# I. On-chain Anomaly Data Analysis

- Hyperliquid Whale Dynamics: Continuous Reduction of ETH Positions, BTC Shorts at a Loss of $9 Million Still Increasing

According to BlockBeats news on August 15, monitoring by HyperInsight shows that during today's market correction, some whales are adjusting their positions: a whale starting with address 0x7fdaf continues to reduce ETH short positions, having reduced by $1.66 million and $7.79 million in the past 6 hours, currently at a floating loss of about $5.27 million, with a liquidation price of $7,304; a whale starting with address 0x5d2f4 is increasing BTC short positions against the trend, adding $853,000 in positions, currently at a floating loss of $9.02 million, with a liquidation price of $127,873; a whale starting with address 0x5648A is reducing ETH long positions, having reduced by 830 coins (about $3.95 million), currently at a slight floating loss of $44,600, with a liquidation price of $4,091.

- Epic Gains and Losses of Major On-chain Whales, Image Source @ Ice Red Tea bitRoy

# II. Perp DEX Major Events Quick Report

HyperLiquid

- $HYPE is currently still pushing for a new high. The price is less affected by PPI data, with its intraday decline even smaller than that of $BTC and $ETH.

Data Source: https://app.hyperliquid.xyz/trade/HYPE

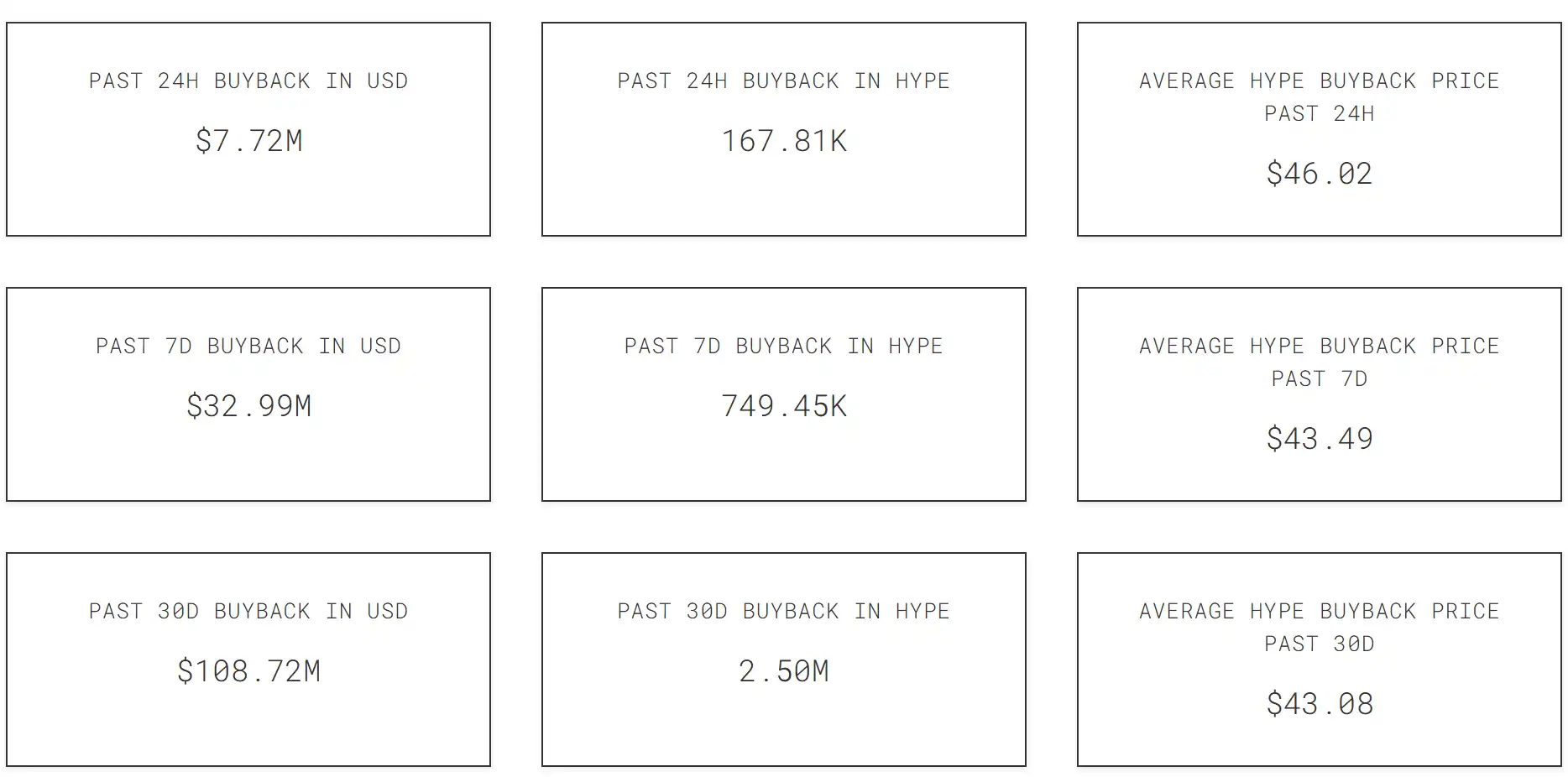

- $HYPE Buyback Data

In the past 24 hours, approximately 168,000 $HYPE have been repurchased, costing nearly $7.72 million, with an average price of $46.02. The buyback amount has reached a historical high.

