释放比特币的新路径:从沉睡资产到金融引擎

过去十年,比特币始终是加密世界最坚固的价值锚。它不服从权威、不可增发,拥有绝对的稀缺性和无需许可的全球共识,以最简单而优雅的方式定义了什么是“数字黄金”。然而,这枚“黄金”在链上的使用效率却始终偏低,大量 BTC 长期沉睡,难以参与链上交互与金融流动。

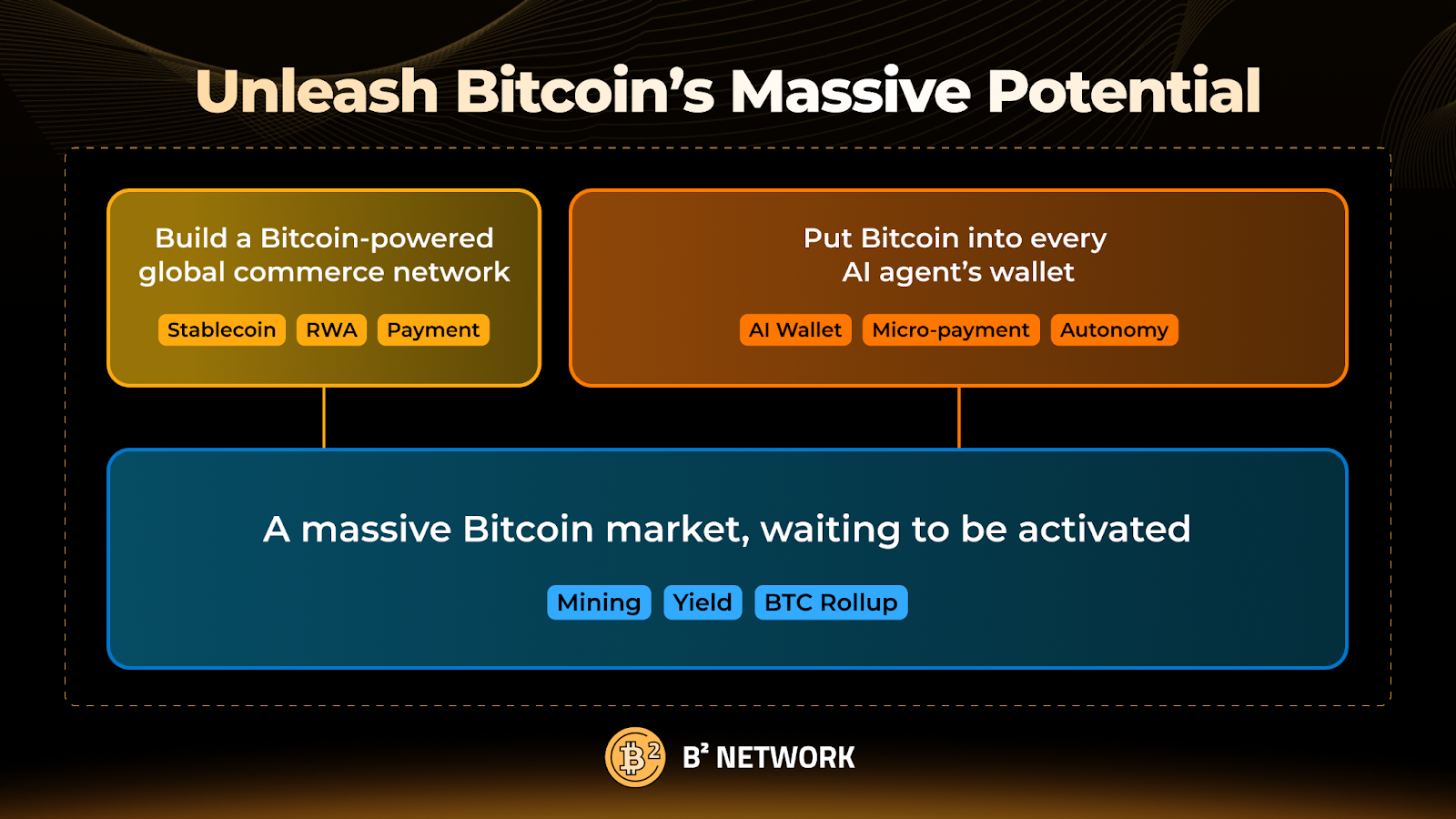

而过去一年,B² Network 一直致力于唤醒这份沉睡的价值。我们搭建高性能 Rollup 与数据可用性层,将智能合约、安全性与比特币主网深度绑定;我们推出 BTCFi 聚合平台 Buzz 和创新型矿池 Mining Squared,为比特币持有者与矿工构建可持续、可组合的收益通道;我们吸引了超过 5000 BTC 流入、服务超 50 万比特币持有者和矿工、并连接起多链生态。

在这条“释放比特币使用性”的路径上,我们已经迈出了决定性的一步。

但当越来越多的 BTC 被调度起来,参与借贷、流动性、质押乃至跨链协同,一个更深层的问题也逐渐暴露出来:我们仍缺乏一个稳定而原生的标准价值单位,让 BTC 能在这些应用之间自由流动、灵活结算。

原生 BTC 的高波动性,使它不适合作为支付单位或价格参考;而当前主流稳定币虽然流通广泛,却大多脱离 BTC 体系、缺乏链上透明度,甚至在机制上无法规避中心化风险;而 AI、大模型、Agent 等新一代链上用户,正迫切需要一个能在毫秒内完成支付结算、又足够安全透明的“经济燃料”。

因此,面对未来更复杂、更高频的金融交互,比特币需要一个真正属于它的稳定币。而这正是是我们推出 U2 的原因。

U2:比特币驱动的稳定币系统,为 BTC 铸造真正的流动性单位

U2 是由比特币驱动、美元锚定的稳定币,运行在 B² Network 的高性能执行层与安全托管体系之上。它是比特币流动性的放大器,是 BTC 与链上经济、AI 智能体连接的关键接口,是一个真正意义上的“比特币原生稳定币”。

