The market's focus on favorable regulations may have contributed to Ethereum's outstanding performance.

Author: Grayscale

Translated by: Deep Tide TechFlow

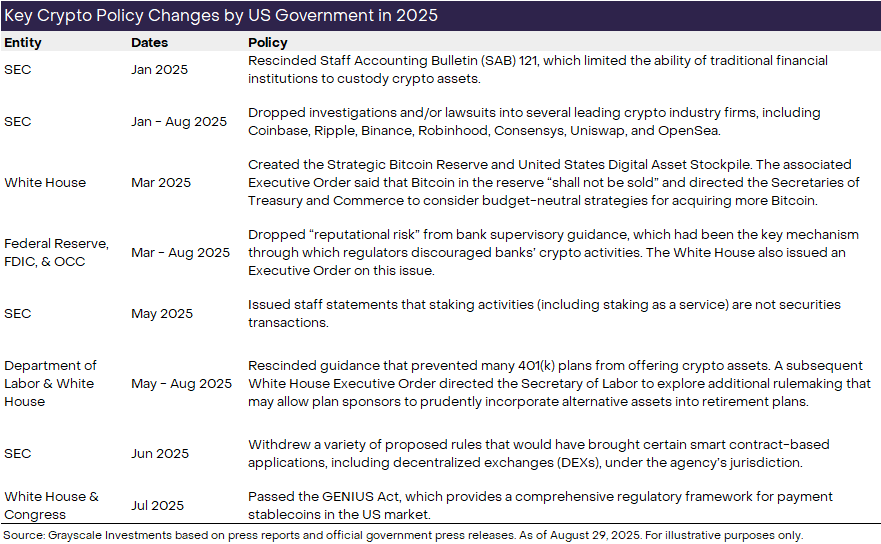

The clarity of regulations regarding digital assets in the United States has been brewing for a long time—although the path ahead is still unfolding, policymakers have made significant progress this year.

The market's focus on favorable regulations may have contributed to Ethereum's outstanding performance. As a leader in the blockchain financial market, Ethereum could benefit if regulatory clarity promotes the adoption of stablecoins, tokenized assets, and/or decentralized financial applications.

The Digital Asset Treasury (DAT)—public companies holding cryptocurrencies on their balance sheets—has surged in recent months, but investor demand may have reached saturation. The valuation premium for large projects is compressing.

Bitcoin's price once reached an all-time high of about $125,000 but closed lower that month. Although Bitcoin's price movement in August was not as strong as others, the pressure surrounding the Federal Reserve's independence reminded investors why Bitcoin has always been in high demand.

