Author: Frank, PANews

The Hyperliquid token HYPE reached a new high again on August 27, and on the day before, August 26, a meticulously planned "lightning short squeeze" storm swept through the pre-market contract market for XPL on Hyperliquid. In less than an hour, the price chart was violently pulled into an almost vertical line, causing countless short traders' accounts to be instantly wiped out, while the manipulators made off with over $46 million in profits.

This incident quickly caused an uproar in the crypto community, with cries of despair, anger, and conspiracy theories intertwining. People couldn't help but ask: was this merely a random extreme market fluctuation, or a precise "slaughter" exploiting protocol vulnerabilities? And why does Hyperliquid, at the center of the storm, repeatedly become the perfect hunting ground for whales to commit their misdeeds?

A Premeditated "Hunt"

This seemingly sudden market crash was, in fact, a carefully orchestrated hunt.

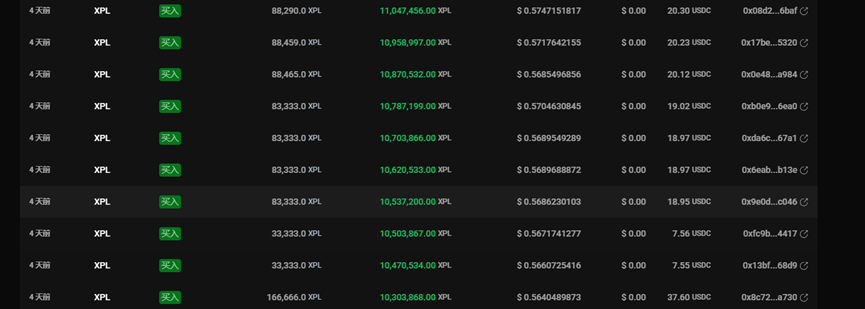

According to on-chain data tracking by Ai Yi, this coordinated attack was executed by at least four core wallet addresses. Among them, the roles and fund deployments of two main attacking addresses were particularly clear: one is an address starting with 0xb9c0, and the other is an address with the username "silentraven" on DeBank. The other two addresses played supportive roles. The operational behaviors of these wallets were quite similar; between the 23rd and 25th, three addresses transferred large amounts of funds to start long positions in XPL. Notably, the main attacking address, 0xb9c0, preemptively used $11 million in USDC to open long positions in XPL on Hyperliquid at an average price of around $0.56.

The address with the DeBank username "silentraven" also established a long position of 21.1 million XPL using $9.5 million in USDT at the same average price of $0.56 over the past three days.

These addresses collectively invested over $20 million, gradually accumulating massive long positions within almost the same price range. Several of these addresses were clearly set up to only ambush long positions in XPL after their creation.

Around 5:30 AM on August 26, while most traders in the Asian region were still asleep, the hunting moment quietly arrived.

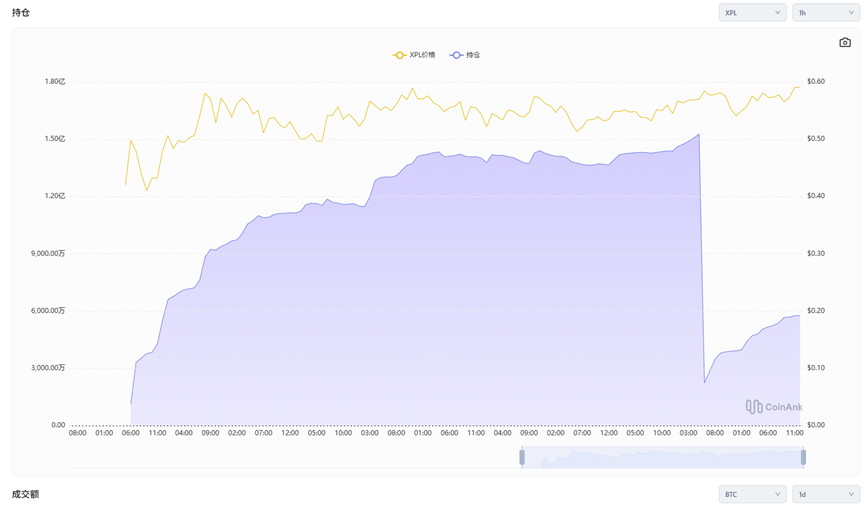

The 0xb9c0 address transferred an additional $5 million to the Hyperliquid platform. Then, it indiscriminately pumped the price of the token. In the pre-market for XPL, where liquidity was already extremely thin, this fund acted like a spark thrown into a powder keg, instantly igniting the entire order book. Within just a few minutes, the price of XPL skyrocketed from around $0.6 to $1.8, an increase of over 200%.

This rapid price surge led to several obvious outcomes. First, most traders were unable to increase their margin to raise their liquidation prices. Second, even the minimum 1x leverage hedging orders were liquidated. Third, as many short positions were liquidated one by one, the forced buy orders further pushed the price up, creating the most terrifying "short squeeze" phenomenon in financial markets.

Ultimately, at the peak price stage, the manipulators began to close their positions at prices between $1.1 and $1.2. According to Ai Yi's statistics, this attack brought the manipulators over $46 million in profits.

$60 Million in Despair and the Platform's "Indifference"

A feast of capital inevitably accompanies the cries of another group of people. While the manipulators returned with their spoils, other market participants were left with bloody losses and endless questions.

Crypto KOL @Cbb0fe stated that he allocated 10% of his funds to hedge on Hyperliquid, resulting in a loss of $2.5 million, and he vowed never to touch isolated markets again.

Other media reported that a single address suffered a maximum loss of about $7 million. However, specific address information was not disclosed, leaving room for doubt.