用户可使用 BTC(或对应跨链资产)作为抵押,在头部托管机构的保障下铸造 U 2,并享受高效、安全、透明的铸币流程。其特点如下:

- 稳定锚定:U2 可按 1:1 兑换主流稳定币,确保锚定稳定性;

- 安全抵押:采用超额抵押机制,抵押过程完全透明结合 AI 驱动的“自适应清算引擎”,确保在 BTC 波动中仍能安全维持锚定,动态管理风险;

- 资产托管:接入头部托管方,支持定期审计与合规监管,保障系统稳健运行;

U2 的特别之处在于它是比特币价值的放大器。与传统稳定币不同,U2 背后的 BTC 并不会“闲置”,而是可以继续参与挖矿、收益策略和链上活动,实现“铸币生息”的双重价值释放。U2 设计了一整套围绕收益与治理的金融体系,进一步增强其使用性和对 $B2 的支撑价值:

- B2 治理与激励:$B2 持有者拥有治理权,可参与投票调整风控参数(如抵押率上限、利率门槛等),同时通过质押 $B2 获得更高借款额度或手续费折扣。协议还将定期分发 B2 奖励,并保留一定比例作为风险准备金池,增强系统稳健性。

- B2 价值增强:所有通过 U2 借贷和收益获得的协议盈余,部分将用于回购 $B2 并注入生态循环。此外,平台部分利息费用也可直接使用 $B2 支付,进一步提升其使用率和市场需求。

- 利率与收益机制:未来 U2 将采用创新的收益模型。在 B² 自有的丰富的链上收益产品的加持下,用户将有机会享有多种链上复利。敬请期待。

这一套机制背后,有着清晰的使用者视角:设想你是一位 BTC 长期持有者,将 BTC 抵押铸造 U 2 后,既可以用这笔稳定币参与链上收益策略,赚取额外收益;又能通过质押部分 $B 2 获得更高额度与折扣,甚至还能用赚到的 sU 2 继续复利。BTC 依旧在手中持有,它的收益却在持续累积——真正实现“资产高效运转”。

