Original | @marvellousdefi_

Compiled | Odaily Planet Daily (@OdailyChina)

Translator| Dingdang (@XiaMiPP)

Editor's Note: Currently, there are numerous prediction market protocols emerging, from Polymarket and Kalshi to Zeitgeist, all attracting significant funds and users. On the surface, prediction markets seem to be a natural "future information aggregator," allowing bets on event outcomes while capturing collective wisdom. (Related reading: The Evolution of Prediction Markets 2025: From Polymarket Frenzy to Kalshi Compliance and Social Embedded Explosions)

However, the question is, not every prediction market is worth your time or money. So how do we determine whether a prediction market project has value?

If you are not familiar with the concept of prediction markets, let’s first explain that prediction markets are a type of exchange where participants bet on the outcomes of future events, and they are becoming increasingly popular in the crypto and financial sectors.

However, not all prediction markets are the same. Evaluating whether a platform is "worth it" (in terms of time or money) depends on a combination of three key factors:

- Market Design

- Economic Environment

- User-Related Factors

Each factor is crucial, as they determine whether a prediction market can provide accurate predictions, sufficient liquidity, and a trustworthy trading experience. Let’s break them down one by one.

1. Market Design: Structure, Mechanism, and Clarity

Market design explores the structure and operation of prediction markets—including trading mechanisms, contract rules, and outcome determination methods. I believe a good design must align incentive mechanisms reasonably while ensuring smooth market operation.

i) Trading Mechanism

Different prediction markets use different trading matching methods. Some platforms (like @Polymarket and @Kalshi) use order books, while others (like @ZeitgeistPM) use automated market makers (AMM), such as LMSR.

Overview of common models:

- Order Book (CDA): Efficient when liquidity is sufficient, but performs poorly in quiet markets.

- CPMM (x*y=k): Simple, but has high slippage in extreme price conditions.

- LMSR: Bounded loss, probability normalization, but sensitive to parameters.

- DLMSR / pm-AMM: Newer models aimed at addressing liquidity and slippage issues.

ii) Contract Types and Clarity

A good market must have clearly defined contracts and settlement standards. Typically, contracts are divided into binary options (yes/no outcomes, paying $1 if the event occurs) or multi-outcome contracts, scalar contracts (graded payments based on numerical results).

It is particularly important that the questions being bet on are clear and verifiable. Research indicates that "clearly defined questions with explicit settlement standards" are key factors for the efficient operation of prediction markets.

Because if the questions are vague or the outcomes are subjective, traders cannot trust that their bets will be settled fairly.

iii) Outcome Determination and Oracles

Design must ensure the credibility of outcome determination. Traditional prediction markets rely on the platform or third-party adjudicators to determine and pay out rewards, while crypto prediction markets use oracles (on-chain trusted data sources) to input real-world results into smart contracts.

Not familiar with crypto oracles? You can refer to this: https://x.com/marvellousdefi_/status/1812810604454789141

For example, @Polymarket uses @UMAprotocol to provide real-world data (like election results) to complete market settlements.

A sound adjudication mechanism can prevent disputes and manipulation, thereby maintaining the integrity of the market. Therefore, when evaluating a platform, consider:

- Does it have reliable oracles or adjudicators?

- Is there a possibility of disputes? If so, how are they handled?

iv) Fees and Technical Design

Excessively high transaction costs or slow systems can directly "choke" the usability of a platform.

Looking back at early decentralized markets, such as Augur (a pioneer on Ethereum launched in 2018), it struggled to gain mainstream adoption due to high gas fees, insufficient liquidity, and poor user experience.

Therefore, you need to consider which chain the product is deployed on, for example: @GroovyMarket_ on @SeiNetwork, @Polymarket on @0xPolygon, @triadfi on @solana, etc.

The commonality among these platforms is that the chosen chain ensures lower transaction fees and faster transaction speeds, simplifying the user interface. For instance, Polymarket is built on Polygon (an Ethereum sidechain), trading with USD stablecoins, providing a fast and stable experience while avoiding exposing users directly to cryptocurrency price fluctuations. It also charges a 0% transaction fee, making trading nearly frictionless. Such designs greatly enhance user experience, making first-generation platforms seem clunky by comparison.

