The core project WLFI, honed by the Trump family for half a year, will launch tonight at 8 PM, attracting worldwide attention. Some are betting on price fluctuations, while others are trading hot coins. Besides the real trading of "betting on the up or down direction," can we rely on a more certain way to profit from this wave of hype? The answer is arbitrage. In this article, Rhythm BlockBeats has compiled some practical arbitrage opportunities for WLFI:

Price Difference Arbitrage

1. Arbitrage Between CEXs

Due to the different matching rules, opening hours, buying density, fees, and deposit/withdrawal arrangements of various trading platforms, there will be price differences for WLFI in a short time, creating arbitrage opportunities.

For example, WLFI will open for spot trading on Binance at 9 PM tonight, but withdrawals will only be available at 9 PM tomorrow. This means that before withdrawals are enabled, funds can only "flow into Binance and be sold to on-site buyers," but cannot "flow out" temporarily. This one-way flow will make on-site pricing more likely to be overpriced.

The practical approach is quite simple. First, select two to three controllable scenarios as a "price difference triangle," usually one leading CEX (most likely Binance today, due to its high buying volume and public attention), one secondary CEX that supports withdrawals (you can choose one with lower fees to better preserve profits), and an on-chain observation point (like the WLFI pool on Uniswap, used to determine the strength of on-chain marginal buying).

At the same time, open the order books and recent transactions of both exchanges and keep an eye on the price difference of WLFI. Once you see that the price on Binance is significantly higher than on the other exchange, and after accounting for transaction fees, spreads, and possible slippage, if the net difference is still positive, you can buy in and then sell on Binance.

The difficulty of the whole process lies not in the "logic," but in the "timing." Cross-exchange arbitrage is essentially a race against delays: the opening of deposits and withdrawals, risk control pop-ups, on-chain confirmations, and even your own confirmation speed will determine whether this 0.x% to 1.x% gross profit can be realized. Therefore, it is safest to first run through the entire process with a very small amount, measuring the time and costs of each step before scaling up.

2. Triangular Arbitrage

Triangular arbitrage can be simply understood as an upgraded version of the previous "arbitrage between CEXs," involving more on-chain paths and sometimes requiring currency exchanges between stablecoins. Therefore, there are more opportunities, but also more friction.

The most common "sandwich price difference" in the early stages of a project is: the price on the BNB chain is approximately equal to the price on the Solana chain, which is greater than the price on the Ethereum mainnet, which is greater than the price on the CEX. Since the pools on the BNB and Solana chains are generally small and have many bots, prices are more easily pushed up by a few orders; Ethereum has high fees and fewer bots, resulting in relatively conservative transactions and thus lower prices; while centralized exchanges are controlled by market makers, often not opening deposits and withdrawals or imposing limits, making it impossible for price differences to be immediately arbitraged, resulting in the lowest spot price. Since WLFI is deployed across multiple chains, there is also room for such operations.

Additionally, new stablecoins like USD1 and USDT/USDC may have slight decoupling or fee differences, which can amplify loop profits.

However, it is important to note that triangular arbitrage is more complex than CEX arbitrage, and beginners should avoid trying it. Prerequisites include being familiar with cross-chain mechanisms, cross-chain paths, slippage, and fees in advance.

3. Spot-Permanent Basis/Funding Fee Arbitrage

This "spot-permanent basis/funding fee" arbitrage is a common technique used by market makers, market-neutral funds, quantitative traders, and arbitrageurs. Retail investors can also participate, but with smaller volumes, higher rates, and borrowing costs, the advantages are not obvious.

The "profit" it captures has only two essential sources: the first is the funding rate. When the perpetual price is higher than the spot price and the funding is positive, longs must pay "interest" to shorts periodically—you can do "long spot + short perpetual" to collect this interest; conversely, when the funding is negative, you can do "short spot + long perpetual," with shorts paying longs. This way, your net exposure is close to zero, and the funding fee acts like a floating interest, rolling over within a certain time period, capturing cash flow from "emotional premiums/pessimistic discounts."

