Why Strategy Bitcoin Drives Uncertainty While Self Custody Secures Con

Crypto commentator and Cofounder of TIP.GP, Preston Pys has recently shared his views on why self-custody Bitcoin makes more sense for everyday investors.

He compared Strategy Bitcoin holdings from 2024 to today and highlighted how Strategy Bitcoin stocks may look attractive but also carry higher risk, recently shared on his X handle (formerly twitter).

Source: X

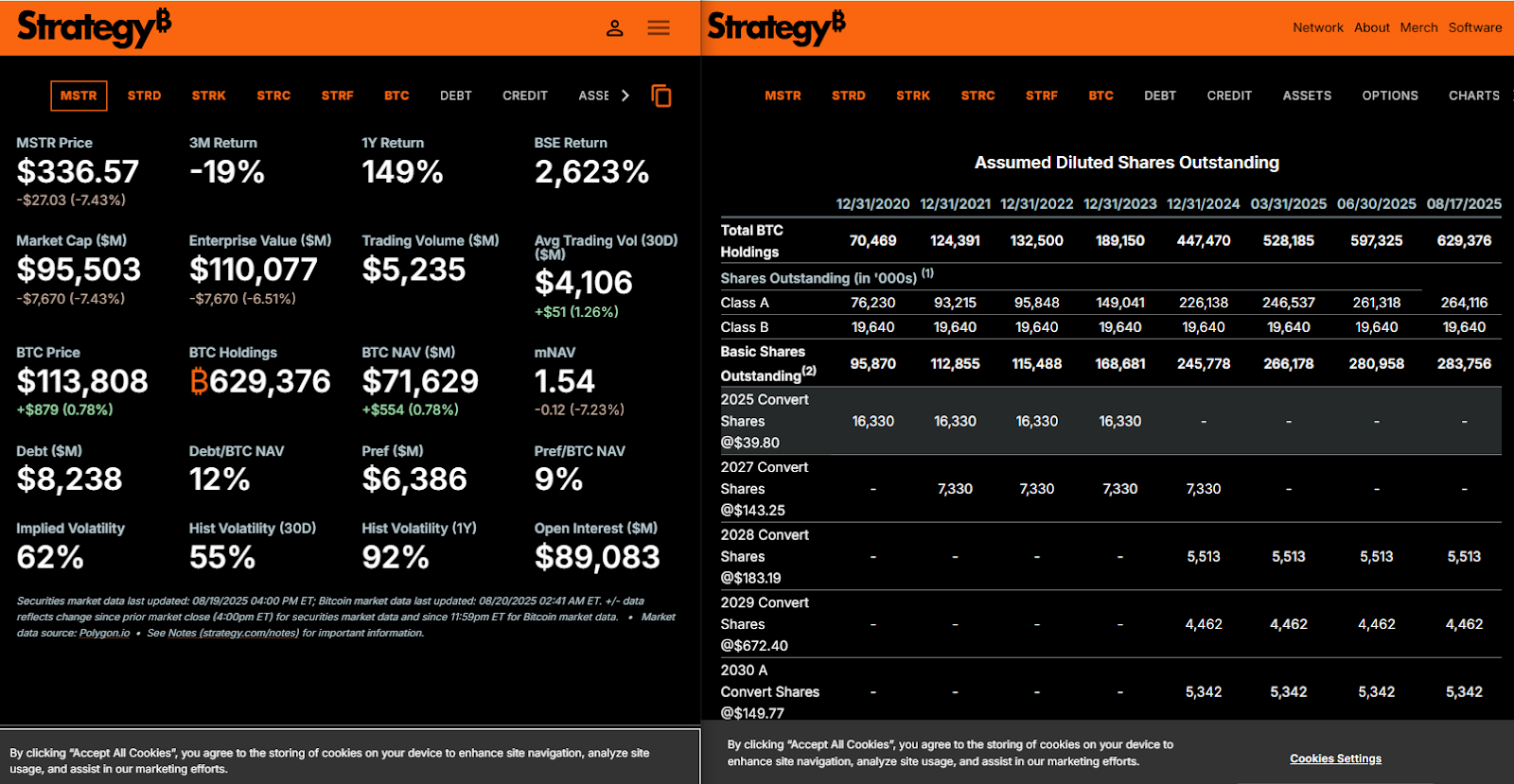

MSTR’s BTC stash has grown massively

According to Preston, back in November 2024, the firm held about 279,420 BTC with 193 million shares outstanding. This worked out to roughly 0.00145BTC per share.

At that time the stock was trading around $338. And now in August, 2025 Strategy Bitcoin holds a total 629,376 coins with 283.6million shares which equals 0.00222 BTC per share and a 53% increase in asset exposure per share even though the stock price is still the same in USD.

Source: MSTR

More BTC also means more volatility

Preston pointed out that Strategy Bitcoin is now even more leveraged compared to last year and trying more to buy the asset and strengthen its treasury . That means its stock can swing much harder than BTC itself whenever the market moves.

For small investors that kind of added volatility can be difficult to manage especially without a solid understanding of risk.

Why self-custody makes sense

According to him, the better option for retail investors is to hold coins directly in their own wallets. This way there is no dependence on a company , an exchange or a third party.

If you do not understand the risks or can’t calculate them properly then there are chances you will end up buying and selling at the wrong time, do not take decisions by flowing in emotions and think logically.

Owning the coin directly is like holding your money in your own hands. You remove the extra layers of risk that come with corporate strategies, stock dilution and market leverage.

For most people who just want long-term security, self custody is unmatched as keeping your asset in your custody keeps things simpler and safer.

Conclusion

From my point of view, Preston’s message is on spot. While companies like MicroStrategy make headlines with their massive bets everyday investors do not need that complexity. Holding assets directly gives you control, peace of mind and protection from unnecessary risks.

But, if you hold a large amount of assets, MicroStrategy can be a good option since it is trusted, transparent, and provides clear details about its holdings.

Also read: Turn Your Bitcoin Into Rewards With CORE And Hex Trust Alliance免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。