Data Source: https://data.asxn.xyz/dashboard/hl-buybacks

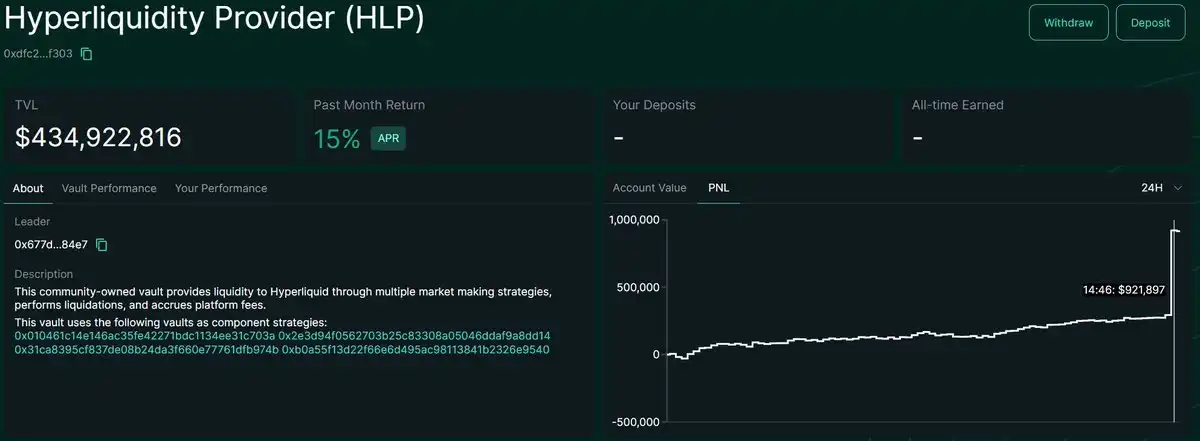

- Hyperliquidity Provider (HLP) Earnings and TVL Situation

With a TVL exceeding $430 million, HLP maintains an APR of about 16%. According to data from @HyperliquidNews, yesterday HLP generated over $600,000 in revenue in less than 15 minutes. Hyperliquid's fees and revenue yesterday were $7.48 million and $6.96 million, both reaching historical highs.

Data Source: https://app.hyperliquid.xyz/vaults/0xdfc24b077bc1425ad1dea75bcb6f8158e10df303

