Original Source: K1 Research, Klein Labs

Overview of Research Methods

This report analyzes the listing paths and market logic of cryptocurrency on Korean trading platforms, combining listing data from January 2024 to July 2025. It employs a panel fixed effects regression model to quantify the impact of factors such as BTC price, trading volume in Korean won, and policy windows on the number of listings. Through statistical analysis and return calculations, we reveal patterns in the listing rhythm, track preferences, and token price performance across three major trading platforms, providing quantifiable references for project teams to choose listing timing, trading platforms, and marketing strategies.

Key Highlights

The scale and activity of the Korean market are globally leading: Since 2025, the trading volume of cryptocurrencies denominated in Korean won has consistently ranked second globally, only behind the US dollar market, and has long been a leader in the altcoin trading sector, demonstrating a high acceptance of new coins and abundant liquidity. For project teams, this is a high-potential market willing to experiment.

Dual drivers of policy and market sentiment influence listing rhythm: Panel regression results indicate a significant positive correlation between the average monthly BTC price and the number of listings on trading platforms, suggesting that market heat directly influences listing decisions. Additionally, policy windows amplify this effect, showing the combined impact of regulatory signals and market sentiment. For project teams, when entering the Korean market, it is essential to consider market heat, investor attention, and policy timing comprehensively, to reasonably arrange the listing rhythm, enhance project exposure, and optimize trading liquidity, achieving a strategic listing layout.

The "bridge effect" of token listings and market diffusion mechanism: Overall, Bithumb and Coinone play a "bridge effect" in the listing rhythm, with some tokens listed on these platforms before entering the larger trading volume of UPbit. Coinone's listing performance is particularly notable, achieving a secondary amplification of price and trading volume. Project teams can prioritize Coinone as an entry point and gradually expand to larger trading platforms, realizing the linkage and release of resources and heat. All three trading platforms belong to the DAXA alliance, and the internal transmission effect further enhances market diffusion of listings.

Differentiated layout in platform selection: There are significant differences in user profiles, listing rhythms, and market influence among trading platforms, and simply pursuing the largest platform is not the optimal strategy. For project teams, it is crucial to match the type of trading platform and listing order based on token characteristics, community structure, and promotional budget to improve the return on investment.

Localized and multi-channel marketing is essential for the Korean market: An effective market entry strategy in Korea relies not only on the listing application on trading platforms but also includes Naver keyword optimization, local crypto forum topic guidance, offline event marketing, and KOL collaborations. Project teams should synchronize the listing rhythm with localized marketing to create a closed-loop conversion from awareness to trading volume.

1. Introduction

In the global cryptocurrency landscape, South Korea is rising at an astonishing pace. Since 2025, the total trading volume of cryptocurrencies denominated in Korean won has reached $663 billion, making it the second-largest cryptocurrency market globally, only behind the US dollar. Notably, South Korea has maintained a long-term leading position in the altcoin trading sector, boasting the highest trading volume of altcoins worldwide. Up to 25.4% of the Korean population actively participates in cryptocurrency trading, a level of engagement that is extremely rare globally. This enthusiasm has also given rise to the unique "kimchi premium" phenomenon.

At the same time, the South Korean government is actively reshaping the cryptocurrency regulatory framework, moving away from previous restrictive policies towards a new phase that encourages innovation and market development. The recently launched cryptocurrency ETF roadmap and stablecoin development plan not only inject new institutional benefits into the market but also further solidify South Korea's strategic position as an important cryptocurrency market in Asia and globally.

Against this backdrop, studying the potential of the South Korean cryptocurrency market can provide project teams with practical strategies on "how to enter Korean trading platforms" and reveal opportunities and risks in this unique market for investors. This report will focus on the listing paths and performance of the five major trading platforms in Korea—UPbit, Bithumb, Coinone, Korbit, and GOPAX—analyzing the latest data from 2024 to 2025 in a more micro and in-depth manner, helping readers comprehensively understand the listing ecology and market logic of Korean trading platforms.

2. Preparations Before Listing: Marketing is Not Everything, But It Is Indispensable

Successful listings depend not only on the project's hard power and technical level but also on marketing and publicity, which are equally essential. Especially on Korean trading platforms, where listing requirements are strict and numbers are limited, projects must possess strength in technology, community, and market recognition simultaneously. Below, we organize several key local marketing methods from the perspective of trading platforms, focusing on their roles in enhancing project exposure, gaining user recognition, and attracting capital attention, providing reference experiences for successful listings:

2.1 KOL and Community Influence

In the promotion and listing process in the Korean market, high-quality local KOLs and community resources are indispensable. Currently, several highly active and professionally content-producing Korean crypto communities have long been entrenched in the market.

On Telegram, KOL communities with a coverage of 20,000 to 40,000 members, known for their professional and high-quality content, include:

● MBM Creator Academy (@MBMweb3)

● We Crypto Together (@WeCryptoTogether)

● Cobacknam Announcements (@cobacknamannounce)

● Yobeul's World (@yobeullyANN)

● Telegram Coin Rooms & Channels - CEN (@emperorcoin)

● Jammin123 (@muijammin123)

● Fire Ant CRYPTO (@fireantcrypto)

● Youth Passion Flavor House Co., Ltd. (@minchoisfuture)

These groups are core OG communities established early on, possessing historical depth and influence, and gathering experienced and atmosphere-creating active players, enjoying high popularity in Korea.

Additionally, there are smaller communities with around 10,000 stable members, which, while relatively smaller in scale, have more precise user profiles and higher stickiness, including:

● CRYPTO Sea (@crypt0_sea)

● KOOB Crypto 3.0 (KOOB Crypto) (@kookookoob)

● Coin Boy's Crypto Story (@coinboys)

● Naback's coin life (@ysytop2)

● Lee Dojin Metaverse Announcement (@leedojin2)

Considering that South Korea has a population of only 50 million, a few tens of thousands of followers is already a significant scale compared to English-speaking or other language communities. Unlike English-speaking regions, the use of X is still relatively rare among Koreans (though there is a trend of some KOLs and users migrating to X), with more people using Kakao and Telegram. Due to stricter speech control on Kakao, the number of users on Telegram is relatively higher.

These KOL communities not only have a wide coverage but also play an important role in transmitting industry information and guiding market sentiment, providing a solid foundation for project landing and volume enhancement in Korea. Additionally, there are many unlisted KOLs who also possess certain influence.

2.2 Media Coverage and Article Promotion

In the promotion and listing process in the Korean market, high-impact and locally preferred authoritative media coverage is also crucial, as it can quickly establish project credibility and effectively expand market awareness and participation.

