9 月 1 日,World Liberty Financial(WLFI)代币正式上线的消息,把整个加密市场的目光再度拉向特朗普家族。短短半年时间,这个原本被认为只是「Aave 分叉」的项目,已经从一场边缘尝试,演变成特朗普家族加密战略的核心拼图。

故事的戏剧性在于它的背景。就在一年前,市场对特朗普涉足加密的印象还停留在「川普币」这样的玩笑层面。但当特朗普再次入主白宫,他的家族没有停留在投机式的 NFT 或 Meme 币,而是选择了稳定币、借贷、国债类资产这些金融基础设施。WLFI 的定位,也因此从单一的借贷协议,跃升为一个试图整合稳定币、资产库(Treasury)、交易与支付的「DeFi 超级应用」。

这种转变不仅仅关乎一个协议的上线,更是一个政治与资本联手的标志性事件。特朗普的儿子亲赴香港参会,成为亚洲 Web3 舞台的明星;阿布扎比主权基金用 WLFI 稳定币 USD1 完成对 Binance 20 亿美元的投资;孙宇晨、DWF Labs、Ryan Fang 等加密 OG 纷纷站台。政治资源与加密资源的高度绑定,让 WLFI 的影响力远远超出了一个普通 DeFi 项目的范畴。

为什么我们要关注 WLFI?因为它揭示了一个全新的命题:当美国总统的家族亲自下场,稳定币是否会被重新定义?当资本、政策与叙事捆绑在一起,加密行业的秩序是否会因此改写?

近日,BlockBeats 与《Web3 101》联合出品新一期播客节目,与主理人刘峰、dForce 创始人民道深入探讨 WLFI 崛起背后更复杂的脉络,它的现实逻辑、叙事手法以及潜在风险。以下观点均来自播客内容整理(收听播客:《E60|再聊特朗普和 WLFI :总统亲友团来摘 DeFi 革命果实了?》):