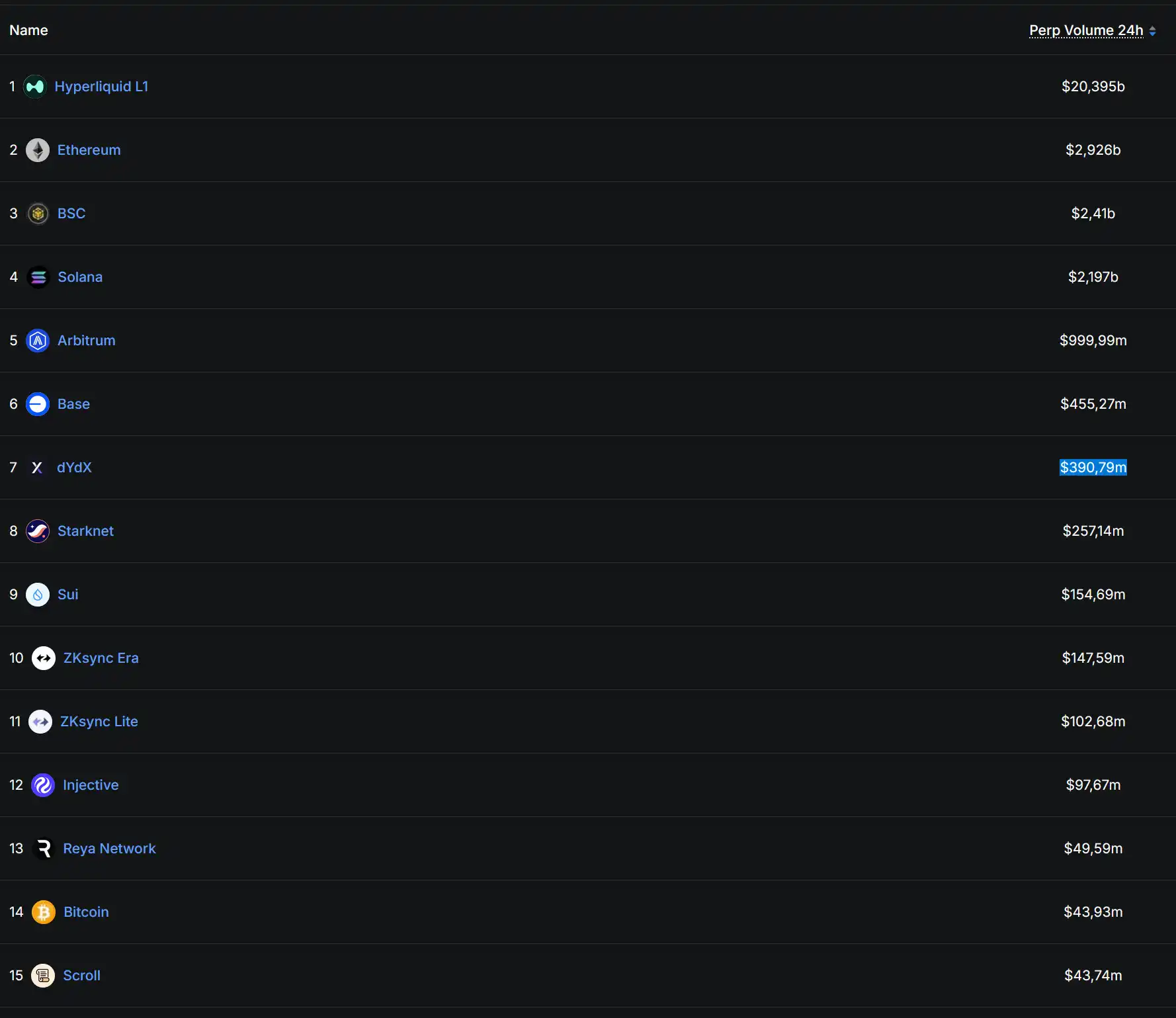

- In the past 24 hours, the derivatives trading volume data shows that Hyperliquid L1 still ranks first among all public chains.

Original Link: https://x.com/Hyperliquid_Hub/status/1956159942773367119

edgeX

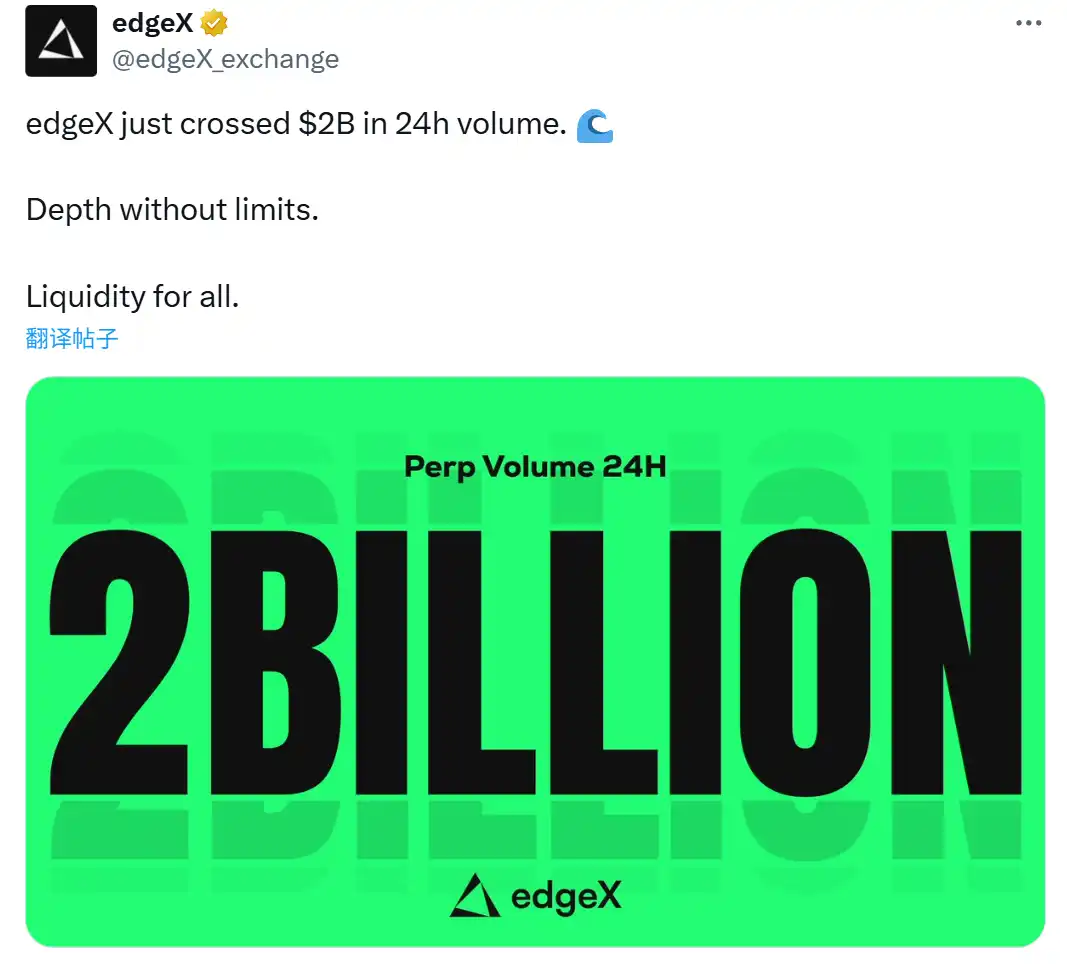

- edgeX's 24-hour trading volume has surpassed $2 billion.