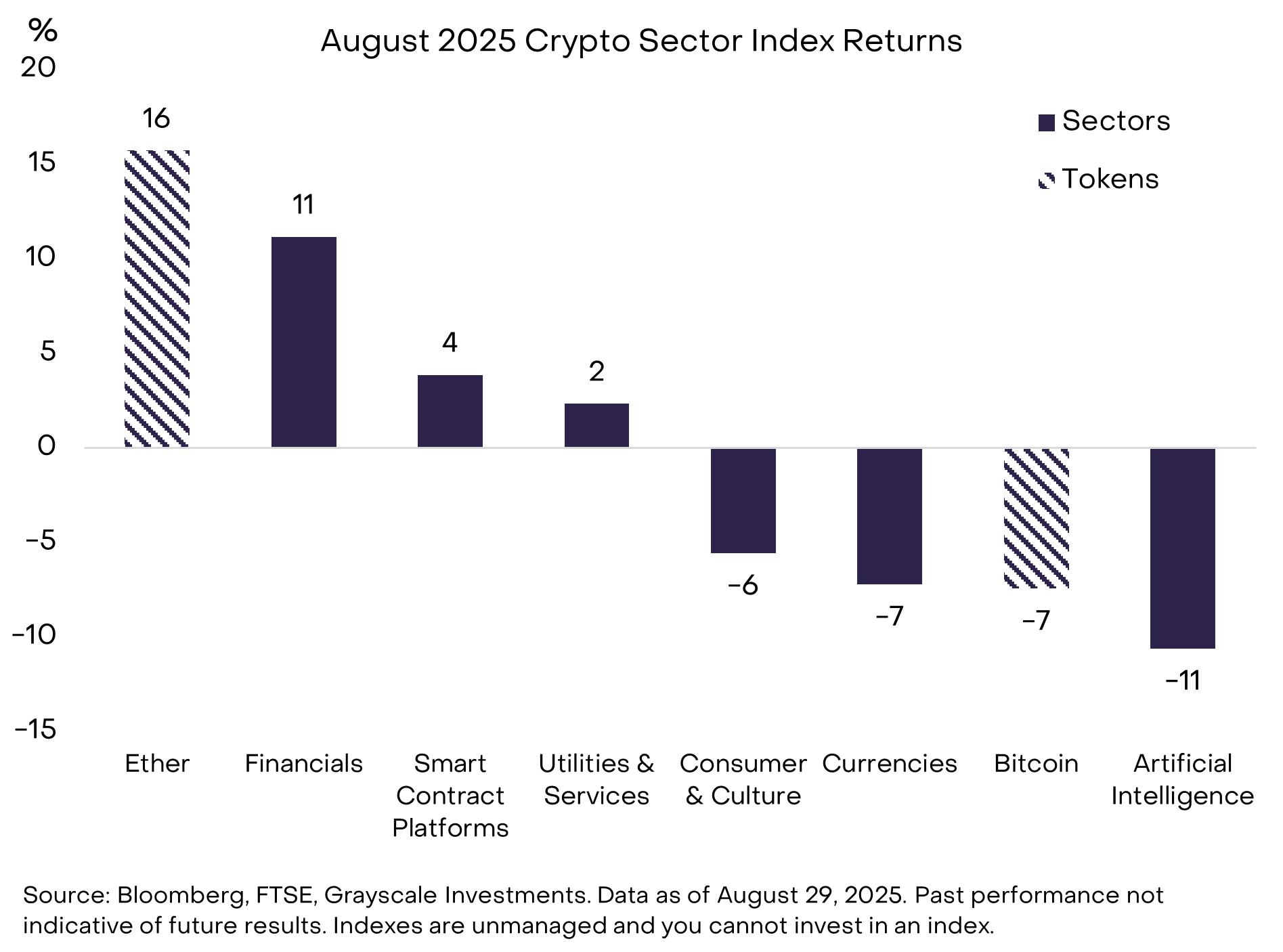

In August 2025, the total market capitalization of cryptocurrencies stabilized around $4 trillion, but significant sector fluctuations occurred within the market. The crypto asset category encompasses various software technologies, each driven by different fundamentals, so token valuations do not always fluctuate in sync.

Despite Bitcoin's price decline in August, Ethereum rose by 16%. [1] This second-largest public chain by market capitalization seems to benefit from investors' attention to regulatory changes, which may support the adoption of stablecoins, tokenized assets, and decentralized finance (DeFi) applications—areas where Ethereum currently leads the industry.

Figure 1: Significant Rotation in Crypto Sectors in August

The GENIUS Act and the Future

We believe that Ethereum's recent outstanding performance is primarily related to improvements in fundamentals, the most important of which is the increased clarity of regulations regarding digital assets and blockchain technology in the United States. One of the most influential policy changes this year was the passage of the GENIUS Act in July. This legislation provides a comprehensive regulatory framework for payment stablecoins in the U.S. market (for related background, see The Future of Stablecoins and Payments). Ethereum is currently the leading stablecoin blockchain (measured by transaction volume and balances), and after the passage of the GENIUS Act, Ethereum's price rose nearly 50% in July, [3] continuing to drive its price higher in August.

However, this year's policy changes in the U.S. are not limited to stablecoins but cover a range of issues from crypto asset custody to banking regulatory guidance. Looking ahead, these policy changes may further drive institutional investors into the crypto industry. Based on our observations, the most significant policy actions taken by the Trump administration and federal agencies in the digital asset space are summarized in Figure 2. These policy changes, along with more potential policies in the future, are triggering an institutional investment wave in the crypto industry (for more details, see March 2025: Institutional Chain Reaction).

Figure 2: Policy Changes Bring Greater Regulatory Clarity to the Crypto Industry

In August, Federal Reserve Governor Waller and Bowman both attended a blockchain conference in Jackson Hole, Wyoming, a scene that would have been unimaginable a few years ago. This conference followed the Federal Reserve's annual Jackson Hole Economic Policy Symposium. In their speeches, they emphasized that blockchain should be viewed as a financial technology innovation, and regulators need to find a balance between maintaining financial stability and creating space for new technology development. [4]

Entering September, the U.S. Senate Banking Committee plans to review legislation on crypto market structure—this regulation will cover issues related to the crypto market beyond stablecoins. The Senate's efforts are based on the bipartisan passage of the CLARITY Act in July by the House of Representatives. Senate Banking Committee Chairman Scott stated that he expects the market structure legislation to also gain bipartisan support in the Senate. [5] However, there are still some significant issues that need to be addressed. Industry groups are particularly focused on ensuring that the market structure legislation protects the rights of open-source software developers and non-custodial service providers. This issue may continue to spark debates among legislators in the coming months. (Notably, Grayscale is one of the signatories of a recent letter of opinion submitted by industry groups to members of the Senate Banking and Agriculture Committees.)

