Inside Metaplanet Bitcoin Holding Growth, Yield, and Future Plans

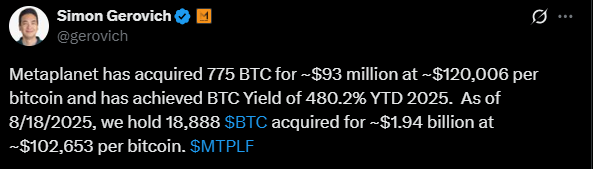

The bitcoin giant, Metaplanet , has shown another move in its acquiring process through the recent purchase of 775 BTC, which valued almost $93 million. As of today the Tokyo Stock listed firm has accumulated a total of 18,888 BTC, worth $1.94 billion by spending an average of ~$102,653 per coin. Along with this it also achieved a 480.2% year to date BTC yield.

Source: X

The details of Metaplanet bitcoin holding have been shared by the president of the company’s board, Simon Gerovich. Now the question that arises is why the company so aggressively wants to acquire the coin by spending millions? What contributes to its strength to trust the golden asset? And what if the currency fails to prove itself, who's going to suffer more?

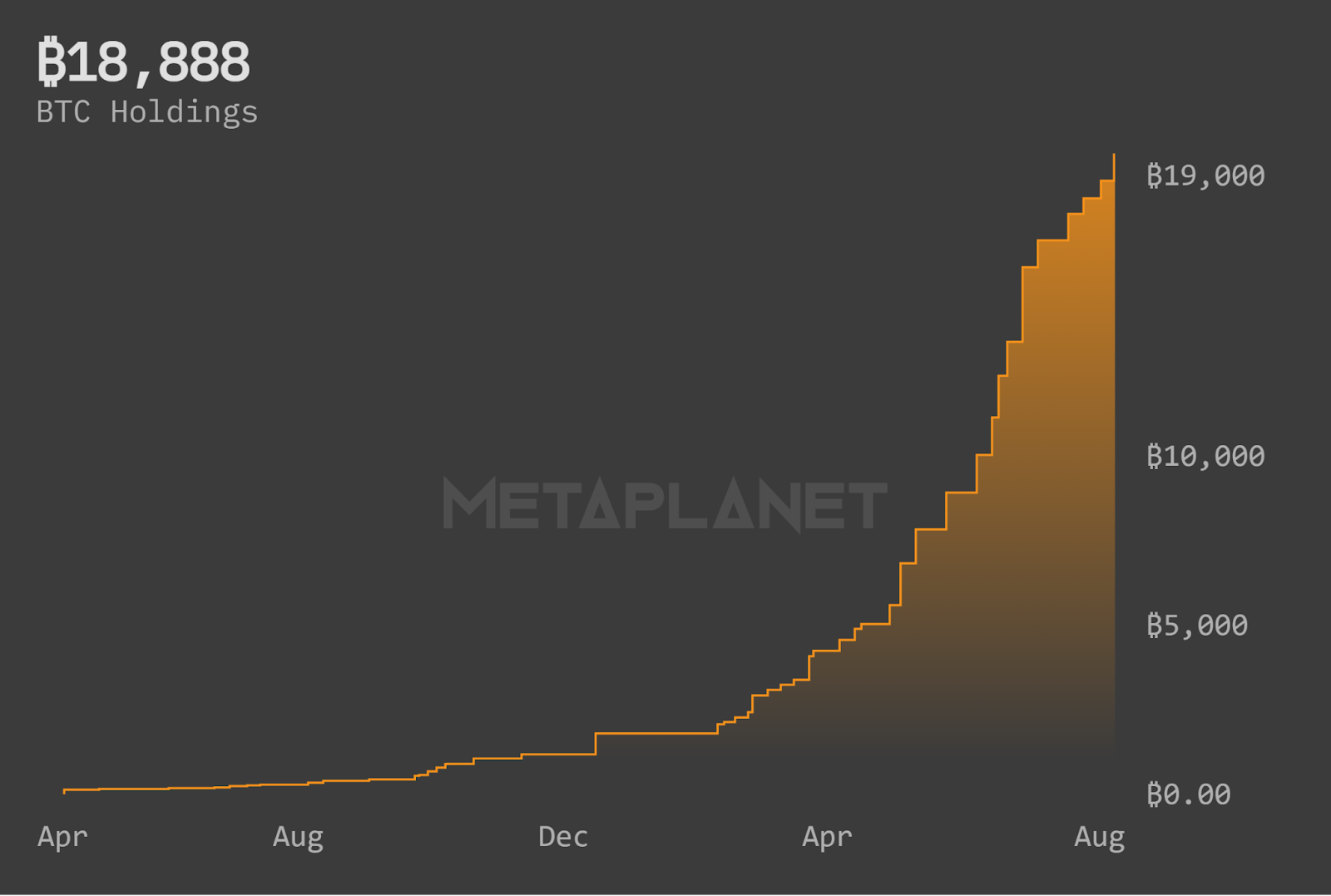

A Accumulation Race That Didn’t Want to Stop

This crazy hoarding started April, 2024. Yes, just in 1 year confidence in the digital asset led the company to invest millions. As of the Dec. 30, 2024, it has ₿1,762. But when it entered into the 2025 specially from mid February, the aggressive buy landed it as one of the top public BTC holder firms.

Source: Metaplanet

From Mid Feb it continuously piled up the reserve with digital assets, in which special high jumps are from May to July. So, what is fueling the purchase? Even against recent market pullbacks?

Bitcoin: A Rollercoaster Ride

When Metaplanet bitcoin holding started in April 2024, the coin was trading at around $70,000, but after that it faced frequent volatility, even went to $53,000 in August 2024. But the price went up again in November and reached its all time high of $124,454 in August 2025, exactly after one year.

Now it again becomes a subject of market frequencies as it is facing a 5.04% low since last week with the current price $115,555. With the hopes of the experts to reach $150K by year end and a $300K-$400K by next year, the currency is still on the top of any other crypto priorities. Although some altcoin like ethereum (ETH) are also acquiring pace, BTC is unbeatable.

Is this hope the base of Metaplanet bitcoin holding? And does it only depend on future earnings?