The second source is basis convergence. During the launch or emotional fluctuations, there may be a one-time premium or discount of the perpetual relative to the spot; as emotions cool and market makers restore balance, the perpetual will converge towards the spot/index price, allowing you to pocket the one-time profit from "narrowing the price difference" within the hedging structure. Combined, these two sources yield a "interest + convergence" combination, from which borrowing costs, fees, and slippage are deducted to arrive at net profit.

However, it is crucial to understand the clearing mechanisms, slippage, fees, funding rate settlement times, and trading depths of different trading platforms to prevent XPL short squeeze events. Related reading: "How to Avoid Being Liquidated by Large Players Manipulating the Market with ETH and HL's XPL?"

Additionally, in the most common "long spot + short perpetual" strategy, you can also find some vaults with relatively high annualized returns, such as StakeStone and Lista DAO's vaults, which have an APY of over 40% after subsidies.

4. LP + Short Hedge Arbitrage

Simply forming an LP is not arbitrage; it is more like "exchanging directional risk for fees." However, if you add a short hedge, leaving only the net profit curve of "fees - funding fees/borrowing interest - rebalancing costs," it is also a good hedging idea.

The most common structure is to provide concentrated liquidity on-chain (such as WLFI/USDC or WLFI/ETH pools) while shorting an equivalent nominal value of WLFI perpetual on the exchange; if there is no perpetual, you can borrow coins in a margin account to sell the spot, but the friction will be greater. The purpose of this approach is simply to avoid betting on price movements and focus entirely on "the more transactions, the thicker the fees."

When executing, treat the LP as a "fee-generating market-making range." First, select a fee rate and price range that you can monitor, such as a 0.3% or 1% fee tier for new coins, setting the range close to the current price with "medium width." After deployment, part of the LP position will become WLFI spot, and part will be stablecoins; you use the "equivalent nominal" of this WLFI to open a short perpetual, initially aligning the dollar values of both legs. As the price fluctuates within the range, the on-chain leg earns fees through turnover and captures a bit of price difference through passive rebalancing; the direction is borne by the short leg, creating a net neutral position overall. If the funding fee is positive at this time, your short leg can also earn additional interest; if the funding fee is negative, you need to rely on a wider range, lower leverage, and less frequent re-hedging to maintain net profit.

The difference from basis arbitrage is that basis arbitrage captures the price difference convergence between "perpetual ↔ spot" and funding fees, while this captures the fees generated by on-chain turnover. The difference from pure LP is that pure LP's profit and loss largely depend on direction and impermanent loss.

WLFI Coin Stock ALTS and WLFI Hedge

ALT5 Sigma (Nasdaq: ALTS) raised approximately $1.5 billion through stock issuance and private placement, part of which was directly exchanged for WLFI tokens, while another part was used to allocate WLFI in the secondary market, thus positioning itself as a "vault/agent exposure" holding WLFI. For more reading on WLFI coin stock ALT5 Sigma (Nasdaq: ALTS), see: "If You Don't Dare to Buy Tokens, Is There Still an Opportunity with WLFI Coin Stock?"

At the same time, observe the price movements of ALTS and WLFI; logically, short the stronger side and long the weaker side, waiting for it to return to normal to close the hedge. For example, WLFI may surge first due to its listing and narrative push, while ALTS is constrained by US stock trading hours or borrowing costs, leading to a "lagging rise," widening the price difference; when US stocks open and funds fill ALTS's "agent exposure," this gap will revert.

If you use WLFI perpetual to hedge, you may also earn funding fees, but the main profit still comes from the price difference itself, rather than a one-sided direction.

The difference from the previous "basis/funding fee arbitrage" is that there is no certainty anchor of "spot-perpetual" here; instead, stocks are treated as a "shadow" holding WLFI, with logic resembling the old idea of "BTC ↔ MSTR," but the execution difficulty lies in friction and timing. The crypto side trades 24/7, WLFI unlocks at 8 PM, but Nasdaq opens at 9:30 AM; if you trade before that, it is pre-market trading, which can place orders and match trades, but the matching rules differ from regular trading, and you also need to be aware of the possibility of halts or circuit breakers.