Are You Tired of DAT Yet?

In August, Bitcoin performed poorly while Ethereum shone, a trend that was significantly reflected in the capital flows of various trading platforms and products.

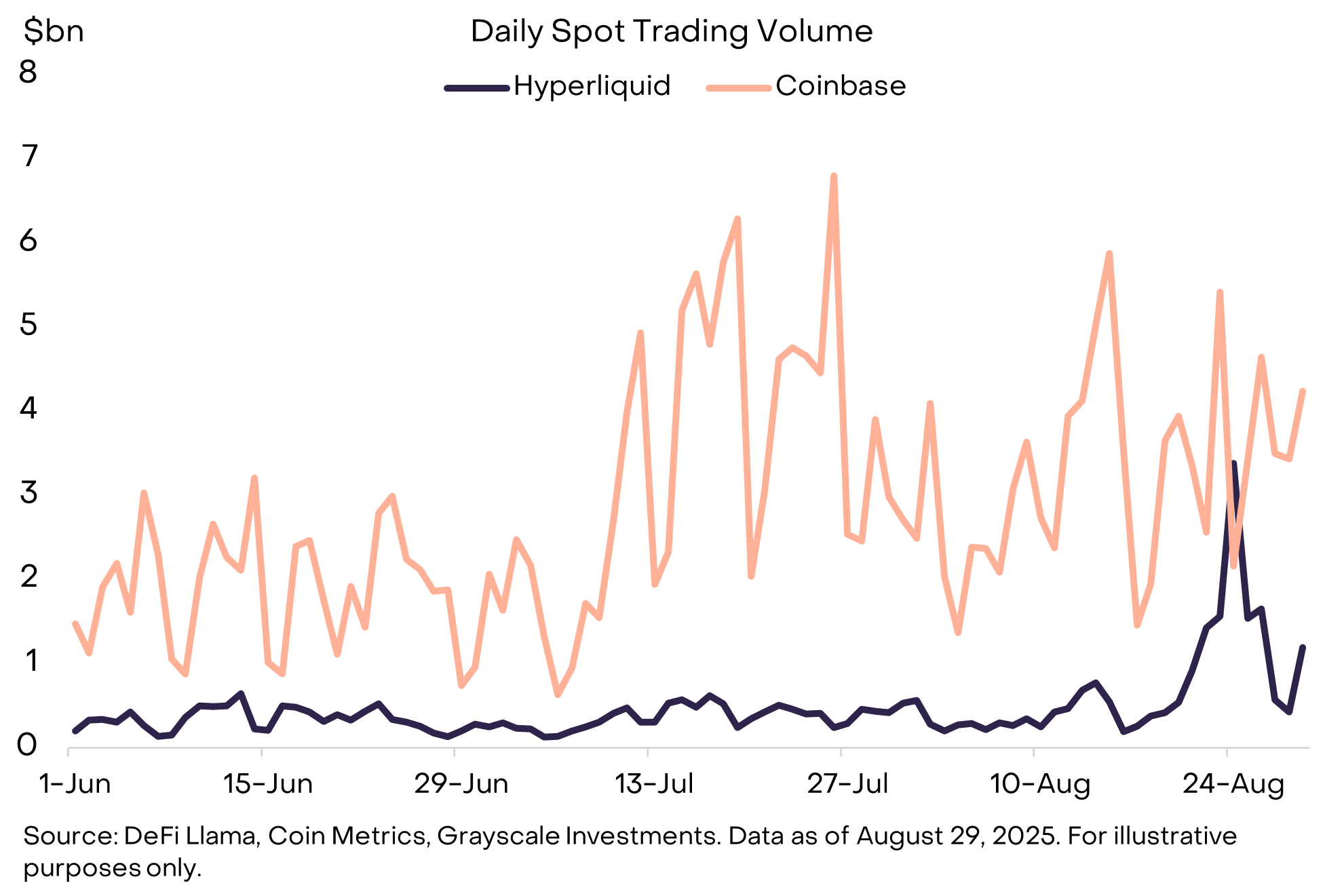

Some dramatic events occurred on Hyperliquid, a decentralized exchange (DEX) that offers spot trading and perpetual contracts (for background information, see The Appeal of DEX: The Rise of Decentralized Exchanges). Starting on August 20, a Bitcoin "whale" (an investor holding a large amount of BTC) sold approximately $3.5 billion worth of BTC and immediately purchased about $3.4 billion worth of ETH. [6] While we cannot speculate on the investor's motives, such a scale of risk transfer occurring on a DEX rather than a centralized exchange (CEX) is an encouraging phenomenon. In fact, on the day with the highest trading volume that month, Hyperliquid's spot trading volume briefly surpassed that of Coinbase (see Figure 3).

