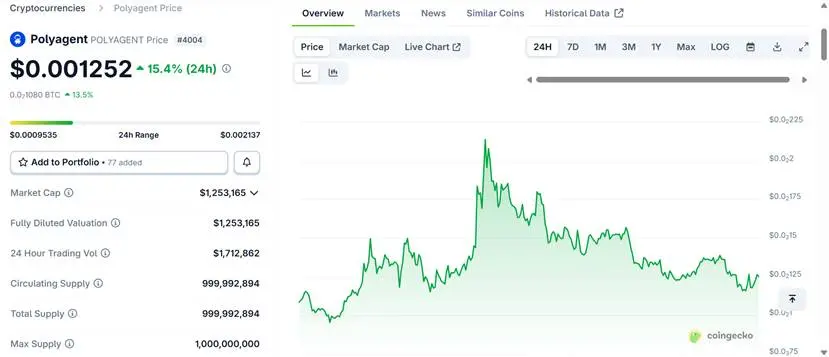

Polyagent | AI Assistant/Research Tool

Polyagent is an AI assistant/research tool centered around Polymarket, primarily focused on intelligence aggregation and analysis. The platform emphasizes using models + retrieval to interpret market data, and the official announcement has indexed over 1,500 Polymarket markets, providing search and dialogue functions, with recent features like tag search added. Its token POLYAGENT was launched on September 8, currently valued at approximately $1.25 million.

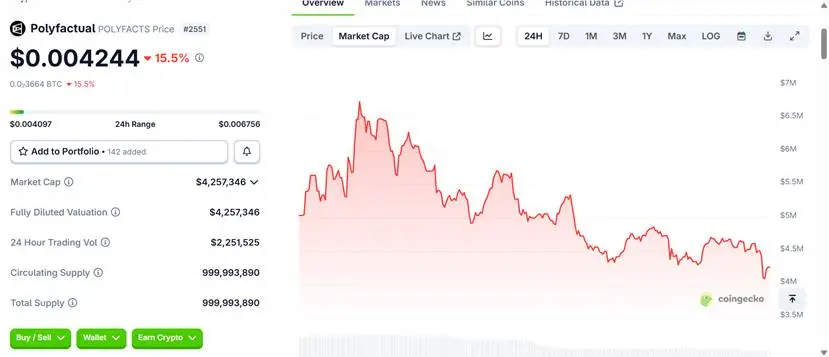

Polyfactual | Insurance + Arbitrage Dual Line

Polyfactual is a risk control and strategy platform aimed at prediction markets. The official business is currently divided into two lines: one part of the funds helps to cover abnormal risks in the market, while the other part aims to profit from price differences between platforms.

Insurance Side (Project X): Issues tokens tied to specific event outcomes, with the raised funds entering a "reinsurance/liquidity" pool. When a market experiences a determination/settlement anomaly, this fund provides protection for participants, effectively adding a buffer layer to the platform's determination layer. Token holders share premiums/earnings according to rules while also bearing corresponding risks.

Arbitrage Side (Project Y): Operates cross-platform bots to monitor Polymarket and platforms like Kalshi over the long term. Once inconsistencies in quotes for the same event are found on both sides, it simultaneously buys and sells to lock in the price difference, with the resulting profits distributed to token holders based on their POLYFACTS holdings/staking ratio. Its token POLYFACTS was launched on September 2, currently valued at approximately $4.26 million.

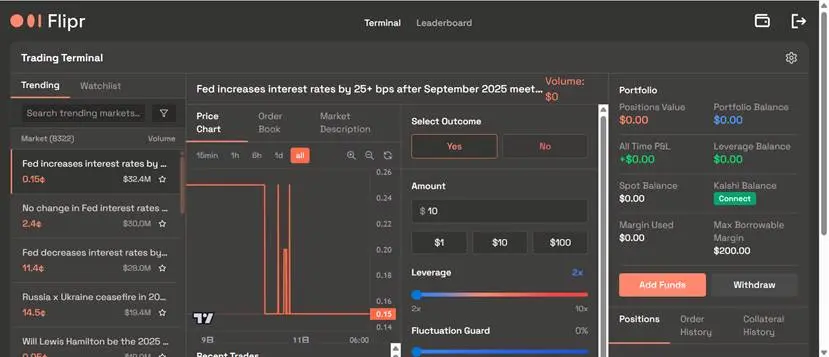

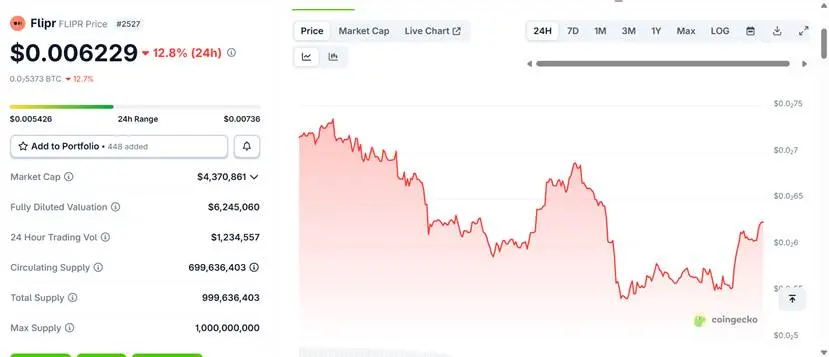

Flipr | Strategic Trading Bot

Flipr is a strategic Polymarket trading bot. Users can configure trigger conditions (price reaching, spread narrowing, volume increasing, keyword appearing, etc.) and execution rules (order quantity, slippage limit, phased entry/exit, automatic position reduction before expiration), allowing it to run continuously in the background. For users who do not want to monitor the market but have clear conditional trading rules, Flipr can turn specific operational ideas into executable strategies. Its token FLIPR was launched on July 11, currently valued at approximately $4.37 million.

Billy Bets AI | Sports Scene AI Agent

Billy Bets AI focuses on AI agents in the sports sector. After selecting leagues/teams, the system directly summarizes their recent performance, injuries, schedules, and market odds, providing probabilities and recommendations for win/loss/point spreads, along with links to related Polymarket sports events, allowing users to place orders with one click. The project's feature lies in connecting data with betting, providing a time-saving pre-match intelligence + execution combination for high-frequency sports users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。