CoinNess

CoinNess is a leading cryptocurrency media platform in Korea, focusing on real-time translation and publication of overseas news. Its Live Feed service provides investors with the fastest market updates. As the largest institutional-level cryptocurrency investment information provider in Korea, CoinNess also collaborates with the Korean national news agency Yonhap Infomax to exclusively provide real-time news sources for cryptocurrencies. (@coinnessgl)

Blockmedia

As Korea's first blockchain-focused media, Blockmedia has long focused on trends in traditional finance and the cryptocurrency market, project progress, and regulatory dynamics. Although its real-time reporting is slightly inferior to CoinNess, it has earned a reputation in the industry for high-quality content and in-depth analysis, covering a wide range of topics including regulations, technology, and lifestyle. (@with_blockmedia)

TokenPost

TokenPost is Korea's largest blockchain and cryptocurrency media outlet, frequently participating as an official media partner in government blockchain forums, Asian cryptocurrency summits, and technical seminars. It has a data platform and industry research department that provides customized intelligence and in-depth analysis services for institutions and enterprises, combining authority and professionalism. (@tokenpost)

Bloomingbit

Bloomingbit is an authoritative cryptocurrency information platform under the most influential and credible comprehensive financial media group in Korea—the Korean Economic Media Group—providing 24/7 news and market reports on blockchain and cryptocurrencies selected by industry experts. Bloomingbit combines broad influence with professional interpretative ability, becoming an important information source for institutional investors. (@bloomingbit_io)

2.3 Professional Consulting Firms and Research Platforms

As some investors find it challenging to fully understand the structure and key points of projects, the marketing of cryptocurrency listings thus relies on professional consulting firms and research teams to help interpret the core value and market potential of projects, providing investors with in-depth analysis and decision support.

Despread

As a leading cryptocurrency data analysis platform, its in-depth market research and industry trend reports help project teams understand market dynamics and accurately assess competitiveness, allowing for more targeted marketing strategies. (@DeSpreadTeam)

Xangle

With its strong blockchain data analysis capabilities and transparent project review mechanisms, Xangle provides investors with authoritative risk assessments and decision support, serving as an important information platform in the cryptocurrency industry. (@Xangle_official)

Tiger Research

Through in-depth research, GTM consulting, and strategic investment, Tiger Research not only gains insights into industry trends but also helps projects optimize growth paths and market strategies, promoting the long-term development of the Web3 ecosystem. (@TigerResearch)

K1 Research

With its advanced market analysis capabilities and strategic data-driven decision-making, it provides in-depth market insights and trend forecasts for crypto projects and investors. By leveraging data analysis, it helps optimize investment decisions and risk assessments, contributing to the sustainable development of the crypto ecosystem. (@K1_Research)

2.4 Other Methods

SEO Optimization: Building on the aforementioned methods, more refined SEO strategies can be developed for the Korean market, especially on the Naver platform, where the effects are most pronounced. If executed properly, this can significantly enhance project visibility and increase the success rate of listings.

In-depth Forum Viral Marketing: By combining community engagement with viral forum marketing, it can effectively amplify discussion heat and user attention, achieving cross-layer penetration. For example, posting meme images that resonate with Korean culture on local popular platforms like Coinpan can often stimulate spontaneous user-generated content and dissemination, creating sustained heat diffusion.

Offline Events: Offline events are an important part of marketing for projects in Korea. These include community study groups, seminars, and hosting informational sessions where tokens are distributed on-site. Such activities can enhance user trust and brand loyalty while promoting interaction among community members and word-of-mouth marketing.

Event Sponsorship: This includes sponsorship of both cryptocurrency and non-cryptocurrency events. A common example in cryptocurrency event sponsorship is hackathons. In non-cryptocurrency event sponsorship, sports events are the most widespread, such as soccer, racing, and esports events, which not only raise awareness of the project among potential users but also significantly enhance brand influence.

Kaito Marketing: Kaito marketing is based on algorithms and data, providing rankings and metric tools that allow project teams to monitor user engagement and interaction effects in real-time, achieving transparent and efficient targeted promotion. The cost structure is more favorable for small and medium-sized projects, helping to enhance community activity and precise user reach, but care must be taken to avoid excessive noise that could lead to user aversion.

Professional Marketing Solutions: Engaging professional third-party marketing agencies for comprehensive managed marketing services, including brand positioning, community operations, content creation, and advertising placement, to enhance visibility and user engagement.

3. Basic Situation of Token Listings on Korean Trading Platforms

3.1 Market Share

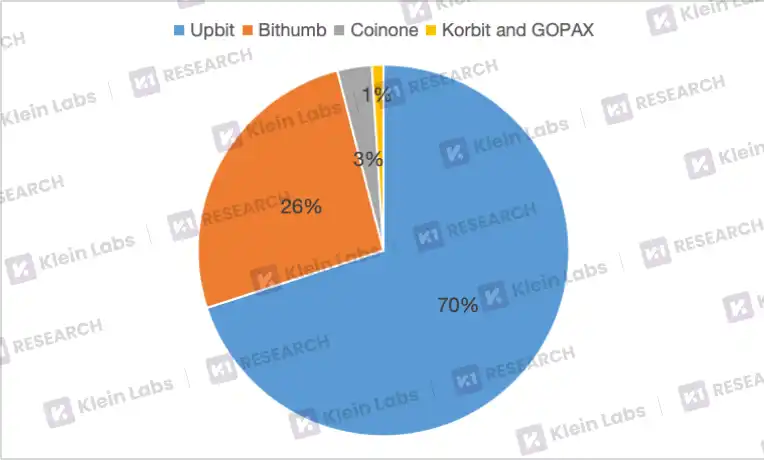

● UPbit: Due to competitive influences from other trading platforms launching trading fee reduction activities, UPbit's market share has gradually declined from a high of 86% in 2021, stabilizing at around 70% in February 2025.

● Bithumb: With proactive marketing strategies, especially a significant increase in marketing investment and the launch of zero-fee promotions since 2024, Bithumb has seen a notable recovery in market share, maintaining a stable trading volume of about 26%.

● Coinone: Since launching the "zero-fee early bird ticket" to attract new users in October 2024, along with community operation strategies like trading leaderboards and activity survey participation codes, Coinone has accelerated market share growth while solidifying its existing user base, currently holding about 3% market share.

Among all local trading platforms in Korea, the combined market share of the top three platforms—UPbit, Bithumb, and Coinone—reaches as high as 99%, while Korbit and GOPAX together account for about 1%.

These major trading platforms are all part of the DAXA alliance, which enhances the overall stability of the industry and the efficiency of token listings through information sharing and market collaboration, while also creating a certain coordinated effect in the listing rhythm and market response for new tokens. In 2023, the five major cryptocurrency trading platforms in Korea established DAXA (Digital Asset Exchange Alliance) as a self-regulatory alliance aimed at improving the transparency, compliance, and investor protection levels of the cryptocurrency market. The alliance ensures that project teams meet safety and compliance requirements through unified listing standards while collaborating with regulatory agencies to promote policy improvements, thereby enhancing the overall compliance and transparency of the industry.