Figure 3: Surge in Hyperliquid Spot Trading Volume

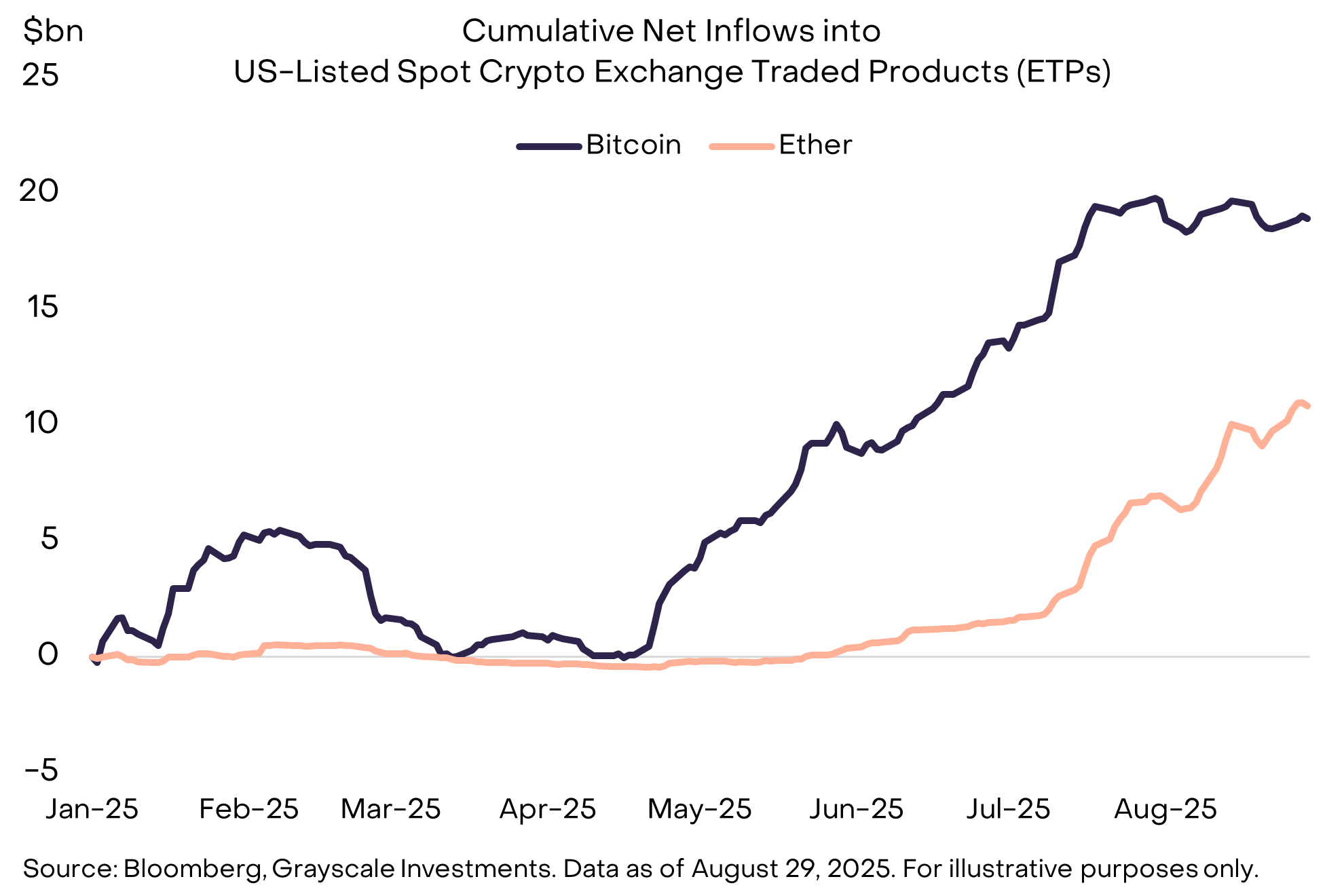

That month, a similar preference for ETH was also reflected in the net capital inflows of exchange-traded products (ETPs). The U.S.-listed spot Bitcoin ETP saw a net outflow of $755 million in August, marking the first net outflow since March. In contrast, the U.S.-listed spot Ethereum ETP experienced a net inflow of $3.9 billion in August, following a significant increase of $5.4 billion in net inflows in July (see Figure 4). After a surge in net inflows for ETH over the past two months, both BTC and ETH ETPs now hold over 5% of their respective token circulations.

