RWA has been regarded as the core interface driving the integration of Web3 and Web2 finance, and is a key track for on-chain finance to achieve mainstream adoption.

This article is jointly published by Aquarius Capital and K1 Research.

Introduction

Since 2024, Real-World Assets (RWA) have re-emerged as one of the core narratives in the crypto market. From stablecoins to U.S. Treasury bonds, and to stocks and non-standard assets being tested, the process of bringing real-world assets on-chain is transitioning from a validation phase to an expansion phase. The driving forces behind this are not only technological maturity but also a clearer global regulatory environment and the proactive embrace of blockchain infrastructure by traditional finance. This wave of RWA enthusiasm is not coincidental; it is the result of multiple converging variables:

- Macroeconomic background: Global interest rates remain high, and institutional capital is reassessing on-chain yield instruments.

- Policy evolution: Major regulators in the U.S. and Europe are gradually establishing frameworks for "regulated tokenized assets," expanding the compliance space for project parties.

- Technological evolution: On-chain settlement, KYC modules, institutional wallets, and permission management infrastructures are becoming increasingly mature.

- DeFi integration: RWA is no longer just a "packaging" of off-chain assets but is now a component of the on-chain financial system, possessing liquidity, composability, and programmability.

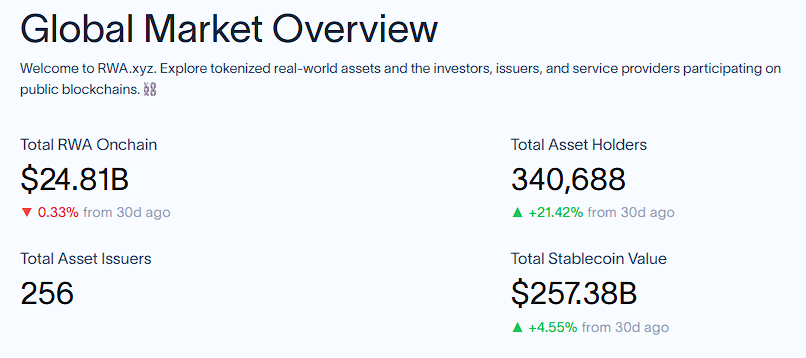

Data shows that by August 2025, the total scale of global RWA on-chain assets (excluding stablecoins) has reached over $25 billion, with stablecoins reaching a market value of over $250 billion. RWA has been viewed as the core interface driving the integration of Web3 and Web2 finance, and is a key track for on-chain finance to achieve mainstream adoption.

1. Tokenization of Real Assets: Motivations and Implementation Path

1.1 Why RWA? Why should real assets go "on-chain"?

The traditional financial system relies on centralized registration institutions and multiple layers of intermediaries, which inherently leads to structural inefficiencies, becoming a bottleneck for asset circulation and financial inclusivity:

- Limited liquidity: Real assets such as real estate, private equity, and long-term bonds generally face high trading thresholds (e.g., minimum investments in the millions), long holding periods (years or even decades), and limited circulation channels, resulting in a large amount of capital being "locked" and difficult to allocate efficiently.

- Complicated settlement and custody processes: Asset issuance, trading, and clearing depend on multiple intermediaries such as brokers, clearinghouses, and custodial banks, making the processes complex and time-consuming (e.g., cross-border bond settlements take 3-5 days), which not only increases transaction costs but also raises operational risks and delays.

- Insufficient data transparency: Asset valuation relies on fragmented offline data (e.g., property appraisal reports, corporate financial statements), and transaction records are scattered across different institutional systems, making real-time synchronization and cross-verification difficult, leading to delayed pricing and inefficient portfolio management.

- High participation thresholds: High-quality assets (e.g., private equity, high-end art) are often only accessible to institutions or high-net-worth individuals, while ordinary investors are excluded due to capital amounts and compliance qualifications, exacerbating inequality in financial markets.

Blockchain, as a decentralized distributed ledger system, reconstructs asset records and transaction logic through "disintermediation," addressing the pain points of traditional finance from a technological foundation. Its core advantages and the value of real asset tokenization are as follows:

Underlying Support of Blockchain Technology

- Decentralized resilience: Asset ownership records are maintained collectively by all network nodes, eliminating reliance on a single centralized institution, reducing risks of data tampering and system crashes, and enhancing the entire system's fault tolerance.

- Immutability and traceability: Once confirmed, on-chain transactions are permanently recorded and can be traced back through timestamps, providing an immutable "digital certificate" for asset ownership transfer, reducing fraud and disputes.

Specific Value Brought by Tokenization

- Liquidity innovation: By enabling "fractional ownership," high-value assets can be divided into smaller tokens (e.g., a $10 million property split into 1,000 tokens of $10,000 each), combined with 24/7 decentralized markets and automated market makers (AMMs), significantly lowering investment thresholds and enhancing trading flexibility.

- Process automation and disintermediation: Smart contracts automatically execute asset issuance, dividend distribution, and maturity redemption processes, replacing manual operations of traditional intermediaries; Oracles connect to offline data (e.g., property valuations, corporate revenues), supporting automated triggers for complex scenarios like insurance claims, significantly reducing operational costs.

- Compliance and audit upgrades: On-chain built-in KYC/AML rules can automatically verify investor qualifications; all transaction data is recorded on-chain in real-time, facilitating efficient verification by regulatory bodies and auditors, estimated to reduce compliance costs by 30%-50%.

- Atomic settlement and risk elimination: Smart contracts enable "synchronous delivery of assets and funds," achieving atomic settlement that completely eliminates counterparty risks of "asynchronous money and goods" in traditional transactions, reducing settlement time from T+3 to seconds.