Original Link: https://x.com/edgeX_exchange/status/1955918213050720489

- eLP Earnings and TVL Situation

The current total TVL of eLP is approximately $150 million, with an APR of around 34% over the past month.

Data Source: https://pro.edgex.exchange/vault/1?vaultName=eLP&leader=0x10a9b6FfA380c9463a61499483CC1017b94625D4

- A comparative study of edgeX, lighter, and backpack:

https://x.com/Adriana_flaka13/status/1955570763639226634

- The article "This DEX Without a Token Earns More Than Uniswap" provides a detailed analysis of edgeX's earnings.

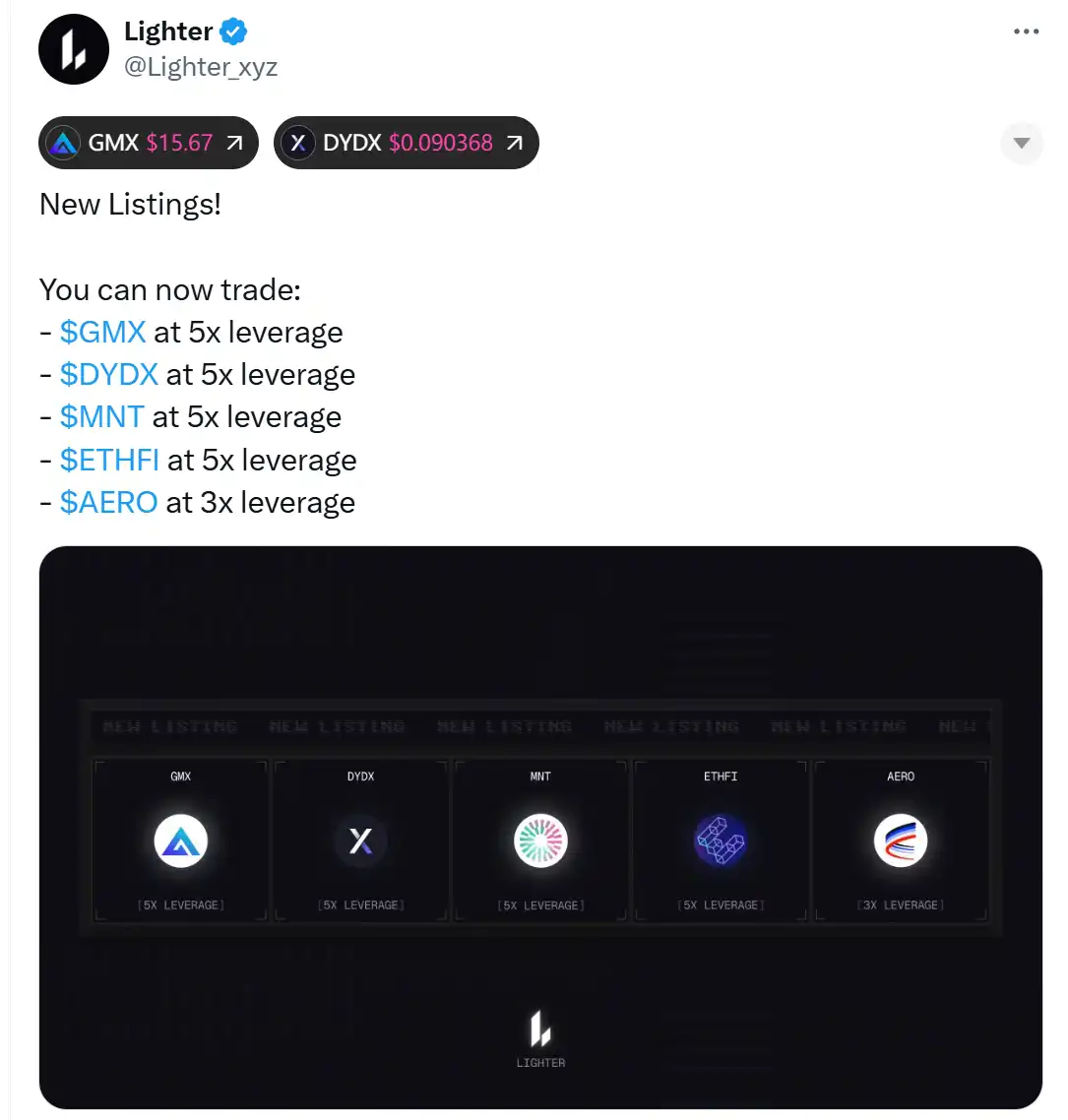

Lighter

- Lighter has launched five times leveraged products for the tokens $GMX, $DYDX, $MNT, and $ETHFI.