这一切,B² 只用了几步就完成了接口打通,让“BTC HODL”拥有了全新的活力范式。

U2 能做什么?7 项能力全面激活 BTC 的链上使用性

U2 是比特币进入现代链上金融、AI 商业和全球支付网络的桥梁。它通过与多种场景的联动,拓展出前所未有的使用路径。从矿工融资、链上支付,到 Agent 微支付和全球消费,U2 正逐步建立起一个基于 BTC 背书、全球通用、可组合的稳定币能力矩阵:

1)铸币即生息,让 BTC 继续工作:抵押 BTC 铸造 U2 的同时,底层资产可被部署于多个收益策略中:包括接入 B² Buzz 平台以获得链上原生收益、参与 Delta-Neutral 等量化套利策略,以及投入矿机/算力融资获取借贷回报。与此同时,U2 本身也为持有者提供稳定年化收益,构建起双边生息的可持续稳定币模型,实现“BTC 继续生息 + U2 持有生息”的双轮收益结构。

2)为矿工提供融资渠道,未来收益也能变现:U2 与 B² 的创新型矿池产品 Mining Squared 联动,让矿工不仅可以抵押现有 BTC,还能抵押代表未来收益的算力 RWA 和实体矿机,提前获得 U2 稳定币作为流动资金,同时矿工可以用后续挖矿获得的 BTC 或其他收益偿还贷款。这意味着矿工不再需要抛售 BTC 就能运营矿机,既保留了上涨潜力,又提升了现金效率。

3)支付与结算,U 2 是比特币链上的“可用美元”:得益于 B² Network 高吞吐与低成本的执行环境,U2 可以广泛用于日常消费、协议交互、跨境支付等多种场景。B² 将接入如 ShareX 等千万级用户量的 Web2 应用,U2 可被直接用于加密支付,推动 BTC 生态中的消费落地。

4)Gas 费用支持,用 U2 玩转整个 B² 网络:U2 可直接作为 B² Network 的 gas token 使用,用户无需另备其他代币,即可完成合约交互、转账、交易等所有链上操作。随着生态协议持续增长,U2 的使用频率与需求将不断扩张。

5)多链账户体系,U2 无需跨链即可快速流转:B² Network 原生支持多链账户系统,U2 可以在多个区块链生态之间无感转移,无需传统的桥接步骤。这不仅降低了使用门槛,也极大提升了在不同链间的可用性,U2 将成为更灵活的链上通用单位。

6)自适应清算引擎,让 AI 保驾护航,动态抗风险:U2 背后的风控引擎引入了 AI 驱动的实时动态抵押率调整机制。模型综合 Chainlink、Bitstamp 等多源数据和链上市场深度,每 10 秒评估风险,并预测 1 小时内可能出现的极端尾部事件,从而提前调整铸币条件、触发预警。这使得系统在面对极端行情时能主动应对,避免强平与系统性风险。

7)毫秒级 AI 微支付标准,连接 Agent-to-Agent 商业模式:未来每个 AI 微服务都需要一种稳定且全球可达的微支付手段。AI 可通过支付 U2 获取 API 访问权限、数据片段或算力资源,形成链上 AI-to-A 商业的新型结算层。U2 正在成为“AI 原生美元”的候选者。

一枚稳定币,七种能力,全场景穿透。U2 作为“统一价值接口”,为 HODL 多年的 BTC 用户、经营中小矿场的矿工、搭建链上支付渠道的开发者,以及运行 AI Agent 系统的技术者,打开了使用比特币的新方式。

结语:Scaling BTC,从稳定币开始

U2 作为持续 Scaling BTC 战略的一部分,让 B² Network 在基础设施、金融能力和智能生态三条主线上,持续推动比特币完成从“硬通货”向“高效流动资产”的演进。

稳定币是承接 BTC 的第一跳,是释放资产效率的钥匙,更是开启智能体经济时代的入口。

我们相信,一个可扩展、透明、高效的比特币金融网络正在形成,它真正服务于持有者、开发者和未来的智能系统。接下来的故事,将由每一位用 BTC 构建未来的你,共同书写。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。