- Global circulation and DeFi synergy: Tokenized assets break geographical limitations and can flow seamlessly within the global blockchain network; at the same time, they can be used as collateral in lending, liquidity mining, and other DeFi protocols, achieving "one asset, multiple uses," releasing higher capital efficiency.

- Overall, RWA represents a Pareto improvement for the traditional financial industry, optimizing the efficiency of traditional finance based on technological innovation.

Successful Path Validation: The Experience of Stablecoins

As a "gateway" for bringing real assets on-chain, stablecoins have fully validated the feasibility of blockchain technology in connecting off-chain value with on-chain ecosystems:

- Model prototype: Stablecoins like USDT and USDC achieve a 1:1 peg to off-chain U.S. dollar reserves, realizing the standardized mapping of fiat assets to blockchain tokens for the first time, becoming the initial practice of "bringing real assets on-chain."

- Market validation: As of August 2025, the market value of stablecoins has exceeded $256.8 billion, dominating the RWA market, proving the scalability potential of bringing off-chain assets on-chain.

- Insight value: The successful operation of stablecoins validates the security, transparency, and efficiency of the "off-chain asset - on-chain token" mapping, providing technical standards and compliance templates for more complex RWA (such as real estate and bonds) tokenization.

Through blockchain technology, real assets can break free from the limitations of traditional finance, achieving a paradigm shift from "static holding" to "dynamic circulation," and from "exclusive to a few" to "accessible to all."

1.2 How to RWA? Implementation Path and Operational Structure of RWA

The essence of RWA is to transform valuable assets in the real world into programmable digital certificates on-chain through blockchain technology, achieving a closed loop of "off-chain value - on-chain liquidity." Its core operational path can be divided into four key stages:

a) Off-chain asset identification and custody:

- Off-chain asset identification investigation: It is necessary to verify the legality, ownership, and value of assets through third-party institutions (law firms, accounting firms, appraisal agencies). For example, real estate requires verification of property certificates, rental income rights need to confirm lease contracts, and gold must be stored in LBMA-certified vaults and audited regularly. For accounts receivable, the core enterprise must confirm the authenticity of the debt and provide blockchain evidence.

· Custody model classification and practice:

Centralized custody

a. Advantages: Strong compliance, suitable for financial assets (e.g., government bonds, corporate bonds). For example, MakerDAO's bonds are held by banks, with on-chain contracts recording collateral status and updating data quarterly.

Risks: There is a possibility of asset misappropriation by the custodian. In 2024, a real estate project in Singapore became an "orphan asset" due to the failure to synchronize property changes on-chain, highlighting the information lag issue of centralized custody.

Decentralized custody

Technical implementation: Automatic execution of income distribution through DAO governance and smart contracts. For example, the DeFi protocol Goldfinch brings loan assets on-chain, with smart contracts managing repayments and default handling.

Challenges: Lack of legal support, and code vulnerabilities may lead to asset loss. Some projects attempt to combine zero-knowledge proofs (ZKP) to verify ownership consistency, but large-scale implementation is still lacking.

Hybrid custody

Balanced approach: Off-chain assets are held by trusted third parties, while on-chain data is verified by nodes. For example, in the Huamin Data RWA Alliance chain's node system, institutional nodes (banks, trust companies) are responsible for asset custody, regulatory nodes (30% share) set compliance standards, and industry nodes (e.g., ports) provide logistics data.

Case: The carbon credit tokenization project Toucan Protocol is managed by an environmental organization, with on-chain records of transactions and destruction information to ensure transparency.

b) Legal structure establishment:

By using SPVs (Special Purpose Vehicles), trust agreements, and other legal structures, on-chain token holders can have legal ownership or income rights, while establishing an executable legal bridge with the off-chain judicial system to ensure "token = equity certificate."

Due to differences in regulatory frameworks, legal structure designs vary significantly across regions:

- United States: Focused on "SPV isolation + securities compliance." A common structure is to register an LLC (Limited Liability Company) in Delaware as an SPV, which holds the underlying assets (e.g., U.S. Treasury bonds, equity), and token holders indirectly enjoy asset rights through holding LLC equity shares. At the same time, it must adapt to the SEC regulatory framework based on asset types—if the token represents bonds or equity, it must comply with Reg D (for accredited investors) or Reg S (for non-U.S. investors) registration exemptions; if income rights are split, the "tokenized note" structure must clarify the creditor-debtor relationship to avoid being classified as "unregistered securities."

- Europe: Based on the MiCA (Markets in Crypto-Assets) framework, relying on "trusts or EU-recognized SPVs." For example, registering a SICAV (Société d'Investissement à Capital Variable) in Luxembourg as an SPV to hold assets and issue "Asset-Referenced Tokens (ART)," with the token's linkage to the underlying assets constrained by both smart contract terms and legal agreements. MiCA explicitly requires token issuers to disclose asset custody details, income distribution rules, and undergo regular audits by EU regulatory bodies to ensure the legal binding of on-chain tokens and off-chain rights can be enforced across the EU.

c) Tokenization issuance:

Minting the aforementioned off-chain assets into tokens (usually ERC-20), serving as vehicles for on-chain circulation and composition.

- 1:1 full mapping: Each token corresponds to the complete rights of an equivalent underlying asset. For example, in Paxos Gold (PAXG), one token corresponds to one ounce of physical gold, and holders can redeem an equivalent amount of gold at any time, with the token value fully synchronized with the gold price; U.S. Treasury bond tokens like $OUSG correspond 1:1 to shares of short-term U.S. Treasury bond ETFs, encompassing complete rights to principal and interest.

