Why Robert Kiyosaki Bitcoin Strategy Focuses on Real Assets and Value

Why does Robert Kiyosaki Bitcoin consider, Gold, and Silver as ‘Real Money’?

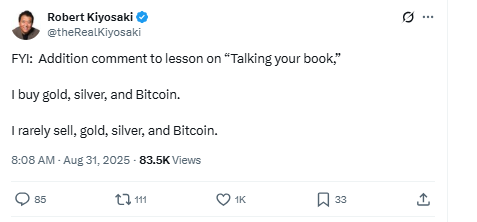

In a recent tweet, the famous author Robert Kiyosaki Bitcoin analyst shares his views on money and markets. According to him BTC, gold and silver are the only forms of real money.

Source: X (formerly twitter)

Robert Kiyosaki Bitcoin believes that fiat currencies like the dollar or rupee will never make you truly rich. Their value doesn’t really grow and with inflation, it actually goes down over time. On the other hand assets like silver and BTC act as real stores of value

They are limited, protect against inflation, and have the potential to increase in price in the future. His message is simple and clear:

-

Don’t just think short term. Focus on building long-term wealth by holding assets that actually grow in value over time.

-

Analyze the market from your eyes and act smartly, trusting the digital asset , gold and silver will never let you down.

Digital Gold: A Hedge Against Economic Uncertainty

People call BTC “digital gold” because it’s rare and limited just like gold. Where gold is mined from the earth, the coin is mined digitally and there will only ever be 21 million coins.

This limited supply is what makes it valuable, unlike paper money that governments can keep printing and slowly devaluing.

Robert Kiyosaki Bitcoin points out that in tough economic times, people naturally turn to expensive asset as safe assets. Now, BTC is also becoming that safe haven.

It’s global, independent, and not controlled by any government, which makes it even stronger in times of uncertainty.

Will Market Reality Match Robert’s Bold Predictions?

Robert Kiyosaki Bitcoin has always been a strong supporter of golden coins, often sharing his views through tweets. And it’s not just him, some of the biggest golden coin investors like Michael Saylor, VanEck, Steven and Brian Armstrong have also made bold predictions about BTC ’s future.

Whether the price of golden coin goes up or down, their confidence in it remains the same. This shows that Robert's belief in asset is not only genuine but also in line with how major investors see it.

In today's decentralized world, BTC is already one of the most valuable digital assets. Looking ahead, it has the potential to become an even stronger store of value. Kiyosaki’s vision highlights that holding BTC is not just about short-term gains, it's about trusting an asset built to grow in importance over time.

Conclusion

Robert Kiyosaki Bitcoin faith for expensive metals shows that real wealth comes from holding assets, not paper money. In a world of inflation and uncertainty, these investments act as long-term shields. His message is clear: think big, think long-term and trust assets that truly grow in value.

Also read: Metaplanet Stock Crashes 50% as $3.8B Bitcoin Expansion Looms免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。