Additionally, you need to evaluate the various fees charged by the platform: market creation fees, trading fees, deposit/withdrawal fees, profit sharing fees, etc.

In summary: Whether a prediction market's design is "worth it" depends on whether it has a clear and fair structure: efficient trading mechanisms, sufficient liquidity, transparent rules, and trustworthy settlement methods.

Poor design (slow trading, unclear rules, or untrusted adjudication) can kill a market before it even starts.

2. Economic Factors: Liquidity, Pricing, and Incentives

I believe that even the best design needs economic support. Key economic factors determine whether a prediction market can effectively aggregate information and appropriately reward participants. Let’s look at them point by point.

i) Liquidity and Market Depth

Liquidity means there must be enough active trading and funds in the market so that traders can buy and sell at reasonable prices without incurring significant slippage. For a long time, liquidity has been one of the most important considerations.

Research shows that the effectiveness of prediction markets relies on "sufficient market liquidity" and a large trading community. If only a few people are trading, prices may fluctuate wildly or stagnate, failing to reflect true probabilities. Therefore, balance is needed.

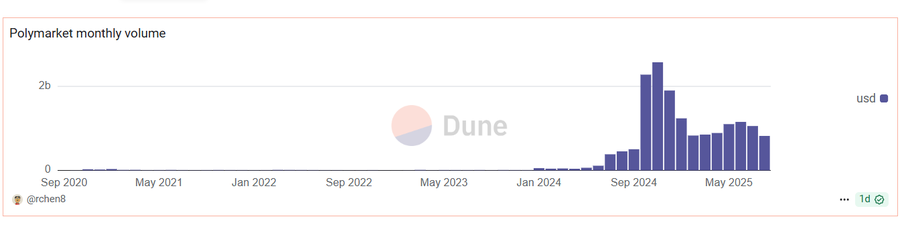

Look for platforms with high trading volumes or liquidity pools. For example, Polymarket has become the largest decentralized prediction market, capturing about 94% market share in 2024, handling over $8.4 billion in bets, even with new competitors emerging this year.

This massive liquidity (especially during major events like the U.S. elections) means that the odds are backed by deep market support, reducing the likelihood of individual users manipulating prices.

ii) Pricing Accuracy (Information Aggregation)

The core idea of prediction markets is that market prices reveal the collective belief of the public regarding the probability of an event occurring. When economic conditions are sound—meaning there are many information-rich, invested traders—market prices become extremely accurate predictions.

In fact, mature markets often outperform polls and experts:

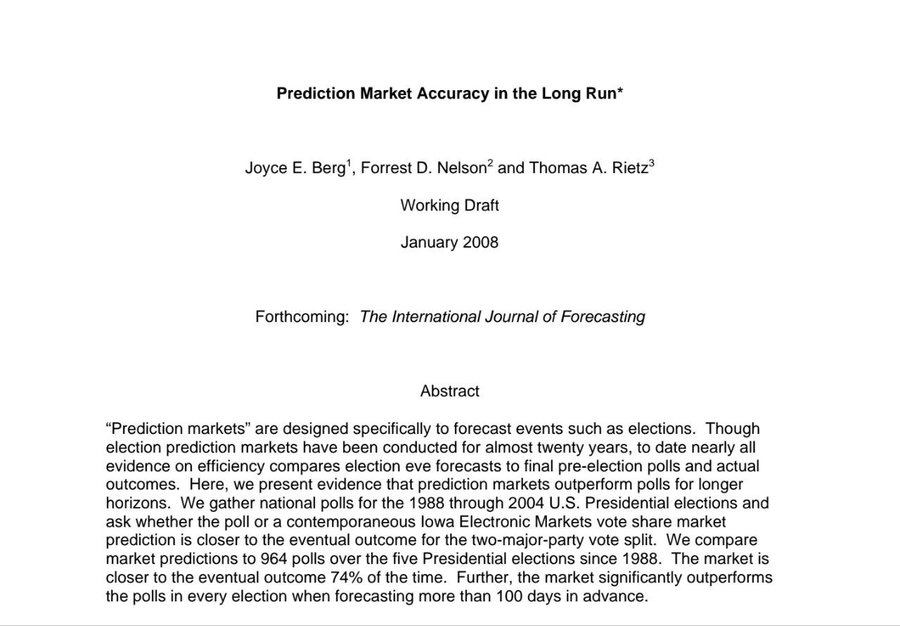

- The Iowa Electronic Markets outperformed professional polling organizations 74% of the time in election predictions.

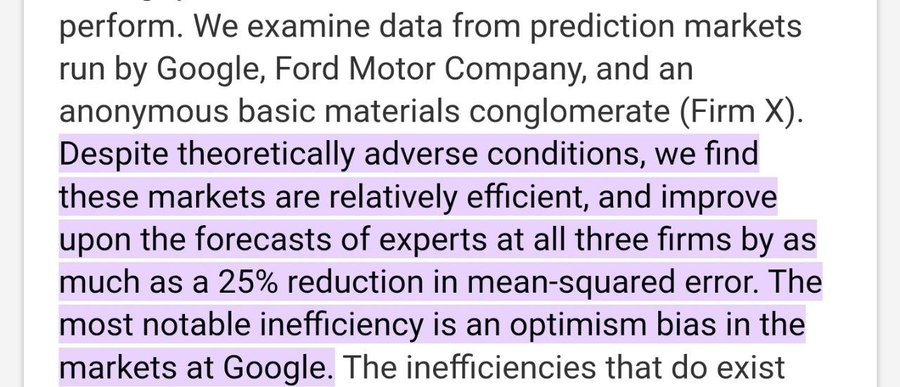

- The results of Google’s internal prediction markets were more accurate than those of company experts.

These are famous cases supporting the power of prediction markets.

However, if the market is too small or dominated by ignorant bettors, the prices become less reliable.

Therefore, always examine its historical performance:

- Does the platform have cases proving that when other predictors were wrong, its odds predictions were correct?

Notably, during the 2024 U.S. elections, Polymarket's odds received close attention and even outperformed traditional polls, attracting the attention of figures like Elon Musk.

iii) Alignment of Incentive Mechanisms

Economic design should also consider how traders are rewarded and the costs of participation. Low or zero fees are significant advantages, as high costs can hinder frequent trading or arbitrage activities, which are key to ensuring price accuracy.

For instance, Polymarket does not charge trading fees, while some markets even subsidize participation through token rewards or profits. Additionally, some platforms reward information discovery, such as providing bonuses or reputation points for the best predictors to encourage knowledgeable participants.

I believe that a healthy prediction market economy allows traders to profit from correcting erroneous odds, making attempts to manipulate prices generally self-correcting. For example, if someone makes an irrational bet, others have the economic incentive to take the opposite side, thereby pulling the price back to a rational level.

However, it is important to note: if the market is small, wealthy manipulators may still sway the odds in the short term, so scale remains critical.

iv) Risks and Regulatory Costs

Another economic consideration is risk, which includes not only the risk of losing money but also counterparty risk and regulatory risk. In crypto prediction markets, the security of smart contracts is crucial (as funds are held by code). In centralized platforms, you rely on the company's solvency and integrity.

It is important to note that regulatory crackdowns can incur significant costs. For example, Polymarket was fined $1.4 million by the U.S. Commodity Futures Trading Commission (CFTC) for operating an unregulated event market and was forced to block U.S. users.

During this period, liquidity in some markets decreased. Similarly, some countries have completely banned prediction markets. By the end of 2024, France, Singapore, and Thailand all blocked access to Polymarket. In reality, these factors can impact the platform's economy (shrinking the user base or forcing it to bear compliance costs).