- Partial rights mapping: Tokens only represent specific rights of the underlying asset (e.g., income streams, dividend rights), without full ownership. For example, in real estate tokenization, a project may issue "rental income tokens," where holders only receive a proportional share of rental income without owning the property or having disposal rights; in corporate bond tokenization, "interest tokens" may be issued, corresponding only to the interest income of the bonds, while the principal remains with the original holder. This model is suitable for fractionalizing high-value assets, lowering investment thresholds.

d) On-chain integration and circulation:

Tokens entering the DeFi ecosystem can be used for collateralized lending, market making, re-staking, structured asset design, etc., supported by permission management and on-chain KYC systems to facilitate compliance for users.

The on-chain KYC system is a core tool for achieving compliant circulation, operating on the logic of "identity verification on-chain + dynamic permission control":

- Core functions: By integrating with smart contracts and third-party identity verification service providers (such as Civic, KYC-Chain), users must submit identity information (passport, proof of address, proof of assets, etc.). Upon successful verification, a "chain-based KYC certificate" is generated (not the identity data itself, but a hash of the verification result).

- Permission control: Smart contracts restrict trading permissions based on KYC certificates— for example, only allowing "qualified investors" (assets over $1 million) to participate in private credit token trading; for U.S. Treasury bond tokens, non-U.S. investors (Reg S framework) are restricted to redeeming only during specific time windows.

- Privacy protection: Using zero-knowledge proof (ZK-proof) technology, users can prove "compliance" to smart contracts without disclosing specific identity information, balancing compliance and privacy needs. For instance, a user's KYC certificate may only show "passed EU anti-money laundering verification," without revealing specific names or addresses.

Through the closed-loop design of the above four stages, RWA achieves the transformation from "real assets" to "on-chain programmable assets," retaining the value foundation of traditional assets while endowing them with the efficient circulation and composability characteristics of blockchain.

2. Classification: Mainstream Asset Categories of RWA and the Rise of the U.S. Treasury Narrative

Real World Assets (RWA) are migrating to the blockchain world at an unprecedented pace, extending their coverage from the core categories of traditional finance to a broader range of the real economy. From standardized financial instruments like government bonds, corporate bonds, and stocks to physical assets like real estate, gold, and crude oil, and to non-standardized rights such as private equity, intellectual property, and supply chain receivables, almost all real assets that can generate value or possess ownership characteristics are being explored for tokenization to access the blockchain network.

2.1 Seven Mainstream Asset Classifications of RWA

Currently, in the RWA (Real World Assets on-chain) ecosystem, mainstream assets have formed seven major categories: stablecoins, tokenized U.S. Treasuries, tokenized global bonds, tokenized private credit, tokenized commodities, institutional alternative funds, and tokenized stocks. As of August 2025, the scale of on-chain RWA assets reached $25.22 billion, with stablecoins and U.S. Treasuries firmly occupying the leading positions, where the stablecoin market size reached $256.82 billion, and tokenized government bonds amounted to $6.80 billion. (Data source: RWA.xyz | Analytics on Tokenized Real-World Assets)

2.1.1 Stablecoins

- Although stablecoins are not typical "off-chain assets," their core anchoring mechanisms are mostly based on off-chain fiat or bond reserves, thus occupying the largest share in the broad definition of RWA.

- Representative assets: USDT, USDC, FDUSD, PYUSD, EURC

- On-chain motivation: Payment composability, on-chain financial infrastructure, fiat settlement alternatives

- Extension direction: Accelerated exploration of local currency stablecoins like KRW and JPY to serve local crypto ecosystems and reduce reliance on the U.S. dollar; traditional banks piloting tokenization of deposits as on-chain currency to enhance transaction efficiency and scenario adaptability; multiple countries advancing CBDC simulation pilots (e.g., Hong Kong's "Digital Hong Kong Dollar") to accumulate technical and policy experience for formal issuance.

2.1.2 U.S. Treasuries

- U.S. Treasury bonds have become the most mainstream on-chain asset, accounting for over 60% of the market value, introducing a low-risk yield curve to DeFi.

- Representative protocols: Ondo, Mountain Protocol, Backed, OpenEden, Matrixdock, Swarm

- On-chain motivation:

- Demand side: In the context of declining crypto-native yields, introducing a stable, composable "risk-free interest rate benchmark."

- Technology push: Increasingly mature infrastructure for on-chain packaging, KYC whitelisting, cross-chain bridges, etc.

- Compliance structure: Achieving asset penetration and regulatory compatibility through SPVs, tokenized notes, BVI funds, etc.

- Typical product structures:

- $OUSG (Ondo): Tracks short-term U.S. Treasury ETF, pays interest daily.

- $TBILL (Mountain): 1:1 corresponding to short-term T-bills, stable redemption, and strong composability.

- $USDM (Mountain): The first stablecoin pegged to U.S. Treasury yields.

2.1.3 Global Bonds

- In addition to U.S. Treasuries, government bonds and corporate bonds from Europe, Asia, and other regions are also beginning to be tokenized.

- Representative protocols: Backed, Obligate, Swarm

- On-chain motivation: Expanding geographical and currency coverage; serving non-U.S. dollar stablecoin issuance (e.g., EURC); forming a global interest rate curve.

- Challenges: Complex cross-border legal structures, inconsistent KYC standards.

2.1.4 Private Credit

- Connecting off-chain SME, micro-loans, real estate loans, working capital financing, and other real yield assets.

- Representative protocols: Maple, Centrifuge, Goldfinch, Credix, Clearpool

- On-chain motivation: Creating real yield sources for on-chain capital; improving credit transparency and composability.

- Typical structure:

- SPV manages underlying assets, DeFi provides capital liquidity, investors enjoy on-chain interest rates.

- Chainlink Proof of Reserve / Attestation enhances data credibility.

