Author: Alea Research

Translated by: Tim, PANews

Avalanche was originally designed as a high-performance public chain for institutional-grade finance, but its next phase of development will shift focus to the RWA sector. Avalanche does not solely compete on throughput or virtual machine compatibility; instead, it positions itself as the preferred platform for tokenized credit, treasury bills, and other regulated assets.

According to recent news, Grove Finance plans to allocate approximately $250 million in RWAs on the Avalanche blockchain through Centrifuge and Janus Henderson, which will introduce new institutional partners and financial products to the ecosystem.

In this article, we will introduce Avalanche's technical architecture for institutions, Grove's RWA deployment and its impact, and interpret why tokenized credit and government bonds can make Avalanche the preferred public chain in the RWA sector.

Why is Avalanche Important for RWA?

The Avalanche platform, with its unique Avalanche consensus protocol, achieves sub-second transaction finality and high throughput, enabling developers to build customized layer-one networks: subnets, that balance compliance and performance. These characteristics make the platform particularly suitable for institutional-grade application scenarios, where deterministic settlement and low transaction fees have become rigid demands.

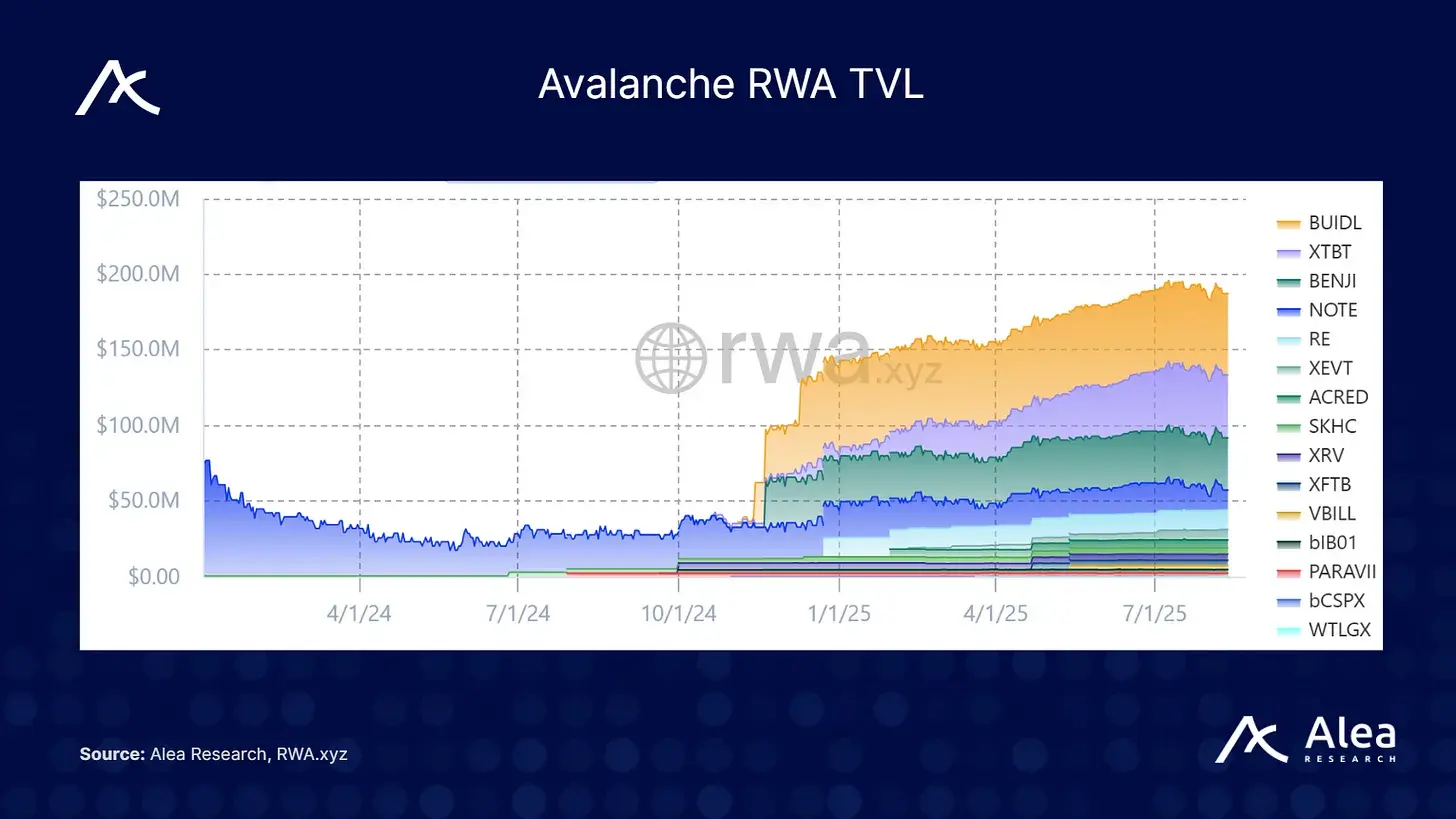

As of now, Avalanche has supported nearly $180 million in tokenized RWA value, covering 35 asset classes.

These assets already include some significant categories of traditional financial products, such as tokenized government bonds, credit products, institutional funds, and alternative assets.

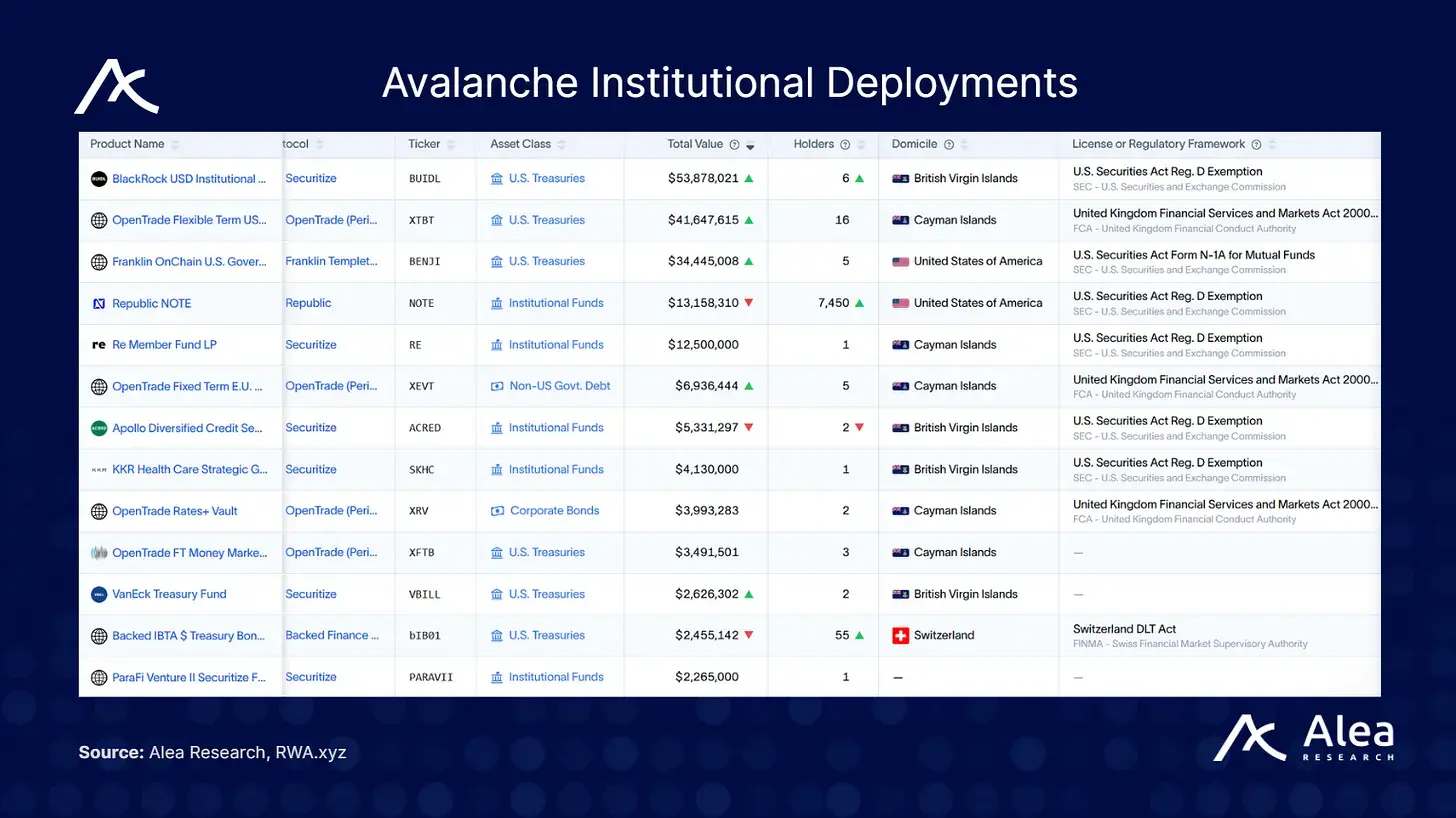

- Tokenized government bonds and credit products: OpenTrade connects U.S. Treasury short-term notes and institutional credit to DeFi, while Backed Finance brings regulated stocks like SPY and COIN onto the blockchain under the Swiss regulatory framework.