Since the virtual asset committee meeting in June 2025 confirmed that the "zero-fee policy" applies to the three major fiat-to-crypto trading platforms in Korea—UPbit, Bithumb, and Coinone—it has further solidified and promoted the dominant positions of these three in the market.

3.2 Supported Trading Pairs

3.3 Number of Listings

To analyze the listing situation, we selected the period from January 2024 to July 2025 as the statistical interval. This period not only covers a complete cycle of bull and bear markets but also includes important political nodes in the Korean cryptocurrency market. This statistical interval can comprehensively reflect the changes in the number of listings on Korean trading platforms and the market environment, providing reliable references for studying project listing patterns and marketing strategies.

Overall, during the statistical period, the number of listings in the Korean market showed a significant upward trend, particularly active in the second quarter of 2024 and the first half of 2025. During this period, almost all major trading platforms accelerated the pace of new token listings, with market activity rising to relatively high levels. This phenomenon is closely related to the policy environment.

● Second Quarter of 2024: The "Virtual Asset User Protection Act" is set to take effect on July 19. In the two months leading up to the official implementation of the new regulations, leading trading platforms like UPbit and Bithumb noticeably accelerated their listing and token review processes, attempting to complete more project listings during the brief "window period" before stricter token listing and existing token review mechanisms are enforced. This concentrated listing activity during this phase directly boosted the overall number of listings in the market.

● First Half of 2025: Political factors also played an important role. During the Korean elections, Lee Jae-myung clearly stated that he would fully support the domestic cryptocurrency industry and promote the legalization and deregulation of cryptocurrencies. This policy expectation, along with the subsequent introduction of the "Digital Asset Basic Law," further strengthened market confidence. For the world's largest altcoin trading market, known for its activity and speculation, the implementation of this law is widely seen as a significant benefit, prompting trading platforms and project teams to accelerate their layouts in the short term.

Specifically, against the backdrop of the overall market listing boom, the strategic differences among different trading platforms also reflect their varying considerations in resource allocation, risk tolerance, and competitive positioning.

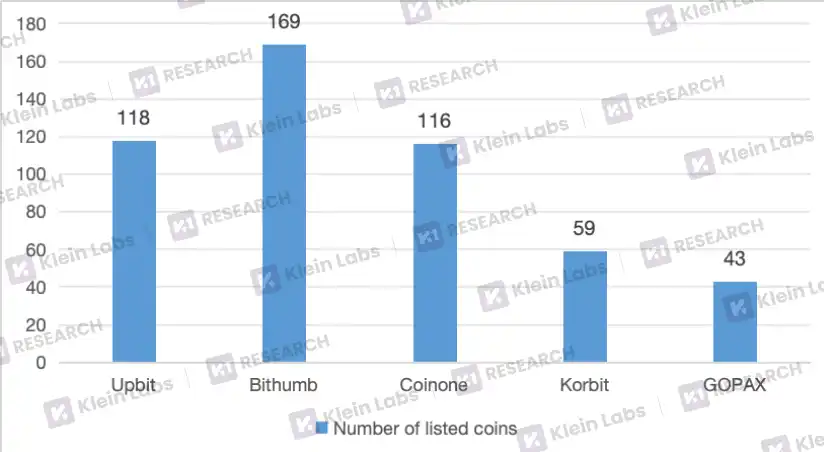

● Bithumb's number of listings ranks first, leading other trading platforms. Bithumb not only has advantages in user base and liquidity but also maintains a relatively aggressive listing rhythm to seize market opportunities.

● Among the top three trading platforms, UPbit and Coinone have similar numbers of listings, reflecting a more stable and cautious listing strategy focused on maintaining existing ecosystem stability and compliance requirements.

● In contrast, Gopax and Korbit have relatively fewer listings, indicating that these two trading platforms have a smaller scale in introducing new tokens. This is closely related to their limited market scale, financial strength, and risk control capabilities.

4. Analysis of Listing Paths

After gaining a preliminary understanding of the listing characteristics and overall situation of several major trading platforms in Korea, the next step will be to conduct an in-depth analysis based on specific listing price data. By comparing the specific data on the types of tokens listed and their performance across different trading platforms, we can more clearly outline their commonalities and differences in project selection, pricing strategies, and market feedback, thus providing a more intuitive and data-supported perspective for understanding the operational logic and competitive strategies of each trading platform.

To more accurately grasp the overall patterns and trend characteristics of listings in Korea, this study will next focus on analyzing the three trading platforms with the highest market share.

4.1 Analysis of Listing Numbers and Influencing Factors

4.1.1 Monthly Overview of Listings on the Three Major Trading Platforms

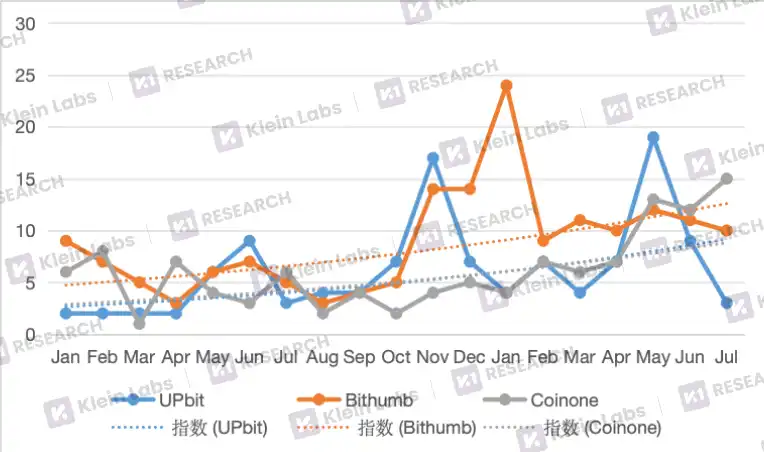

Overall Trend: Since November 2024, the number of listings on the three major trading platforms has shown an upward trend. The increase in listings reflects heightened market sentiment. In November 2024, the results of the U.S. presidential election were announced, with Trump winning, bringing new confidence to the market. At the same time, Bitcoin prices continued to reach new highs, with popular sectors such as Layer 1, memecoins, AI, and DeSci performing strongly, resulting in positive market sentiment. During this period, the actions of trading platforms regarding listings noticeably increased, reflecting the pattern that the number of listings typically rises during bull markets.

Specific Analysis:

● UPbit: The overall peak characteristics are quite evident, with significant differences between periods of dense listings and more stable periods, showing three peaks in total, occurring in June 2024, November 2024, and May 2025. The latter two concentrated listing periods coincide with market bull runs:

In November 2024, Bitcoin rose nearly 40%, driving overall market prosperity;

In May 2025, Bitcoin broke through the $100,000 mark, and Ethereum also rebounded strongly, with listings concentrated in the Layer 1 sector, coinciding with the regulatory window period before the formal introduction of the "Digital Asset Basic Law."

