Gold Bitcoin Gains Strength as Nations Rethink Fiat Dependence

Why in news

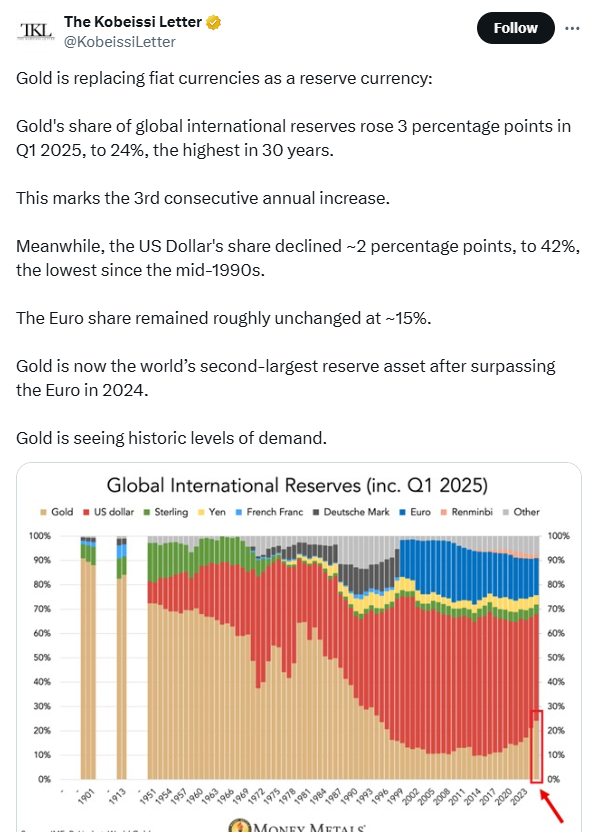

The Gold Bitcoin discussion is heating up as investors question which is the real safe-haven asset in today’s shifting economy? So, according to a recent analysis of The Kobeissi Letter shared on X (formerly twitter).

The precious metal is replacing fiat currencies as a global reserve currency, with its global share climbing 3 percentage points in Q1 2025 to 24%, the highest in 30 years and marking a third straight annual rise.

Meanwhile, the US Dollar’s share fell by 2% to 42% that is the lowest since the mid-1990s, while the Euro stayed flat near 15%. After surpassing the Euro in 2024, precious metal is now the world’s second-largest reserve asset.

Source: X

Why Fiat Currencies Are Losing Trust Worldwide?

Fiat currencies are losing credibility as inflation, debt and excessive money printing continue to erode their value, as discussed above how the US dollar weakened its value. This steady decline signals weakening confidence in fiat systems.

Analysts note that this fall is not only about numbers but also about a growing loss of trust in the stability of fiat-backed systems:-

-

Money printing & inflation: Excessive printing reduces purchasing power and has triggered hyperinflation in countries like Hungary, Zimbabwe and Venezuela.

-

Fiscal & currency crises: Like Greece’s 2010 debt crisis and Iceland’s 2008 collapse highlight how fragile fiat-backed economies can be.

-

Shift to hard assets: With precious metal reserves touching a 30-year high at 24% in 2025, central banks are actively diversifying to reduce dollar dependency.

This global rebalancing has fueled the Gold Bitcoin discussion , with many asking if Bitcoin could be the next safe-haven alternative in global trade and finance.

The Dollar’s Declining Dominance in Global Trade

The US Dollar is still the world’s most used reserve but its dominance is weakening for deeper reasons than just numbers.

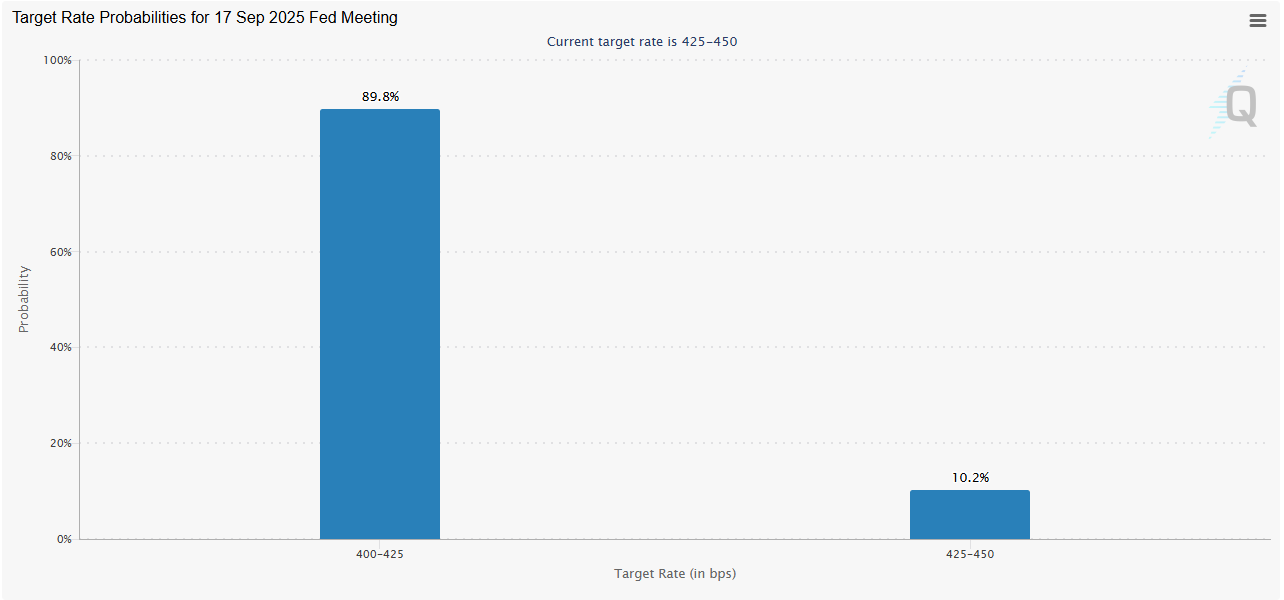

Like the high US Interest rates (4.25-4.5%) strengthen the dollar for a short-term but hurt the global trade which further raise debt costs and push nations towards alternatives like Gold Bitcoin for stability.

