1. Market Observation

On Monday, the Chinese A-share market performed strongly, with the Shanghai Composite Index reaching a nearly ten-year high of 3731.69 points. The trading volume of the two markets exceeded 1.5 trillion yuan for the tenth consecutive trading day, and the Hong Kong stock market also rose simultaneously. Several brokerages expressed their views on this, with Industrial Securities believing that the core logic behind the market's rise lies in policy support and the emergence of new momentum, while Guotai Junan Securities emphasized the decisive role of institutional reform in the market and is optimistic about the market continuing to set new highs. Galaxy Securities pointed out that market volume has reached a new level, with the balance of margin trading continuing to grow, and the market is expected to rotate around sectors such as the AI industry chain. However, CITIC Securities warned that investor sentiment is rising rapidly, and attention should be paid to the potential for market adjustments or accelerated topping due to overheating.

At the same time, international geopolitical risks are escalating, with U.S. President Trump pressuring Ukraine to accept a peace agreement and having met with Russian President Putin in Alaska to discuss a plan for peace in exchange for some territory. However, this plan faces doubts and opposition from Ukraine and its European allies. Against this backdrop, all eyes are on Federal Reserve Chairman Powell's speech this week in Jackson Hole. The market generally expects the Federal Reserve to cut interest rates in September, but given that inflation remains above the 2% target and economic data is uncertain, analysts are divided on whether Powell will provide clear guidance for easing.

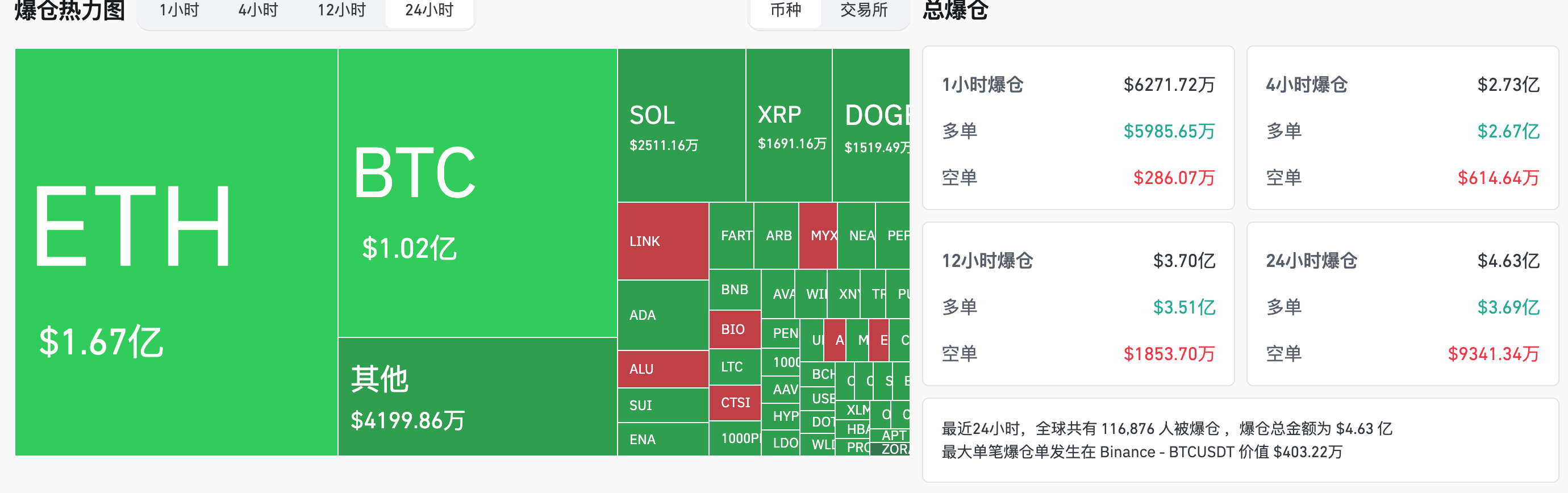

In the cryptocurrency market, HashKey's chief analyst Jeffrey Ding pointed out that the recent synchronized decline of Bitcoin and Ethereum highlights the dual pressure from macroeconomic and funding aspects. He believes this round of correction is mainly driven by two factors: first, the unexpected surge in the U.S. July PPI data reignited inflation concerns, boosting market risk aversion and weakening demand for risk assets; second, on the micro-funding level, Coinglass data shows that the liquidation scale of leveraged funds reached $980 million within 24 hours, with long positions accounting for the vast majority, and this excessive accumulation of leverage amplified the market's sell-off effect. Although institutions remain optimistic in the long term, short-term profit-taking behavior has led to capital outflows, exacerbating market panic. However, from a technical analysis perspective, Jeffrey Ding believes this adjustment resembles a healthy correction within an overall upward trend, and the market may rebound after finding a short-term bottom.