Although BTC and ETH showed weak trends in June 2024, the overall market capitalization of the Korean crypto market remained high, and trading platforms launched a public official cryptocurrency asset information disclosure system, enhancing transparency, which also led to a peak in listings on Upbit that month.

● Bithumb: The number of listings peaked in January 2025. Since November 2024, its number of listings rapidly climbed to 24 new tokens in a single month, stabilizing at around 10 new tokens per month, nearly double the average level in the first half of 2024. Since the strategic adjustment in 2023, Bithumb's market share has steadily increased. With the new president taking office and favorable conditions for the Korean cryptocurrency market, it adopted a more aggressive listing strategy to accelerate market share acquisition.

At the beginning of 2025, Bithumb accelerated its listing rhythm to capture the user growth trend and attract more participants. This move is closely related to the fact that the proportion of new users among Korean cryptocurrency investors reached 33% in December 2024, driven mainly by market sentiments such as Bitcoin halving and Trump's election victory, indicating that the user base is continuously expanding.

● Coinone: The listing rhythm is relatively balanced, maintaining a stable high volume of listings in the first quarters of both 2024 and 2025. In May of this year, Coinone experienced a significant peak in the number of listings, surpassing the peaks of the previous months. This change is attributed to the previously launched fee reduction policy and marketing investments, which successfully solidified a loyal user base; at the same time, multiple favorable news regarding cryptocurrencies and the introduction of the "Digital Asset Basic Law" provided stronger policy support for Coinone. Based on these factors, Coinone chose to increase the variety of listings by expanding the number of supported trading pairs to attract more users, thereby further expanding its market share.

Similar to UPbit, Coinone also reached a phase peak in May of this year; however, unlike UPbit, which saw a sharp decline in listings in July, Coinone set a new high in the same month. This indicates a difference in strategies between the two in responding to market conditions. Overall, the listing rhythm is closely related to BTC price trends and market sentiment, with Coinone more inclined to maintain an active listing strategy during bullish market phases to attract users and sustain growth momentum.

From the index curve of the number of listings, UPbit and Coinone show a generally similar trend, but their performance styles differ. UPbit's curve exhibits more pronounced peaks and troughs, forming periodic adjustments to help maintain overall balance; whereas Coinone's curve maintains a high synchronization with BTC price trends, remaining relatively stable and continuously upward, indicating that its listing strategy directly follows market conditions, pursuing stable expansion.

4.1.2 Quantitative Analysis of Influencing Factors on Listings

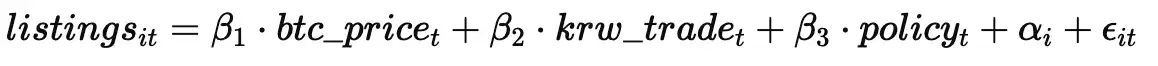

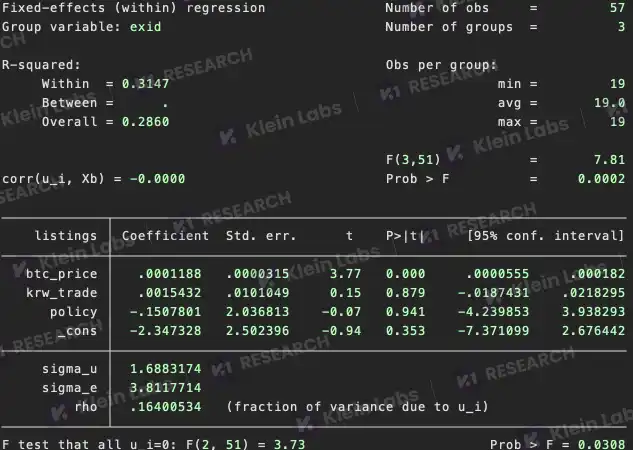

This section employs a panel data fixed effects regression model aimed at systematically assessing the impact of BTC prices, KRW-denominated trading volumes, and policy factors on the number of listings on major trading platforms in Korea.

● Panel data has the advantage of simultaneously containing both time series and cross-sectional dimensions, allowing for the capture of dynamic effects of variables over time while controlling for individual differences. Compared to single cross-sectional or time series analyses, the panel method can effectively enhance estimation accuracy and reduce omitted variable bias.

● The introduction of the fixed effects model is primarily to control for time-invariant characteristics at the trading platform level, avoiding interference from these long-term structural differences on coefficient estimates. By introducing trading platform fixed effects αᵢ, the model can focus on changes over time, thereby more accurately identifying the marginal effects of BTC price fluctuations, trading volume changes, and policy windows on listing decisions.

● In interpreting the results, this study uses the p-value as the core measure of statistical significance. When the p-value of a variable exceeds 0.05, it means that at the 5% significance level, we cannot reject the null hypothesis that "the coefficient equals zero," indicating that the model does not provide sufficient evidence to prove that the variable has a stable statistical association with the number of listings during the sample period. However, statistical insignificance does not equate to economic ineffectiveness. In the high-volatility environment of the crypto market, short-term sample noise, measurement errors of variables, and individual heterogeneity may obscure their true effects. Therefore, for variables with p-values > 0.05, we will adopt a cautious interpretation in our conclusions, providing supplementary discussions from economic implications and potential mechanisms rather than relying solely on statistical significance for conclusion judgments.

We set the following model:

Where:

listings: The number of listings on trading platform i in month t

btc_price: The average BTC price for the month (in USD)

krw_trade: The total trading volume for the month denominated in KRW (in Billion)

policy: Policy dummy variable (1 = policy window period, 0 = no)

αᵢ: Trading platform fixed effects to control for long-term strategic differences among different trading platforms.

Panel regression results indicate:

● BTC price is significantly positively correlated. For every $1 increase in BTC, the average number of listings increases by approximately 0.00012; if the average monthly BTC price rises by $10,000, the average number of listings will increase by about 1.19, with a very small p-value, indicating that this relationship is statistically robust.

● Changes in KRW-denominated trading volume are not significantly correlated with the number of listings, possibly due to significant short-term trading fluctuations and project heterogeneity, which do not directly drive the listing strategies of trading platforms.

● The policy window period does not have a significant impact on the number of listings, suggesting that different trading platforms respond differently to policies.

● The fixed effect αᵢ helps control for long-term strategic differences among trading platforms, allowing the model to focus on the impact of time dimension factors.