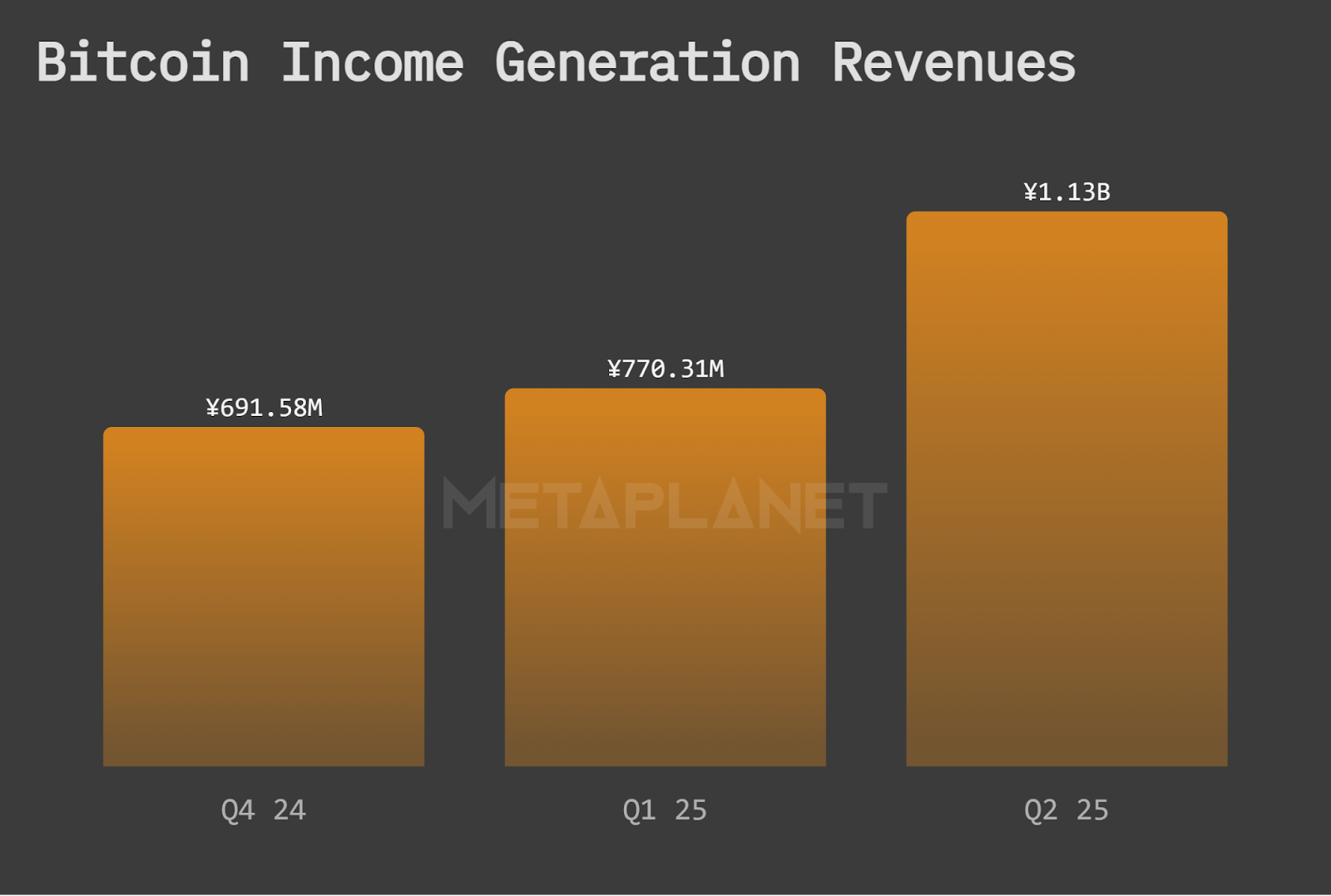

Planning of Future Lump Sum with Regular Steady Earnings

It is not just about reserves, but also an income generator over time. In recent quarters, Metaplanet bitcoin holding highlighting gains in both dollar terms, BTC accumulation, and yield. The yield chart shows an impressive 480.2% BTC yield YTD, led by an remarkable 309.8% surge in the fourth quarter of 2024. Metaplanet is making more and more money from Bitcoin each quarter. It earned ~$4046M (¥691.58M) in Q4 2024, then ~$4097M (¥770.31M) in Q1 2025, and jumped to ~$7029M (¥1.13B) in Q2 2025.

Not A Reserve but, A Global Standing

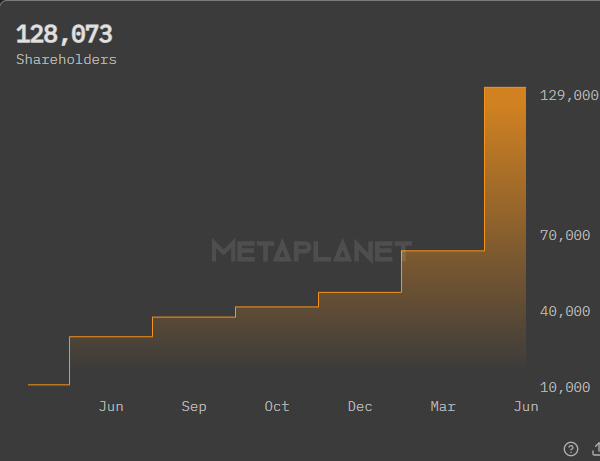

With the current standings and a target of ₿100,000 by 2026, and a ₿210,000 by FY27, stating its non stop view towards currency. By that time it will compete with the other major BTC admirers like Strategy, MARA Inc., Bullish, etc.

But the thing is the shareholders which are 128,073 as of date, were indirectly a part of investment, so any unpredictable event will directly affect them or maybe more than the company itself, as it has their whole capital in it. So, the company and the investors both play risky or maybe their confidence is firm.

Whatever, let time decide whose bet is more profitable and the hopes towards the currency, how potentially it came.

Also read: Lykke crypto hack: $22.8M theft tied to Lazarus Group attack免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。