Therefore, a "worthwhile" market must have a stable legal foundation or contingency plan. Otherwise, participants may face the risk of sudden shutdowns or being unable to withdraw funds.

In summary: The economic foundation of prediction markets must ensure sufficient "real money" participation and smooth trading. The best markets will have a large number of active users, low trading costs, and the ability to incentivize accurate predictions.

3. User and Community Factors: Engagement, Trust, and Experience

I also tend to approach from user-related factors, which essentially pertain to the human aspect of the market. The effectiveness of prediction markets depends on their users and community.

Key points to evaluate include:

i) Scale of Participation

Prediction markets rely on scale. The more participants there are, the more effective the market becomes. A large and active user base means that more diverse information and perspectives are introduced.

ii) Diversity of Opinions

Diversity is crucial. If all traders share the same views (or collude), the market cannot aggregate independent information.

Therefore, attention should be paid to the following indicators:

- Number of active users

- Number of bets and open contracts

Overall, a platform with thousands of active traders is far more robust than one with only a few users. Participants with diverse informational backgrounds are a key driving force behind the accuracy of prediction markets.

For example, Augur, despite being fully decentralized, had very few early users, limiting its effectiveness.

In contrast, Polymarket quickly accumulated a critical mass of users by providing markets on popular topics (elections, sports, crypto prices) and simplifying the onboarding process (no KYC required globally, simple web interface). This greatly enhanced the "wisdom of the crowd" effect.

iii) User Experience and Accessibility

Even for crypto-native users, experience is important. If a platform is too complex or requires cumbersome wallet setups, it can deter users.

Emerging prediction markets generally emphasize a smooth onboarding experience: a clean interface, intuitive charts, and clear odds display can attract more users, thereby improving market quality.

Conversely, if the operation is cumbersome (such as needing to manually purchase and stake a certain token first, or long wait times for transaction confirmations), ordinary users may feel it is "not worth it."

Therefore, you need to consider:

- Is it convenient to deposit on the platform?

- Does it support mobile access?

- If issues arise, is there customer support or community help available?

iv) Community Reputation and Trust

Since real money is involved, trust is core. Sources of trust include transparency (open-source code, audited contracts, reputable investors) and a history of fair operations.

Check if the platform has had scandals or instances of refusing to pay.

Decentralized markets like Polymarket, where funds are not controlled by centralized entities, are considered "trustless"; while others like Kalshi build trust through complete regulatory compliance. For example, in 2024, Kalshi became the first exchange to be regulated by the CFTC, legally offering event contracts in the U.S., and won a lawsuit allowing it to conduct election betting.

Such regulatory backing enhances credibility, indicating that users can trust it to operate within a legal framework.

In contrast, platforms operating in gray areas are a warning sign. They must either be fully decentralized and auditable or fully compliant.

v) User Motivation and Behavior

Another human factor is: why do users participate? Is it for interest-based betting, profit-driven trading, or expert risk hedging? I believe that a community with professional predictors (scholars or experts in relevant fields) may provide higher-quality insights.

The culture of a platform—whether it has a gambling atmosphere or is a serious prediction tool—will also affect whether it suits your purposes. When judging whether a market is worth using, observe the community:

- Is it active and serious?

- Is there a diversity of opinions?

"Having a diverse and actively participating user base" has been proven to be an important factor for the success of prediction markets.

I believe that a constructive community will drive meaningful markets that can be settled correctly; while a poor community may be filled with vague or frivolous questions.

In summary: User factors ultimately boil down to the quantity and quality of participation. A platform with a large, diverse, and trustworthy user base is more likely to provide a valuable experience. If a market has almost no users or the community is toxic, then no matter how advanced the technology is, it is not worth entering. After all, prediction markets are a form of "crowd outsourcing," and without a crowd, there is nothing to outsource.

Final Thoughts

When evaluating prediction markets, always return to three core points:

- Market Design

- Economic Viability

- User Factors

A platform with a reasonable mechanism, sufficient liquidity, and an active, trustworthy community is more likely to provide a valuable experience—both in terms of profit opportunities and accurate predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。