- Main contradictions: Transparency vs. privacy protection, yield vs. risk control quality.

2.1.5 Commodities

- Tokenization of physical assets such as gold, carbon credits, and energy.

- Representative protocols: Tether Gold (XAUT), Pax Gold (PAXG), Toucan, KlimaDAO

- On-chain motivation: Providing commodity exposure for on-chain investors; physical custody + on-chain trading.

- Hot directions: Green finance, carbon markets, sustainable development scenarios.

2.1.6 Institutional Funds

- On-chain issuance of closed-end fund shares such as private equity, hedge funds, and ETFs.

- Representative protocols: Securitize, ADDX, RedSwan, InvestX

- On-chain motivation: Increasing share liquidity, lowering entry barriers, expanding the global base of qualified investors.

- Development limitations: High compliance barriers, limited to Reg D / Reg S investors.

2.1.7 Stocks

- Token/synthetic forms mirroring off-chain stock assets.

- Representative protocols: Backed (xStock), Securitize, Robinhood, Synthetix

- On-chain motivation: Supporting on-chain trading strategies, cross-chain arbitrage, fractional investing.

- Development stage: Primarily early attempts, with compliance paths still being explored.

Among various RWA assets, bond assets are considered a benchmark for adaptability. Bonds inherently possess a high degree of standardization, whether U.S. Treasuries, corporate bonds, or personal bonds, relying on clear contractual structures and payment mechanisms, providing an efficient path for large-scale on-chain integration. In contrast, the forms of off-chain physical assets are diverse, and the rights confirmation processes are complex, while the standardized nature of bonds makes their on-chain mapping process more certain and smooth. Additionally, bond yields have relatively predictable characteristics, and the efficiency of on-chain capital interactions and off-chain yield realization is significantly superior to other asset classes, enabling the rapid construction of a "on-chain - off-chain" value closed loop, precisely aligning with the core demands for the digitalization and efficiency of RWA assets.

2.2 U.S. Treasury RWA Lays the Foundation for Industry Development

The reason U.S. Treasury RWA has quickly become a "traffic entry point" for on-chain assetization is not only due to its strong financial attributes but also because it has hit the "gap" and "urgent need" in the current crypto market on both the supply and demand sides. The following points are particularly critical:

Supply side: Structural safety and clear compliance paths

- U.S. Treasuries inherently possess no default risk (theoretically), making them the most trusted foundational asset globally.

- The ETF and note markets already have a mature secondary market, providing high liquidity.

- Compared to equity and credit, the legal structure for tokenizing U.S. Treasury assets is more stable and clear (e.g., BVI fund + token wrapper).

Demand side: Alternatives after the exhaustion of crypto-native yields

- Since the liquidity peak in 2021, many DeFi yield models have collapsed, and the market has entered a "no yield" period.

- Investors are beginning to turn their attention to on-chain composable real yield assets, with U.S. Treasury tokens being the most natural choice.

- The demand for "on-chain interest rate anchors" has risen, especially after the emergence of interest rate protocols like LayerZero, EigenLayer, and Pendle.

Technical side: Gradual maturity of standardized packaged asset structures

- Typical structures:

- Tokenized Note (e.g., Ondo, Backed): Linked to underlying ETFs, paying interest daily.

- Real-time redeemable Stablecoin (e.g., USDM): Redeemable at any time, with composability.

- Supporting tools such as Oracles, audits, Proof of Reserve, and token-ETF NAV tracking are becoming more complete.

Compliance side: Relatively easy to penetrate regulatory scrutiny

- Most U.S. Treasury-related protocols use Reg D / Reg S paths, open only to qualified investors.

- Financing structures are clear, and tax and regulatory risks are relatively controllable.

- Suitable for institutional participation, promoting the intersection of TradFi and DeFi.

3. Progress and Market Landscape of RWA

Real-World Assets (RWA) are gradually transitioning from the narrative stage to structural growth, with market participants, asset types, technological frameworks, and regulatory paths all entering a substantive evolution phase. This section will systematically outline the current progress and landscape evolution of the on-chain RWA market, analyzing it from four dimensions: asset development trends, participation ecology, regional regulation, and institutional adoption.

3.1 Market Progress and Key Trends

From the current development trend, RWA demonstrates strong growth momentum. Globally, its market size continues to expand rapidly; in the first half of 2025, the total value of on-chain RWA assets surpassed $23.3 billion, growing nearly 380% compared to early 2024, making it the second-largest growth track in the crypto space. Numerous institutions are entering the market, such as Wall Street financial institutions accelerating their actions, Tether launching an RWA tokenization platform, Visa exploring asset tokenization, and BlackRock issuing tokenized funds, pushing the market towards standardization and scaling. Different types of RWA assets are also continuously exploring their respective tracks, with U.S. Treasury assets leading growth due to their stability and mature systems, private credit actively expanding the market and optimizing risk control driven by high yields, commodity tokenization gradually expanding its application scope, and equity tokenization striving to break through regulatory constraints.

U.S. Treasury Market (T-Bills): The Dominant Growth Engine Under Structural Rate Attraction

- As of August 2025, the market value of on-chain U.S. Treasury assets exceeded $68 billion, with a year-on-year growth of over 200%. This track has become the largest sub-category of RWA outside of stablecoins.

- Mainstream platforms such as Ondo, Superstate, Backed, and Franklin Templeton have achieved distributed mapping of U.S. Treasury ETFs/money market funds on-chain.

- For institutions, U.S. Treasury RWA provides the infrastructure for on-chain risk-free yields; for DeFi protocols, they become a source of yield for stablecoins and DAO reserves, constructing a "on-chain central bank" model.

- U.S. Treasury products possess high maturity in compliance, clearing, and legal structure, making them the RWA type with the most scaling potential.