- Institutional funds: BlackRock's BUIDL fund, issued through Securitize, can be deposited into Avalanche wallets and used as DeFi collateral. This fund contributes $53 million to the institutional RWA TVL.

- Reinsurance and alternative investments: RE tokenizes reinsurance premiums to create uncorrelated sources of income.

Avalanche's network supports customizable subnet functionality, allowing asset management institutions to deploy dedicated chains equipped with independent validation nodes and compliance rule systems. The ecosystem is compatible with programmable stablecoins (such as avUSD and sAVAX) and supports permissionless lending protocols as well as various liquid staking solutions (including innovative protocols like sAVAX, ggAVAX, and yyAVAX).

Collaboration between Grove, Centrifuge, and Janus Henderson

In late July 2025, Avalanche announced that the institutional credit protocol Grove Finance would launch on its platform, aiming to introduce approximately $250 million in RWAs. Currently, Grove is collaborating with tokenization pioneer Centrifuge and the asset management giant Janus Henderson, which manages $373 billion in assets, to facilitate the on-chain deployment of two funds:

- Janus Henderson Anemoy AAA-rated Loan Collateralized Securities Fund (JAAA): A loan collateralized securities fund that allocates priority credit assets through regulated standards.

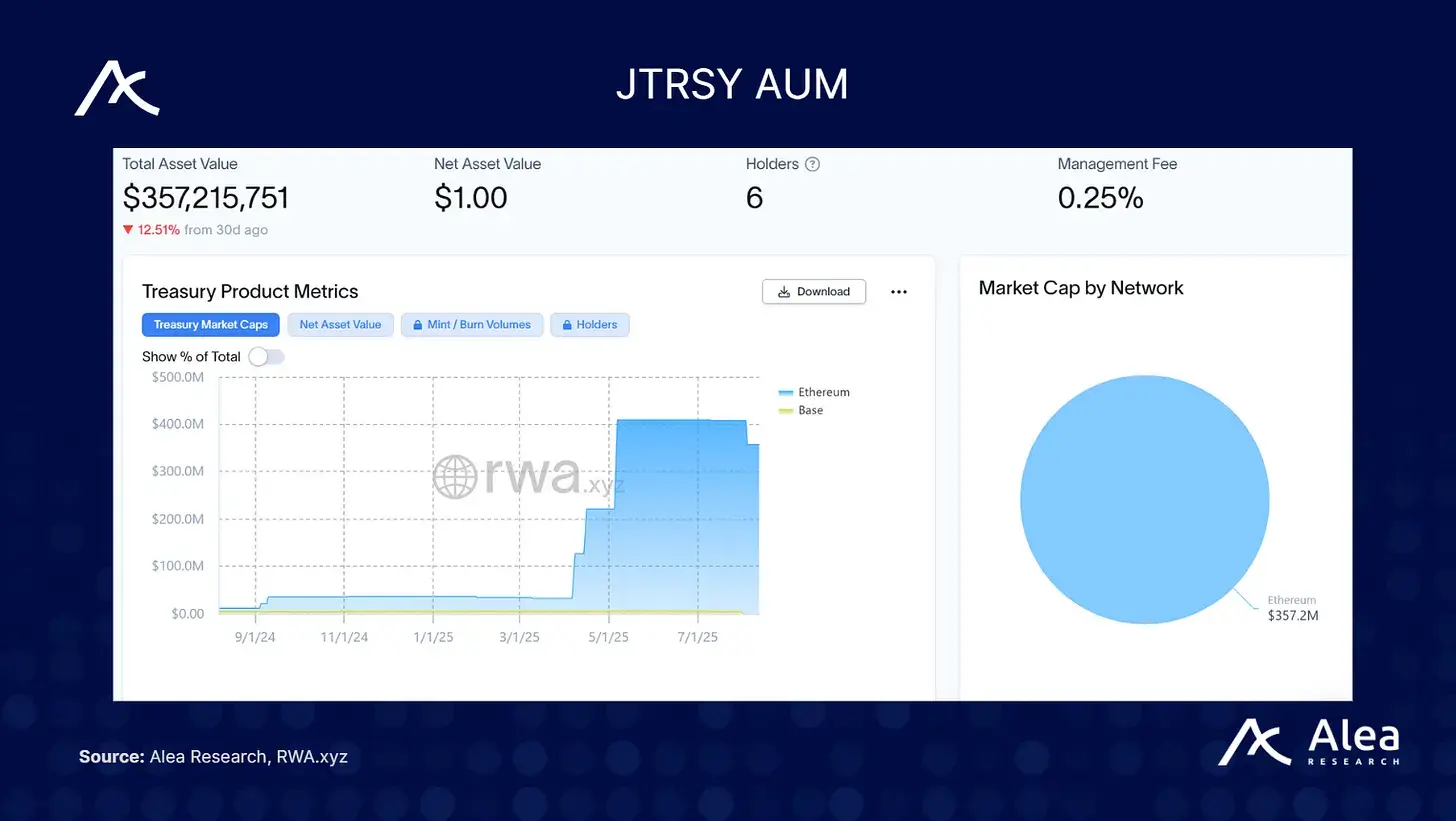

- Janus Henderson Anemoy Treasury Fund (JTRSY): A strategy that invests in short-term U.S. Treasury bonds.