From the manipulators' profit situation, it is evident that the maximum profit amount at that time indeed exceeded $46 million, and it remains unknown whether there were other undiscovered partners involved in the process.

From the changes in contract positions, before the attack began, the contract position for XPL on Hyperliquid reached a peak of $153 million, which then rapidly plummeted to $22.44 million, with a reduction of over $130 million. It is estimated that the overall loss for short users could reach $60 million.

This loss even surpassed the maximum floating loss of $11 million caused by the manipulation of the JELLY token on Hyperliquid in March. This time, perhaps because the official platform did not suffer direct losses, the victims could only silently swallow their bitter losses.

In community discussions, a familiar name was repeatedly mentioned: Sun Yuchen, the founder of TRON. Some users pointed out that one of the addresses involved in the attack had transferred ETH to an address associated with Sun Yuchen a few years ago, but this action does not directly prove any actual connection between the address and Sun Yuchen.

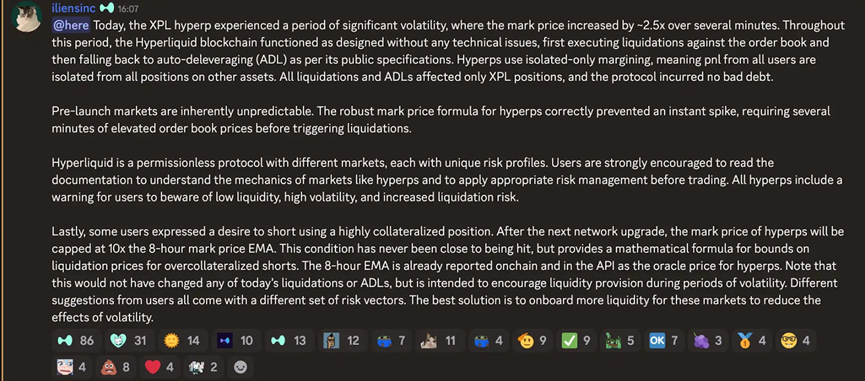

After the incident, many users also turned their hopes to Hyperliquid, expecting the platform to provide an explanation or remedial action. However, Hyperliquid did not respond as aggressively as it did in March when it dealt with the manipulation of the JELLY token by closing profitable orders and directly shutting down related accounts. Instead, they responded in their official Discord community, stating that the XPL market experienced severe fluctuations, but Hyperliquid's blockchain operated normally during this period without any technical issues. The liquidation and automatic deleveraging (ADL) mechanisms were executed according to public protocols, and due to the platform's use of a fully isolated margin system, this incident only affected XPL positions, and the protocol did not incur any bad debts.

For many onlookers, the lack of adjustments was understandable. After all, when XPL was launched, Hyperliquid had already warned about high volatility and risks, and such manipulation was all carried out within the rules of the market.

However, for those severely affected users, such a response felt somewhat cold.

Causes of the Tragedy: The Fatal Conspiracy of Platform, Asset, and Timing

Looking back at the entire process of the incident, this is not the first time Hyperliquid has experienced similar market manipulation. It is evident that the manipulators premeditated and meticulously planned this outcome. On the other hand, it is also closely related to the platform design of Hyperliquid itself.

First, such short squeeze operations are not uncommon in financial markets, often occurring in markets with poor liquidity and isolated prices. This operation on Hyperliquid was based on several characteristics of Hyperliquid: first, the extreme transparency on-chain allows manipulators to calculate the funds needed to manipulate the market and the effects achieved through publicly available data such as open positions, liquidation prices, and funding rates. Second, Hyperliquid's isolated oracle system means that XPL uses an independent pricing system on Hyperliquid, not relying on external oracles. This allows manipulators to freely control prices within this enclosed space without worrying about the difficulties posed by price balancing from other exchanges.

Additionally, there are many subtleties in the choice of the asset being manipulated. The manipulated XPL (and another token WLFI that experienced a similar but less exaggerated situation) are both tokens that have not yet been launched, meaning they are a type of "paper contract" without issues of spot delivery and spot dumping suppression, making them easier to manipulate.

Finally, the timing of the attack was also crucial. Before the attack, the trading volume of XPL every five minutes was only a few hundred thousand tokens, amounting to about $50,000. This was precisely during the weakest period of trading enthusiasm after its launch, and this thin liquidity provided an opportunity for attackers to manipulate the market with minimal funds.

The XPL incident exposed deep structural risks, reminding us to reflect on both the platform and user levels.

From the platform's perspective, the first issue is the vulnerability of the mechanism. Since 2025, Hyperliquid has experienced three market manipulation incidents. Each time, it has almost exposed some vulnerabilities of Hyperliquid as a decentralized derivatives exchange. The result of these vulnerabilities is that ordinary users' funds are harmed, while the credibility of the Hyperliquid platform diminishes. In this case, on one hand, it is the enclosed space created by the isolated oracle mechanism, and on the other hand, it is the lack of active price intervention by the platform's liquidity when abnormal positions appear.

Secondly, is it more important to treat wrongdoers equally or to maintain the decentralized facade? In the JELLY incident, Hyperliquid unhesitatingly initiated an on-chain vote, ultimately preserving the losses and expelling the wrongdoers. The rationale at that time was to protect the funds of the platform's user treasury from losses, which forced them to take actions detrimental to decentralization. However, in the face of losses far exceeding the previous incident, is it because the platform treasury was not harmed or to avoid letting the banner of decentralization fall again that they chose to ignore? This may leave a significant question in users' minds.

Finally, for users, the XPL manipulation incident once again raises our vigilance against scarce liquidity and isolated markets. In the market, pre-market contracts with extremely low liquidity and lacking spot market anchoring are often the "hunting grounds" favored by whales. Additionally, reducing leverage and setting stop-losses—these age-old trading principles—are never just empty words.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。