特朗普家族的全景式布局

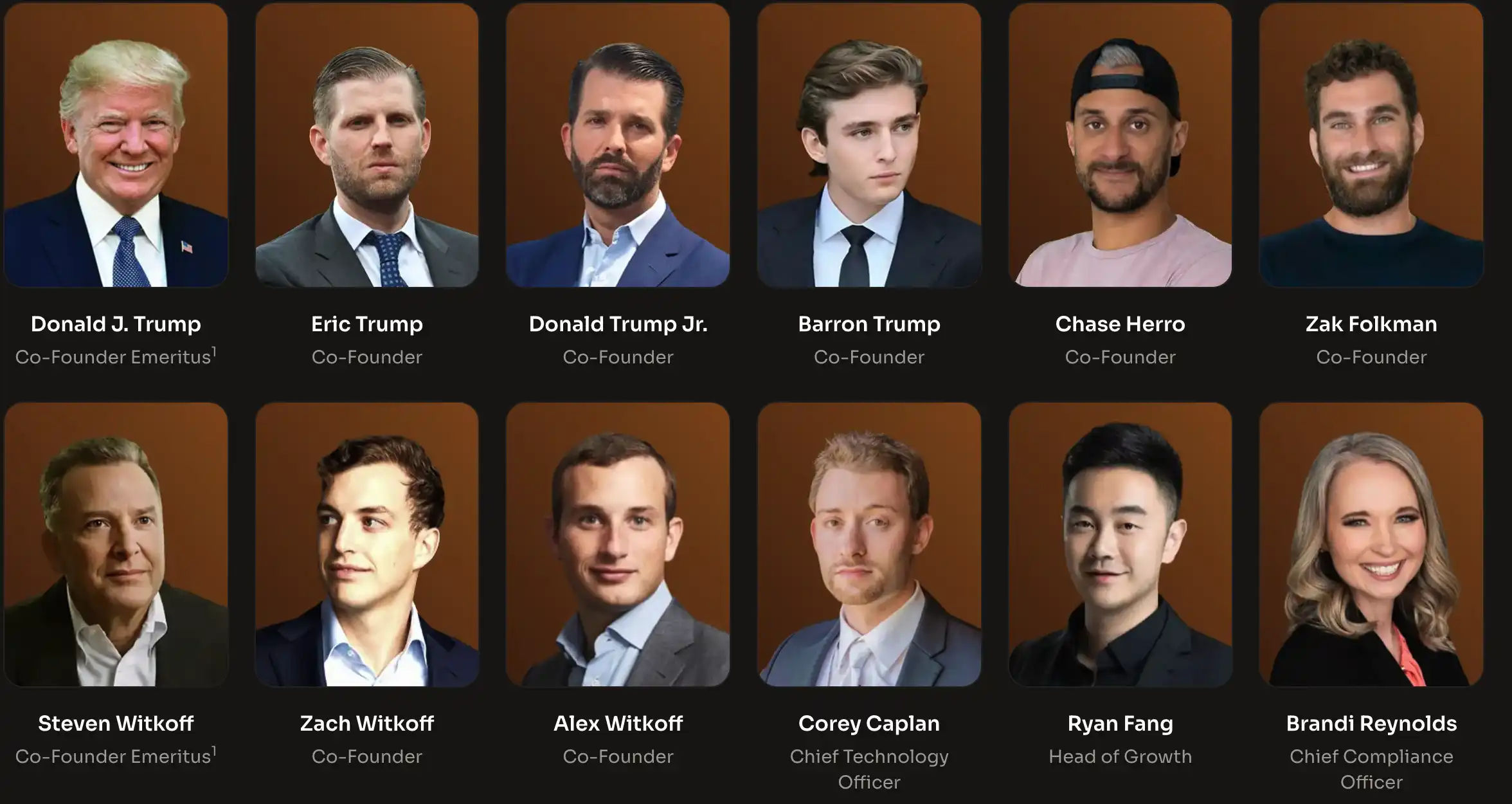

特朗普家族进军加密世界的动作并不是临时起意,而是有一套清晰的战略逻辑。早在 2024 年 10 月,也就是特朗普还未再次当选总统之前,World Liberty Financial(WLFI)就已经对外发布。那时市场的热度并不算高,ICO 也是花了一段时间才卖完,但项目的定位已经初见端倪:川普家族将旗下成员几乎全部列为所谓的「联合创始人(Co-Founder)」,展现了他们对项目的高度绑定与野心。

从整体布局来看,WLFI 延续了特朗普家族在加密世界的「一贯思路」——几乎所有大的赛道都要插上一脚:从最初的 Trump Meme 币,到 DeFi 协议,再到稳定币、比特币挖矿,甚至 Treasury 财库公司,基本覆盖了加密世界的全景。而 WLFI 便是最能体现其野心的项目,它从最早一个 Aave 的简单分叉,逐渐升级成一个「全矩阵」的 DeFi Super App,野心远远超出了最初的想象。

如今,它不仅准备推出稳定币,还与 DAT 的财库模式挂钩,俨然成为家族在加密布局中最具落地性的旗舰产品。至于代币分配,目前没有披露家族具体持有多少,但业内普遍认为,WLFI 与川普币类似——除了投资人和 ICO 公募部分,其余大多数份额仍牢牢掌握在特朗普家族手中。换句话说,尽管有一些联合创始人和外部投资人参与,但真正的主导权依然集中在特朗普家族和他们最亲近的盟友手中。

WLFI 究竟跟特朗普及其家族到底是什么关系?

尽管特朗普总统本人被列为 World Liberty Financial(WLFI)的「联合创始人(Co-Founder)」,但他并不直接参与项目的日常运营。从团队披露的信息来看,核心阵容由特朗普家族与拥有四十多年纽约地产背景的 Witkoff 家族共同主导,再加上 Dolomite 等几位亲密盟友,以及部分在加密行业摸爬滚打的老朋友。换句话说,这个项目的骨架并不是临时拼凑,而是建立在深厚的家族关系与长期商业纽带之上。

随着团队逐渐扩张,WLFI 的朋友圈也快速延伸到了加密世界的原生势力,尤其是华人圈。Ankr 创始人 Ryan Fang、Paxos 联合创始人 Rich Teo 以及 Scroll 的创始人 Sandy Peng,都在早期便站到了阵营的一侧。甚至有传言称,项目最初曾计划依托华人团队开发的 Layer2 链 Scroll 上线,不过后续便淡出人们的视野。更广为人知的还有孙宇晨以及备受争议的做市商 DWF Labs,他们与 WLFI 的关系同样紧密。DWF 不仅获得了项目的代币投资,还在自家平台 Falcon Finance 上第一时间上线了 WLFI 的稳定币 USD1。