Figure 4: ETP Net Inflows Shift to ETH

Bitcoin, Ethereum, and many other crypto assets have also received support from purchases by Digital Asset Treasuries (DATs). DATs are publicly traded companies that hold crypto assets, providing equity investors with access to cryptocurrencies. The largest digital asset treasury holding Bitcoin, Strategy (formerly MicroStrategy), purchased an additional 3,666 BTC (approximately $400 million) in August. Meanwhile, the two largest Ethereum treasuries collectively bought 1.7 million ETH (approximately $7.2 billion). [7]

According to media reports, at least three new Solana DATs are in preparation, including a project sponsored by a consortium of Pantera Capital, Galaxy Digital, Jump Crypto, and Multicoin Capital, with over $1 billion in funding. [8] Additionally, Trump Media & Technology Group announced plans to launch a DAT based on the CRO token, which is associated with Crypto.com and its Cronos blockchain. [9] Recent announcements from other DATs have mainly focused on Ethena's ENA token, Story Protocol's IP token, and Binance Smart Chain's BNB token. [10]

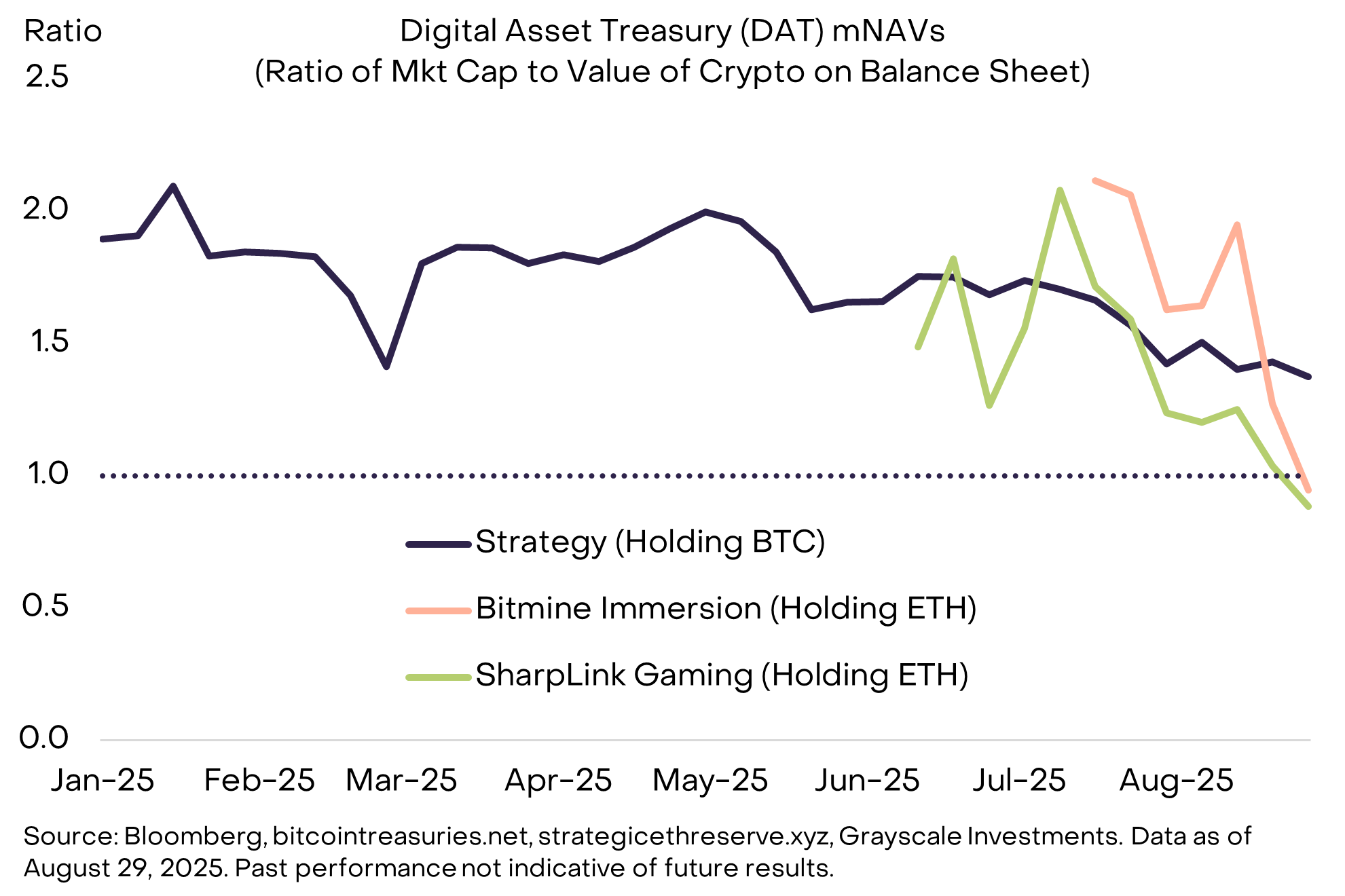

Despite the ongoing provision of these investment tools by sponsors, price performance suggests that investor demand may have reached saturation. Analysts typically monitor their "mNAV," which is the ratio of a company's market capitalization to the value of crypto assets on its balance sheet, to measure supply-demand imbalances. If there is excess demand for crypto assets in the form of publicly traded equity instruments (i.e., insufficient DATs), mNAV may exceed 1.0; if there is excess supply (i.e., too many DATs), mNAV may fall below 1.0. Currently, the mNAV of some large projects seems to be approaching 1.0, indicating that the supply and demand for DATs are tending toward balance (see Figure 5).

Figure 5: The Valuation Premium of DATs is Declining

Returning to the Basics: The Case of Bitcoin

Like all asset classes, public discussions about the crypto market often focus on short-term issues such as regulatory changes, ETF capital flows, and DATs. However, taking a step back to re-examine the core investment logic of Bitcoin may be more important. Among the many assets in the crypto space, Bitcoin's significance lies in providing a currency asset and peer-to-peer payment system based on clear and transparent rules, independent of any specific individual or institution. Recently, the independence of central banks has been threatened, reminding us once again why many investors are so interested in these assets.

For context, most modern economies adopt a "fiat" currency system. This means that currency has no explicit backing (i.e., it is not pegged to any commodity or other currency), and its value is entirely based on trust. Throughout history, governments have repeatedly exploited this characteristic to achieve their short-term goals (e.g., re-election). This can lead to inflation and diminish trust in the fiat currency system.

