Gold Bitcoin Battle: Schiff and McGlone Highlight Risks for Investors

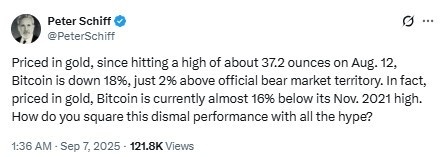

The long-running Gold Bitcoin debate has taken a fresh turn after gold advocate Peter Schiff pointed out coin’s poor performance against the precious metal.

Since August 12 when digital asset priced in gold peaked at 37.2 ounces it has dropped 18%, leaving it only 2% above official bear market territory. Compared with its November 2021 ratio, BTC is still almost 16% lower.

Source: X

Schiff stressed that while asset hit a new record above $3,586, The coin continues to struggle in relative terms. He said this proves golden remains the superior safe haven despite all the hype surrounding digital assets.

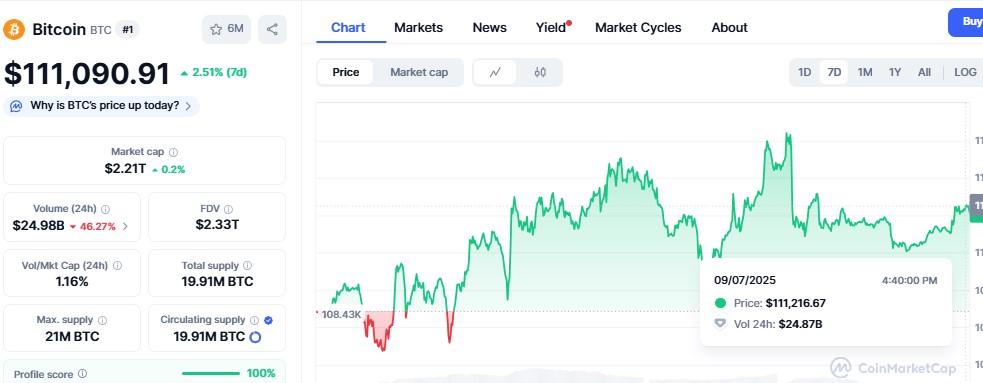

As the digital gold (BTC) is still trading around $110,267, and in the last week the coin was trading around $107k to $113k, showing dips and little surge sometimes triggers the market confidence.

Source: CMC

Gold Bitcoin Performance Shows Clear Contrast

The comparison shows why many big investors still trust metal asset more, like Robert Kiyosaki who supports B TC but also says to trust in Golds and Silver.

As per the Trading view data, it has risen 36% year-to-date, 42% over the past twelve months, and 23% in the past six months.Over the last five years, expensive asset has gained more than 85%, proving its ability to deliver steady growth through cycles.

The digital, however, trades near $110,160, showing short-term weakness down 0.46% in one day and more than 4% in a month. Yet, in the longer term, BTC remains a strong performer, with gains of 18% this year, 36% in six months, 96% in one year.

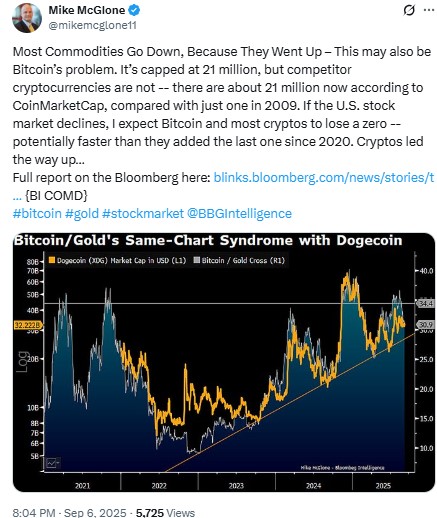

McGlone Warns of Wider Crypto Risks

Adding to the debate, Bloomberg analyst Mike McGlone said B coin’s 21 million coin cap does not shield it from risks. Back in 2009, there was only one cryptocurrency but now there are about 21 million, according to CoinMarketCap.

McGlone warned that if the U.S. stock market falls, Bitcoiin and other digital assets could “lose a zero faster than they added one since 2020,” showing their vulnerability to larger market shocks.

Source: X

C onclusion

The long-going Gold Bitcoin debate is unlikely to end soon. Schiff continues to argue that metal’s stability and record-breaking growth prove it is the ultimate safe haven. asset, on the other hand, offers massive upside but with extreme volatility.

For investors, the choice remains between the tested safety of metal or the high-risk, high-reward nature of BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。