Author: Wilbur Fernandes

Translation: Shaw Golden Finance

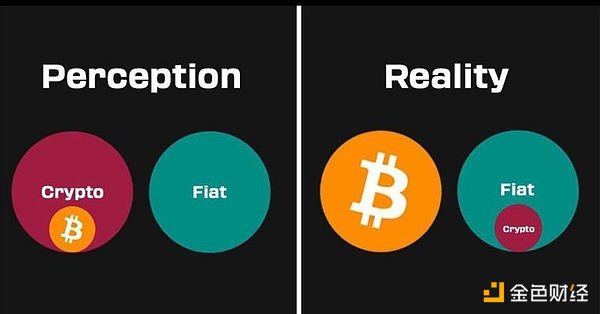

Look at the image above. It completely changed my perspective on money, investment, and the future. For a long time, I thought Bitcoin was just another "cryptocurrency"—like the thousands of currencies you see on apps like Coinbase or Binance. Oh boy, was I wrong.

When you first start out, no one tells you this: Bitcoin and "cryptocurrency" are not the same thing. In fact, they are completely opposite. It took me too long to figure this out, and I really wish someone had explained it to me sooner. So let me break it down in simple terms.

The Biggest Lie in Finance Today

When most people hear the term "cryptocurrency," they tend to lump it all together. Bitcoin, Ethereum, Dogecoin, Shiba Inu Coin—they all seem like different variations of the same digital currency, right? And that’s exactly what the cryptocurrency industry wants you to think.

But the truth is: Bitcoin is trying to replace our existing, flawed monetary system. Everything else? They are just companies trying to profit from our current flawed system.

Think of it this way. Imagine our current financial system is a leaking boat. Most cryptocurrency projects are like selling you better buckets to bail water, fancier pumps, or more expensive decorations for the boat. And Bitcoin? Bitcoin is building you a brand new boat that doesn’t leak.

Why Almost All So-Called "Cryptocurrencies" Are Just Wolves in Sheep's Clothing

Let me tell you something that shocked me when I first learned it. Except for Bitcoin, almost all mainstream cryptocurrencies operate just like regular companies. They have CEOs, marketing teams, headquarters, and boards of directors that decide the direction of your investment.

Take Ethereum, for example. It is operated by the Ethereum Foundation, and its founder, Vitalik Buterin, regularly publishes the development direction of Ethereum. When they switch from one system to another (from "proof of work" to "proof of stake"), it’s not because of a user vote—it’s because the Ethereum leadership believes it’s best for the business.

Cardano is the same—led by founder Charles Hoskinson. Solana is operated by the Solana Foundation. They are not decentralized networks; they are tech companies issuing tokens instead of stock certificates.

This is why so many people lose money in cryptocurrency "scams." When you buy these tokens, you are essentially buying shares in a company, but this company has no legal obligation to do anything for you. The founders can make decisions that benefit themselves, change the direction of the business, or simply abandon the project altogether.

Remember when Facebook rebranded to Meta? Imagine if Mark Zuckerberg decided to pivot to another business entirely, and your Facebook stock became worthless. This situation is actually quite common in cryptocurrency projects.

The True Meaning of "Decentralization" (Most Cryptocurrencies Are Not)

Here’s another question that confused me for a long time. Every cryptocurrency project claims to be "decentralized," but what does that really mean?

Most cryptocurrency companies think decentralization means storing copies of the database on partners' computers instead of just their own. It’s like a group of friends keeping copies of club rules at each other's houses and calling it "decentralized" because no one has the only copy.

But that’s not true decentralization; it’s just a company with a good backup system.

True decentralization means anyone in the world can participate without needing permission from anyone. With Bitcoin, you can download the software and start participating in the network immediately, and no one can stop you. You don’t need approval from a foundation, you don’t need to meet wealth requirements, and you don’t need anyone’s permission.

Is it the same with most other cryptocurrencies? Good luck. To validate transactions on Ethereum, you need ETH worth about $50,000 to $100,000. This directly excludes 99% of the global population. The people who can participate are mostly institutions and the wealthy—those who are the very controllers of our current financial system.

Bitcoin: The True Meaningful Rebel

Bitcoin is different. Completely different. When someone created Bitcoin under the pseudonym Satoshi Nakamoto, they were not trying to start a company or get rich. They were trying to solve a problem that has existed for thousands of years: how to create a currency that is not controlled or manipulated by governments and banks?

Here’s what makes Bitcoin special:

Fixed supply: There will only ever be 21 million Bitcoins. No company can decide to print more Bitcoins to keep operating. No government can issue more Bitcoins to pay bills. No CEO can dilute your Bitcoins by issuing more. Mathematically, it’s impossible.

Anyone can participate: You can secure the Bitcoin network with hardware that costs less than a smartphone. You can send Bitcoin to anyone in the world without needing permission from any bank or government. You can store Bitcoin without trusting any company.

No one controls it: Bitcoin has no CEO, no headquarters, and no board of directors. Its creator disappeared over a decade ago, and Bitcoin runs on its own. Making changes to Bitcoin requires consensus from global users—a process so difficult that Bitcoin has maintained considerable stability for over 14 years.

It’s actually very secure: Bitcoin uses a mechanism called "proof of work," which means the security of the network is ensured by computers solving mathematical problems that require actual electricity. This is not just clever programming; it’s a manifestation of physics. To attack Bitcoin, you would need to consume more electricity than you would gain from the attack.

Why Bitcoin Consumes So Much Energy (And Why This Is Actually Beneficial)

You may have heard that Bitcoin "wastes" a lot of energy. I used to think that too, until someone explained to me what that energy actually does.