Source: Fedwatch

On the other hand countries like China adopting stablecoin, Russia and members of BRICS are actively promoting trade in local currencies to bypass dollar control.

Can Bitcoin Soon Replace Gold as the Ultimate Safe Haven?

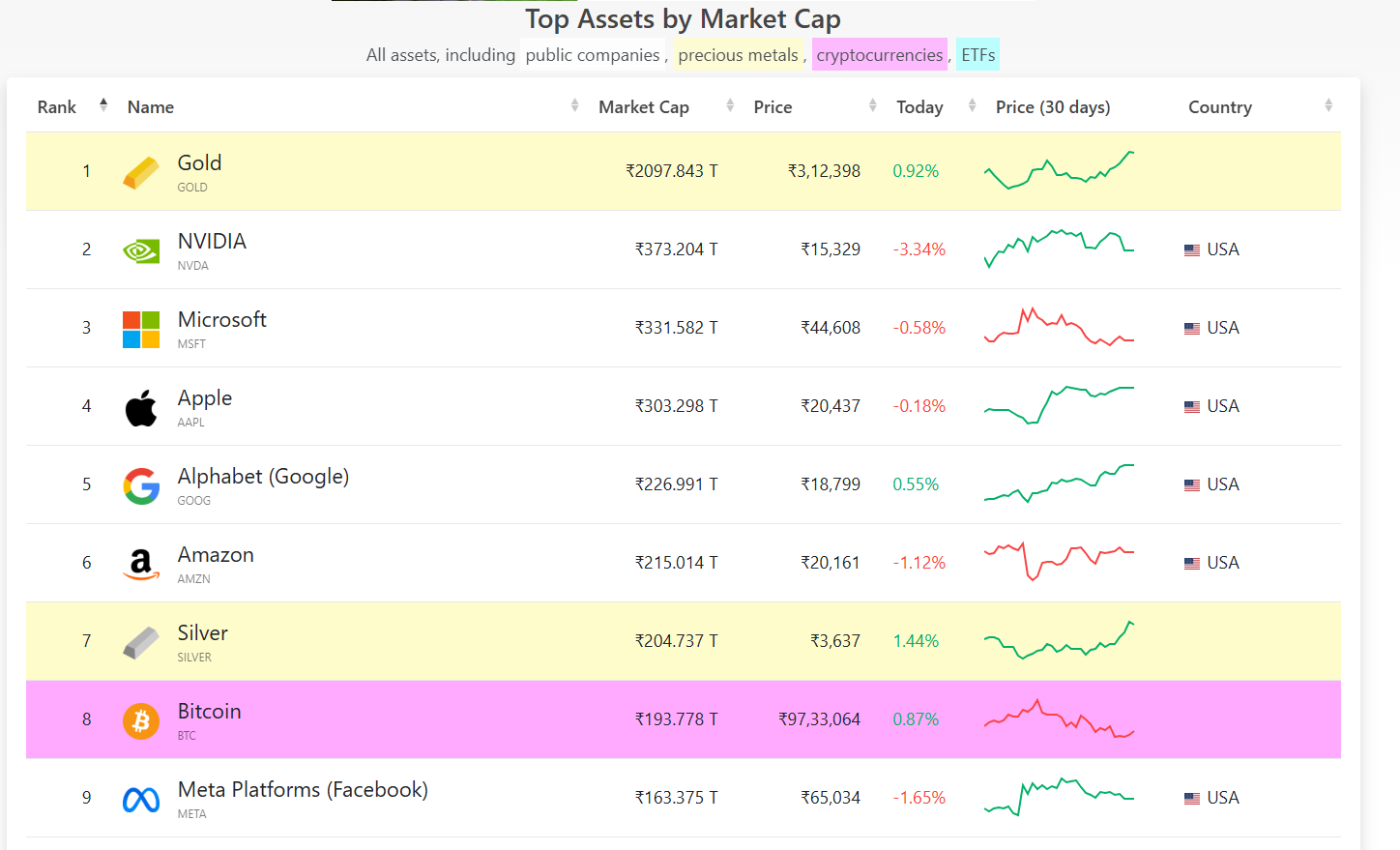

As per the data of CompaniesMarketCap , let’s understand Gold Bitcoin values one by one:

Gold

Current price: $3,750

Market cap value: $25.28 trillion

Asset value ranking : 1st

Currently , precious metal is ranking at the top as an asset and it has centuries of trust while BTC brings decentralization and limited supply.

Bitcoin

Current price: $110,425

Market cap value: $2.19 trillion

Asset value ranking: 8th

Source: CompaniesMarketCap

BTC is often called “digital gold,” which is proving true, as countries like China, India and even Pakistan are slowly exploring decentralized systems. It may not happen overnight but the future looks more open to alternatives beyond fiat.

People are researching, analyzing and gradually accepting BTC as part of the safe-haven debate.

Conclusion

The precious metal still leads as the trusted reserve, but the growing Gold Bitcoin debate shows a clear shift. Nations and investors are slowly embracing decentralization, signaling that t he future of safe-haven assets may not remain limited to precious metal alone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。