Private Credit: Coexistence of High Yields and High Risks

- Protocols like Maple, Centrifuge, and Goldfinch are expanding around on-chain credit, exploring SME loans, revenue sharing, consumer finance, and other tracks.

- They feature high yields (8–18%), but face significant risk control challenges, relying on off-chain due diligence and asset custody. Some projects, such as TrueFi and Clearpool, are also transitioning to serve institutions.

- Goldfinch and Centrifuge expanded new credit pilot projects in Africa and Asia in 2024, enhancing financial inclusivity.

Commodity Tokenization: On-Chain Mapping of Gold & Energy Assets

- Representative projects like Paxos Gold (PAXG), Tether Gold (XAUT), Meld, and 1GCX map precious metal reserves through on-chain tokens.

- Gold is the preferred choice for mainstream commodity tokenization due to its clear reserve logic and stable value, often used as collateral for stablecoins.

- Energy commodities (such as carbon credits and crude oil) face higher regulatory thresholds and are still in the experimental phase.

Equity Tokenization: Early Breakthroughs but Still Limited by Regulation

- The current market value of on-chain equity tokens is only about $362 million, accounting for 1.4%, primarily led by Exodus Movement (EXOD) (which accounts for 83%).

- Representative platforms like Securitize, Plume, Backed, and Swarm are conducting compliant equity mapping around U.S. stocks, European listed companies, and startups.

- The biggest challenge for these assets is compliance in secondary market trading and KYC management, with some projects adopting permissioned chains or restricted address whitelist strategies to address this.

Looking ahead, RWA is expected to become a multi-trillion-dollar market. Citibank believes that almost any valuable asset can be tokenized, predicting that by 2030, the tokenization scale of private assets will reach $4 trillion. BlackRock forecasts that by 2030, the RWA tokenization market size could reach $16 trillion (including private chain assets), accounting for 1% to 10% of the global asset management scale. On the technology front, with the iteration of blockchain technology, such as further optimization of smart contracts and the development of cross-chain technology, the efficiency and security of asset tokenization will improve, reducing operational costs. The Internet of Things (IoT) will collect asset data in real-time, AI will optimize valuation models, and zero-knowledge proof technology will enhance privacy protection, all providing technical support for RWA development. Application scenarios will also continue to expand, with the tokenization of emerging fields such as carbon assets, data assets, and intellectual property accelerating. On the global policy front, if countries can further improve regulatory frameworks and form relatively unified standards, it will greatly promote the global circulation and development of RWA. RWA will become a core link connecting the traditional economy and Web3, profoundly changing the global asset allocation landscape.

3.2 Ecological Structure and Participant Landscape

3.2.1 Participation Distribution in On-Chain Protocol Layer

Public Chain Ecology

Mainstream Projects

Characteristics

Ethereum

Ondo, Superstate, Franklin, Plume

Concentration of mainstream institutions, complete compliance paths, the most mature stablecoin and fund ecology

Stellar

Franklin Templeton FOBXX

Transparent operations for institutional custody, efficient payment and issuance

Solana

Maple, Zeebu, Clearpool

Low transaction costs suitable for high-frequency credit operations, but security and infrastructure are still inadequate

Polygon

Centrifuge, Goldfinch

Supports off-chain asset mapping and DAO credit governance, low cost, strong scalability

Avalanche / Cosmos

Backed, WisdomTree

Exploring multi-chain interoperability and fund governance compliance, more experimental deployments

Trend Observation: The Ethereum ecosystem remains the main battlefield for RWA assets, especially suitable for high-compliance assets like funds and bonds; meanwhile, credit-related RWA is beginning to migrate to low-cost, high-throughput chains.

3.2.2 Regional Policy and Regulatory Friendliness Comparison

Region

Regulatory Attitude

Representative Policies

Key Impacts

United States

Strong regulation, varied paths

SEC / CFTC compliance review + Reg D/S/CF framework

Large institutions prefer Reg D models, such as Securitize and BlackRock

European Union

Open, unified

MiCA regulations implemented (2024)

Clearly distinguishes between electronic money tokens and asset reference tokens, facilitating compliant operations for institutions

Singapore

Highly friendly

MAS sandbox + RMO license

Supports RWA product pilots and multi-currency clearing, with Circle and Zoniqx already established

Hong Kong

Gradually opening

SFC VASP mechanism + virtual asset ETF policy

Supports compliant tokenized funds going live, promoting local TradFi-Web3 integration

Dubai (VARA)

Most proactive

Multi-layer licensing framework + project sandbox

Becoming a hub for RWA experimentation in the Middle East, attracting deployments from Plume, Matrixdock, and others

Some regions in Asia (Singapore, Hong Kong, Dubai) are leading in regulatory design and innovation for RWA, gradually becoming centers for capital and project aggregation.

3.2.3 Analysis of Institutional Participation

Institutional participation in RWA is transitioning from "observational pilots" to "substantive deployments." According to market tracking, the current major institutional players include:

Type

Institution Name

Participation Path

Asset Management Giants

BlackRock, Franklin Templeton, WisdomTree

Issuing on-chain funds and money market products; launching stable yield tools via Ethereum/Stellar

Brokerage/Issuing Platforms

Securitize, Tokeny, Zoniqx

Supporting compliant issuance of stocks/bonds/funds, integrating traditional securities accounts with on-chain holdings

Crypto-Native Protocols

Ondo, Maple, Goldfinch, Centrifuge

Building RWA native structures, serving DAOs, Treasuries, and DeFi ecosystems

Trading Platforms/Synthetic Protocols

Backed, Swarm, Superstate

Providing secondary liquidity for tokenized assets, exploring LP equity combinations and compliant trading mechanisms

The roles of institutions are gradually diversifying, expanding from "issuers" to "clearing service providers," "custody platforms," and "secondary trading facilitators," with RWA becoming a bridge connecting Web3 and TradFi.