在更高层的资源动员上,WLFI 更是联动了阿布扎比主权基金 MGX。2025 年 3 月,这家基金向 Binance 投资 20 亿美元,而这笔资金的结算方式,正是通过特朗普家族的稳定币 USD1。这一操作让 USD1 的市值在极短时间内从 1 亿美元飙升至 20 亿美元,其中超过 90% 的储备直接托管在 Binance 账上。此后,Binance 在 BNB Chain 上大量为 USD1 提供应用场景,从 Meme 币流动性调节到打新服务,应有尽有。火币(HDX)等交易所也紧随其后,第一时间上线了 USD1。Falcon Finance 更是将其纳入抵押品体系,用户可以直接用 USD1 进行借贷。

这种打法的效果立竿见影。依靠特朗普家族的政治与商业影响力,加上 Binance、DWF、孙宇晨等加密 OG 的资源倾斜,USD1 在短短几个月内就打通了整个加密市场的流通网络。无论是一线的头部交易所,还是二三线平台,都在快速接入这一新兴稳定币。可以说,WLFI 通过这种「家族背书 + 全球资源整合」的模式,把原本复杂而艰难的稳定币推广,变成了一场资源玩家联手推动的「快车道」。这也是为什么 WLFI 能在短时间内迅速走红的关键原因之一。

半年即成气候,WLFI 是如何迅速打开生态局面?

在过去半年里,World Liberty Financial(WLFI)交出了一份令整个 DeFi 行业都艳羡的成绩单。对于大多数 DeFi 产品来说,获得用户采用和形成有效的生态支持,往往需要漫长的积累:既要有交易所愿意支持,又要有其他协议愿意接入,尤其是对稳定币这种「硬仗赛道」,要打开局面几乎是一场持久战。但 WLFI 却在短短半年内就全面铺开了市场,这在竞争激烈的加密世界中堪称罕见。

那么,WLFI 到底是什么?它的产品逻辑和发展路径如何?如果从头梳理,WLFI 最早只是一个 Aave 的简单分叉。Aave 是加密世界最经典的借贷协议之一,允许用户抵押比特币、以太坊等资产来借出稳定币。而 WLFI 的起点几乎就是照搬 Aave 的模式,定位为一个标准的 DeFi 借贷项目。但随着项目推进,它逐渐扩展出了更雄心勃勃的方向,尤其是稳定币的发行。WLFI 的稳定币 USD1,某种程度上试图与 USDT、USDC 等主流稳定币竞争,成为它的重要战略支点。

与此同时,WLFI 还跨界进入了传统金融市场,成立了一家在美股上市的币股公司 Alt5 Sigma Corporation,并计划把 WLFI 代币作为储备资产,走出类似「微策略(MicroStrategy)式飞轮」的路径。团队甚至宣布要涉足加密支付,几乎把能蹭的所有热点全都纳入蓝图。可以说,WLFI 从一个简单的借贷协议,逐渐演化为一个「边发币、边改白皮书」的状态。随着版本的更新,它的愿景也越来越宏大,正在朝着「全矩阵化 DeFi Super App」迈进:有了稳定币,就能延伸出生息类产品、国债类产品、借贷、套利,甚至可能扩展到交易、衍生品等领域,构建一个覆盖 DeFi 所有赛道的「超级应用」。

从产业的联动来看,特朗普家族的其他业务也在与 WLFI 产生互动。例如,Trump 旗下市值数十亿美元的媒体科技公司 Trump Media & Technology Group Corp(DJT)也开始尝试整合加密支付,未来家族旗下的币股公司很可能与 WLFI 的稳定币和借贷产品打通,形成家族产业与 DeFi 协议的闭环。这种「产业链互补」不仅为 WLFI 提供了落地场景,也强化了它的金融生态野心。

在对外叙事上,WLFI 团队始终强调,他们的使命是「Bank the Unbanked」——让那些无法接触传统金融体系的人,通过 DeFi 和 Web3 的方式获得金融服务。这个口号并不新鲜,几乎是加密行业的老生常谈。但如果仔细观察 WLFI 的实际进展,会发现其执行过程远比口号复杂。