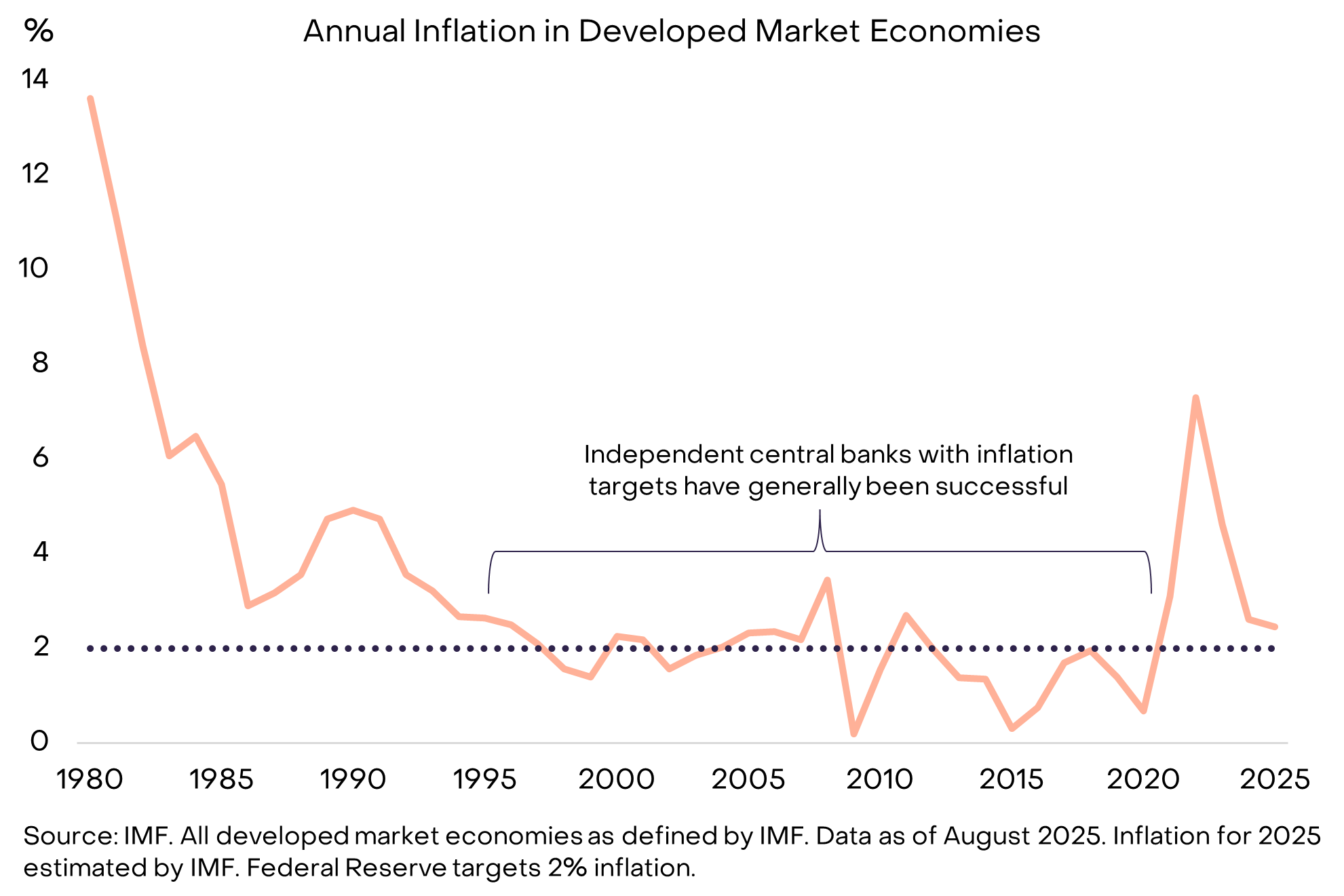

Therefore, for fiat currency to function effectively, it is essential to ensure that governments can fulfill their commitments and do not abuse this system. The approach adopted by the U.S. and most developed market economies is to grant central banks explicit goals (often in the form of inflation targets) and operational independence. Elected officials typically exercise some oversight over central banks to ensure democratic accountability. Aside from a brief spike in inflation following the COVID-19 pandemic, this clear goal, operational independence, and democratic accountability system have achieved low and stable inflation in major economies since the mid-1990s (Figure 6).