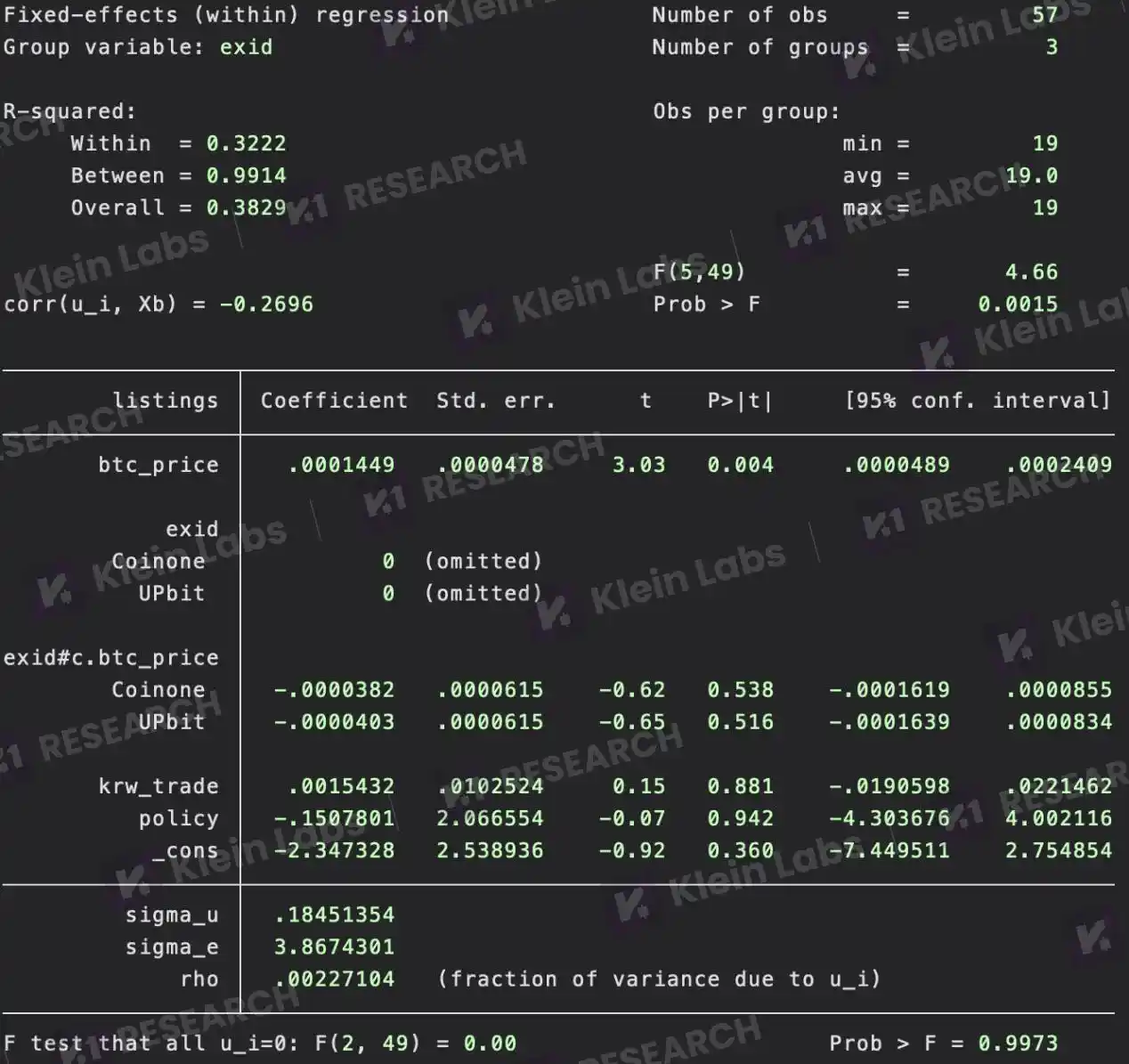

When further analyzing the differences among trading platforms, the regression results show:

● In comparison, UPbit and Bithumb have slightly lower marginal responses to BTC prices, but the difference with Coinone is not statistically significant, indicating that the three major trading platforms exhibit a similar positive response pattern when facing BTC price fluctuations.

● Specifically, Coinone is particularly sensitive to changes in BTC prices. For example, when the average BTC price increases by $10,000, the number of listings on Coinone is expected to increase by about 1.45, indicating that price increases stimulate its listing of new tokens to capture market enthusiasm and investor attention.

● Overall, BTC price signals have a significant impact on the listing decisions of Korean trading platforms in the short term and serve as an important reference for project teams in choosing listing windows.

Combining the two analyses, the conclusions indicate:

● During favorable market conditions, the three major trading platforms generally adopt synchronized expansion strategies, but Coinone is more sensitive to market conditions.

● BTC price is the main driver of the number of listings, rather than strategic differentiation among trading platforms.

● The overall Korean crypto market is guided by macro market conditions, with the differences among trading platforms having limited impact on long-term strategies.

4.2 Analysis of Listing Tracks

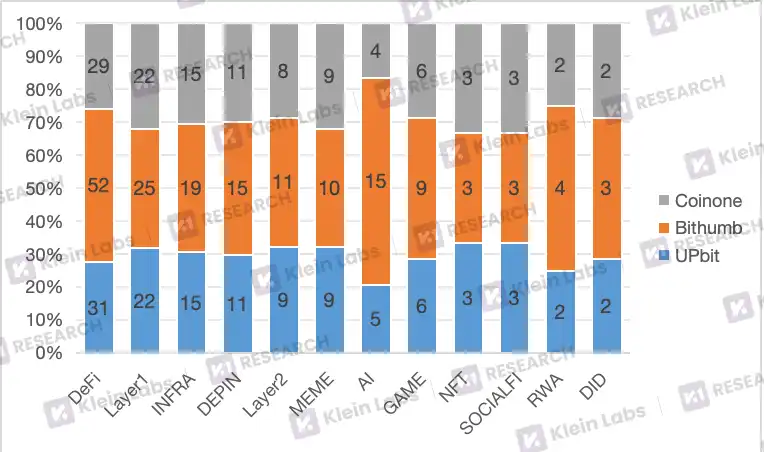

To further study the listing preferences of the three major Korean trading platforms, we conducted a systematic review and analysis of their recent listings. This analysis provides project teams with referenceable listing strategies and helps investors identify potential investment targets, grasping the hotspots and trends in the local Korean market.

Common Points

● In the listing structure of the three major trading platforms, the number of DeFi, Layer 1, and Infra projects ranks among the top. This indicates that all platforms remain highly focused on listing strategies that possess practical application value, particularly emphasizing the DeFi ecosystem and Web3 foundational infrastructure. DeFi projects account for about one-third of the total number of listings.

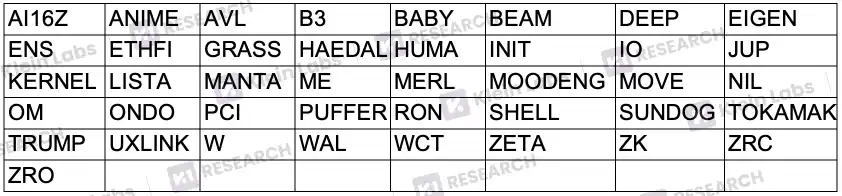

● In the DeFi sector, the three trading platforms jointly listed 12 major high-quality overseas projects, including BABY, COW, DEEP, DRIFT, ENA, HAEDAL, JTO, JUP, KERNEL, PUFFER, W, and ZRO, all of which are representative projects with high recognition and user bases globally, demonstrating the platforms' convergence in selecting high-quality DeFi assets.