Specifically for Bitcoin, its price has dropped to around $115,231, near the opening price at the beginning of the month. Technical analyst Zia ul Haque pointed out that during Bitcoin's rise from $98,000 to $124,000, a significant volume gap was formed in the $110,000 to $112,000 range, and the market typically tends to fill such inefficient areas. AlphaBTC also stated that if Bitcoin cannot quickly return above $116,000, it may test the $112,000 level again. Analyst KillaXBT predicts that Bitcoin will test the $114,000 to $115,800 range this week while retaining the possibility of returning to $120,000. From a historical cycle perspective, Rekt Capital noted that the current correction is similar to the trends in 2017 and 2021, where shallow and rapid corrections laid the technical foundation for subsequent strong rises. Looking ahead, Canary Capital CEO Steven McClurg provided an extremely optimistic forecast, believing that driven by growing ETF demand and an expanding group of institutional buyers, Bitcoin has over a 50% chance of rising to the $140,000 to $150,000 range this year, before entering a new bear market.

Regarding Ethereum, analysts generally believe it still has significant upside potential after experiencing a correction. Mechanism Capital co-founder Andrew Kang predicts that ETH may soon face large-scale liquidations, with prices potentially dropping to the $3,200 to $3,600 range. If prices fall further, Breakout founder Mayne stated he would consider building positions in the $3,600 to $4,000 range. More analysts are focusing on the key support level around $4,100, with analyst Ted planning to make significant purchases in the $4,100 to $4,200 range, while The Crypto Professor emphasized that as long as ETH prices can stabilize above $4,100, the overall bullish structure remains valid. He believes that if it can successfully consolidate in the $4,100 to $4,700 range, it will build momentum for a subsequent breakout. Once the local high of $4,793 is broken, both Ted and The Crypto Professor believe the price could move towards the $5,000 to $5,200 area, potentially setting a new historical high within days.

In the altcoin market, some analysts have differing views on the long-term competitiveness of mainstream public chains. For example, despite Ethereum's strong performance over the past few years, Canary Capital CEO Steven McClurg bluntly stated he is not optimistic about its long-term prospects, considering it "old technology." He pointed out that protocols like Solana and Sui have already surpassed Ethereum in terms of transaction speed, cost, and security.

2. Key Data (as of August 18, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $115,231 (YTD +23.51%), daily spot trading volume $29.657 billion

Ethereum: $4,309.03 (YTD +29.54%), daily spot trading volume $27.518 billion

Fear and Greed Index: 60 (Greed)

Average GAS: BTC: 2 sat/vB, ETH: 0.3 Gwei

Market Share: BTC 58.8%, ETH 3.4%

Upbit 24-hour Trading Volume Ranking: ETH, XRP, STRIKE, CYBER, BTC

24-hour BTC Long/Short Ratio: 46.92%/53.08%

Sector Performance: The entire crypto market faced setbacks, with the GameFi sector leading the decline at 3.98%, and the NFT sector down 3.73%

24-hour Liquidation Data: A total of 116,876 people were liquidated globally, with a total liquidation amount of $463 million, including $102 million in BTC liquidations, $167 million in ETH liquidations, and $25.11 million in SOL liquidations.

BTC Medium to Long-term Trend Channel: Upper line ($118,950.12), lower line ($116,594.67)

ETH Medium to Long-term Trend Channel: Upper line ($4,321.81), lower line ($4,236.23)

Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 15)

Bitcoin ETF: -$14.1295 million

Ethereum ETF: -$59.3371 million

4. Today's Outlook

Binance Alpha will launch Reservoir (DAM) on August 18, supporting spot and futures trading

Binance will launch the 34th TGE project RICE (RiceAI) on August 18

U.S. President Trump will hold a bilateral meeting with Ukrainian President Zelensky in Washington. (August 19, 01:15)

Fasttoken (FTN) will unlock approximately 20 million tokens at 8:00 AM on August 18, accounting for 2.08% of the current circulation, valued at approximately $91.4 million;

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8:00 AM on August 18, accounting for 5.60% of the current circulation, valued at approximately $5.7 million.

Today's top gainers in the top 100 by market cap: HEX up 11.9%, Monero up 7%, Chainlink up 5.4%, PulseX up 5.3%, Pulsechain up 3.9%.

5. Hot News

This Week's Macro Outlook: Powell to "Battle" Market Rate Cut Expectations

Ethereum Spot ETF Saw Net Inflows of $2.85 Billion Last Week, Setting a New Historical High

This article is supported by HashKey, HashKey Exchange is Hong Kong's largest licensed virtual asset exchange and Asia's most trusted fiat gateway for crypto assets. It aims to set a new benchmark for virtual asset exchanges in terms of compliance, fund security, and platform assurance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。