The influx of Grove funds will more than double Avalanche's scale in the RWA sector. This collaboration will also introduce strong new partners to the ecosystem, deepening strategic synergies with asset management giant Janus Henderson and decentralized asset protocol Centrifuge. Deployments of products from Apollo Global Management's ACRED, WisdomTree's tokenized funds, KKR's healthcare growth fund, as well as products from BlackRock, Franklin Templeton, and VanEck, all demonstrate Avalanche's overall strong development momentum in institutional applications.

Adoption of RWA on Avalanche

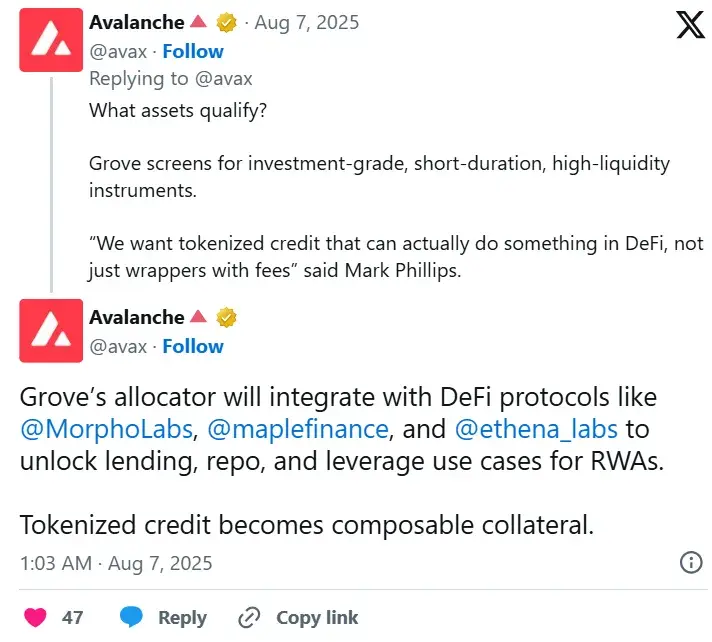

For users and developers, Avalanche's expanding RWA ecosystem provides new foundational components for building yield strategies and fixed-income products.

Developers can integrate tokenized loan collateral certificates and U.S. Treasury bonds into lending markets or automated vault systems, while retail investors can access financial fields traditionally limited to institutional participation.

For asset allocators, Avalanche is gradually becoming a reliable alternative to Ethereum in the institutional RWA space. Its high-performance architecture, low fees, and proven subnet technology are significantly attractive to asset management institutions seeking to achieve fund tokenization.

The Grove deployment plan indicates that large credit portfolios have achieved on-chain operationalization, expected to unlock liquidity and enhance transparency for investors. The network's collaboration with Visa in the global stablecoin settlement space, combined with record trading volumes on DEXs, collectively confirms that Avalanche is building infrastructure for payment systems and capital markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。