4. Typical Project Analysis

The following focuses on representative RWA projects in the tracks of U.S. Treasuries, private credit, commodities, and equity, breaking down their token models, investor structures, product mechanisms, and yield logic:

4.1 U.S. Treasury Track: Ondo Finance

Ondo Finance is a platform focused on tokenizing traditional financial assets, particularly U.S. Treasury assets, aiming to introduce low-risk yield assets to the crypto market and provide investors with stable and composable sources of yield. It builds a bridge between traditional finance and decentralized finance (DeFi) in a compliant manner, allowing U.S. Treasuries to be traded and utilized in tokenized form on-chain.

• Token Model: Issues ERC-20 tokens, pegged to off-chain U.S. Treasury ETFs (e.g., $OUSG corresponds to short-term U.S. Treasury ETF), with a 1:1 mapping of underlying asset value and daily automatic interest settlement.

• Investor Structure: Primarily composed of institutions (family offices, asset management companies) and qualified investors, entering through Reg D/S compliance paths, with some retail users able to participate indirectly through DeFi protocols.

Product Mechanism: Constructs an "on-chain fund" structure, with an SPV (Special Purpose Vehicle) holding U.S. Treasury assets, and smart contracts managing subscriptions, redemptions, and interest distribution, supporting on-chain staking and lending (e.g., integrating Aave, Compound).

• Yield Logic:

• Underlying Asset Yield: The basic yield source for tokens like $OUSG comes from the interest income of the underlying U.S. Treasury assets. U.S. Treasuries themselves have relatively low risk and stable interest yields, which will be distributed to token holders after deducting platform management fees (e.g., 0.15% - 0.3% management fee) according to certain rules.

• DeFi Ecosystem Yield: When tokens like $OUSG are used within the DeFi ecosystem, they can generate additional yields. For example, using $OUSG as collateral to borrow other assets in lending protocols, and then investing the borrowed assets into liquidity mining or other DeFi applications to earn returns; or participating in liquidity pools related to these tokens to earn trading fee income, etc.

4.2 Private Credit Track: Maple Finance

Maple Finance is a multi-chain DeFi platform focused on institutional-grade on-chain lending and RWA investment, operating on Ethereum, Solana, and Base public chains. Its core service clients include hedge funds, DAOs, crypto trading firms, and other institutional clients. By simplifying the complex processes of traditional finance, it offers low-collateral loans, tokenized U.S. Treasuries, and trade receivables pools. As of June 2025, its assets under management (AUM) surpassed $2.4 billion, making it a representative private credit platform amid the trend of institutional entry.

- Token Model:

- Core Token: SYRUP (ERC-20 standard), total supply of 118 million tokens, with a current circulation of about 111 million tokens, nearly fully circulated, reducing potential selling pressure.

- Core Functions:

- Staking Mechanism: SYRUP holders can stake their tokens to become "risk bearers," prioritized for loss compensation in case of loan defaults, and share platform rewards (such as fee sharing) when there are no defaults.

- Value Capture: The platform charges a 0.5%-2% fee on each loan, of which 20% is used to repurchase SYRUP and distribute to stakers, forming a value support for the token.

- Investor Structure: Institutional investors (hedge funds, crypto VCs) provide large amounts of capital, while DeFi treasuries (such as early participation from Alameda Research) supplement liquidity. Borrowers must undergo off-chain due diligence (KYC, credit rating).

- Product Mechanism: Adopts a "decentralized credit pool" model, where smart contracts match borrowing needs (such as SME working capital, crypto mining loans) with funding supply, automatically executing repayments and default liquidations (verified through Chainlink oracles for off-chain repayment data).

- Yield Logic:

- Base Yield: Lenders earn interest from providing liquidity, with returns linked to product risk (e.g., High Yield due to investments in high-risk assets, yielding higher than Blue Chip).

- Platform Sharing: Stakers earn a share of platform fees by staking SYRUP (20% of fees are used for repurchasing SYRUP and distribution), while also bearing the responsibility for default risk compensation.

- Ecological Synergy: Institutional borrowers quickly obtain liquidity at low costs, supporting their crypto trading, arbitrage, and other businesses, indirectly driving the growth of platform lending demand, forming a closed loop of "borrowing - lending - yield distribution."

4.3 Commodity Track: Paxos Gold ($PAXG)

Paxos Gold is a gold tokenization product issued by the compliant fintech company Paxos, aimed at achieving the on-chain circulation and efficient management of physical gold through blockchain technology. Its core value lies in combining the value-preserving properties of traditional gold with the programmability of blockchain, allowing investors to participate in gold investment without bearing the storage and transportation costs of physical gold, while also supporting 24/7 global trading and DeFi ecosystem integration.

- Token Model:

- Core Token: $PAXG (ERC-20 standard), strictly adhering to a 1:1 peg rule, with each token corresponding to 1 ounce of London Bullion Market Association (LBMA) certified standard physical gold, stored and secured by top global custodians like Brink’s.

- Issuance and Redemption Mechanism: When users purchase $PAXG, Paxos simultaneously increases its holdings of an equivalent amount of physical gold; upon redemption, the tokens are burned and the corresponding gold is released, ensuring that the total amount of on-chain tokens matches the off-chain gold reserves, eliminating the risk of over-issuance.

- Investor Structure: Retail investors (purchasing through crypto exchanges and wallets), institutions (asset management companies with gold exposure), and DeFi protocols (as collateral to supplement stablecoin issuance reserves).

