Author: Jiahua, ChainCatcher

The bull market of 2025 seems like a hellish trial. On one side, the crypto market rebounded after evaporating $1.3 trillion over three months, accompanied by extreme volatility and countless liquidation tragedies. On the other side, Bitcoin soared from a low of $40,000 at the beginning of 2024 to over $120,000, continuously breaking new highs.

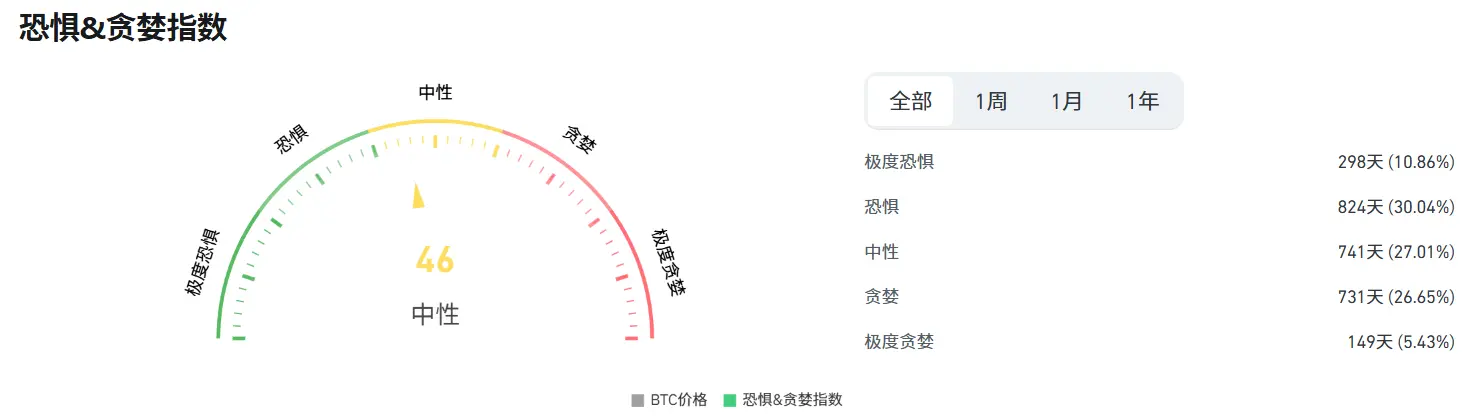

In terms of market sentiment, traders are primarily driven by greed (46.85%), mixed with significant fear and neutrality, facing a trading environment of extreme volatility and strong FOMO emotions.

As X user "Killing the Wolf" said: This bull market is of hellish difficulty; only true believers can reap the fruits of victory!

This article will focus on the star traders in the crypto market, revealing the harsh realities of the market through their trading gains and losses, as well as our coping strategies.

Can Star Traders Also Lose Everything?

The hellish bull market is not only a challenge for ordinary investors but also a trial for star traders. They are often known for their high-risk, high-reward style, but their experiences also highlight the cruelty of the market. Below are a few well-known star traders; some excel in long positions, some in short-term trading, some started with small capital, and some are extremely sensitive to macro information, but their final outcomes are invariably zero or even negative.

1. James Wynn

● Trading Style: Bold and aggressive, primarily trading long positions in PEPE and BTC. Skilled at capturing early opportunities in high-potential tokens, often increasing positions during price fluctuations. Frequently shares positions on social media to attract attention but has also been targeted by whales, repeatedly falling to stop-loss prices before rebounding.

● Peak Performance: Achieved over 10,000 times returns early on through PEPE, holding 1.23 billion BTC long positions; turned $0 into $87 million in 70 days.

● Loss Situation: Multiple liquidations led to a complete loss of profits and a loss of $23 million.

2. Insider Bro qwatio

● Trading Style: Sensitive to macro events, skilled in short-term operations, with a high win rate. Has often opened positions like an "insider trader" before key time points.

● Peak Performance: Grew from $3 million in capital to $26 million; made a profit of $2.15 million in 40 minutes by capturing macro fluctuations in BTC and ETH.

● Loss Situation: Account ultimately went to zero; lost $25.8 million in leveraged short liquidation within 3 hours; total losses exceeded $28 million.

3. AguilaTrades

● Trading Style: Enthusiastic about high leverage and rolling positions, prefers BTC and ETH. Win rate depends on market trends but neglects position diversification and emotional management, often returning to heavy positions immediately after losses.

● Peak Performance: Grew from $300,000 in capital to $41.7 million.

● Loss Situation: Lost $37.6 million, leaving only $30,000 in the account.

Additionally, there are star traders like jasonleo, who went from a floating profit of $700 million to zero, suffering heavy losses in this hellish bull market.

Lessons from Gains and Losses: Restraint and Rationality, the Ultimate Rule for Surviving a Bull Market

Under the baptism of the hellish bull market, the trading situations of star traders serve as a mirror, reflecting the harsh reality of the crypto market and alerting us: only by restraining greed and maintaining rational strategies can we survive in the market. X user "Web3 Philosopher" commented: Many people are actually gambling but mistakenly believe they are trading. Many are gamblers but claim to be traders.

Gamblers are on the left, traders on the right; the two seem to be separated by a fine line, but in fact, they are worlds apart.

The former often relies on luck and emotional drives, buying in heavily at market peaks and panic selling at lows, neglecting timing and position control. The latter views the market as a battlefield, formulating rigorous strategies: using technical analysis, fundamental research, and stop-loss mechanisms, diversifying investment portfolios, and maintaining emotional neutrality.

The three star traders mentioned above once stood on a pedestal but ultimately experienced a dramatic reversal from peak to zero due to "seeing red."

In a bull market, timely locking in profits is a key strategy to avoid wealth evaporation. The market is highly volatile; while prices can soar from lows, corrections can often wipe out all profits. Timely locking in principal provides a layer of insurance for your positions, allowing profits to be used for operations, ensuring long-term survival in the market.

At the same time, we should strengthen emotional management. Here, emotions refer not only to maintaining composure and restraint during significant losses, analyzing where strategies went wrong, and then adjusting to start over; it also means not flaunting large position orders, staying low-key, trading smartly, and protecting your funds from whale attacks.

In this hellish bull market, glory and traps coexist. The crypto space is never short of opportunities to make money; what is lacking are investors who master restraint and rationality. Only they can survive the tide of greed and laugh last.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。