● In contrast, the number of listings in emerging sectors such as NFT and SocialFi is significantly lower across the three platforms. From the explosive growth in 2020 to the rollercoaster fluctuations in the market, followed by a prolonged winter for NFTs, market sentiment and liquidity have remained under pressure. Recently, the NFT market has seen a strong rebound, and the three major trading platforms selectively listed three leading blue-chip NFT projects: PENGU, ME, and ANIME while supplementing their top assets. However, overall, the three major trading platforms still maintain a relatively cautious and observant attitude towards the NFT sector.

Differences

● Bithumb ranked first in the number of listings during the statistical period, and compared to UPbit and Coinone, it has a higher proportion of new tokens in the DeFi and AI sectors, fully reflecting Bithumb's keen capture of market opportunities and hotspots during the AI boom in 2024, as well as its rapid response in listing strategies.

Coinone and UPbit have a high overlap in overall listing numbers and timing rhythms, but there is a clear differentiation in their specific token selection styles. Taking the DeFi sector as an example:

● UPbit has independently listed established projects like COMP and BNT, which have long-term ecosystem support and have been market-validated, demonstrating a focus on stability and historical performance.

● Coinone, on the other hand, has independently listed relatively newer but promising innovative DeFi projects like NAVX and YALA, showcasing an open attitude towards emerging high-quality projects and forward-looking layouts, with a more inclusive selection standard, leaning towards supporting early innovative projects with long-term growth potential.

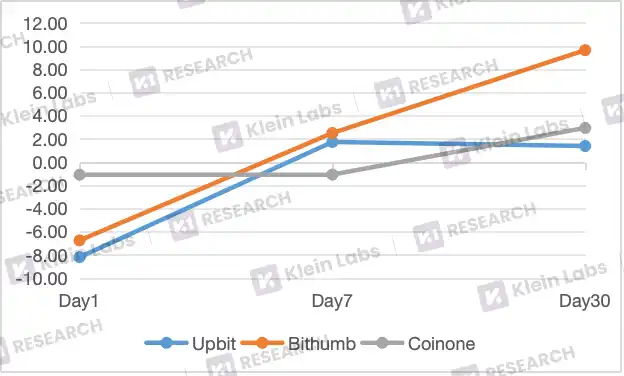

4.3 Token Price Performance Analysis

This study primarily focuses on the price performance of newly listed tokens on the three major trading platforms. It examines the price changes on the 1st, 7th, and 30th days compared to the initial pricing set by the trading platforms for the new tokens, to analyze their trends, volatility patterns, and market responses.

● The first-day price reflects the market's immediate acceptance of the new asset, influenced by speculative buying and FOMO emotions, making it a critical phase for initial market pricing;

● The price changes from the 1st to the 7th day can capture short-term market sentiment and initial recognition of the project's fundamentals, measuring the sustainability of market enthusiasm and helping to assess reasonable initial pricing;

● The price trends from the 1st to the 30th day reflect the long-term support of the token, as short-term speculation cools down and speculators exit, the changes in price and trading volume become important references for market recognition.

In calculating price returns, to avoid the impact of extreme values on the overall trend, we excluded the top and bottom 25% of outliers and used a trimmed mean method for analysis, thereby more accurately reflecting the typical price volatility of the tokens.

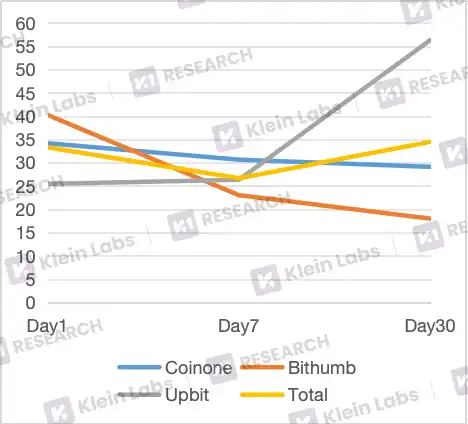

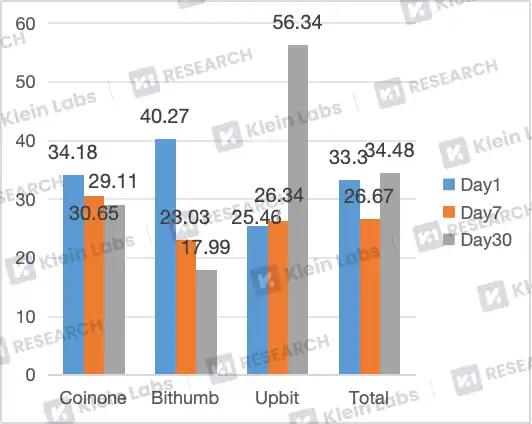

● UPbit: The average closing price on the first day is the lowest, possibly due to a large user base and concentrated selling by speculators, leading to price pressure on the first day. On average, UPbit's price quickly rebounds on the seventh day, with the subsequent increase gradually diminishing, showing a steady upward trend after short-term adjustments.

● Bithumb: The average price performance exhibits the largest fluctuation range, with both upward and downward movements being quite strong, which may be related to the larger variety of listed tokens and higher market activity. Although the curve indicates an upward trend for Bithumb, the steep slope and amplitude may also increase the risk for investors.

● Coinone: The price fluctuation is the smallest, indicating a high level of stability and predictability. Throughout the observation period, its price trend remained steady, with the increase on the 30th day even surpassing that of UPbit, suggesting that even with limited short-term volatility, the token still possesses the potential for sustained growth. This stable return means that investors face relatively low price volatility risk, making it more suitable for investment strategies that pursue steady returns and long-term investment value.

4.4 Return Analysis: The Bridge Effect of Trading Platforms

4.4.1 Research Methodology

In this study, we analyze the secondary indicator—token returns—to examine the impact of the initial listing on Korean trading platforms on the price performance of newly listed tokens. Compared to absolute prices, returns have significant advantages:

Ignoring unit effects: Unlike absolute prices, returns are relative indicators that are not affected by token face value or trading unit differences, making cross-token and cross-platform comparisons easier.

Reducing scale bias: The price differences among different tokens can be enormous, and direct price comparisons may be misleading, while returns can standardize the scale, highlighting the magnitude of changes rather than absolute values.

Capturing market response sensitivity: Returns reflect investors' immediate emotions and behavioral responses to new listings, helping to measure the impact of the initial trading platform on price fluctuations.