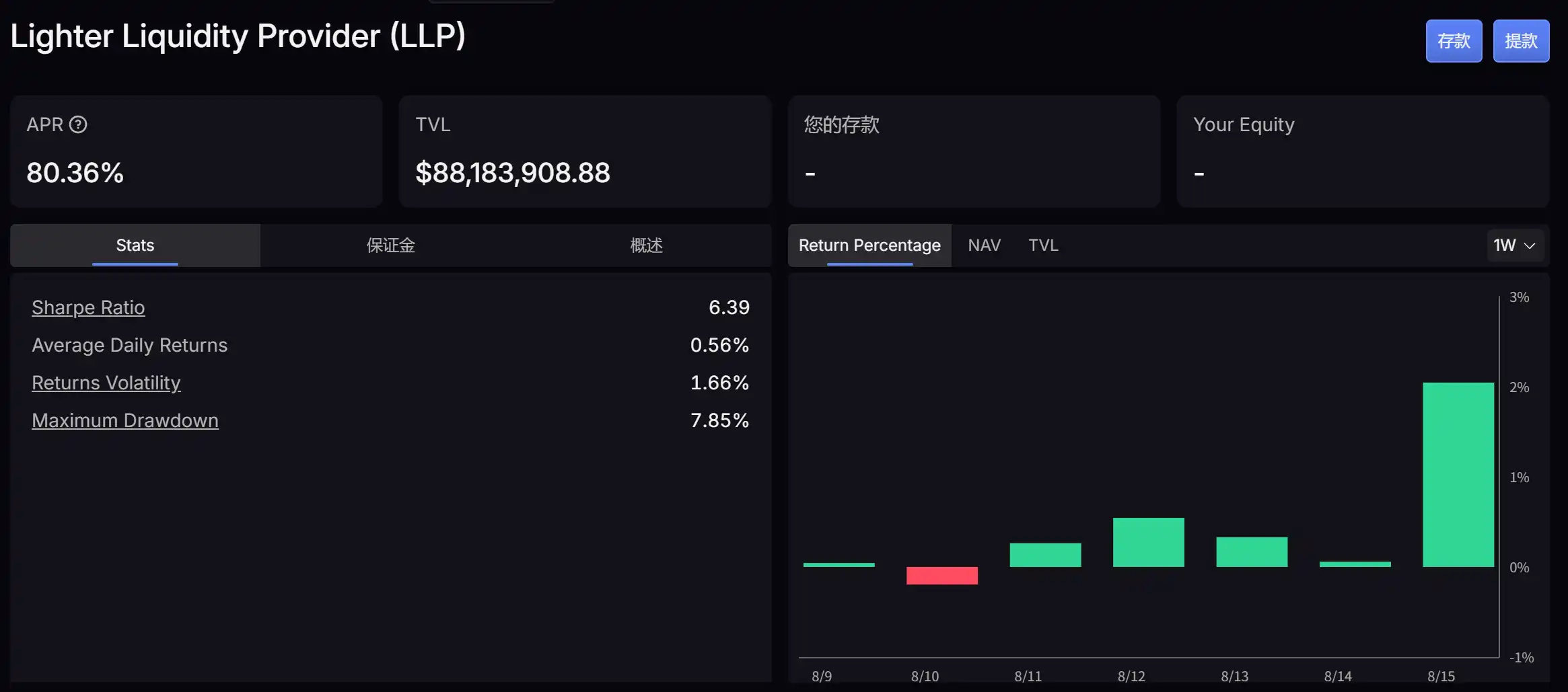

- Lighter Liquidity Provider (LLP) TVL and Earnings Data

Currently, the total TVL of LLP has exceeded $880 million, with an APR maintained at around 80%. The return rate on August 15 reached as high as 2.5%.

Data Source: https://app.lighter.xyz/public-pools/281474976710654?locale=zh

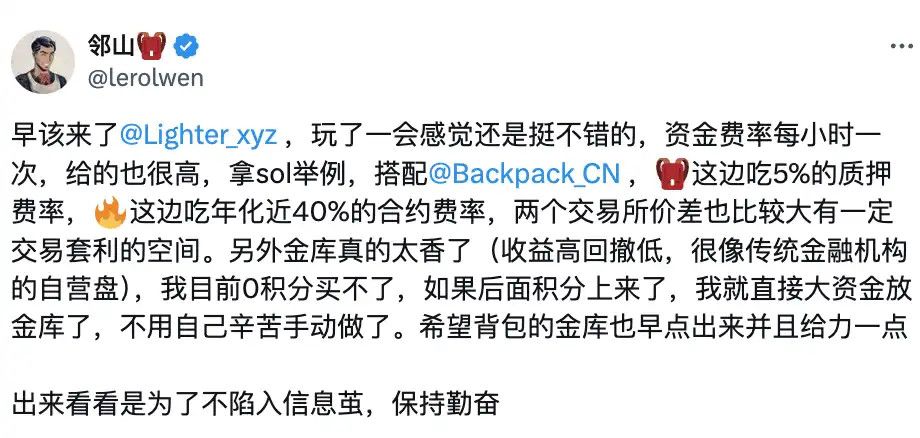

- KOL Linshan @lerolwen shares their experience and feelings about Lighter:

Original Link: https://x.com/lerolwen/status/1955842222026580129

Other Perp DEX

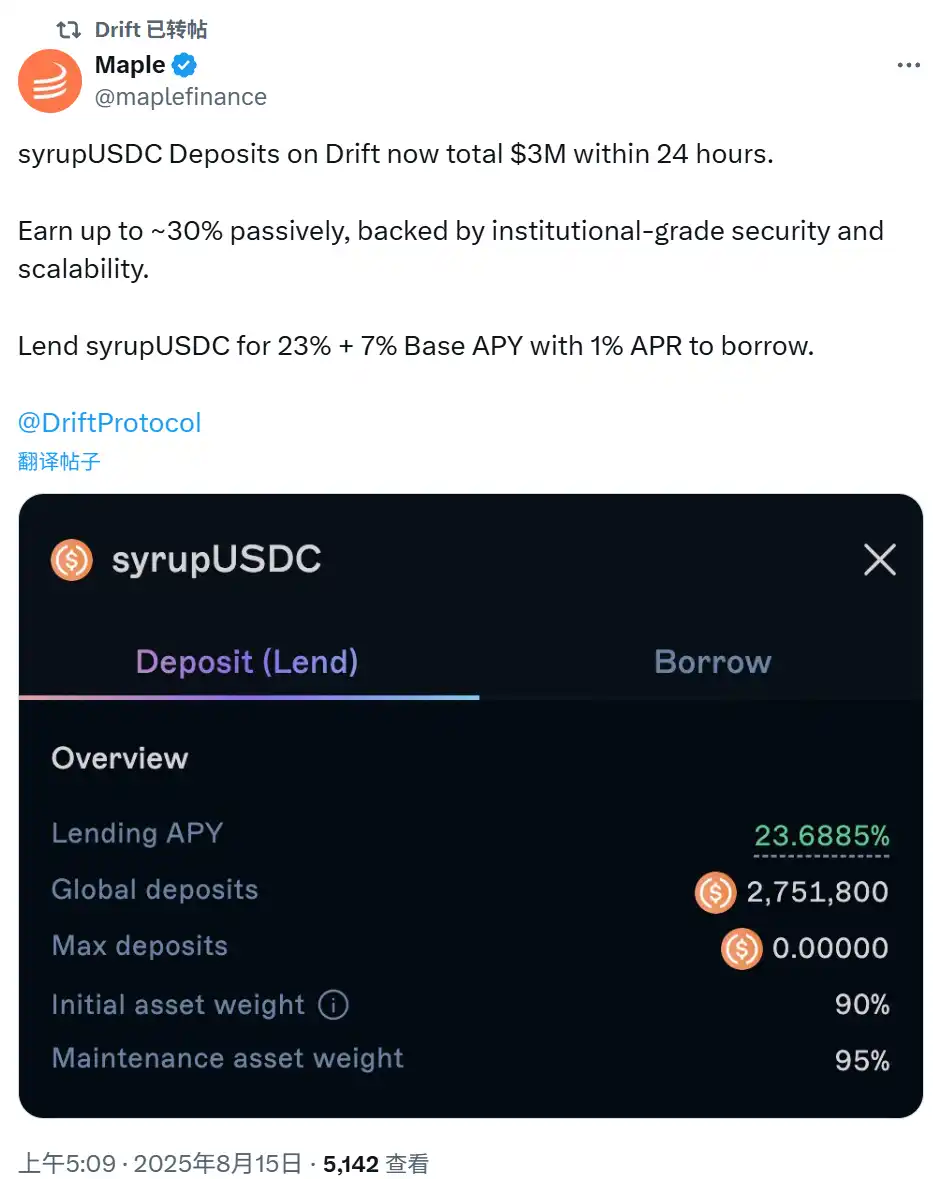

- The syrupUSDC deposit product on Drift can provide a 30% APY.

Original Link: https://x.com/maplefinance/status/1956100928442077451

- A relatively new perp DEX on Solana, Pacifica, is worth paying attention to.

Founded by FTX COO Constance Wan, this is a Solana-based perpetual contract DEX. Team members also include NFTperp founder Jose (@The0xJose). The project is fully self-funded and has not undergone any external financing. Currently, the daily trading volume exceeds $50 million, with over 1,000 users. Related reading: "Pacifica, the Perp DEX Founded by FTX COO".

