Metaplanet Bitcoin Accumulation Surges, Holdings Reach 20,000 BTC

Metaplanet Bitcoin latest purchase

Japan’s Metaplanet Bitcoin treasury company has strengthened its crypto holdings with a new purchase of 1,009 BTC worth at $112 million (16.48 billion yen). With this addition the Metaplanet Bitcoin holdings now stand at 20,000 BTC that is highlighting its aggressive accumulation strategy.

Source: X

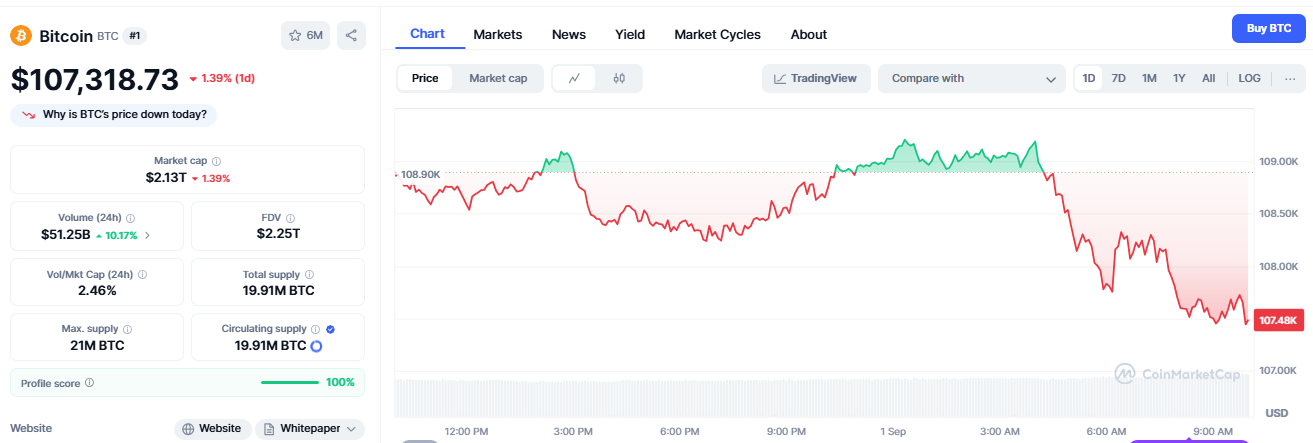

The latest batch was acquired at an average price of around $111,068 per coin according to Metaplanet’s disclosure . Currently the asset is trading at $107,438 with a down seen of 1.26% in 24 hours.

From the past week the coin is trading between between $107k - $113k, this might be due to following reasons, as per the data of CoinMarketCap–

-

Huge ETF outflows, geopolitical risks

-

Price Drop: Coin slipped 1.38% in 24h to $107,392, with a 7-day decline of 4.64%

-

Whale Sell-Off: Around 30,109 coins (worth $3.5B) moved to exchanges, hinting at profit-taking by big holders.

-

Price broke below the key $118,859 support, which triggered a wave of stop-loss orders.

-

Strong U.S. PPI data reduced chances of a Fed rate cut, strengthening the dollar and adding selling pressure on asset.

Source: X

Position among global treasuries

With this milestone, Metaplanet Bitcoin ranks as the sixth-largest public treasury globally by surpassing Riot platforms, Inc. with a total holding of 19,239 BTC. Now the firm is all set to compete with Bullish whose total holdings is 24,000 tokens.

That means if Metaplanet Bitcoin buys more coins, by taking the profit from dips , it will soon be ranked to 5th position among the largest asset holders, according to the data of Bitcointreasuries.net

The company reached 10,000 BTC just three months ago and recently updated its year-end target to 30,000 BTC from an initial 10,000 BTC, reflecting strong confidence in coins future value.

Funding plans and expansion strategy

The firm has recently announced its plan to raise $880 million (130 billion yen) through an international share offering. Most of the funds raised will be directed toward the coins buyings, over the next two months.

These planned moves support its position as a major corporate BTC whale in Asia and signal continued interest in the digital asset accumulation.

Web3 and institutional support

Beyond the asset the firm is also leading a Web3 project and securing $87 million in funding from institutional investors like Capital Group.

This support shows the confidence in the Metaplanet blockchain and Web3 technologies that is showcasing its potential for innovation and influence in the rapidly growing Web3 space.

Market Impact and Technical Overview

Metaplanet Bitcoin recent purchases have fueled bullish sentiment in the crypto market. However the traders remain cautious due to equity expansion risks and fundraising pressures.

Technical indicators are mixed that are showing, the coin appears oversold on the CRSI while MACD momentum is still bearish and prices are hanging near local lows. Volume spikes show that short-term market activity may remain volatile.

But following the dips and boosting its treasuries the firm might soon secure its position in the Top 5 asset holders.

Conclusion

Metaplanet Bitcoin focused accumulation strategy, combined with its Web3 initiatives, positions the company as a significant player in the Asian crypto ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。