4.4.2 Token Selection and Sample Determination

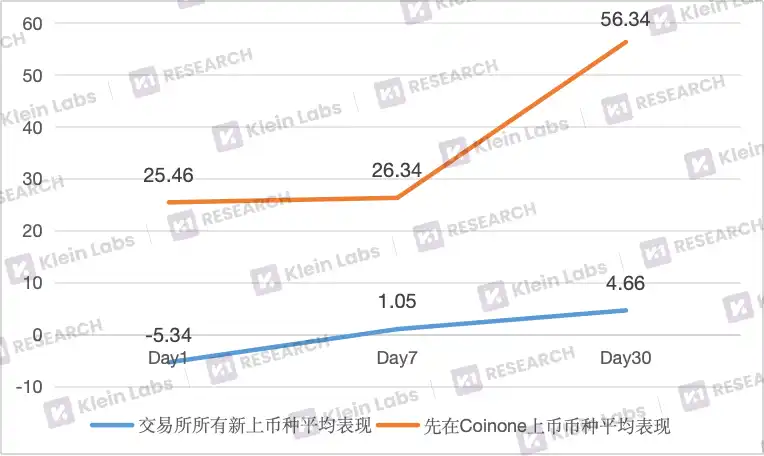

Data shows that both Bithumb and Coinone exhibit a certain "bridge effect." Among them, Bithumb has 57 tokens that were first listed on its platform before landing on UPbit; Coinone also performed significantly, with as many as 41 tokens first listed on Coinone before subsequently being listed on UPbit and Bithumb, with an average listing interval of 93.6 days. Next, this section will take Coinone as an example to analyze its characteristics in listing rhythm and market linkage.

For some representative projects, such as EIGEN, ENS, ETHFI, etc., Coinone's layout time even precedes by more than a year. Overall, the average return performance of these tokens is better than the overall market level, further validating Coinone's role as a "bridge" in the ecosystem—introducing potential assets early and channeling them to platforms with larger trading volumes and broader coverage.

This bridge effect is reflected not only in the time difference but also in return performance: tokens listed early on Coinone provide significant excess return opportunities for early participants, and when they subsequently enter other mainstream trading platforms, they form a cross-platform price and liquidity transmission mechanism. Therefore, Coinone plays a dual role as a project incubator and asset circulation hub in the Korean trading platform ecosystem.

4.4.3 Return Time Window Analysis

From the analysis of the time distribution of price performance, the overall return performance of tokens listed on Coinone is the best. In the three observation windows of the 1st, 7th, and 30th days, Coinone's returns at two time points are higher than the overall average level of tokens, while the remaining time point is slightly below the average. In contrast, UPbit and Bithumb only outperform the average at one time point, while falling behind the overall market level in other time periods.

Overall, in the short-term phase of tokens, projects that were first listed on Coinone and Bithumb often perform the best; while in long-term development, UPbit shows a more robust and superior average level.

● UPbit: Adopts a relatively conservative strategy in the early stages of new tokens, often listing them only after the market heat has been validated. The price performance on the first day is the weakest, but due to later liquidity and a large user base advantage, the return performance on the 30th day surpasses others, becoming the best performer, indicating that its tokens are more likely to attract funding attention and secondary boosts later on.

● Bithumb: The strategy relies more on market heat, with the best price performance on the first day, showing significant short-term effects, but the overall return rate subsequently declines, indicating that without ongoing maintenance and market operation support, short-term bursts are difficult to convert into medium- to long-term advantages.

● Coinone: With the premium effect brought by first-mover advantage, it strategically lays out popular assets, allowing early participants to gain arbitrage opportunities when tokens are listed across platforms, while also enhancing its appeal to early investors. Coinone tends to take on the risks of early listings in exchange for the potential high-return token selection rights, consistently outperforming the overall average level of tokens across most time dimensions.

Based on the clear differences in token performance across trading platforms, investors can formulate more targeted strategies according to their risk preferences and operational cycles:

● Short-term speculative funds: Should focus on the performance of new tokens on Bithumb on the first day of listing, leveraging short-term market heat to capture price difference opportunities.

● Medium- to long-term trend investors: Are more suitable for tracking the performance of new tokens on UPbit 30 days after listing, capturing later funding attention and secondary boost potential.

● Early layout dividend seekers: Should closely monitor Coinone's early listing dynamics, utilizing its first-mover advantage and bridge effect to gain premium returns during the cross-platform listing process.

4.4.4 Overall Return Performance

Statistical results show that tokens listed on Coinone have average price performance far superior to the overall average level of all newly listed tokens, exhibiting a general upward trend. This phenomenon indicates that these tokens, which were first listed on Coinone, not only possess strong project quality and market competitiveness but also reflect Coinone's foresight and precision in token selection. The ability to identify and introduce quality assets in the early stages is a significant manifestation of its bridging role in the Korean trading platform ecosystem.

The analysis results also provide a reference for a potential listing strategy: by choosing platforms with relative selection advantages for early listings, there is not only an opportunity to gain initial market attention and price performance but also to facilitate the subsequent expansion of liquidity and user coverage on larger trading platforms, thus forming a complete market development path from initial exposure to medium- to long-term value accumulation.

5. Excellent Listing Marketing Cases

The overall listing threshold for Korean trading platforms is relatively high: there are strict requirements for project technical strength, compliance, and team background, as well as high expectations for market potential, community foundation, and early user activity, resulting in a limited number of actual projects that can be listed. This means that project teams must adopt a dual approach in both project hard power and market promotion strategies when vying for listings on Korean trading platforms.

The following five projects have shown outstanding performance in early marketing, and their token price trends after listing are also quite prominent. We have summarized and analyzed their marketing characteristics to provide references for other project teams. By referencing such successful cases, project teams can strategically layout in areas such as promotion, community building, media cooperation, and early user incentives, thereby enhancing the likelihood of passing audits and achieving smooth listings.

5.1 UXLink

● Media Cooperation and Special Reports

UXLink has established partnerships with multiple blockchain media and industry research institutions to publish special reports and technical analyses, enhancing the project's recognition in the market. CoinDesk Korea conducted an in-depth interpretation of UXLink's cross-chain technology, boosting technical credibility; CryptoSlate published an interview article introducing UXLink's ecological layout and token economic model; TokenPost and BlockBeats shared reports in Korean and Asian communities, expanding market exposure and community attention.

● Ecological Expansion and Cooperative Layout

UXLink built its community based on Telegram, with partners including the TON ecosystem, UOB, Arbitrum, Animoca Brands, etc. Through cross-chain interoperability, AMAs, and technical seminars, active users grew by 150% within three months, and daily trading volume increased by 200%, significantly enhancing liquidity and market influence while promoting the development of the decentralized finance ecosystem. Additionally, UXLink sponsored the Consensus Hong Kong conference and collaborated with BNB Chain and Meet48 to host the "AI Agent Rising" themed event in Hong Kong, further enhancing industry influence and community recognition.

● Incentive Mechanisms and User Participation

Participated in AIRDROP2049, distributing SBT points through social relationships on-chain to incentivize user interaction and community participation while enhancing on-chain reputation and activity.