Figure 6: Independent Central Banks Achieve Low and Stable Inflation

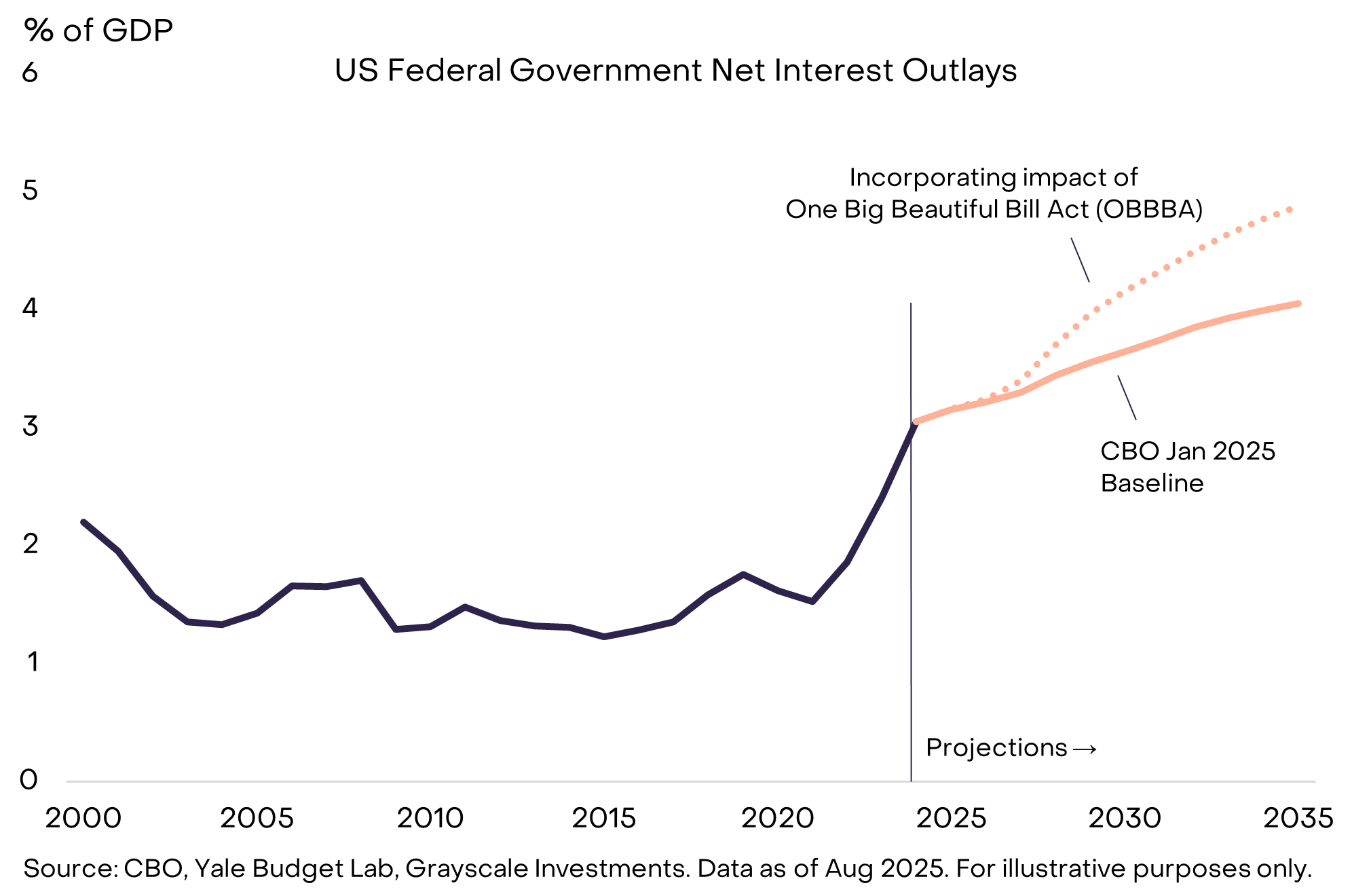

In the U.S., this system is currently under pressure, not primarily due to inflation issues, but stemming from deficits and interest expenditures. The total debt of the U.S. federal government is currently about $30 trillion, which is 100% of GDP, the highest level since World War II, despite being in peacetime and having a low unemployment rate. As the Treasury refinances debt at about 4% interest, interest expenditures continue to rise, crowding out resources for other uses (see Figure 7).

Figure 7: Interest Expenditures Take Up More of the Federal Budget

The One Big Beautiful Bill Act (OBBBA), passed in July, will lock in high deficits for the next ten years. Unless interest rates decline, this will mean higher interest expenditures and further squeeze other uses of government revenue. As a result, the White House has repeatedly pressured the Federal Reserve to lower interest rates and called for the resignation of Fed Chair Powell. In August, as one of the six current members of the Federal Reserve Board, Lisa Cook was dismissed, further escalating threats to the Fed's independence. [11] While this may be advantageous for elected officials in the short term, the weakening of the Fed's independence increases the risk of high inflation and currency depreciation in the long term.

Bitcoin represents a monetary system based on transparent rules and predictable supply growth. When investors lose confidence in the institutions that protect the fiat currency system, they turn to more trustworthy alternatives. Unless policymakers take steps to strengthen the institutions supporting fiat currency, allowing investors to believe in the commitment to maintain low and stable inflation in the long term, demand for Bitcoin may continue to grow.

Index Implications:

FTSE/Grayscale Crypto Sectors Total Market Index

- This index measures the price return performance of digital assets listed on major global exchanges, providing a reference for the overall trend of the crypto market.