- Product Mechanism: Smart contracts link to the gold reserve proof from custodians (verified through Chainlink PoR oracles), supporting the redemption of physical gold at any time (subject to minimum amounts and fee requirements), and can also be freely traded on DEXs (like Uniswap).

- Yield Logic: Long-term value appreciation of gold (against inflation) + liquidity yield from on-chain trading/collateralization (e.g., staking $PAXG to generate $DAI, then investing in DeFi mining); Paxos charges redemption fees, custody fees, and transaction service fees to cover gold storage, auditing, and technical maintenance costs, forming a sustainable operational loop.

4.4 Equity Track: xStocks (Backed Finance U.S. Stock Tokenization Platform)

xStocks is a U.S. stock tokenization platform launched by Swiss fintech company Backed Finance, which converts U.S. stocks like Tesla (TSLAx) into on-chain tradable tokens via the Solana blockchain. Its core goal is to break the time zone restrictions and liquidity barriers of traditional stock markets while integrating the DeFi ecosystem to achieve the programmability of stock assets. As of July 2025, its tokens have been listed on exchanges such as Bybit, Kraken, and DEXs like Raydium, becoming a representative case of "around-the-clock trading + on-chain reuse" in the equity tokenization field.

- Token Model:

- Core Token: Issued based on the SPL standard on Solana (e.g., $TSLAx corresponding to Tesla stock), pegged 1:1 to the underlying stock, with each token backed by 1 share of real stock held by Backed in collaboration with compliant institutions (such as U.S. Alpaca Securities, Swiss InCore Bank).

- Pricing Mechanism: Real-time synchronization of U.S. stock prices through Chainlink oracles, with the last closing price as a reference during traditional market closures (such as weekends and holidays), allowing on-chain supply and demand to autonomously form trading prices, possessing "predictive market" attributes.

- Investor Structure: No strict accredited investor restrictions (must go through exchange KYC), covering individual investors (purchasing through Bybit, Kraken, or Solana wallets) and small asset management companies (configuring fragmented U.S. stock exposure).

- Product Mechanism:

- Issuance and Custody: Backed pre-purchases the underlying stocks, which are held by compliant brokerages and banks, minting corresponding tokens on the Solana chain at a 1:1 ratio; upon redemption, tokens are burned and off-chain stocks are released, ensuring reserve transparency (regularly verified through Proof of Reserve mechanisms).

- Equity Handling: Does not support shareholder voting rights or participation in shareholder meetings, but dividend income is realized through "token airdrops" — after the underlying stock dividends, Backed issues corresponding amounts of tokens to token holders based on their holdings, indirectly conveying economic benefits.

- On-Chain Circulation: Supports 24/7 trading (breaking traditional stock market time restrictions), can be traded on centralized exchanges (Bybit, Kraken) and decentralized platforms (Raydium, Jupiter), and has cross-chain potential (future plans to integrate cross-chain bridges).

- Yield Logic: Appreciation of underlying stocks and dividend income + liquidity premium from on-chain trading (fractional trading, 24/7 market); Backed charges token issuance fees, custody fees, and trading channel fees to cover compliance and technical costs.

4.5 RWA Infrastructure Track: Plume Network

Plume Network is a full-stack blockchain platform focused on Real-World Assets (RWA), aiming to build a bridge between traditional finance and the crypto space, efficiently bringing various real-world assets on-chain and integrating them with the DeFi ecosystem, addressing compliance, liquidity, and user experience challenges faced by RWA projects during the asset tokenization process.

- Token Model:

- Core Token: $PLUME (ERC-20 standard), total supply of 10 billion tokens, with 59% allocated for community incentives and ecosystem development. Token functions include paying on-chain transaction fees, participating in governance voting, staking for yield sharing, and serving as a settlement medium for asset trading within the ecosystem.

- Incentive Design: Users configuring RWA assets (such as real estate tokens, credit certificates) on the platform can earn additional $PLUME rewards on top of base yields (10%-20% annualized), with the reward ratio linked to the asset holding period and staking amount, enhancing ecosystem stickiness.

- Investor Structure: Institutional investors such as Brevan Howard Digital and Haun Ventures are injecting capital and promoting on-chain pilot projects for their assets; retail and crypto-native users participate in trading and mining through the Passport wallet, primarily individual investors seeking a combination of "traditional assets + crypto yields," focusing on compliance and cross-chain opportunities.

- Product Mechanism:

- Asset Classification Management: Covers various asset types including collectibles (such as sneakers, Pokémon cards, watches, wine, and art), alternative assets (private credit, real estate, or green energy projects), and financial instruments (stocks or corporate bonds), catering to users with different risk preferences and investment needs.

- Suite Support System:

- Arc: Tokenization issuance system that helps assets go on-chain in flexible forms such as NFTs, tokens, or composite assets, optimizing asset issuance structure and enhancing liquidity.

- Nexus: RWA track-specific oracle that ensures accurate synchronization of on-chain information and off-chain asset data, providing a reliable data foundation for transactions and yield calculations.

- Passport: Aggregated asset management tool that integrates different token standards and on-chain DeFi composability into a smart wallet, allowing users to easily participate in various RWA asset operations and DeFi applications, such as yield farming.

- SkyLink: Cross-chain bridge that allows users to access institutional-level RWA yields without permission through mirrored YieldTokens, breaking down inter-chain barriers and expanding asset circulation.

- Compliance Assurance: Relies on partners in different regions to flexibly switch licenses to meet local regulatory requirements, providing a full set of compliance solutions from development to operation, ensuring the security and legality of asset tokenization. For example, its supported ERC 3643 standard utilizes the built-in decentralized identity system ONCHAINID to ensure that only users meeting specific standards can hold tokens, maintaining regulatory compliance.