5.2 Mantle Network

● Media Cooperation and Special Reports

Mantle Network systematically lays out media communication, collaborating with several well-known media and research institutions to publish special reports and technical analyses, significantly enhancing the project's influence within the industry. Klein Labs provides comprehensive ecological interpretations for investors; Binance Square published an interview about Mantle Network, introducing its modular architecture and Eigen-DA data availability support, enhancing technical credibility; Messari conducted an in-depth analysis of the project and released a research report to increase capital attention; TokenPost and CoinNess shared reports on the project's progress in the Korean market, expanding recognition in the Asian community.

● Community Operations and Social Media Promotion

Mantle Network actively operates social media and community platforms, building a highly engaged user base. X has over 800,000 followers, regularly updating project dynamics and interacting with the community; the official Telegram and Discord communities have over 200,000 members, regularly hosting AMAs and community discussion events to enhance user participation and sense of belonging. This refined community operation not only promotes information dissemination but also provides strong support for user activity and loyalty.

● Incentive Mechanisms and User Participation

Mantle Network enhances user activity and participation through incentive mechanisms. The Mantle Journey user participation program launched in August 2025 distributes a reward pool of 20 million MNT to participating users and applications through Soulbound Token minting, incentivizing community building and ecological activity. These incentive measures not only enhance user loyalty but also validate the economic attractiveness of the project ecosystem, effectively forming a self-reinforcing community loop.

5.3 Flock.io

● Media Cooperation and Special Reports

Flock.io systematically lays out media communication, collaborating with well-known media such as Messari and Cointelegraph Korea to publish special reports and market analyses, enhancing industry influence; Klein Labs provides a comprehensive interpretation of the project ecosystem, offering investment references; TokenPost reports on its progress in the Korean market, increasing local market awareness.

● Ecological Expansion and Cooperative Layout

Flock.io has partnered with Alibaba Cloud Qwen and Base to introduce centralized AI models into decentralized platforms, achieving decentralized operations for on-chain transactions and wallet management. Through the Web3 Agent model, locally running AI assistants ensure user privacy, while community AMAs and technical seminars significantly enhance user activity and market influence, strengthening decentralized ecosystem construction.

● Incentive Mechanisms and User Participation

Flock.io supports the launch of the Qwen × Flock × Base AI hackathon. The event attracts participation from developers at Korean SKY universities and KAIST, utilizing federated learning technology to promote innovation and practical application of decentralized AI models, reinforcing Flock.io's technological leadership and industry influence in the decentralized AI ecosystem.

5.4 BigTime

● Media Cooperation and Special Reports

BigTime systematically lays out media communication, collaborating with well-known media such as CoinDesk Korea, CryptoSlate, and TokenPost to publish special reports and project ecosystem analyses, enhancing industry influence; Messari provides an in-depth interpretation of its game economic model and token incentive mechanisms, offering references for investors; BlockBeats reports on BigTime's community activities in the Asian market, increasing local market awareness.

● Community Forum Viral Marketing

BigTime implements a viral marketing strategy through community forums, Twitter, and Discord, activating player interaction and information dissemination. By utilizing a game team formation mechanism and invitation code system, players are encouraged to actively invite new users, rapidly expanding the community size while enhancing user stickiness and brand influence.

● Incentive Mechanisms and User Participation

BigTime requires player participation through invitation codes, creating a short-term "hard-to-get code" craze, significantly boosting community activity. This reflects market demand. The project also offers multiple incentive measures such as free game OTC, voice channel support, daily NFT drop rate sharing, and advanced dungeon sharing, effectively enhancing user participation and community activity.

5.5 Sign

● Media Cooperation and Special Reports

Sign systematically lays out media communication, collaborating with Tiger Research, CoinDesk Korea, CryptoSlate, and other well-known media and research institutions to publish special reports and technical analyses, enhancing industry awareness and capital attention; TokenPost and BlockBeats share reports, expanding the project's exposure and influence in Korean and Asian communities.

● Community Forum and Viral Marketing

Sign utilizes cultural symbols to build a strong sense of identity and belonging, successfully cultivating a self-sustaining community of over 50,000 members. The community exhibits high loyalty, with some core members even tattooing the Sign logo on their bodies, reflecting the project's deep cultural influence and social dissemination effects.

● Incentive Mechanisms and User Participation

Sign encourages user interaction and content sharing through on-chain tasks, airdrop rewards, and a fair incentive system based on Soulbound Tokens (SBT); a high proportion of community incentives combined with a diversified product matrix effectively penetrates the on-chain trust and distribution infrastructure market, promoting the vigorous development and self-reinforcement of the "Orange Dynasty" community.

The above cases fully demonstrate that through systematic and multi-dimensional marketing strategies, projects not only gain capital attention and user recognition but also successfully enter the strictly regulated and limited Korean trading platform market. This indicates that the project's strength and market recognition have reached high standards, providing other project teams with valuable successful experiences and reference models.

6. Conclusion

In the global cryptocurrency landscape, the uniqueness and vibrancy of the Korean market provide project teams with highly valuable reference samples. Data indicates that the resonance between policy and market sentiment significantly influences the listing rhythm; fluctuations in BTC prices not only affect investor confidence but also subtly change the listing strategies of trading platforms. This dual-driven mechanism of market and policy reminds project teams that when formulating global issuance plans, they must incorporate macro trends and regulatory dynamics into their decision-making framework.

Moreover, the "listing bridge effect" prominently reflected by Coinone is noteworthy—its early listings often signal attention and follow-up from other mainstream trading platforms, not only bringing secondary liquidity but also amplifying the project's market voice. This suggests that, in the face of limited resources, precisely selecting entry platforms may leverage market dynamics more effectively than blindly pursuing large platforms.

However, the experiences of the Korean market cannot simply be replicated. The user profiles of different trading platforms, community cultures, listing review mechanisms, and localized promotional resources all determine the success or failure of projects in this market. For project teams seeking international expansion, true competitiveness lies in their ability to deeply integrate data analysis, market judgment, and localized execution, appearing on the most suitable platform at the right time with the most fitting strategy.

The cryptocurrency market is ever-changing, but patterns have never disappeared. The cases from Korea teach us that a project's success depends not only on technology and ideas but also on a precise grasp of the market's microstructure and emotional fluctuations. In the future, facing such a stage, can project teams seize short-term benefits while laying the groundwork for long-term value? The answer depends on every strategic choice they make before taking the first step.

7. References

Kaiko: Korean Crypto Market Report

Simplicity: Token Launch Dynamics: The Science Behind Price Performance

Namuwiki: Controversies in Cryptocurrency Regulation in South Korea

[Video] The Democratic Party is considering the establishment of a Digital Asset Agency.. Will cryptocurrencies be managed like stocks?

DeSpread Research: 2024 Trends Report for Individual Investors in South Korea's Virtual Assets

UPbit and Bithumb's listing strategies diverged in 2025… Conservative vs. Aggressive

This article is submitted and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。