WLFI Market Cap Bets on Polymarket

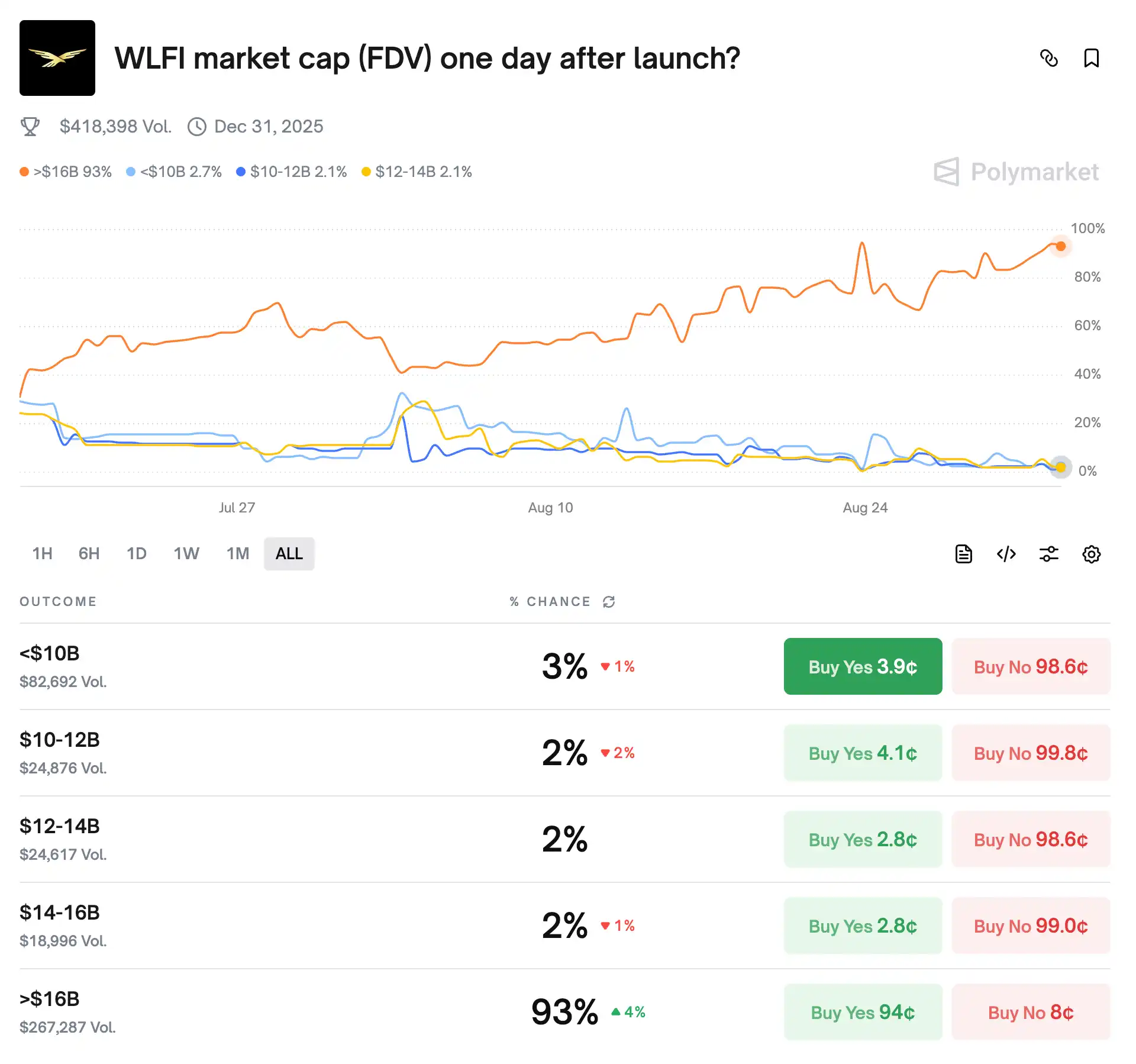

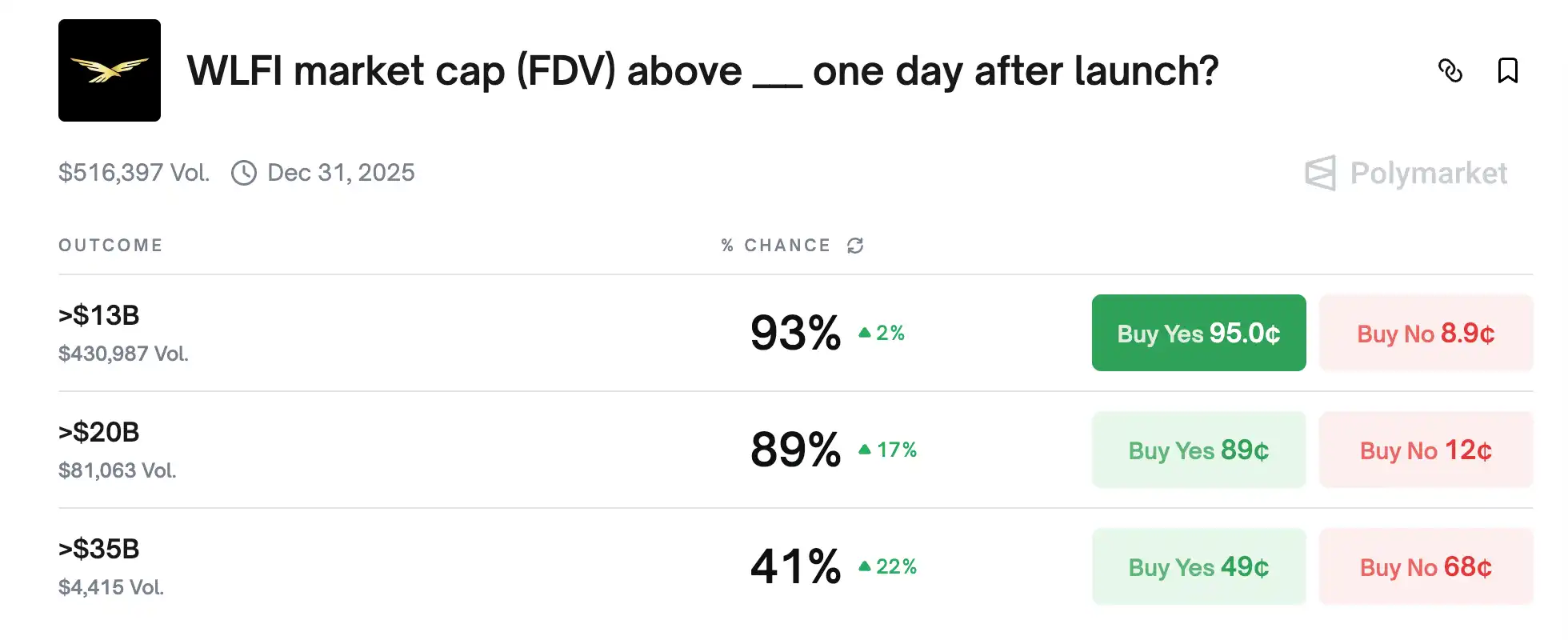

Currently, there are two bets on WLFI on Polymarket, both concerning the market cap on the day WLFI launches. One is a tiered market (with options like $10B, $10–12B…,$>16B), and the second is a threshold market (with binary judgments of >$13B, >$20B, >$35B).

Since both are asking about "the FDV one day after WLFI's launch," their prices must be consistent with each other: the sum of probabilities in the tiered market should equal 100%. Therefore, the price for the "> $16B" tier must match the P(>16B) in the threshold market.

At the same time, the prices of its complement in the tiered market ($10B, $10–12B, $12–14B, $14–16B) must equal 1 − P(>16B) in the threshold market. If you find an imbalance, for example, if the "> $16B" tier is priced high, but the total of the four tiers is also high, causing the sum of "> $16B + the other four tiers" to clearly exceed 1, you can place a sell order on the expensive side or hedge with "No," while buying up the cheaper side to create a "guaranteed $1, cost < $1" basket; if the total is less than 1, then directly buy up both sides to lock in the difference.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。