How Sol Strategies Nasdaq Listing Expands Solana Access for Investors

Sol Strategies, a Canadian company fully focused on the Solana blockchain , has officially started trading on the Nasdaq under the ticker symbol STKE.

Source: Wu Blockchain

This marks a big step for both the company and the wider community, as it opens the door for more traditional investors to take part in the fast-growing ecosystem.

A New Identity for Sol Strategies

The company, which was earlier known as Cypherpunk Holdings, is not new to the crypto world. But this move to Nasdaq gives it a major push in terms of visibility and access to U.S. investors.

It will continue trading on the Canadian Securities Exchange (CSE) under the ticker HODL, but has dropped its U.S. OTC listing in favor of Nasdaq.

“This is a big moment not just for us, but for the whole crypto community,” said CEO Leah Wald. “We are proud to be one of the first Solana-focused companies to be listed on a major U.S. exchange.”

Strong Holdings and a Bigger Vision

Sol Strategies currently holds more than 435,000 tokens, valued at around $94 million.

This makes it one of the largest institutional holders of Solana . However, the company’s plan goes beyond just holding tokens.

It also operates validator nodes and offers staking services. These activities bring in revenue through staking rewards and infrastructure fees, giving investors exposure not only to altcoin’s price growth but also to the business model supporting the network.

Celebrating with the Community

To mark the Nasdaq debut, Sol Strategies held a unique on-chain bell-ringing ceremony at stke.community .

Participants could record the moment directly on the Solana blockchain, while a live audio session with leaders and company executives followed the event.

Why It Matters for Investors

By going on Nasdaq, Sol Strategies is now much more accessible to American investors , particularly institutions who have been seeking regulated and safe means of exposure to crypto. Trading on Nasdaq also enhances liquidity, facilitating easier buying and selling of the stock.

This listing is significant in particular because Sol Strategies is the first Nasdaq-listed firm specifically dedicated to infrastructure and treasury management.

That makes it an absolutely key player for anyone placing a bet on Solana's future growth.

Market Reaction and Solana's Momentum

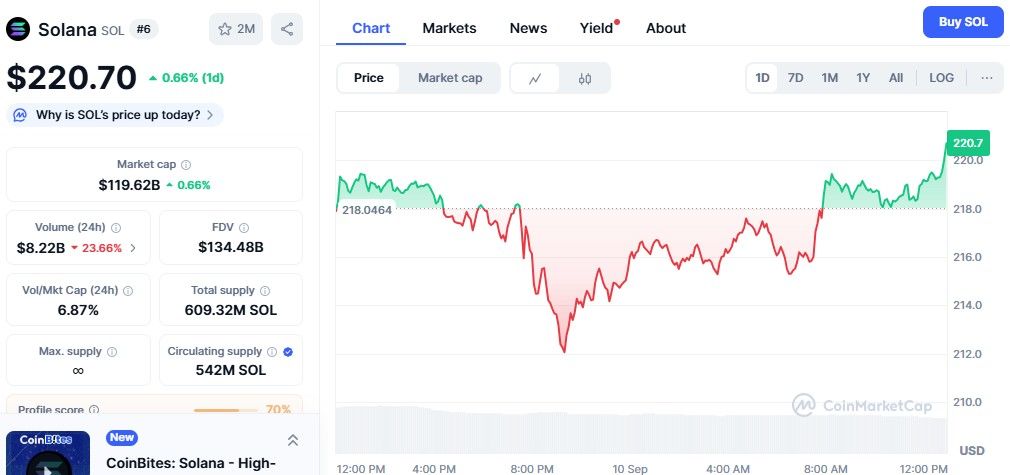

The news provided the digital asset with a significant boost. The price increased over 0.66% within 24 hours, even as the overall crypto market remained flat.

Many traders view this as an indication that there is growing confidence about Solana's long-term success.

Source: CoinMarketCap

The coin is now trading at $220.70 with an increase of 0.66% while trading volume has decreased by 23%.

Recent events, including the Alpenglow upgrade that accelerates transaction times and the growing adoption of tokenized assets on Solana, have also been contributing to the network's momentum.

What's Next?

In spite of the hype, Sol Strategies had a bad first day on Nasdaq, losing 42% of its stock. Nevertheless, the firm is optimistic about the future. With its significant holdings, robust business model, and ability to tap into global investors, it is well poised to grow with Solana.

For anyone keeping an eye on the Solana ecosystem, Sol Strategies is now a name to keep in close attention.

Also read: Hamster Kombat Daily Cipher September 10 2025: Play And Win免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。