# III. Perp DEX Data Analysis

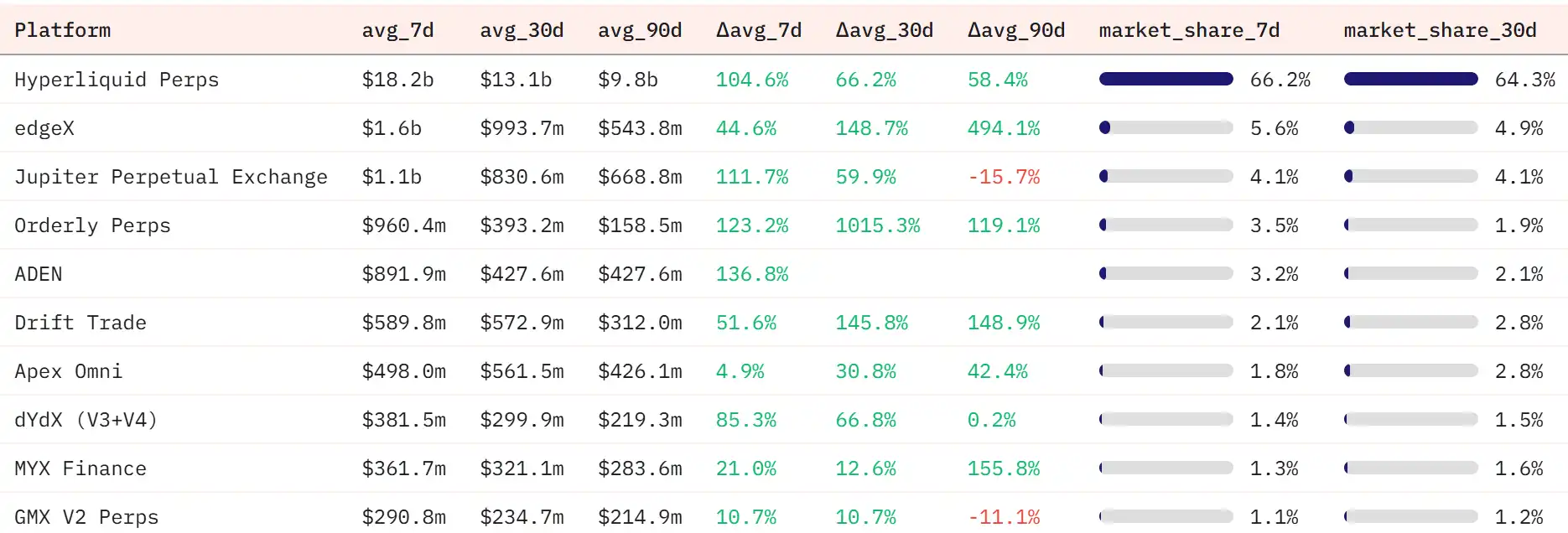

- Seven-Day Average Trading Volume

Almost all leading Perp DEXs have seen a significant increase in their seven-day average trading volume, with Hyperliquid, Jupiter, and Orderly showing the largest increases.

Data Source: https://dune.com/uwusanauwu/perps

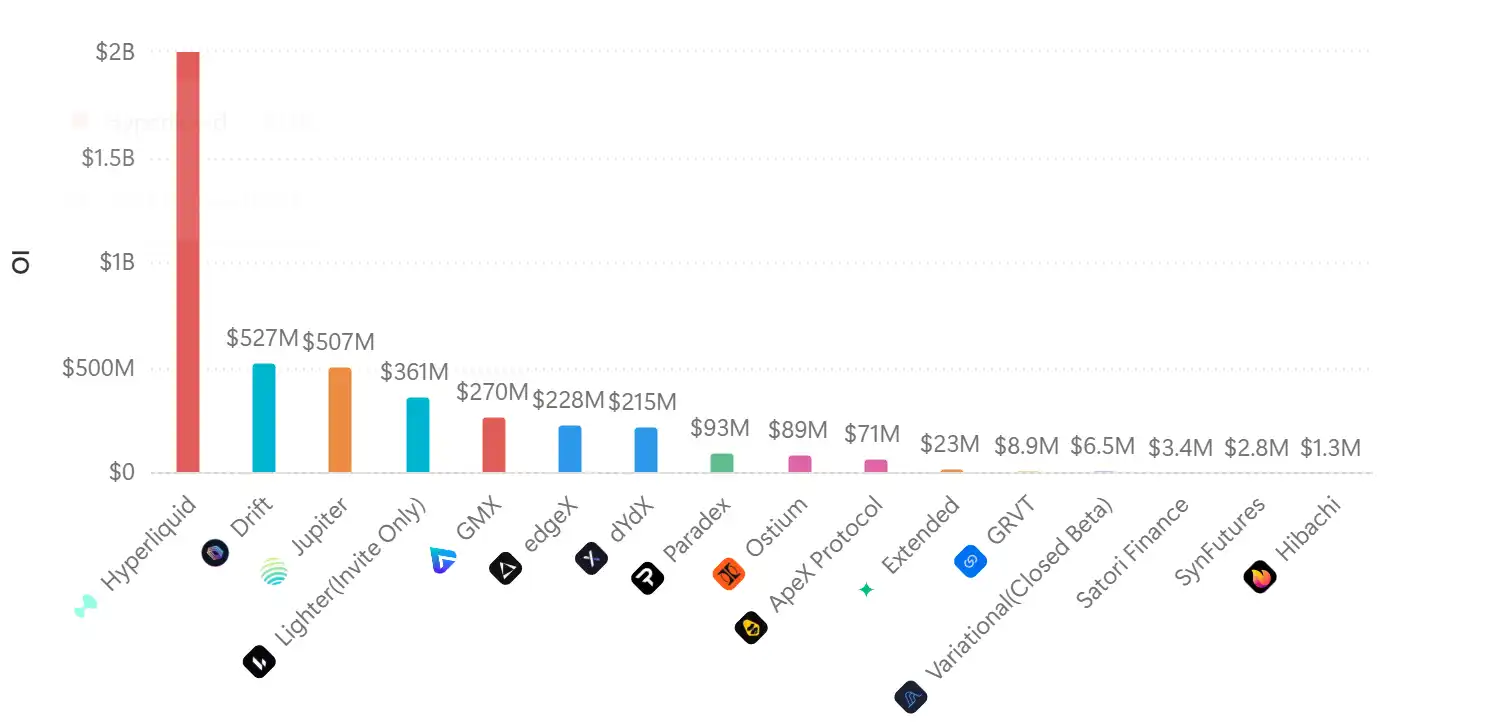

- Open Interest (OI)