最初,WLFI 不过是一个借贷协议的复制品,很快却进入了稳定币赛道。它的 USD1 稳定币采用了与 USDT、USDC 类似的中心化发行模式:用户把美元交给团队,团队在链上发行等额的 USD1。这种模式并不新颖,但凭借强大的资源和资本整合能力,USD1 的规模在几天内就从 1 亿美元飙升到 20 亿美元,刷新了市场对「速度」的认知。

然而,如果你今天打开 WLFI 的官网,会发现大部分产品依旧停留在「Coming Soon」的状态:不论是借贷,还是交易所,都还在「马上上线」的阶段。换句话说,WLFI 的产品矩阵大多尚未真正落地。但与此同时,它的影响力和叙事却早已渗透进整个行业:稳定币已经上线,代币也已完成多轮销售,已经为项目带来了大量的收入,并在 9 月 1 日登陆全球一线交易所。

这就是 WLFI 的现实画像——一个故事极大、愿景极广,但产品仍在酝酿的 DeFi 项目。它的模式更像是「先画饼,再造势」,再用政治资源与资本联盟将饼迅速兑现为现实影响力。虽然目前具体的应用还有限,但它已凭借 USD1 的爆发和家族资源的绑定,成为市场热议的超级话题。换句话说,WLFI 或许还在「造城的蓝图阶段」,但这座城池的影子,已经足够引人注目。

从 DeFi 协议到稳定币,「Bank the Unbanked」概念只是个口号吗?

很多人以为特朗普家族涉足 DeFi,只是一次迎合热点的投机行为。但从 World Liberty Financial(WLFI)的发展路径来看,这个判断并不准确。特朗普过去确实玩过 NFT、Meme 币,这些更像是追逐市场情绪的短期操作;而 WLFI 的定位,却明显不同。它是家族在加密版图里最具战略意味的一环,不仅规模宏大,更承载着一种现实的痛感和长远的考量。

原因要追溯到「被去银行化」的切肤之痛。特朗普第一任下台后,家族在美国的数百个银行账户被一夜关闭,地产公司也在 JP Morgan、美国银行等传统金融巨头那里失去了基本的账户服务。特朗普的儿子在接受采访时回忆起这一幕时,眼中满是愤怒。无论是出于政治报复还是监管理由,这场「DeBank」事件让特朗普家族切身体会到,传统金融体系对他们而言并不可靠。若 2028 年特朗普卸任、民主党重新执政,类似的封杀极有可能再度发生。地产、媒体这些传统产业在那种情况下几乎没有防御力,但如果家族的核心资产已经转向加密世界,情况就完全不同了。因此,他们所从事的这个业务和过去的切肤之痛的一个经历是有非常直接的关系,站在特朗普家族的角度建设 WLFI 是一个非常符合逻辑的决定。

加密货币的成长史,本身就是一部「反传统银行化」的抗争史。从中国到美国,从监管打压到政策封锁,Crypto 在被驱逐和抗拒中崛起,最终孕育出如今 4 万亿美元的市场和完整的 DeFi 基础设施。特朗普家族深知这一点,于是开始把商业重心迁移到加密轨道上。这不仅是防御性的选择,更是一次进攻性的布局:趁着执政期推动立法,把加密金融嵌入美国法律体系,确保即便政权更替,家族的加密帝国也能获得制度保障。

从这个角度看,WLFI 不是一时兴起的投机,而是「既现实又战略」的决策。它不仅让家族的财富体系脱离对银行的依赖,还为未来的不确定性留下一道防火墙。更重要的是,相比单纯投资 Aave 这样的既有协议,WLFI 是一次真正的创业。项目的价值不仅在代币本身,更在于通过稳定币、借贷、衍生品等业务,把特朗普的政治影响力与全球加密资源绑定在一起,上限比简单的投资要高得多。

特朗普如何将美国总统影响力「变现」的?

