Why Michael Saylor Continues to Buy Bitcoin and Hold for Long-Term Gai

Why in news?

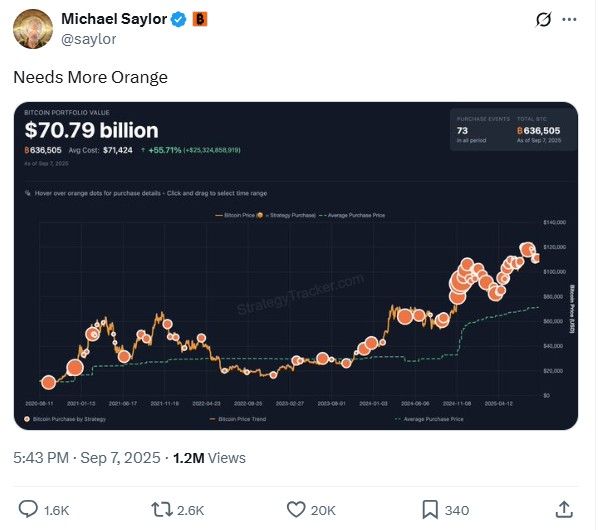

Recently, Michael Saylor firm, Strategy has made headlines by purchasing 4,048 Bitcoins on September 2, 2025. But the Bitcoin saga doesn’t stop there, he himself is signaling that his company is ready to buy even more digital gold coins, without focusing on BTC market ups and downs.

This bold approach highlights his unwavering confidence in the cryptocurrency, showing that for him, the coin is not just an investment but it is a long term strategy.

Michael saylor Bitcoin bold strategy

Recently in a X post , Michael Saylor says in a tweet that “Need more Oranges”, suggesting that his appetite for asset will never last. The Oranges are Bitcoin which he sees as the best asset for the future, shared a graph showing the Orange dote, signalling the buying.

Source: X

Currently Strategy holds a total of 636,505 BTC, the firm balance sheet is heavily BTC-focused. He explains that the company’s equity, debt and preferred shares combined effectively make 121% of the Strategy’s value tied to BTC, Michael shared in his X post recently .

Source: X

All the profits which are earned by the MSTR stock are reinvested into buying more Bitcoins, he believes that selling the coins could be a foolish step but holding is the key to long-term gains.

Michael's consistent purchases not only boost MicroStrategy’s stock but also grow its Bitcoin treasury. So far, he hasn’t sold a single coin, aiming for massive future returns.

CEO's next plan?

Recently, with the continuous purchase of the asset, Michael Saylor has ranked 491 in Bloomberg Billionaires Index with a net worth of $7.37 billion. Soon, with his strategy he will surpass Mitchell Rales whose total net worth is $7.41 billion.

Michael's this strategy might be because of following reasons that:

-

He will make him stand in the top 400 as the richest person globally.

-

Converting company cash (USD) into cryptocurrency to protect against the dollar losing value.

-

Big repeated buys by a public company may encourage others to follow, boosting adoption.

When Saylor Buys: How the Bitcoin Market Shifts

It might be possible that soon, Strategy will boost its Bitcoin treasury by buying more, as Michael Saylor suggests the dips a mega sale .

It could be possible that again he took the dip as an opportunity and purchased the asset in the current week. That will indirectly surge the coin’s price. As it happened earlier, when asset prices had been facing dips over weeks, but after firm’s purchase of 4,048 BTC, prices surged from $107k to $111k.

Conclusion

Michael Saylor is clearly all-in on Bitcoin, seeing it as a long-term bet, not just an investment. Every buy he makes grows MicroStrategy’s crypto stash and even shakes up the market a bit.

Disclaimer: This article is intended for educational and informational purposes only. The content reflects our analysis and opinion. It is not financial advice. Always conduct your own research and consult a professional before making any investment decisions.

Also read: Hamster Kombat Daily Cipher September 08 2025: Play And Win免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。