FTSE Grayscale Smart Contract Platforms Crypto Sector Index

- This index aims to assess the performance of crypto assets that support the development and deployment of smart contracts, serving as the foundational platform for self-executing contracts.

FTSE Grayscale Utilities and Services Crypto Sector Index

- This index focuses on measuring the performance of crypto assets designed to provide practical applications and enterprise-level functionalities.

FTSE Grayscale Consumer and Culture Crypto Sector Index

- This index evaluates the performance of crypto assets that support consumer-centric activities across various goods and services sectors.

FTSE Grayscale Currencies Crypto Sector Index

- This index measures the performance of crypto assets that fulfill one of three core functions: store of value, medium of exchange, and unit of account.

FTSE Grayscale Financials Crypto Sector Index

- This index specifically assesses the performance of crypto assets aimed at providing financial transactions and services.

Sources:

[1] Source: Bloomberg. Data as of August 29, 2025. Past performance is not indicative of future results.

[2] Source: Bloomberg. Bitcoin reached an all-time high on August 14; Ethereum reached an all-time high on August 24.

[3] Other organizations have recently announced Layer 1 blockchains targeting stablecoin use cases, including Circle (Arc), Stripe (Tempo), and Bitfinex (Plasma). Google also began promoting its Layer 1 GCUL in August. While Ethereum is currently the market leader, many blockchains will compete for stablecoin transaction volume and associated fees.

[4] Source: Federal Reserve, Federal Reserve.

[5] Source: CoinTelegraph.

[6] Data source: mempool.space, hypurrscan.io, etherscan.io, Grayscale Investments. Prices are in USD as of August 29, 2025.

[7] Data source: Bitcointreasuries.net, strategicethreserve.xyz, Bloomberg, Grayscale Investments. Data as of August 29, 2025.

[8] Source: Unchained, CoinDesk.

[10] Source: CoinDesk, The Block, DL News.

[11] Source: New York Times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。