如果真正理解特朗普家族的考量,就会发现 World Liberty Financial(WLFI)并不是一场简单的加密投机,而是一盘极大的战略棋局。在当下,他们借助特朗普作为美国总统的影响力,把这种政治和社会资本转化为一种新的资源变现方式。这里的「变现」要打上引号,因为家族未必认同这种说法,但对外界而言,这的确是一种借势将影响力资本化的路径。

这种路径的妙处在于,它不仅能为家族带来关注度,还能吸引加密世界里最有力量的参与者站队支持。借助总统任期内的光环,他们先在 Crypto 里积累影响力,再通过区块链抗审查、抗政府干预的特性,为未来的商业利益筑起防火墙。这样,即便在特朗普卸任后,家族依然能保持延续性的护城河。

更聪明的是,特朗普家族把影响力放在全球市场来消化。地产和媒体生意高度依赖本地化与银行体系,而 Crypto 的特性是去中心化和全球化,它可以让影响力在全球范围内得到最有效的资本化。例如,特朗普的私人晚宴上有三到四成的与会者是华人面孔,而 WLFI 的支持者也高度集中在亚洲市场——尤其是大中华区的离岸交易所。加密货币带来全球化的触角,远比传统地产项目要高效得多。

在这背后,Binance CZ、孙宇晨等华人 OG 阵营扮演了关键角色。如今,WLFI 稳定币 USD1 的主要使用场景,首先就是在 Binance 和火币(HDX)上落地。BNB 链上的质押协议 ListaDAO、香港正在积极布局 RWA 的 Plume Network,以及 StakeStone 等项目,都与 Binance 强关联;具有华人背景的 DWF Labs 投资的 Falcon Finance、Ankr 创始人 Ryan Fang、Paxos 创始人 Rich Teo 等重量级玩家也深度参与 WLFI 的项目。换句话说,WLFI 的全球影响力,正在通过亚洲加密社区的网络加速释放。

更有意思的是,上周 CFTC 公布了非美国本土交易所回归美国市场的生命,这些原本离岸的巨型交易所,可能借助这一合规窗口重新回到美国市场。无论是 Binance 还是 OKX,如果能通过这种渠道与特朗普家族建立更紧密的关系,不仅能在立法与准入门槛上获得便利,还可能在美国市场的竞争中占据优势。

因此,WLFI 不只是特朗普家族「变现影响力」的工具,更是他们构建全球盟友网络的一枚战略棋子。它既服务于当前的政治资本,也在为卸任后的生意版图留出安全空间。

交易平台少赚钱也要接受 USD1,有什么好处吗?

为什么那么多加密 OG 会支持 World Liberty Financial(WLFI)?我们可以从坊间传闻得到一些线索。比如 CZ,就有人猜测他对特朗普的支持,部分原因是希望在未来换取潜在的「特赦」;而孙宇晨在接受采访时也被问过类似问题:这种支持是不是某种「政治现金」?不论真假,对顶级的离岸交易所而言,这确实是一笔划算的交易——通过资本投入来换取政治资源,往往比单纯的商业投资更有回报。

另一方面,特朗普本身就像马斯克一样,拥有超强的注意力引力场(attention gravity),几乎是一个「流量黑洞」。无论是他发的币、NFT,还是各种公开表态,都能瞬间吸引全世界的目光。对交易所来说,选择支持这样一个项目风险并不大:毕竟有特朗普家族的背景,几乎不必担心项目会 rug pull 或被黑掉。以稳定币 USD1 为例,这笔和中东资本捆绑的 deal,对 Binance 而言就是一笔聪明的生意。因为金主既然要投钱,用哪个稳定币其实无所谓,而用特朗普家族的稳定币不仅没有额外成本,还能赢得川普方面的好感。

更现实的考量是,美国市场的潜力。未来三年,像 Binance、OKX 这样的巨型交易所重返美国市场的可能性,远远大于重返中国。与特朗普家族走近,意味着在美国市场的合规与立法层面可能获得更多便利。Coinbase 虽然更谨慎,但也在川普币上线时第一时间表态支持。每个交易所会掂量支持川普家族的利弊,但是无论从从政治考量讲,还是从经济考量讲,是挺划算的一个生意。

至于 Binance 接受近 20 亿美元的 USD1 稳定币,外界常问:这是笔好生意吗?从表面看,Binance 放弃了可观的收益。因为如果这笔资金是以美元或 USDC 存入,光是利息收入就可能高达每年 8,000 万到 1 亿美元;而 USDC 还会给分销伙伴补贴。但接受新生的 USD1,意味着这些收益被放弃。不过,Binance 得到的好处可能更多:

首先,这是合规发行的稳定币,完全符合美国监管下的稳定币框架,有可能和 USDC、USDT 一样被纳入主流。坊间猜测,Binance 与特朗普家族或中东基金之间可能有「back to back」的协议,例如利息收益分成,或流动性支持补贴,这使得 Binance 并未真正失去那么多收益。其次,这笔钱本身由中东基金主导,可能不是 Binance 说了算。Steven Witkoff 作为中东的大使与 WLFI 的联创,完全有可能指定用 USD1 作为投资工具,Binance 自然要顺势接受。这里的逻辑很清楚:这是政治与资本绑定的结果,而非单纯的商业选择。第三,对 Binance 来说,USD1 本身是一个战略性选项。自从 BUSD 被监管「扼杀」后,Binance 一直缺少一款与自己关系足够紧密、又能在合规层面落地的稳定币。FDUSD 虽然存在,但前景不明。相比之下,USD1 拥有特朗普家族的背书与美国的合规身份,未来甚至可能成为 Binance 的「默认稳定币」。一旦成功,双方之间将形成更紧密的战略结盟。

换句话说,通过中东财团投资 Binance,支持 WLFI 和 USD1,从而获得更多亚洲交易所的支持是 WLFI 做的非常正确的决定。它让 OG 们站在潜在的权力一边,也为未来可能的美国市场重返埋下伏笔。在这一点上,WLFI 倒像是特朗普家族与加密 OG 之间的一次双向选择:川普用影响力换取资本和支持,而交易所则用资本下注未来的政治保护与市场机会。

WLFI 和 World Liberty Financial 的关系是什么?他的代币模式又如何?

WLFI 是 World Liberty Financial 协议的治理代币,但它的设计和一般治理代币不太一样。首先,这个代币没有分红功能,也不能映射到项目背后实体公司的股权,因此实质性的决定权并不在代币持有者手中。换句话说,WLFI 更像是一个「纯治理代币」,但它是否真正发挥治理作用仍值得怀疑,因为协议的关键决策依然由公司本身决定,而不是由链上的治理流程来推动。

代币分配方面,WLFI 显得非常集中。特朗普本人据称持有超过 15% 的代币,而孙宇晨因为此前的大额买入,占据了大约 3% 的流通量。此外,还有一批巨鲸通过场内外交易获得了大量筹码。整体来看,WLFI 在 ICO 期间总共出售了约 30% 的代币,其余 70% 则掌握在项目方手中。至于这些内部份额如何分配、解锁节奏如何、未来能否出售,目前市场完全没有公开信息,这也让 WLFI 的抛压前景存在很大不确定性。

发行设计上,WLFI 也延续了很多 DeFi 项目的「典型操作」。比如在 2024 年 10 月白皮书发布、仍处于预售阶段时,代币被设定为不可转让(non-transferable),这在美国市场其实是规避监管的一种常见手段,类似做法也出现在 EigenLayer 等项目中,锁定期通常长达一年。如今 WLFI 开始逐步具备转让与上线条件,一方面是因为美国的立法环境更加明朗;另一方面,SEC 主席更迭、监管态度转向友好,也为代币的流通和上市扫清了障碍。

从代币经济逻辑来看,WLFI 与许多 DeFi 项目类似,具备治理功能,支持链上投票与分发机制,即使在不可转让期间,持有人也能参与治理投票。这种安排在美国本土项目中很常见,被视为减轻监管压力的一种保护性设计。但最终,WLFI 是否真的能发挥治理价值,抑或更多只是一种「带有政治光环的筹码」,仍然是外界关注的焦点。

WLFI 与 Aave 代币分配的风波是什么情况?强资源无创新的产品总是市场的赢家吗?

WLFI 在去年 10 月曾以「将基于 Aave v3 搭建借贷协议」为叙事,在 WLFI 自身与 Aave 的治理论坛上提出配套提案:其一,WLFI 协议未来产生的费用收入中有 20% 拟划拨至 Aave DAO 国库;其二,WLFI 代币总量的 7%(当时口径为百亿枚基数)将转赠 Aave,用于治理、流动性激励或推动去中心化进程。

今年 8 月 23 日 Aave 创始人曾对外确认「该提案有效」,但随后 WLFI 团队成员公开否认「7% 配额」的真实性,国内媒体进一步向 WLFI 团队求证后亦得到「假新闻」的答复,Aave 创始人对此十分气愤,社区舆论由此急转直下。若按当时盘前估值粗略折算,7% 对应的价值已达「数十亿美元」量级,这也是引发社区强烈情绪的直接诱因之一。