Data Source: https://www.perpetualpulse.xyz/

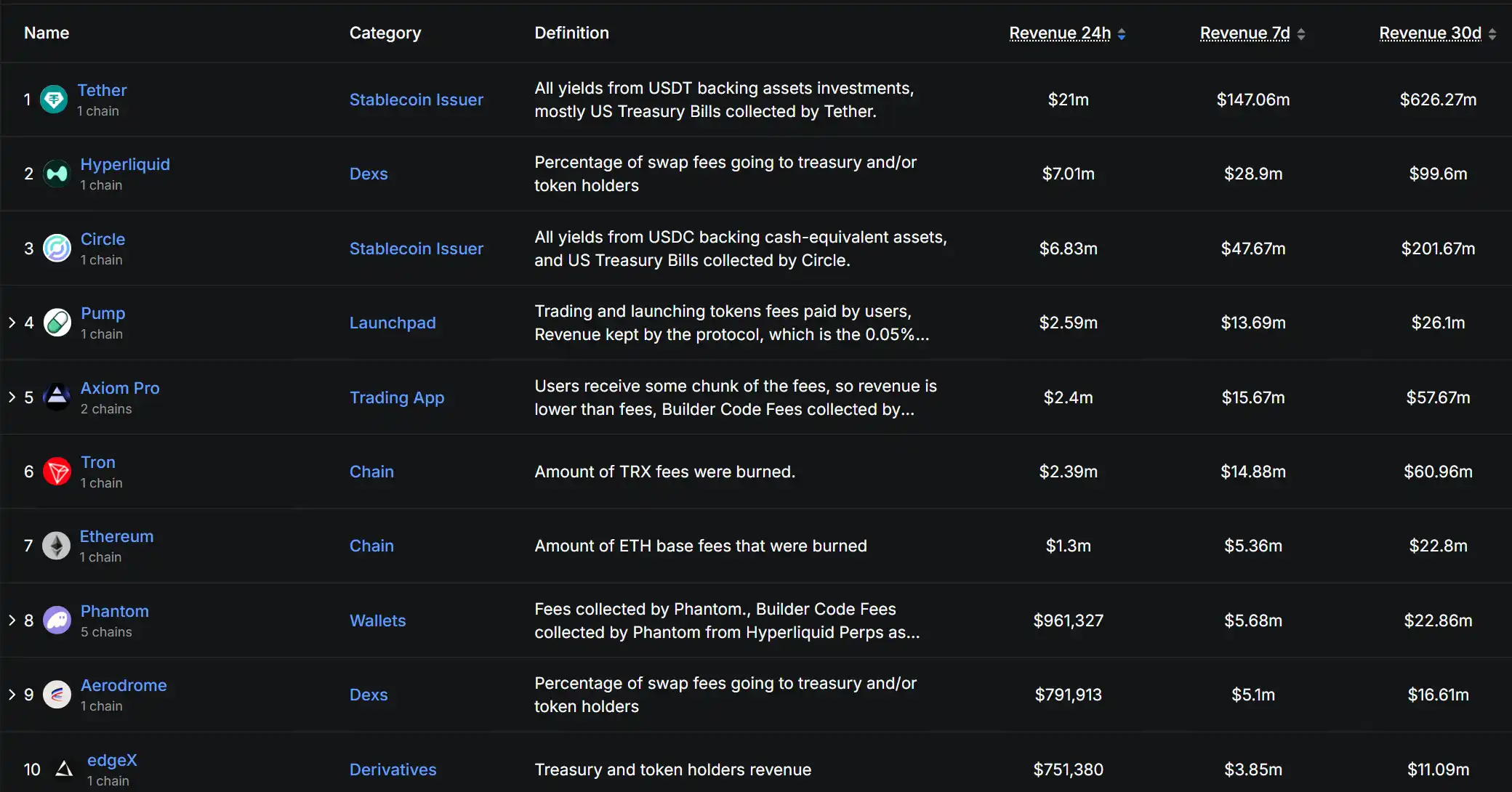

- Protocol Revenue

edgeX's revenue in the past 24 hours exceeded $750,000, still ranking first.

Perp DEX Revenue Ranking, Data Source: https://defillama.com/revenue?category=Derivatives

Hyperliquid's revenue in the past 24 hours has significantly increased, exceeding $7 million, surpassing Circle to become second on the list.

Crypto Protocol 24-Hour Revenue Ranking, Data Source: https://defillama.com/revenue

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。