Bitcoin does not use energy to speed up payment processing. Bitcoin uses energy to create absolute truth in the digital world. Every 10 minutes, computers around the world compete to write the next page in Bitcoin's historical ledger. The winner must prove they have done a significant amount of computational work, and once they win, that page of history becomes permanent and unchangeable.

This is revolutionary. For the first time in human history, we have a way to create digital records that cannot be changed, deleted, or manipulated by any authority. When you receive Bitcoin, you can be 100% sure that those coins are real and that the transaction can never be reversed.

In contrast, in other cryptocurrencies, a small group of wealthy validators could potentially collude to change transaction records. Or compare it to your bank account, where banks can freeze your funds, reverse transactions, or even close your account entirely.

The energy consumption of Bitcoin is not waste; it is the cost of creating the most secure and trustworthy monetary system in human history.

Scalability Issues: Why Slow and Steady Wins the Race

Another criticism you’ll hear about Bitcoin is that it is "slow." Bitcoin processes about 7 transactions per second, while newer cryptocurrencies claim to handle thousands per second.

But the problem is—Bitcoin's base layer is designed like the foundation of a house. The foundation needs to be solid, not fast. Every Bitcoin transaction is a final settlement, like transferring gold bars between bank vaults. It should be secure and permanent, not quick and convenient.

For everyday transactions, Bitcoin has solutions like the Lightning Network that enable instant Bitcoin payments. It’s like having a solid foundation (the Bitcoin main network) with fast and convenient rooms built on top (the Lightning Network).

Other cryptocurrencies try to make their infrastructure faster, but this always comes with trade-offs. Solana can process thousands of transactions per second, but its network has crashed multiple times—while Bitcoin has never experienced such issues. Would you prefer a rock-solid infrastructure that requires you to build extra floors for convenience, or a faster infrastructure that could completely collapse?

Why Governments Treat Bitcoin Differently

There’s an interesting phenomenon that helped me understand the difference between Bitcoin and cryptocurrencies. Look at how governments around the world regulate them.

Most crypto projects are regulated like companies because they are companies. The U.S. Securities and Exchange Commission (SEC) can take action against the Ethereum Foundation, subpoena Cardano executives, or shut down the Solana development team. These projects have offices, employees, and decision-makers who can be held accountable.

Bitcoin? There is no Bitcoin company to regulate. There is no CEO to arrest. There is no headquarters to shut down. Bitcoin simply exists as software running on computers around the world, just like email or the internet itself.

That’s why even skeptical regulators acknowledge that Bitcoin is different. They refer to it as "digital gold" or a "commodity," rather than a security issued by a company. Some countries have even designated Bitcoin as legal tender, which they would never do for tokens issued by cryptocurrency companies.

The Real Problem Bitcoin Solves (And Its Importance)

The more I learn about Bitcoin, the more I realize it is not trying to be a better payment app or a faster transfer method. Bitcoin is trying to solve the problem of money itself.

Think about it—when we step back and examine our current monetary system, it’s quite bizarre. Governments can print money without limit, which devalues your savings over time. Banks can freeze your accounts, reverse your transactions, or prevent you from sending money to certain people or places. Financial institutions can exclude entire groups from the banking system.

For most of human history, the money people used was not controlled by authorities—like gold, silver, or other rare items. But these physical currencies have limitations. They are hard to transport, difficult to divide, and can be easily stolen.

Bitcoin combines the best features of traditional money (scarcity and independence from authority) with the advantages of digital technology (instant global transfers and perfect divisibility). It’s like having digital gold that you can send instantly to anyone in the world.

Network Effects: Why Bitcoin Continues to Win

As I delve deeper into this field, I’ve discovered one thing. Despite thousands of alternative cryptocurrencies being created every year, Bitcoin has continued to grow. It has the most users, the strongest security, the widest acceptance, and the most real-world applications.

From a historical perspective, this makes sense. People always tend to choose the best form of money available at the time. Gold dominated for thousands of years, not because governments forced people to use it, but because it was simply better than other forms of money.

In the digital world, Bitcoin follows the same pattern. Even though new cryptocurrency projects claim to be faster, cheaper, or more advanced, people still choose Bitcoin for long-term savings and real monetary purposes.

When large institutions, governments, and businesses enter the cryptocurrency space, their focus ultimately turns to Bitcoin. They may trade other tokens for speculation, but when it comes to storing significant wealth in digital form, they choose Bitcoin.

Make the Right Choice for Your Future

Understanding all of this has completely changed my perspective. I no longer view cryptocurrencies as a means to get rich overnight or a way to trade the latest hot tokens. I have begun to understand that Bitcoin may be the most important monetary innovation in centuries.

The cryptocurrency industry spends billions of dollars on marketing, partnerships, and hype, trying to convince people that their tokens represent the future. But the future of money does not lie in complexity, flashy features, or the latest technological innovations; it lies in returning to sound monetary principles that have worked for thousands of years, improved with modern technology.

Every penny you spend chasing the latest cryptocurrency trend could have been used to acquire what might be the best form of money in the world. Every hour you spend researching which altcoin to buy next could have been used to understand the monetary revolution that is happening.

I say this not to preach or persuade you of anything, but to share my thoughts, as I wish someone had explained these concepts to me when I first started. Understanding the difference between Bitcoin and cryptocurrencies has completely changed my financial strategy and given me more confidence in my decisions.

The image at the top of this article represents a choice we all must make. We can accept the notion that everything digital and monetized is essentially the same, or we can take the time to understand what is actually happening in the world of money and technology.

Whatever decision you make, ensure that it is based on a well-informed understanding rather than following the crowd or being swayed by marketing hype. Your financial future may depend on it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。