事实上当时的提案仅进行到「温度检查」(temperature check)与「具约束力」的治理存在本质差异。前者多是文字性意向表达,票决「通过」并不等于具备「可执行代码」的绑定效力。若缺少与提案绑定的合约逻辑,治理结果随时可能被后续提案推翻。

换言之,若无可链上执行的条款,所谓「通过」更接近于无约束力的谅解备忘录(MOU),在法律与协议实现层面均难以成立,且通常这种技术平台层面的项目合作(例如 Spark 与 Aave)不会将如此大比例的代币「送」出去,因此当初提案的「慷慨程度」偏离行业常识,其中存在一些「暧昧」的判定依据,在尚未验证 Aave 对 WLFI 的实质贡献前,承诺「固定比例」的总代币配额与长期收入分成并不寻常。

回到当时的时间点,2024 年四季度 WLFI 仍承受「可信度不足、估值偏高」的质疑,加之创世团队此前项目有被黑客攻击的「前科」,因此代币的销售并不理想。在这种情况下,借 Aave 的品牌与安全信誉来「体面化」自身,是一种可理解的公关与市场策略「Fork + 分成/让渡代币」的组合,一方面缓解了「照抄」的道德拷问,另一方面也对冲了安全层面的不安。

但此后数月,WLFI 迅速升温,并将战略主轴转向以 USD1 稳定币为核心的 DeFi 枢纽,原本「以借贷协议为内核」的定位退居次要。叙事主轴迁移之后,早期「固定比例」的静态承诺自然面临重谈:更可能演变为与实际使用与贡献挂钩的动态激励,或将部分代币专款化为 Aave 相关市场的专项引流。

刘峰在此处引用了 Laura Shin 与 Multicoin 的创始人 Kyle Samani 在 18 年的访谈内容,当时 Kyle 提出的一个观点「在 Crypto 世界,技术不重要,Go to Market 怎么做市场、怎么搞运营才是最重要的。」这个观点在当时被许多人质疑,但到现在来看,这类事情越来越频繁的发生了。

USD1 是否能从「交易所驱动的流动性」走向「用户真实使用」?

首先,当前稳定币的普遍图景并不乐观,从 Cypto Native 的视角来看,除少数头部外(USDC、USDT),缺乏收益堆叠时鲜有日常使用,USDE 即便有约 20 亿美元注入也难见自然留存,FDUSD 多用于交易所打新等策略性场景、平时几乎无人用,说明「把规模堆起来」并不等于「被用户需要」。

在此参照系下,USD1 面临三重门槛:其一是政治与银行通道的双刃效应,政治光环有利于在离岸交易所迅速组织流动性,却可能在本土金融体系形成阻力,美国大型银行是否愿意提供友好清结算与托管仍存不确定,部分司法辖区与机构甚至会因政治敏感而回避同台(如香港相关人士因 Eric Trump 访港而选择回避的例子)。

其二是渠道与分发的现实瓶颈,当前 USD1 撬动的主要是境外交易所资源,而迈向「用户真实使用」需要打通银行端、支付端、电商与社交/超级 App 的嵌入式场景,这些都是重资质、重风控、重商务谈判的慢变量,缺位则稳定币易沦为「所与所之间的结算筹码」。

其三是产品与激励的自洽要求——加密原生用户普遍反感「组局叙事」,更看重可验证的可靠性与清晰用例,USD1 若要突破 USDT/USDC 的强惯性,需要在储备透明/审计披露节律、多链可用性与桥接体验、钱包/托管原生集成、商户费率与返利结构、合规地区便捷赎回等方面形成稳定预期,并把早期资源优势转化为与「实际使用」挂钩的长期激励,而不是一次性做市补贴。

但同时 WLFI 的「资源盘」确实具备独特外溢价值:通过让特朗普家族形成切身利益与政策驱动力,有望为更广泛的链上创新铺路;USD1 的第一步「链上流动性堆高」已显现,但从「被动流动性」转为「主动使用」的关键在于能否借既有生态名单与吸引力,持续引入高质量应用并完成跨域分发。

短期内很难撼动 USDT/USDC 的地位,更现实的 USD1 现在确实在多所之间充当通用结算稳定币,但 USD1 对于银行出入口、支付/电商/薪资等试点进展、主流钱包与托管默认支持的资源渠道则较弱势。加之美国本土政治环境的边际变化,这是一把双刃剑并不一定是加分项。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。