- Yield Logic:

- User Yield: Users participating in different asset projects on the platform can earn returns from the assets themselves, such as stable returns from green energy projects; simultaneously, by staking $PLUME, they can share platform transaction fee revenues and also capture capital gains through trading amid asset price fluctuations. For instance, in the collectibles asset category, users can engage in asset buying, collateralized lending, and asset synthesis trading to seize profit opportunities from price changes.

- Platform Yield: Plume covers operational costs and achieves profitability by charging asset issuance fees, transaction fees, and service fees for institutions, forming a sustainable business model. Additionally, as the ecosystem flourishes, the demand and value of $PLUME tokens are expected to increase, bringing additional token appreciation benefits to the platform.

5. Challenges and Considerations

The explosive growth of RWA is not without challenges; it fundamentally represents a collision and compromise between "traditional asset logic" and "blockchain decentralization philosophy." The following five dimensions directly address core contradictions, revealing the "structural problems" that the industry cannot avoid:

5.1 Legal and Regulatory: Dynamic Balance of Rule Adaptation

- The Double-Edged Sword of Regulatory Arbitrage: Current RWA projects often choose the "offshore registration + onshore operation" model (e.g., BVI companies issuing tokens, U.S. users participating), which seems to comply with the Reg D/S framework but actually buries the hidden danger of "jurisdictional conflicts." For example, the EU's MiCA views U.S. Treasury tokenization as "asset reference tokens," while the U.S. SEC may classify them as "securities." In the event of cross-regional trading disputes, investors may face the dilemma of having "no place to seek redress."

- The Gray Area of Ownership Definition: The SPV structure claims that "tokens = equity certificates," but the legal connection between on-chain token transfers and off-chain asset transfers remains blank. If a holder of a real estate token is sued due to a debt dispute, can the court directly freeze the off-chain property rights corresponding to their on-chain tokens? Currently, there are no judicial precedents globally to support this, creating a "legal gap" that reduces RWA to "self-certified compliant digital IOUs."

5.2 Valuation and Transparency: Boundaries of Data Credibility

- The Dark Door of Data Manipulation: Oracles like Chainlink claim to be "decentralized," but the off-chain data they capture (such as corporate bond ratings, property valuations) still rely on centralized institutions like S&P and Jones Lang LaSalle. If a private credit protocol colludes with a rating agency to manipulate default rate data, the on-chain smart contract will execute liquidations based on false information, leading to "systemic fraud of digital endorsements."

- The Trade-off Between Timeliness and Accuracy in Dynamic Valuation: Standardized assets (like U.S. Treasuries) can achieve precise pricing through high-frequency data updates, but the valuation assessment cycle for non-standard assets (like private equity) is longer, potentially causing a lag between on-chain token prices and actual asset values. This "mismatch" may trigger arbitrage or liquidation risks.

5.3 Liquidity and Composability: Real Constraints of Ecological Synergy

- The liquidity of RWA tokens exhibits clear layered characteristics: Standardized assets like U.S. Treasuries and gold have significant trading depth in both DEXs and CEXs due to high market acceptance, but secondary trading of non-standard assets like private credit and equity remains relatively thin, primarily relying on redemption mechanisms within protocols, which diverges from the original intention of "blockchain enhancing asset liquidity."

- The composability of cross-chain and cross-ecosystem faces dual challenges of technology and trust: Although cross-chain bridges and Layer 2 solutions attempt to address asset circulation issues between different public chains, the trust costs, transaction fees, and potential security risks during the cross-chain process may weaken the synergistic efficiency between RWA and the DeFi ecosystem. For example, if a U.S. Treasury token on one chain needs to be staked in a lending protocol on another chain, the trust costs in the intermediate steps may offset the on-chain composability benefits.

5.4 Risk Control System Implementation: Risk Transmission Between Online and Offline

- On-chain risk control rules cannot fully cover off-chain risks: Smart contracts can control on-chain risks through parameters like collateral ratios and liquidation thresholds, but for actual defaults of off-chain assets (such as bankruptcy of corporate bond issuers or damage to property collateral), on-chain mechanisms often can only respond passively, making it difficult to intervene proactively. This "risk control gap" may lead to investor losses.

- The cross-transmission of systemic risks warrants attention: RWA is closely linked to traditional financial markets (e.g., U.S. Treasury RWAs are affected by interest rate policies), and the leverage mechanisms in the DeFi ecosystem may amplify this correlation. When traditional markets experience volatility, whether the price fluctuations of RWA tokens will trigger on-chain liquidity crises through channels like collateralized lending remains to be tested over a longer period.

5.5 Technical Infrastructure and Trust Bridges: The Gradual Nature of Decentralization

- Existing blockchain performance does not meet the scalability demands of RWA: Issues like throughput and gas fees on public chains like Ethereum create barriers for large-scale institutional capital participation in RWA trading. Although Layer 2 and new public chains have made breakthroughs in performance, their ecological maturity and security have not yet been fully recognized by institutions.

- The construction of trust mechanisms remains a hybrid model: While RWA emphasizes "decentralization," its actual operation still relies on custodial institutions (such as storage providers for gold, custodial banks for bonds), auditing institutions (such as reserve verification), and other centralized roles. This "technical decentralization + trust centralization" hybrid model is a realistic choice at the current stage, but whether it will evolve into "traditional finance empowered by blockchain" in the long term remains uncertain.

The development of RWA is essentially a cross-system integration experiment, with challenges arising from both the objective limitations of technology implementation and the deep integration of financial logic and technological philosophy. Solving these issues may require the joint evolution of the industry, regulation, and technology, rather than breakthroughs from a single dimension, and its ultimate form still awaits continuous exploration and validation by the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。